Market Wrap 2025-11-11

- China is reportedly formulating a strategy to prevent the US military from acquiring its rare earth magnets and is considering a 'validated end-user' system to expedite certain export licenses.

- European stock exchanges are generally firmer, with the FTSE 100 showing stronger performance; US equity futures are slightly lower.

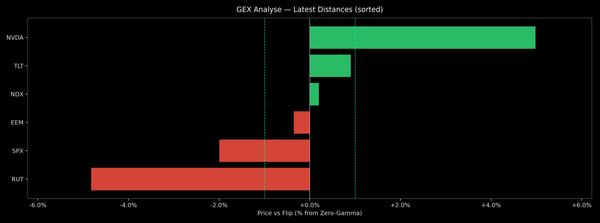

- NVIDIA (NVDA) is down -1.5% following Softbank's sale of its stake and weaker results from CoreWeave.

- The British pound (GBP) is declining due to weak UK jobs data, while the euro (EUR) is not reacting to the ZEW survey; the US Dollar Index (DXY) is stable.

- UK Gilts are rising after jobs data increased the likelihood of a December Bank of England (BoE) rate cut; US Treasury cash bond trading is closed for Veterans' Day.

- Gold (XAU) is peaking just below USD 4150/oz as continued attacks on Russian refineries push crude oil benchmarks higher.

- Key events include the Weekly Preliminary Estimate from ADP and speeches from BoE's Dhingra and RBA's Jones.

- It is a holiday in the US (Veterans' Day) and Canada (Remembrance Day).

TARIFFS/TRADE

- China is reportedly devising a plan to keep the US military from getting its rare earth magnets and is considering a ‘validated end-user’ system to fast-track certain export licenses.

- China's Foreign Minister Wang held a phone call with Canada's Foreign Minister on Tuesday and said China is willing to strengthen communication with Canada and willing to accelerate the resumption of exchanges and cooperation in various fields, while he added that diplomatic, commercial and other departments of their countries can properly resolve concerns.

- Switzerland is nearing a 15% tariff agreement with the US, potentially finalized as early as Thursday or Friday. The deal is contingent upon US President Trump's approval.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (STOXX 600 +0.6%) opened stronger across the board and have remained near their highest levels throughout the European morning. The FTSE 100 is outperforming today, following a weaker-than-expected jobs report, which has pressured the GBP and slightly increased odds of a December rate cut at the BoE.

- European sectors are generally positive, with notable strength in Consumer Products & Services, Health Care, and Construction. Gains in Consumer Products & Services are led by LVMH (+1.7%), after reports the company plans to open several flagship stores across China in December, amidst early indications of a regional recovery.

- US equity futures are trading lower (ES -0.2% NQ -0.4% RTY -0.2%). The tone is cautious amid a light macro backdrop, with participants awaiting the Prelim Estimate ADP release for further directional cues. NVIDIA (NVDA) shares slip pre-market (-1.4%) following CoreWeave (-9%) earnings in which they provided weak guidance, whilst Japan's Softbank said it sold its NVIDIA (NVDA) stake for USD 5.83bln in October.

- Apple (AAPL) reportedly pulled the next-gen iPhone Air off its release schedule next fall, while manufacturing partners have already stopped or cut production of the first iPhone Air.

- Apple (AAPL) is reportedly looking at adding a second camera to next iPhone Air to increase sales.

FX

- The DXY is holding steady through the European session, mirroring the subdued tone from APAC trade, after a mild softening earlier in the week. Market reaction was muted to the Senate’s approval of the government funding bill—largely in line with expectations—with attention now turning to the House, where Speaker Johnson aims for a Wednesday vote on the stopgap measure. The DXY trades within a tight 99.60–99.74 band, comfortably inside Monday’s 99.46–99.74 range, with resistance seen at the November 7th high of 99.87. No move seen on lower-than-prior US NFIB ; inner report suggested "many firms are still navigating a labor shortage and want to hire but are having difficulty doing so".

