Market Wrap 2025-11-06

- US Challenger job cut figures for October showed a 175.3% increase, reaching a 7-month high of 153,074, compared to 54,064 in September.

- European stock markets are experiencing downward pressure, while US stock futures are showing slight gains or remaining flat.

- The unexpected early release of US Challenger data caused the DXY to fall below 100, and the Norwegian Krone (NOK) strengthened following the Norges Bank decision. The British Pound (GBP) is awaiting the Bank of England (BoE) announcement.

- The early Challenger data pushed US Treasury (UST) prices to a session high, while Gilts are awaiting the BoE's decision.

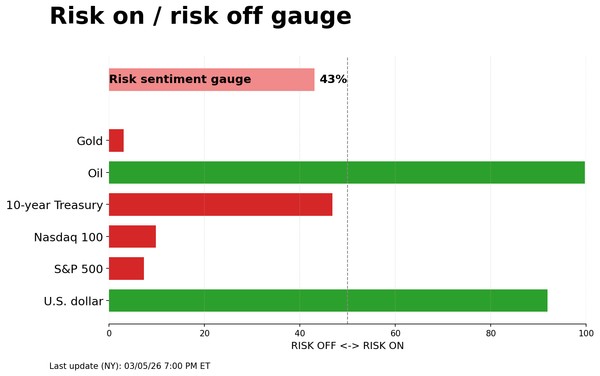

- Crude oil prices are rising despite Saudi Arabia's oil price cuts and an increase in US inventories. The focus is on Israel's declaration of the Egyptian border as a closed military zone.

- Upcoming events include US Chicago Fed Labor Market Indicators, BoE and Banxico policy announcements, speeches from Fed officials Williams, Barr, Hammack, Waller, Paulson, and Musalem, and ECB officials Lane and Nagel, as well as BoE's Bailey and BoC's Macklem, Rogers, and Kozicki.

- Earnings reports are expected from Airbnb, ConocoPhillips (COP), and Warner Bros.

TARIFFS/TRADE

- According to traders cited by Reuters, China purchased two cargoes of US wheat, totaling approximately 120,000 tons, for shipment in December. The US Grains and Bioproducts Council Chairman also reported that a US sorghum shipment was sent to China last week.

- Japanese PM Takaichi stated that Japan will explore specific ways to enhance cooperation with the US in developing rare earth mining in the waters surrounding Minamitori Island.

- The Chinese Commerce Ministry stated its commitment to the stability and security of the global chip industry regarding semiconductor flows, and will approve export license applications from qualified Chinese exporters.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (STOXX 600 -0.2%) opened with a slight decrease and have maintained a negative trend throughout the European morning. There is no specific reason for this sentiment, but traders are aware of upcoming US data and the BoE policy decision.

- European sectors are showing mixed performance. Banks are leading, closely followed by Retail and Real Estate. Construction & Materials is lagging, followed by Insurance. Key movers include AstraZeneca (positive headline metrics), Maersk (-5.2%, strong Q3 metrics but faces "challenging" 2026), and Commerzbank (-2.5%, boosts outlook but Net Income not so strong).

- US equity futures (ES +0.1%, NQ +0.1%, RTY U/C) are showing modest gains or remaining flat ahead of earnings releases. The main focus was the early release of US Challenger Layoffs data, which showed a 175.3% increase to a 7-month high of 153,074 (previously 54,064). A slight increase in futures was observed following the unexpected release.

FX

- The DXY is weakening after trading within a range. The surprise early release of US Challenger job cuts data led to a break below 100.00. The current intraday range is between 99.89 and 100.11, compared to yesterday's range of 100.06-100.36. The Challenger October US Job Cuts increased by 175.3% to a 7-month high of 153,074 (previously 54,064 in September), according to Bloomberg. This release caused an increase in T-note futures and a decrease in the USD. Regarding tariffs, the US Supreme Court questioned President Trump's use of emergency powers to impose global tariffs, although this risk event is expected to be a slow process, potentially ending in Q1/Q2 2026. ING's base case is that tariffs will remain regardless of the ruling.

