Market Wrap 2025-11-04

- The Reserve Bank of Australia (RBA) maintained the Cash Rate at 3.60%, as anticipated. The RBA assessed that some of the increase in underlying inflation during the third quarter was attributable to temporary influences.

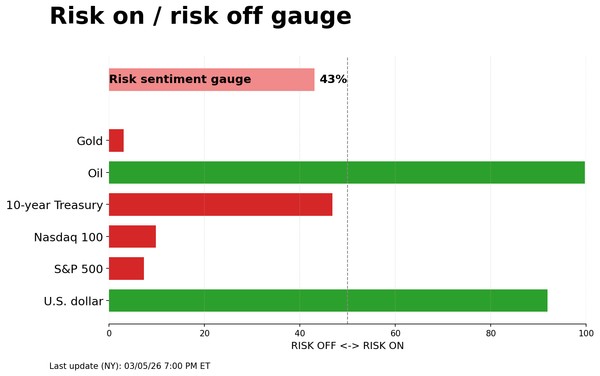

- European stock exchanges are generally lower, reflecting a negative market mood. US equity futures are also down, with the Nasdaq 100 (NQ) falling by 1.3%.

- The US Dollar Index (DXY) briefly touched 100.00. The British pound (GBP) weakened after comments from UK Chancellor Reeves that did not reiterate previous tax pledges. The Australian and New Zealand dollars are underperforming.

- UK Gilts are performing well amid speculation about tax increases, while US Treasury securities (USTs) are awaiting remarks from Federal Reserve officials.

- West Texas Intermediate (WTI) and Brent crude oil prices are declining due to risk aversion, but gold (XAU) is not benefiting and remains below USD 4,000 per ounce.

- Looking ahead, key events include the US RCM/TIPP economic optimism survey, New Zealand jobs data, the Reserve Bank of New Zealand (RBNZ) Financial Stability Report (FSR), Bank of Japan (BoJ) minutes from September, a French Assembly vote on the PLF, and speeches from European Central Bank (ECB) officials Nagel and Balz, Bank of England (BoE) official Breeden, and Federal Reserve official Bowman. Earnings reports are expected from Fresenius MC, Ferrari, AMD, Supermicro, Marathon, Pfizer, and Uber.

TARIFFS/TRADE

- US Treasury Secretary Bessent stated that he will be present at the Supreme Court to emphasize the importance of tariffs, according to Fox News.

- South Korea's Industry Ministry announced plans to increase financial and policy support for exporters facing steel tariffs from the US and EU. South Korea will also restructure its steel sector due to increasing signs of a crisis and take proactive measures to adjust production capacity in oversupplied product areas.

- The Panama Canal chief indicated that a reduction in global trade is likely next year due to an economic slowdown. He anticipates that the passage of LPG vessels will continue to increase, noting that the Panama Canal's market share of US LPG exports to Asia has risen from 80% to over 95%. The long-term reservation system allocated more slots this time compared to the previous edition.

- Regarding Nexperia, the Chinese Commerce Ministry urged the Dutch government to cease interfering in company affairs and stated that it will resolutely protect the rights and interests of firms. It added that the Dutch government has not shown a constructive attitude or actions and has escalated the global supply chain crisis despite China's reasonable demands. The Netherlands should bear full responsibility for the turmoil and chaos in the global semiconductor production and supply chain.

EUROPEAN TRADE

EQUITIES

- European stock markets (STOXX 600 -1.6%) opened lower across the board without a clear catalyst. Indices continued to decline as the morning progressed and are now generally at their lowest points.

- European sectors are all down, with a defensive bias. The smallest losses are in Food Beverage, Real Estate, Utilities, Healthcare, and Optimised Personal Care Drug and Grocery. Basic Resources, Retail, Telecoms (due to losses in Telefonica), and Industrial Goods and Services are performing the worst.

- US equity futures (ES -1.1%, NQ -1.4%, YM -0.8%, RTY -1.6%) are lower across the board, similar to their European counterparts. News flow from a US perspective is relatively quiet this morning, and the US government shutdown is set to extend to its longest streak this week. Today’s data slate is thin, with the US RCM/TIPP economic optimism survey the only major release due; Fed's Bowman is also on the calendar.

- Tesla (TSLA) reported October China-made vehicle sales of 61,497 (previous 90,812 month-over-month), via CPCA.

FX

- The US Dollar Index (DXY) is slightly firmer, trading in a range of 99.73 to 100.04, and has reclaimed the 100.00 level for the first time since early August. There has been a lack of notable news flow recently, but traders remain attentive to the mixed views held at the Federal Reserve and the ongoing US Government shutdown. Today's docket will provide little in the way of additional clues. However, tomorrow markets will be presented by the latest ADP employment change and ISM services print. Note, tomorrow will see the commencement of the hearing on the legality of US President Trump's Reciprocal Tariff Policy. After a venture above the 100 mark, DXY has since moved back to flat levels around the 99.90 mark.