- EUR/USD remains directionless, confined to a narrow range amid a lack of fresh drivers from the Eurozone and with no move seen to the ZEW survey or to ECB commentary. Germany’s ZEW survey disappointed, with commentary noting that while government investment plans may offer short-term support, “structural problems continue to exist". ECB commentary offered little new insight: Vujčić said inflation risks are now broadly balanced, while Elderson reiterated that the current rate level is “appropriate,” stressing continued data dependence and a meeting-by-meeting approach. The pair trades comfortably within Monday’s 1.1541–1.1583 range

- GBP/USD slipped lower in early trade after a lacklustre overnight session , weighed by weaker-than-expected UK labour data. Employment contracted, the jobless rate ticked higher than expectations, while earnings ex-bonus matched forecasts. The release prompted a swift GBP/USD drop from 1.3153 to 1.3121, while EUR/GBP climbed from 0.8781 to 0.8804 within eight minutes. BoE rate expectations turned slightly more dovish, with a full 25bps cut now fully priced for February (vs. 98.8% pre-data). Post-data, BoE’s Greene noted the unemployment report was “not great” and cautioned that survey issues cloud the labour market picture. She added that policy “needs to be more restrictive than otherwise,” but remains unconvinced that current settings are “meaningfully restrictive". GBP/USD trades near the lower end of a 1.3116–1.3178 band

- USD/JPY ticked higher overnight, briefly reclaiming the 154.00 handle before paring gains as broader risk sentiment softened. The session has offered little in the way of fresh domestic catalysts, with price action largely dictated by cautious risk tone and subdued cross-asset moves. The pair continues to consolidate within a 154.03–154.49 range.

- The Antipodeans drifted lower through the APAC session, giving back a portion of yesterday’s gains that were driven by improved risk sentiment. AUD/USD eased further from its 100DMA (0.6539) after encountering resistance at that level yesterday, with the pair trading within a 0.6515–0.6537 band.

- PBoC set USD/CNY mid-point at 7.0866 vs exp. 7.1204 (Prev. 7.0856)

FIXED INCOME

- US Treasury futures are essentially flat, after being pressured overnight; price action today is exceptionally thin, with volumes light as the US observes Veterans’ Day, where cash bond trading will be shut. Currently in a narrow 112-20 to 112-22+ range, with catalysts seemingly light for the remainder of the day, aside from the US NFIB Business Optimism Index and Weekly Prelim Estimate ADP. On the trade front, some progress between US-India with the POTUS suggesting they “are getting close”. Elsewhere, Bloomberg reported that Switzerland is near a deal to cut the US tariff on its exports to 15% from 39%, with an agreement possible within two weeks.

- Bunds are incrementally lower/flat and trade in a 129.97-129.11 range. Specifics are incredibly light heading into the ZEW survey, aside from a few ECB speakers' comments, which ultimately lacked surprises. To recap, Elderson said current rates are appropriate and will continue to take a data-dependent approach. Elsewhere, Vujcic said risks are balanced around inflation and that recent growth and inflation are higher than forecast. Price action today has been lacklustre. Initially bid on the release of the UK jobs report (discussed below), before being capped at and trading sideways for the remainder of the morning, awaiting ZEW data. That failed to budge Bunds – German ZEW Current/Economic Conditions were both weaker than expected.

- Gilts are the clear outperformers today, boosted following a poor regional jobs report, which has raised the odds of a December rate cut (-18bps vs -15.5bps pre-release). UK paper is currently trading in a 93.53 to 93.69 range, and with price action fairly lacklustre since the open. To recap the latest data, the figures were very poor ; Employment Chance contracted by 22k (exp. 0k), whilst the unemployment rate ticked a little higher to 5% - interestingly, the 3M Avg. Earnings printed at 4.8% (exp. 5%). Overall, metrics are conducive to a cut in December, but the focus ultimately remains firmly on inflation developments, highlighted by Governor Bailey at the most recent confab. Following the report, Greene suggested that the “latest unemployment report is not great”, but described the wage data as “good news”. She also highlighted that policy needs to be more restrictive than otherwise, citing worries re. inflation persistence.

- Netherlands sells EUR 2.41bln vs exp. 2-2.5bln 2.50% 2035 DSL: avg. yield 2.810% (prev. 2.749%).

COMMODITIES

- Crude benchmarks traded choppy throughout the APAC session but saw some strength as the European session got underway, as the risk sentiment remains high and attacks on Russian refineries continue. Just as reports that Ukraine’s military hit Russia’s Saratov oil refinery, crude benchmarks surged c. USD 0.60/bbl higher and are currently trading near session highs at USD 60.43/bbl and USD 64.43/bbl.

- Spot XAU has continued to bid higher as the European session got underway as participants hope for further Fed easing. XAU followed on from Monday’s trend day to a peak of USD 4149/oz during the APAC session before pulling back to a low of USD 4125/oz. As the session switched over, European traders haven’t yet managed to extend the day’s parameters but are currently trading near session highs at USD 4144/oz.