- The EUR is slightly stronger against the USD, mainly due to USD weakness. There was little reaction to comments from ECB's Schnabel and de Guindos, as well as pessimistic Construction PMI data. EUR/USD is trading within a 1.1490-1.1524 intraday range, with traders also aware of the converging 50 DMA (1.1670) and 100 DMA (1.1664).

- USD/JPY gave back some of the previous day's gains and fell below 154.00 following an acceleration in wages. USD weakness further weighed on the pair in early European hours. The pair is trading within yesterday's 152.96-154.35 range. One of Japan's largest labor unions, UA Zensen, is reportedly planning to push for a 6% wage hike for regular workers in next year's talks, according to Bloomberg.

- Sterling is in focus as the Bank of England rate decision, minutes, and Monetary Policy Report (MPR) are due at 12:00 GMT/07:00 EST, with the press conference at 12:30 GMT/07:30 EST. The MPC is expected to maintain the Bank Rate at 4.0%, likely with a 6-3 vote, with focus on any signals regarding future easing. Despite softer-than-expected September inflation, elevated year-over-year CPI is expected to keep policymakers on hold, although three members may favor a cut. GBP/USD is currently trading in a 1.3042-1.3089 range after exceeding yesterday's peak at 1.3054.

- The AUD/NZD cross is diverging, rising above 1.1500 from an intraday low of 1.1486, with the AUD supported by base metals and the NZD weighed down by cautious RBNZ commentary. Overnight, RBNZ Governor Hawkesby said he doesn’t think they are out of the worst on global trade tensions, while he added the labor market has deteriorated, which is something they anticipated. AUD/USD is trading in a 0.6497-0.6518 range and is still some way off its 100 DMA (0.6539). NZD/USD is contained in a 0.5651-0.5669 range at the time of writing.

- EUR/NOK stopped just short of its 100 DMA (11.7519) following the policy decision by Norges Bank, which opted to keep rates steady at 4.00% as expected. The Bank largely reiterated the statement from the prior meeting, suggesting that "no information has been received that indicates that the outlook for the Norwegian economy has changed significantly since the September policy meeting".

- The PBoC set the USD/CNY mid-point at 7.0865 vs exp. 7.1222 (Prev. 7.0901)

- The Brazilian Central Bank maintained the Selic rate at 15.00%, as expected, with the decision unanimous. The BCB evaluated that maintaining the interest rate at the current level for a very prolonged period is enough to ensure convergence of inflation to the target. Furthermore, it said that future monetary policy steps can be adjusted, and it will not hesitate to resume the rate hiking cycle if appropriate.

FIXED INCOME

- USTs are contained overnight as newsflow at the time was relatively limited and participants awaited a packed docket of Fed speak, texts are expected from Williams (voter) and Paulson (2026). Spent the morning near enough unchanged and just above the 112-10 session low. Thereafter, a bout of support was seen for havens generally around the European cash equity open; potential drivers include the Israeli comments on Egypt. Thereafter, the docket ahead was lightened by an early release of October’s Challenger job cuts. Printed at 153k (prev. 54k), to a seven-month high. This added to the modest strength seen in USTs and took them to a 112-18 high with gains of eight ticks at best. A print that has added a little bit of dovishness back into Fed pricing, though the odds of a 25bps cut in December remain at around 65% after losing the 70% handle yesterday following ADP and ISM Services. Markets see more job market indicators today via the Chicago Fed BLS unemployment forecast and the latest Revelio statistics.

- Bunds initial action was similar to that outlined above in USTs . Bunds spent the first part of the day holding near enough unchanged and just above the 129.03 opening mark. Thereafter, a pickup occurred around the European cash equity open before a 129.18 peak printed alongside Challenger; again, detailed in USTs above. Prior to this, an interesting speech from ECB’s Schnabel, where she said there are factors that are suggestive of tilting the structure of the ECB’s portfolio towards shorter-dated assets, but no move in Bunds at the time. Construction PMIs passed without impact this morning. Ahead, traders look to the referenced US events before remarks from ECB’s Nagel and Chief Economist Lane; particularly regarding the ECB’s portfolio, in light of Schnabel. No move to supply from Spain and France this morning. Overall, the auctions were well received with the long-dated French metric in particular garnering strength, a welcome sign amid the ongoing political turmoil.

