Market Wrap 2025-11-05

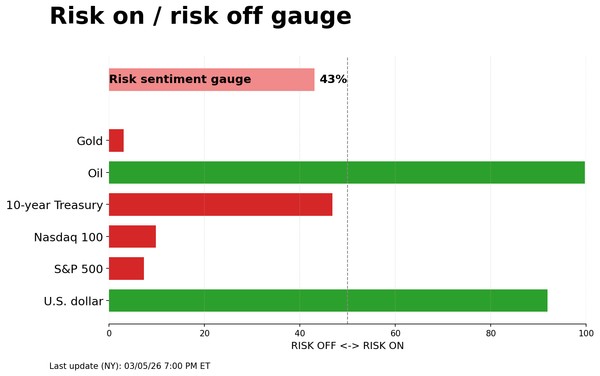

- European stock exchanges are all experiencing losses; US equity futures show mixed performance, with the Nasdaq 100 continuing to perform worse than others while the Russell 2000 takes a pause.

- The US Dollar's recent increase in value is temporarily halted before the release of ADP and ISM services data.

- US Treasury securities are stable ahead of a busy schedule, while UK Gilts continue to decline from their highest values on Tuesday.

- Commodities are recovering after Tuesday's risk-off selling.

- Upcoming events include the US Final PMI, US ADP employment report, US ISM Services PMI, policy announcements from the National Bank of Poland and the Central Bank of Brazil, the start of the US Supreme Court tariff hearing, and speeches from the Bank of England's Breeden, the Bank of Canada's Macklem and Rogers, and the US Quarterly Refunding Announcement. Earnings reports are expected from AMC, Arm, Snap, and McDonald’s.

TARIFFS/TRADE

- US President Trump stated that the Supreme Court case is critical for the country's future, impacting financial and national security. He believes a victory would provide significant advantages, while a loss would leave the country vulnerable. He also noted the stock market's record highs and the country's improved global standing, attributing this to the economic security created by tariffs and trade deals.

- US President Trump reported a meeting with Swiss representatives to discuss trade and trade imbalances. Further discussions are planned between US Trade Representative Jamieson Greer and Swiss leaders.

- The White House announced an Executive Order modifying duties related to the synthetic opioid supply chain in China.

- The White House clarified that it is not currently interested in selling NVIDIA (NVDA) Blackwell chips to China.

- China announced a one-year suspension of 24% US tariffs but will maintain 10% US tariffs. Some tariffs on US agricultural goods will be lifted starting November 10th.

- Chinese Premier Li stated that some unilateral and protectionist measures have negatively impacted the global economic order. He emphasized the importance of equality, mutual benefit, and free trade, especially during economic slowdowns. He added that China is willing to work with all parties to foster an open and inclusive environment and that countries should avoid seeking unilateral gains at the expense of others.

- The White House stated that US President Trump has a positive view of the relationship with India and that trade teams are continuing discussions. President Trump and Indian PM Modi communicate frequently.

- China's Commerce Ministry is suspending the unreliable entity list announced in April, removing the entity list announced in March, and will adjust the list.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (STOXX 600 -0.2%) opened with losses, continuing the negative risk sentiment. The lack of significant news and the release of Eurozone PMIs had little impact on price action, which remained rangebound throughout the day.

- European sectors generally show a negative trend. The automotive sector is performing best, supported by BMW's (+1.5%) post-earnings strength after reporting positive Q3 results and reaffirming its full-year outlook. The technology sector is underperforming due to growing fears of an AI bubble; ASML (-2%). Novo Nordisk (+1%) has recovered some initial losses despite poor headline figures and reduced full-year guidance.

- US equity futures (ES -0.2%, NQ -0.3%, RTY U/C) are mixed, with the S&P 500 and Nasdaq 100 continuing to decline while the Russell 2000 pauses. Focus is on the US ADP figures, which are more important due to the suspension of the NFP report during the US government shutdown. The US ISM Services PMI is also scheduled for release.

- China is banning foreign AI chips from state-funded data centers, according to Reuters sources. This is likely to affect US chipmakers such as NVIDIA (NVDA), AMD (AMD), and Intel (INTC). The ban includes NVIDIA H20, B200, and H200 chips.

FX

- The recent US Dollar rally, driven by improved US-China relations, the hawkish FOMC announcement, and global equity selling, has paused. With the US shutdown matching its prior record of 35 days, official US data releases remain suspended. However, the latest ADP employment report and ISM services print will be released. The ADP is expected to show an increase to 28k in October from -32k in September. The ISM print is expected to rise to 50.8 from 50. The hearing on the legality of US President Trump's Reciprocal Tariff Policy will also begin. The US Dollar Index (DXY) remains below Tuesday's high of 100.25.

- The Euro is attempting to recover against the US Dollar after recent losses that brought EUR/USD down from a peak of 1.1668 last week to a trough of 1.1473 yesterday. Incremental macro drivers remain light for the Eurozone, with final services and composite PMIs and an unrevised ECB annual wage tracker having little impact on the Euro.