- EUR/USD is slightly lower today, trading within a range of 1.1499 to 1.1533. As above, there is not much news flow driving things today, and ultimately moving at the whim of the USD. This morning ECB commentary has not really moved things for the Single-currency ; Rehn highlighted the uncertainty about future economic development, noting that inflation risks are two-sided, whilst Lagarde said currency changeovers can produce a temporary uptick in inflation. Within the Eurozone, attention remains on French politics with the Socialist Party giving the government additional time to come up with a budget it deems acceptable.

- The Japanese Yen (JPY) is the best performer among the major currencies as Japanese investors return from the long weekend. The bid in the JPY is being driven by a combination of risk aversion in the market triggered by selling in global equities and ongoing jawboning from Japanese officials with Finance Minister cautioning against one-sided rapid moves and noting that she is closely watching FX moves with a high sense of urgency. USD/JPY hit a new multi-month high overnight at 154.48 before slipping onto a 153 handle and making a current session low at 153.34.

- The British pound (GBP) is underperforming against the US dollar (USD) and the euro (EUR), with attention in the UK focused on the fiscal situation following a pre-budget press conference by UK Chancellor Reeves. The issue for Reeves is that in her election manifesto she vowed to "not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT”. Recent sentiment has suggested that it is inevitable this pledge will need to be broken. As such, Reeves used today as an opportunity to pitch roll such a decision. That being said, Reeves stopped shy of confirming that the manifesto will be broken and refrained from unveiling specific policy pledges. The negativity surrounding Reeves remarks has weighed on the GBP with Cable back below the 1.31 mark and at its lowest level since mid-April with a current session trough at 1.3060.

- The Australian dollar (AUD) and New Zealand dollar (NZD) are both weaker against the US dollar (USD), primarily due to broad risk aversion triggered by selling in global equity markets. The AUD has also digested the latest RBA policy announcement, which was overall leaned hawkishly. As expected, the RBA opted to keep rates unchanged on hold following last week's hotter-than-expected outturn for Q3 inflation. Within the release, the RBA noted that some of the factors driving the upside were deemed to be temporary. However, markets have focused on the RBA's forecast, which sees just one cut in 2026 vs. the two seen in August.

FIXED INCOME

- UK Gilts are outperforming compared to peers today, attributed to a speech by the UK Chancellor; more-so on the reports pre-presser rather than any announcement itself. In brief, the Chancellor reiterated her fiscal policy stance, but avoided reiterating her tax related pledges. An omission that has been interpreted as confirming the pre-market briefings regarding the likely manifesto breaking tax increase(s). Her press conference then began and saw her avoid questions around policy specifics and the manifesto pledges. Overall, the main takeaway being she has, as expected, laid the foundation for tax increases in the Budget. In terms of price action, Gilts held around 93.70 into the presser, before then rising as she spoke to a session peak of 93.98; UK paper then scaled back down to pre-presser levels. Elsewhere, 2029 Gilt supply was well received with a b/c in excess of 3x and a smaller-than-prior tail. No move to the results.

- US Treasury securities (USTs) are firmer, posting gains of a handful of ticks into a session largely devoid of data owing to the shutdown with just RCM/Tipp optimism due. Prior to that, Fed’s Bowman is scheduled though the topic is banking supervision; Bowman hasn’t spoken on policy since mid-October, where she outlined a view for two more cuts before end-2025. Upside this morning that was spurred by a deterioration in the risk tone , as sentiment drifted during the early European morning and into the European cash equity open itself. No fresh catalyst at the time behind the pullback, but it continued the subdued APAC tone and Wall St. handover where sectors ex-tech ended in the red. At a 112-28+ peak, eclipsing Friday’s high by a tick and notching a new WTD peak. As such, we look to 112-29+ from last Thursday and then a gap before last week’s 113-18 best.

- German Bunds are also firmer with the narrative echoing the above . Bunds hit a 129.35 peak just before the European cash equity open and thereafter moved in tandem with Gilts and pulled back to around the mid-point of the day’s 129.09-35 band. More recently, as tone deteriorates as discussed in USTs, Bunds have reverted back to and are probing the earlier peak. If this is eclipsed, we look to 129.46 from Friday before resistance from early last week between 129.62, 129.64 and 129.73. A tepid Schatz outing thereafter had no impact on the benchmark.

- Germany sold EUR 3.766 billion of 2.0% 2027 Schatz, versus an expected EUR 5 billion: bid-to-cover ratio of 1.7x (previous 1.4x), average yield of 1.98% (previous 1.91%), retention of 24.68% (previous 22.7%).