- Gilts opened firmer by around 15 ticks and then quickly extended a handful more to a 93.33 high, a move that acknowledged the modest bullish action seen at the time, as outlined above. Price action for Gilts was a little more pronounced than that seen in peers, nothing too significant behind this but potentially a function of the relative underperformance seen in Gilts vs Bunds for much of Wednesday and/or positioning into the BoE. The BoE is expected to maintain the policy rate at 4.00%, though the decision will almost certainly be subject to dissent; expectations are broadly for either 7-2 or 6-3, however a split where Governor Bailey has to cast the deciding vote cannot be ruled out.

- Spain sold EUR 4.503bln vs exp. EUR 4-5bln 3.00% 2033, 1.85% 2035, 3.50% 2041 Bono & EUR 0.534bln vs exp. EUR 0.25-0.75bln 1.15% 2036 IL Bono.

- France sold EUR 10.98bln vs exp. EUR 9.5-11bln 3.50% 2035, 3.60% 2042 & 3.00% 2049 OAT.

COMMODITIES

- Crude oil benchmarks have partially recovered from Wednesday's losses following comments from Israeli Defense Minister Katz and the failure of sellers to break through the lows of the 7-day range. After testing prior support lows, crude benchmarks sold off, reversing APAC gains, and troughed at USD 59.46/bbl and 63.37/bbl. However, this selloff was short-lived and benchmarks bid higher to a peak of 60.51/bbl and 64.34/bbl respectively. Saudi Arabia cut its December Light Crude OSP to Asia, in line with expectations. This confirms that the kingdom is comfortable with Brent prices holding between USD 60-65/bbl. Slight downticks were seen in crude benchmarks but move wasn’t sustained.

- Spot XAU has followed on from Wednesday’s gains as the yellow metal continues to consolidate following its 11% selloff from ATHs. XAU dipped to a trough of USD 3964/oz early in the APAC session but reversed higher and extended through Wednesday’s high at USD 3990/oz as the European session risk sentiment started off weak. Currently, the yellow metal is trading near session highs at USD 4017/oz. A surprising Challenger Layoff release had little impact on spot gold action.

- Base metals are trading mixed, with iron ore continuing to sell off as China steel industry heads into the low season while copper gains following risk-on tone during the APAC session. 3M LME Copper dipped to a low of USD 10.69k/t before driving higher as it followed the CME Copper bid back above USD 5/lb. 3M LME Copper peaked at USD 10.79k/t and remains in a c. USD 40/t band near session highs.

- Saudi Arabia set the December Light Crude OSP to Asia to + USD 1.00/bbl vs Oman/Dubai average (prev. + USD 2.20), to Europe at + USD 1.35/bbl vs ICE Brent (prev. +1.35), and to US at + USD 3.20/bbl vs ASCI (prev. + USD 3.70).

- Poland is in talks to import more US LNG to supply Ukraine and Slovakia, according to Reuters citing sources familiar with negotiations.

NOTABLE DATA RECAP

- German Industrial Output MM (Sep) 1.3% vs. Exp. 3.0% (Prev. -4.3%)

- Swedish CPIF Flash YY (Oct) 3.1% vs. Exp. 2.9% (Prev. 3.10%); Modest SEK strength seen on the hotter-than-expected series.

- French Non-Farm Payrolls QQ (Q3) -0.3% (Prev. 0.2%)

- Spanish Ind Output Cal Adj YY (Sep) 1.7% (Prev. 3.4%, Rev. 3.3%)

- EU HCOB Construction PMI (Oct) 44.0 (Prev. 46)

- Italian HCOB Construction PMI (Oct) 50.7 (Prev. 49.8)

- French HCOB Construction PMI (Oct) 39.8 (Prev. 42.9)

- German HCOB Construction PMI (Oct) 42.8 (Prev. 46.2)

- UK S&P Global Construction PMI (Oct) 44.1 vs. Exp. 46.7 (Prev. 46.2)

- EU Retail Sales YY (Sep) 1.0% vs. Exp. 1.0% (Prev. 1.0%, Rev. 1.6%); MM (Sep) -0.1% vs. Exp. 0.2% (Prev. 0.1%, Rev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- ECB's Schnabel says quantitative normalisation is proceeding smoothly, with strong liquidity positions of banks and abundant excess liquidity; on new structural portfolio, says factors suggest tilting the structure towards shorter-dated assets. "policy stance neutrality, the need to maintain policy space and considerations related to financial soundness are important factors that will guide the maturity of assets the ECB will buy under a new structural securities portfolio. These factors suggest tilting the structure towards shorter-dated assets."