- Base metals remain rangebound amid a lack of market catalysts. 3M LME Copper gapped higher to open at USD 10.84k/t before oscillating in a tight USD 10.8k-10.86k/t band as the European session continued.

- Five big Indian refiners haven’t placed any orders for Russia oil for December.

- UBS expects global gold demand this year and next to reach its strongest level since 2011.

- Commerzbank metals year-end forecasts: Copper USD 10,500/t (prev. 9,600/t). Aluminium USD 2,900/t (prev. 2,600/t). Zinc USD 3,000/t (prev. 2,800/t). Gold USD 4,200/oz. Nickel USD 15,000/t (prev. 16,000/t). Silver USD 50/oz. Platinum USD 1,700/oz. Palladium USD 1,400/oz.

NOTABLE DATA RECAP

- UK Employment Change (Sep) -22k vs. exp. 0k (Prev. 91k)

- UK HMRC Payrolls Change (Oct) -32k (Prev. -10k, Revised -32k)

- UK ILO Unemployment Rate (Sep) 5.0% vs. Exp. 4.9% (Prev. 4.8%)

- UK Claimant Count Unem Chng (Oct) 29.0k (Prev. 25.8k, Rev. 0.4k)

- UK Avg Earnings (Ex-Bonus) (Sep) 4.6% vs. Exp. 4.6% (Prev. 4.7%)

- UK Avg Wk Earnings 3M YY (Sep) 4.8% vs. Exp. 5.0% (Prev. 5.0%)

- Barclays UK October Consumer Spending fell 0.8% Y/Y (prev. -0.7% Y/Y in September)

- UK BRC Retail Sales YY (Oct) 1.5% (Prev. 2.0%)

- UK BRC Total Sales YY (Oct) 1.6% (Prev. 2.3%)

- UK Grocery Inflation +4.7%, Sales +3.2% in the 4 weeks to November 2.

- German ZEW Current Conditions (Nov) -78.7 vs. Exp. -78.0 (Prev. -80.0); says, although the investment programme is likely to provide economic stimulus, the structural problems continue to exist; German ZEW Economic Sentiment (Nov) 38.5 vs. Exp. 41.0 (Prev. 39.3)

- EU ZEW Survey Expectations (Nov) 25.0 (Prev. 22.7)

- US NFIB Business Optimism Idx (Oct) 98.2 (Prev. 98.8)

NOTABLE EUROPEAN HEADLINES

- European Commission has begun setting up a new intelligence body under President Ursula von der Leyen, in an attempt to improve the use of information gathered by national spy agencies.

- ECB's Elderson says "current [rate] level is appropriate, but we will continue to be data-dependent and will decide one meeting at a time". "Our monetary policy is in a good place. It’s true that the economic environment remains uncertain, so we cannot commit to a pre-determined interest rate path". Elderson cites risks of higher inflation from supply fragmentation and defence spending. "Among the risks of lower inflation, I would include the appreciation of the euro, which could reduce demand for euro area exports; and a re-routing to the euro area of products previously shipped to the United States". "We do, of course, monitor the euro’s exchange rate against other currencies because it could affect inflation". Elderson says policy should not undermine banking mergers. Elderson argues mergers must be judged on technical and prudential criteria.

- ECB's Vujcic says the risks are balanced around inflation and that recent growth and inflation are higher than forecast. Economically in a good place. Frontloading of tariffs is still unwinding. Consumers are still very cautious in Europe. Market valuations are stretched. A bit concerned that retail participation in stock markets are growing faster than hedge funds.

- BoE's Greene says risk management around inflation needs to influence policy views . Policy : Policy needs to be more restrictive than otherwise. Not convinced that policy is meaningfully restrictive. Labour Market : Latest unemployment report is not great. Problems with the labour force survey make it hard to know what is happening. Inflation : Household inflation expectations are at the very top of expectations. Worried about inflation persistence. Wages : The weaker wage data is good news. Wage settlements data for next year from surveys is higher than we would like to see. Latest data suggests that the disinflationary process is on track. Wages are still "way too high" given weak growth. Says the market pricing of 3.25-3.50% for the neutral rate is reasonable.

NOTABLE US HEADLINES

- US Senate voted 60 vs. 40 to pass legislation to fund the federal government and end the shutdown, while the bill now goes to the House.

GEOPOLITICS

MIDDLE EAST

- US President Trump posted "It was an Honor to spend time with Ahmed Hussein al-Sharaa, the new President of Syria, where we discussed all the intricacies of PEACE in the Middle East, of which he is a major advocate. I look forward to meeting and speaking again. Everyone is talking about the Great Miracle that is taking place in the Middle East. Having a stable and successful Syria is very important to all countries in the Region."

