Market Dashboard

Last Updated: February 20, 2026

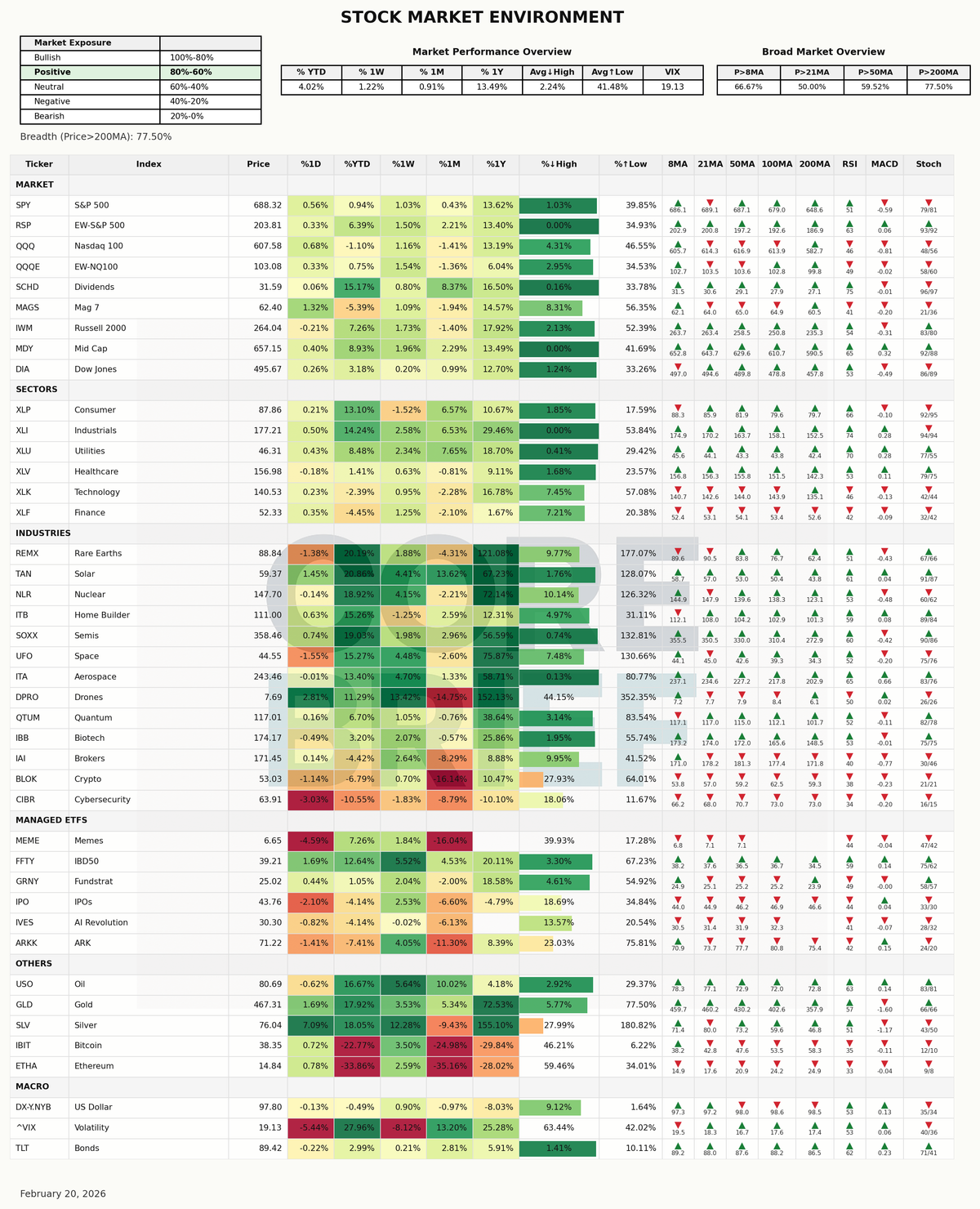

The current market breadth is characterized by a 77.5% proportion of broad markets trading above their 200-day moving average, indicating a Positive breadth label. This suggests a generally favorable trend in the market, with a significant majority of stocks and ETFs exhibiting upward momentum.

Among the notable movers today, SLV led the gainers with a 7.1% increase, followed by DPRO and FFTY with gains of 2.8% and 1.7%, respectively. On the other hand, IPO, CIBR, and MEME were the top losers, with declines of 2.1%, 3.0%, and 4.6%, respectively.

The broad market average year-to-date return stands at 4.02%, implying a modestly positive trend. The current VIX reading of 19.13 suggests a state of elevated caution, as it falls above the typical complacency threshold of 15. A notable tension arises from the juxtaposition of the strong breadth data, with 77.5% of markets above their 200-day moving average, and the relatively high VIX reading, which indicates that investors remain cautious despite the positive market momentum.