- ECB's de Guindos states slight optimism on growth; adds that inflation news is positive. More optimistic on services inflation. Evolution of wages are fully aligned with projections. The level of uncertainty is huge. Comfortable with the current level of rates. Undershooting of inflation will be temporary. No discussion on modifying QT.

- Norges Bank keeps rates unchanged at 4.00%, as expected; Governor Bache says, "The job of overcoming inflation is not complete, and we are in no hurry to lower interest rates".

NOTABLE US HEADLINES

- Challenger October US Job Cuts jump 175.3% to a 7-month high at 153.074k (prev. 54.064k in September), according to Bloomberg .

- US President Trump said regarding the US shutdown, that it was a big factor in elections, while he does not think Democrats will act soon on the shutdown, and does not think it will be sorted soon. Trump reiterated the call to kill the filibuster and reopen the government immediately.

- US President Trump is scheduled to make an announcement at 11:00EST/16:00GMT on Thursday.

- US Department of Transportation announced it will start cutting flights by 4% on Friday which will rise to 10% next week if no shutdown deal is reached, while the FAA confirmed that flight cuts at 40 major airports will begin on Friday and warned it could take more actions after Friday if further air traffic issues emerge.

- Fed finalised new standards for grading large banks and said that the new large bank supervisory standards are substantially similar to changes proposed in July.

- Punchbowl writes, on the US shutdown , that "Trump and Hill Republicans are now in completely different places on the political impacts of this seemingly endless shutdown."

GEOPOLITICS

- According to Al Jazeera, Israeli Defense Minister Yisrael Katz stated, "Declaring war on smuggling operations through drones on our border with Egypt." Iran International reported that he "ordered the border area with Egypt to be turned into a closed military zone."

OTHER NEWS

- US President Trump warned the Nigerian government that they had better move fast to stop the killing of Christians.

- According to sources cited by the WSJ, US President Trump recently expressed reservations to top aides about launching military action to oust Venezuelan President Maduro, fearing that strikes might not compel Maduro to step down.

CRYPTO

- Bitcoin is slightly firmer and trades just above USD 103k, whilst Ethereum outperforms a touch.

APAC TRADE

- APAC stocks were higher as the region took impetus from the rebound on Wall St, where all major indices gained amid dip buying and following stronger-than-expected ADP and ISM Services data releases.

- The ASX 200 saw modest gains amid strength in miners, but the upside was limited as the top-weighted financials sector lagged after Big Four bank NAB reported a decline in full-year profit.

- The Nikkei 225 rebounded from the prior day's selling and briefly reclaimed the 51,000 level before paring some of its gains.

- The Hang Seng and Shanghai Comp benefitted from the improving US-China trade ties after China’s Commerce Ministry suspended the unreliable entity list announced in April and adjusted its export control lists, while there were comments from US President Trump who reiterated that Chinese President Xi is a good friend.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi looks to finalise an economic stimulus package to address inflation by late November and pass a supplementary budget to fund it, with some in the government eyeing a cost of over JPY 10tln, according to Nikkei.

- Japan Innovation Party co-leader Fujita said an early BoJ rate hike may give a mixed signal to businesses, while he added it is not a time for BoJ moves that have a big impact and they will not raise taxes to fund an earlier defence budget jump.

- One of Japan's largest labour unions, UA Zensen, is reportedly planning to push for a 6% wage hike for regular workers in next year's talks , according to Bloomberg.

DATA RECAP

- Japanese Overall Lab Cash Earnings (Sep) 1.9% vs. Exp. 1.9% (Prev. 1.5%, Rev. 1.3%)

- Australian Balance on Goods (Sep) 3,938M vs. Exp. 4,000M (Prev. 1,825M)

- Australian Goods/Services Exports (Sep) 7.90% (Prev. -7.80%)

- Australian Goods/Services Imports (Sep) 1.10% (Prev. 3.20%)