- Turkish Foreign Minister said they discussed Syria and Gaza in talks with US and Syrian counterparts, US VP Vance, Trump aide Witkoff, and special envoy Barrack. He added that US officials understand that Syria needs to be united, and that problems in south and north Syria risk dividing the country.

- US is reportedly planning to build a large military base in Israel’s Gaza border region, the facility would be used by international forces operating in Gaza to help maintain the ceasefire. Facility could accommodate several thousand soldiers. They estimated the project’s budget at roughly USD 500mln.

RUSSIA-UKRAINE

- Ukrainian drone attack damaged civilian infrastructure in Russia's Saratov.

- Russian security services reportedly foiled a joint Ukrainian-British operation to hijack a Russian MiG-31 equipped with a hypersonic missile.

OTHER NEWS

- Thai Defence Minister announced the halting of ceasefire implementation steps and return of Cambodian prisoner of war, while he said they will explain to Malaysia and the US regarding the Thai decision on the ceasefire.

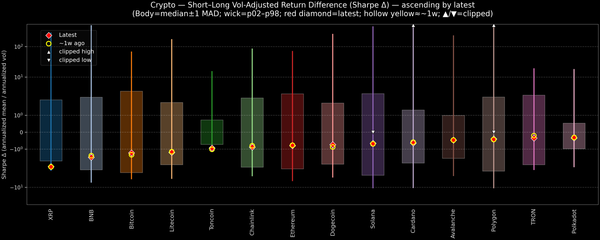

CRYPTO

- Bitcoin is a little lower and trades just shy of USD 105k, whilst Ethereum underperforms and holds just above USD 3.5k.

APAC TRADE

- APAC stocks were mostly subdued with the region failing to sustain the positive global risk momentum that had been spurred by US-China trade optimism and US government reopening hopes, while there were few fresh catalysts overnight to fuel the recent rally.

- ASX 200 faded its early advances as the outperformance in gold stocks and miners was negated by weakness in tech and the top-weighted financial sector following CBA's modest earnings growth, while the improvement in Consumer Sentiment to a 7-year high did little to spur risk appetite.

- Nikkei 225 initially rallied amid currency weakness and as participants digested earnings results, but eventually wiped out all of its gains as sentiment soured.

- Hang Seng and Shanghai Comp were pressured amid losses in tech, including Chinese e-commerce giants Alibaba and JD.com , which failed to benefit, despite it being China's Singles' Day, which is the world's largest shopping event, as sales had begun weeks earlier in an effort to boost sluggish spending.

NOTABLE ASIA-PAC HEADLINES

- Japanese Economy Minister Kiuchi said they are aware that high inflation is weighing on private consumption, and that a weak yen pushes up prices through higher import costs. Kiuchi added they will expand and implement measures to cushion the impacts of higher prices, as well as continue to aim for wage growth exceeding inflation.

- China State Planner Official says private investment has slowed down this year. Adds that there's challenges in private investment. Energy official says it will increase policy supply for attracting private investment in energy. There's plan to support Private Investment to flow to high value service sectors. Aims to encourage private firms to enter the tech sector. Some of the new policy-based financial tool allowed to support private investment in key areas.

- PBoC issues its Q3 monetary policy implementation report: . Policy : To implement appropriately loose monetary policy and strengthen transmission of policy. To keep liquidity ample. To maintain FX flexibility and prevent overshooting risks. Will maintain reasonable relative relationships among various types of interest rates. Global Situation : External situation unstable and uncertain Economy : Economy faces may risks and challenges. To increase efforts to support consumption and tech innovation. To stabilise growth, jobs, and market expectations. Foundation for economic recovery needs to be enhanced. To maintain reasonable growth in total amount of finance. Need to consolidate economic recovery. Inflation : To maintain prices at reasonable level Banks : To reduce cost of bank's liability. To fend off financial systemic risks.

DATA RECAP

- Australian Westpac Consumer Sentiment MM (Nov) 12.8% (Prev. -3.5%)

- Australian Westpac Consumer Sentiment Index (Nov) 103.8 (Prev. 92.1)

- Australian NAB Business Confidence (Oct) 6.0 (Prev. 7.0)

- Australian NAB Business Conditions (Oct) 9.0 (Prev. 8.0)

- New Zealand 1yr Inflation Expectation (Q4) 2.4% (Prev. 2.4%)

- New Zealand 2yr Inflation Expectation (Q4) 2.3% (Prev. 2.3%)