- The Japanese Yen is only slightly firmer against the US Dollar after overnight strength as global equities continued to decline. USD/JPY fell to 152.97 before returning to levels above 153.50. Recent Yen strength is primarily due to risk-aversion in the market rather than Japan-specific factors. Modest Yen appreciation was seen after Japanese Top Currency Diplomat Mimura noted that recent Yen moves are deviating from fundamentals and that excessive FX volatility, not levels, is the main concern.

- The British Pound is attempting to recover from recent losses driven by increasing odds of a December Bank of England rate cut and concerns ahead of the November 26th budget. These concerns were highlighted by Chancellor Reeve's pre-budget speech, which reaffirmed the market's view that it will be a growth-negative event. GBP/USD is holding above Tuesday's low of 1.3010 but remains below the 1.3139 peak.

- Antipodean currencies are mixed, with the New Zealand Dollar slightly outperforming the Australian Dollar. Overnight markets saw Chinese Services/Composite PMI data, with the former slightly exceeding estimates but the composite figure slowing. Overall, trading is quiet as the FX space awaits key US data.

- As expected, the Riksbank kept rates unchanged and reiterated guidance that the "policy rate is expected to remain at this level for some time to come." The outlook for inflation and economic activity remains largely unchanged. The Swedish Krona (SEK) was little moved.

- The People's Bank of China (PBoC) set the USD/CNY mid-point at 7.0901 vs. the expected 7.1336 (previous 7.0885).

FIXED INCOME

- US Treasury securities started the day firmer, but only modestly. Overnight action in US Treasuries occurred in tandem with the broader risk tone. As equity futures moved lower around the beginning of the APAC session, the fixed benchmark picked up, taking US Treasuries to an overnight high of 113-02. The benchmark then drifted as the risk tone picked up off lows and stabilized. Nonetheless, US Treasuries hold onto modest gains but are at the lower end of a narrow 112-26 to 113-02 band. The upcoming schedule is packed from a US perspective. On the data front, the monthly ADP series is due and expected to come in at 28k (previous -32k), and the ISM Services PMI is also due. The Quarterly Refunding Announcement is also due and is expected to maintain the nominal coupon auction sizes for the November-January period. Finally, the Supreme Court tariff hearing begins today with oral arguments to be presented for the first time.

- Bunds are echoing US Treasuries in terms of overnight direction, though the magnitude of action has been slightly more pronounced. Bunds are in a 129.26-47 band but ultimately remain in the green by a tick or two, as is the case with US Treasuries. There was no move to the morning’s final PMIs, which posted upward revisions to the services and composite measures. The latest ECB wage tracker maintained the annual rate and did not spark any price action.

- Gilts are underperforming peers. They opened unchanged at 93.66 before lifting a few ticks higher to 93.69, acknowledging the overnight move, and then slipping into the red and currently to a 93.50 trough, posting downside of 16 ticks at most. Pressure sends Gilts back to the 93.49 low from Tuesday but still above Monday’s 93.37 close, thus retaining some of the support derived from the late-Monday/early-Tuesday press briefings around potential UK tax moves. Overnight updates include The Times reporting that Reeves is considering removing the 5p cut to fuel duty (introduced in 2022, after Russia invaded Ukraine), as it is not being passed onto individual customers. That cut, alongside the duty freeze that has been in place since 2011, costs approximately GBP 3 billion per year.

COMMODITIES

- Crude benchmarks dipped at the start of the APAC session as Asian equities followed the sell-off seen stateside but gradually reversed as the European session got underway as risk sentiment improved a little. WTI and Brent dipped to a trough of USD 60.02/bbl and 63.92/bbl respectively before reversing to a peak of USD 60.90/bbl and 64.78/bbl as European players entered the market. Currently, crude benchmarks remain near session highs as markets wait for a new catalyst to drive the oil market. In the meantime, US ADP/ISM Services will keep markets busy.

- Spot gold (XAU) has rebounded from Tuesday’s selloff, which moved counter to the wider risk theme running through markets. Gold fell just shy of Tuesday’s low of USD 3928/oz at the start of the APAC session before trading higher to a peak of USD 3979/oz as the European session got underway. The yellow metal briefly extended higher to USD 3987/oz but has since fallen back into prior ranges. After falling over 12% from all-time highs, there is a wider consensus that the pullback is mostly over as underlying drivers remain strong.

- Base metals have traded rangebound as the European session gets underway after 3M LME Copper fell for 4 straight days, its longest losing streak since late July. 3M LME Copper oscillates in a USD 10.58k-10.71k/t band as markets wait for a catalyst.

- US Private Energy Inventory Data (bbls): Crude +6.5 million (exp. +0.6 million), Distillate -2.5 million (exp. -2 million), Gasoline -5.7 million (exp. -1.1 million), Cushing +0.4 million.