- The UK sold GBP 5 billion of 4.00% 2029 Gilt: bid-to-cover ratio of 3.06x (previous 2.92x), average yield of 3.845% (previous 4.095%), tail of 0.4bps (previous 0.8bps).

COMMODITIES

- Crude oil benchmarks have been weighed down by the overall risk-off sentiment seen across markets as the European session got underway. After oscillating in a tight c. USD 0.20/bbl range during the APAC session, WTI and Brent extended on Monday’s low at USD 60.51/bbl and 64.33/bbl respectively to a trough of USD 59.94/bbl and USD 63.44/bbl as global risk sentiment sours.

- Spot gold (XAU) continues to oscillate within the range formed over the prior 5 days, despite a wider risk-off theme running through markets during APAC trade and into the European session. Gold dipped to a trough of USD 3967/oz as the APAC session ended before a slight bounce to the key USD 4k/oz level.

- Base metals continue to fall following the tech-led equity selloff in global benchmarks. 3M LME Copper peaked at USD 10.86k/t early in APAC trade before extending on last week’s low at USD 10.81k/t to a trough of USD 10.65k/t. Currently, the red metal is oscillating in a USD 70/t band near the lows of the day.

- The OPEC+ decision on Sunday to keep oil output targets steady in Q1 came after Russia lobbied for the pause because it would struggle to increase exports due to Western sanctions, according to Reuters citing sources.

- Libya's Oil Minister says there is a target to increase oil output to 2 million barrels per day (BPD) (currently c. 1.4 million) in the next five years; looking at 1.6 million BPD in 2026 and then 1.8 million BPD in 2027.

- The Iraq PM ordered a pause on imports of gasoline, kerosene and "White Oil", via State News Agency.

- The Shanghai Futures Exchange is to adjust transaction fees for cast aluminium alloy and offset printing paper futures and options products from the close of trading on November 7th.

NOTABLE DATA RECAP

- French Budget Balance (Sep) -155.4B (Prev. -157.45B)

NOTABLE EUROPEAN HEADLINES

- ECB's Rehn says uncertainty about future economic development remains high and risks are skewed downside.

- French Socialist Party leader Faure said his party will give the government additional time to come up with a budget it deems acceptable before deciding whether to use its power in parliament to topple the administration, according to Bloomberg.

- ECB's Rehn says uncertainty about future economic development remains high and risks are skewed downside.

- ECB's Lagarde says currency changeovers can produce a temporary uptick in inflation.

- SNB's Tschudin says monetary policy is aimed at ensuring price stability. SNB interest rates are where they should be and will only use negative rates when necessary . The value of the Franc is not decisive for the monetary policy of the SNB. Important on how the exchange rate changes and its effect on inflation. Not in a situation where we would like to see lower inflation.

- UK Chancellor Reeves' Pre-Budget Speech : says will make choices necessary to deliver strong foundations for UK economy; important choices that will shape the future of UK for years to come; Inflation has been too slow to come down. Commitment to fiscal rules is iron clad. The more debt UK tries to sell, the more it will cost. Note, Reeves did not mention the manifesto pledges around taxation during this introductory speech.

- UK PM Starmer informed Labour MPs at a private meeting that the budget would be determined by "tough but fair decisions" , adding that the backdrop to the fiscal update was "worse than even we feared". The article frames it as increasing speculation of income tax rises, by Starmer saying they would reject austerity and protect the NHS. (FT)

NOTABLE US HEADLINES

- US President Trump said he is going to ask the Transportation Secretary to take a look at terminating New York City congestion pricing, while he added it is highly unlikely that he will be contributing federal funds to NYC if Mamdani wins the mayoral race.

- "The outlines of a potential deal to end the [US government] shutdown are starting to take shape, although the talks are very fragile at this point and there’s still a long way to go.", according to Punchbowl. "Senators and aides involved in negotiations tell us some Senate Democrats are warming to Thune’s offer to open the government and then hold a vote by a date-certain on renewing the extending the expiring Obamacare subsidies." "The second element under discussion involves pairing the stopgap funding bill to open the government with a three-bill minibus and other guarantees to pass full-year appropriations bills on an agreed-upon timeline." "The attractive part of this offer for senators would be to avoid a full-year CR that many hardline House Republicans and the White House want. " "The Senate will vote for the 14th time today on a GOP-drafted Nov. 21 CR." "House Republican leaders are extremely unlikely to agree to a December CR deadline. And the White House would much prefer early 2026. Trump administration officials pushed for that last time."

GEOPOLITICS

MIDDLE EAST

- Palestinian media reported that IDF vehicles fired at areas in the Maghazi refugee camp in the central Gaza Strip, according to Sky News Arabia.

- "Iranian government spokeswoman: We will never move towards building a nuclear bomb", according to Sky News Arabia.

RUSSIA-UKRAINE

- A blast at a petrochemical plant in Russia's Bashkortostan caused the partial collapse of a workshop, according to TASS.

- Russia says it struck civilian energy and port infrastructure in a large-scale attack on Ukraine's Odesa region overnight, according to the regional governor.

OTHER

- Peru's Foreign Minister announced that the country decided to break diplomatic relations with Mexico, due to Mexico's unfriendly act of starting a process to grant asylum to former PM Betssy Chavez.

CRYPTO

- Bitcoin is on the backfoot and dips below USD 105k whilst Ethereum underperforms and slips below USD 3.5k.

APAC TRADE

- APAC stocks were mostly subdued following the mixed lead from Wall St, where the majority of sectors declined but tech outperformed amid strength in some of the mega-caps following deal announcements.

- The ASX 200 was softer with the downside led by the utilities, materials, mining and resources industries, while participants also awaited the RBA decision in which the central bank kept the Cash Rate unchanged at 3.60%, as expected.

- The Nikkei 225 swung between gains and losses with participants indecisive on return from the extended weekend and alongside a quiet calendar.

- The Hang Seng and Shanghai Comp were lacklustre amid quiet pertinent catalysts and after a report that Trump admin officials torpedoed NVIDIA's push to export AI chips to China. Nonetheless, the downside was limited amid a slew of comments from the Beijing officials at the Global Financial Leaders' Investment Summit in Hong Kong, including from the PBoC's Deputy Governor, who stated they will enhance Hong Kong's status as a global financial centre and will strengthen policy support.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi met with Russian PM Mishustin and said in the meeting that the sides should steadily expand mutual investment and maintain close communication, as well as create new cooperation growth points and cooperate in areas such as AI, digital economy and green development.

- Chinese Vice Premier He said Hong Kong’s competitiveness and attractiveness prove the city thrives under the 'One Country, Two Systems' framework, while he added that Hong Kong will further enhance and improve its status as a global financial centre. He also stated that Hong Kong should strengthen cooperation with the mainland and hopes that Hong Kong will continue to play an active role in connecting the world and advancing global governance. Furthermore, he stated that the global economic environment has seen new challenges this year and it is important to deepen trade and economic activities with other countries.

- PBoC Deputy Governor said will work to enhance Hong Kong's status as a global financial centre, and strengthen policy support.

- China's Financial Regulator Vice Minister said Hong Kong-funded institutions will be supported to develop in the mainland, and they will continue to deepen the Connect programmes, while they will also prevent cross-border financial risks.

- China reportedly offers its tech giants cheap power to boost domestic AI chips, according to FT.

- Nintendo (7974 JT) 6-month Net Profit 198.94bln (prev. 108.66bln Y/Y); raises guidance, sees FY Op. Income JPY 370bln (prev. guided 320bln); sees FY Switch 2 Sales 19mln units; raises dividend payout ratio to 60% (prev. 50%).

- Japan's Finance Minister Katayama says seeing one-sided rapid moves and closely watching FX moves with a high sense of urgency .

RBA

- The RBA kept the Cash Rate unchanged at 3.60%, as expected, with the decision unanimous. The RBA noted that inflation has recently picked up and domestic economic activity is recovering, but the outlook remains uncertain. The board judged it was appropriate to remain cautious, updating its view of the outlook as the data evolves, and it remains alert to the heightened level of uncertainty about the outlook in both directions, while it judged that some of the increase in underlying inflation in the September quarter was due to temporary factors. In terms of the Quarterly Statement on Monetary Policy, the RBA sharply raised forecasts for core inflation out to the second quarter of 2026 with June 2026 Trimmed Mean Inflation now seen at 3.2% (prev. forecast 2.6%) and June 2026 CPI now seen at 3.7% (prev. forecast 3.1%). Furthermore, it stated that recent data suggests there could be more excess demand in the economy than previously thought, while its forecasts assume a cash rate of 3.6% through the end of 2025, 3.4% in June 2026, and 3.3% afterwards.

- RBA Governor Bullock said at the post-meeting press conference that it is possible less easing might be needed in this round than in the past, while she stated that they did not consider cutting rates and that a rate hike was also not considered. Bullock said they discussed holding rates and the outlook for policy, and are being cautious, while it is possible that there are no more rate cuts, and possible that there are some more cuts. Furthermore, she said the board believes policy is close to neutral and will go meeting by meeting, as well as noted that the board does not have a bias on policy and they are at the right spot on monetary policy at the moment.

DATA RECAP

- South Korean CPI MM (Oct) 0.3% vs. Exp. 0.0% (Prev. 0.5%); YY (Oct) 2.4% vs. Exp. 2.1% (Prev. 2.1%)