NOTABLE DATA RECAP

- EU Producer Prices YoY (Sep) -0.2% vs. Exp. -0.1% (Prev. -0.6%); MoM (Sep) -0.1% (Prev. -0.3%, Rev. -0.4%)

- ECB Wage Tracker: 2025 Annual 3.158% (prev. 3.158%)

- German Industrial Orders MoM (Sep) 1.1% vs. Exp. 1.0% (Prev. -0.8%)

- French Industrial Output MoM (Sep) 0.8% vs. Exp. 0.1% (Prev. -0.7%, Rev. -0.9%)

- EU HCOB Services Final PMI (Oct) 53.0 vs. Exp. 52.6 (Prev. 52.6); Composite Final PMI (Oct) 52.5 vs. Exp. 52.2 (Prev. 52.2)

- Spanish Services PMI (Oct) 56.6 vs. Exp. 54.8 (Prev. 54.3)

- Italian HCOB Composite PMI (Oct) 53.1 (Prev. 51.7); Services PMI (Oct) 54.0 vs. Exp. 53.0 (Prev. 52.5)

- French HCOB Services PMI (Oct) 48.0 vs. Exp. 47.1 (Prev. 47.1); Composite PMI (Oct) 47.7 vs. Exp. 46.8 (Prev. 46.8)

- German HCOB Services PMI (Oct) 54.6 vs. Exp. 54.5 (Prev. 54.5); Composite Final PMI (Oct) 53.9 vs. Exp. 53.8 (Prev. 53.8)

- Italian Retail Sales SA MoM (Sep) -0.5% (Prev. -0.1%); YoY (Sep) 0.5% (Prev. 0.5%)

- UK S&P Global Services PMI (Oct) 52.3 vs. Exp. 51.1 (Prev. 51.1); Composite - Output (Oct) 52.2 vs. Exp. 51.1 (Prev. 51.1)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is expected to urge insurance executives to increase investment in London, according to the Financial Times.

- The Times' Shadow MPC suggests that the Bank of England should delay further rate cuts until after the November 26th budget. The decision was reached by a narrow vote of 5-4.

- Politico reports that the sentiment surrounding French Socialist Party Leader Faure regarding the budget bills was optimistic. An associate stated, "What would be the point of a governing party doing all this work if they're not going to vote in the end?".

- The Riksbank maintained its rate at 1.75% as expected and reiterated that the policy rate is expected to remain at this level for some time to come. The labor market is still showing weak development, although there are now some signs that a turnaround is on its way.

- ECB's Nagel stated that the ECB should be vigilant but not complacent about inflation.

NOTABLE US HEADLINES

- Democrat Mikie Sherrill won the New Jersey Governor election, Democrat Abigail Spanberger won the Virginia Governor election, and Democrat Zohran Mamdani won the New York mayoral election.

- According to sources at the Washington Post, a "handful" of moderate Senate Democrats are considering voting to end the government shutdown. The deal would pass three full-year appropriations bills to fund some agencies, along with a short-term bill that would reopen the rest of the government.

GEOPOLITICS

MIDDLE EAST

- IAEA's Grossi stated that Iran must significantly improve cooperation with UN inspectors to avoid escalating tensions with the West, according to the Financial Times.

OTHER

- North Korea is showing signs of preparing to launch additional spy satellites aided by Russia. It was also reported that North Korean leader Kim could conduct a nuclear test in the near future if he wants, according to South Korea's spy agency.

- US Secretary of Defense Hegseth stated that the US military carried out a lethal kinetic strike on a vessel in international waters in the Eastern Pacific.

CRYPTO

- Bitcoin is slightly lower and trading just above USD 101k, after dipping below USD 100k in the prior session. Ethereum is underperforming and is down to a USD 3.3k base.

APAC TRADE

- APAC stocks were mixed after an early sell-off following the losses stateside, where tech underperformed amid valuation concerns.

- The ASX 200 was rangebound as resilience in defensives and the top-weighted financial sector provided a cushion.

- The Nikkei 225 suffered heavy losses and briefly fell beneath the 50,000 level, with the downturn led by tech-related stocks.

- The KOSPI collapsed alongside the tech bloodbath, which prompted the Korea Exchange to briefly trigger sidecars on the KOSPI and KOSDAQ.

- The Hang Seng and Shanghai Comp are mixed after paring most of their earlier losses following somewhat mixed Chinese RatingDog Services and Composite PMI data, in which the former marginally topped estimates, but the composite figure slowed. Both the US and China made adjustments to their tariffs following last week's Trump-Xi talks.

NOTABLE ASIA-PAC HEADLINES

- The Bank of Japan (BoJ) Minutes from the September 18th-19th Meeting stated that members agreed current real interest rates are very low, and the BoJ is likely to continue raising interest rates if its economic and price projections materialize. Furthermore, members agreed there is high uncertainty on trade policy developments and their impact on the economy. A few members said it is appropriate to maintain current monetary policy to scrutinize trade policy impact on the domestic and overseas economy, as well as prices.

- Japan's Top Currency Diplomat Mimura stated that recent JPY moves deviate from fundamentals and that JPY long positions have been shrinking after summer. He added that excessive FX volatility, not levels, is the main concern. There is some speculation in the market about Japan's macroeconomic policies, especially fiscal policy. He also expressed concern about whether the current situation in the stock market might be a little too rapid.

DATA RECAP

- Chinese RatingDog Services PMI (Oct) 52.6 vs. Exp. 52.5 (Prev. 52.9); Composite PMI (Oct) 51.8 (Prev. 52.5)