Market Wrap 2025-11-17

Today's US Market Wrap — Key Points

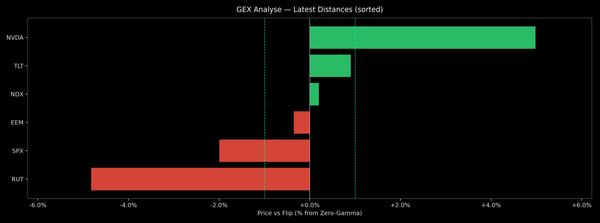

- Equities declined amid risk-off sentiment, driven by AI valuation concerns.

- Fed officials offer differing views on future rate cuts.

- Dollar strengthened, impacting G10 currencies.

- Focus shifts to FOMC Minutes, NVIDIA earnings, and US jobs report.

- Oil slightly down; gold and Bitcoin pressured by equity weakness.

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

- Equities decreased, Treasuries were mostly unchanged to higher, Crude oil decreased, the Dollar increased, and Gold decreased.

RECENT EVENTS

- Fed Governor Jefferson reiterated the need for the Federal Reserve to proceed cautiously. Fed Governor Waller advocated for a 25bps rate cut in December. The NY Fed Manufacturing survey showed solid results. Saba Capital Management sold credit derivatives to lenders seeking protection from technology sector exposure. Former President Trump anticipates issuing a tariff dividend in mid-2026 and expressed dissatisfaction with Mexico. The EU is expected to caution the US against expanding steel tariffs. The UK is considering retaliatory measures against Europe regarding steel tariffs. Israeli warplanes targeted areas in southern Lebanon. Amazon (AMZN) plans to sell USD 15 billion in USD bonds. Apple (AAPL) is reportedly accelerating its CEO succession plan. Berkshire Hathaway has acquired a stake in Alphabet (GOOGL).

UPCOMING EVENTS

- Data releases: US ADP Weekly Estimate, US Factory Orders (August), US Durable Goods (August), Japanese Trade Balance. Event: RBA Minutes. Speakers: ECB’s Elderson; BoE’s Pill, Dhingra; Fed’s Barr, Barkin. Earnings: Home Depot, Baidu, Medtronic, PDD; Imperial Brands.

MARKET WRAP

US indices experienced significant losses, with all sectors except Communications and Utilities declining. The risk-off sentiment at the start of the week lacked a specific catalyst, driven by ongoing concerns about elevated valuations in the AI sector. The SPX fell below 6,700 and closed below its 50-day moving average of 6,707. The Communications sector was supported by Alphabet (GOOGL), which gained following Berkshire Hathaway's disclosed stake. The Dollar strengthened amid risk aversion, negatively impacting all G10 currencies, with the Australian and New Zealand dollars underperforming. The NY Fed Manufacturing survey was positive, while Governor Waller reiterated his support for a 25bps December rate cut, citing no factors likely to accelerate inflation. Governor Jefferson emphasized the need for the Fed to proceed slowly as monetary policy approaches the neutral rate. Treasuries were supported but gains were limited by Amazon's USD 15 billion bond sale, its first since 2022. Crude oil traded in a narrow range and settled slightly lower, despite a brief rally following reports of Israeli airstrikes in southern Lebanon. Gold and Bitcoin were pressured by equity weakness, with Bitcoin reaching a six-month low and gold testing USD 4,000/oz. The week's focus will shift to the FOMC Minutes, NVIDIA earnings (Wednesday), and the September US jobs report (Thursday).

US

NY FED:

The November Empire State Manufacturing survey indicated rising activity, expansionary employment, and a slower pace of price increases. The current business conditions index rose to +18.7 from 10.7 in October, exceeding the forecast of 5.8. New orders and shipments increased significantly, with new orders rising to 15.9 from 3.7. Delivery times lengthened modestly, and supply availability worsened somewhat. Inventories expanded. Labor market indicators improved, showing a small increase in employment and a longer average workweek. The employment index rose to 6.6 from 6.2. The pace of both input price increases and selling price increases slowed slightly but remained elevated. Prices paid slowed to 49 from 52.4, while prices received fell to 24 from 27.2. Capital spending plans grew. Firms anticipate improved conditions in the coming months, although optimism was slightly lower than last month. Looking ahead, prices paid and received are expected to slow, while employment is expected to improve.

FED'S JEFFERSON:

The Fed Vice Chair reiterated comments made in early November, stating that the Fed needs to proceed slowly as monetary policy approaches the neutral rate. He noted that the availability of government data for the next meeting remains uncertain. He reiterated that the current Fed policy rate is "somewhat restrictive" and that the balance of risks has shifted in recent months, with increased potential downside to employment. He also mentioned looking forward to reviewing the Beige Book next week.

FED'S WALLER:

The Fed Governor advocated for continued rate cuts, supporting a 25bps cut in December to provide additional labor market insurance amid signs of economic softening. He cautioned that restrictive policy may be weighing on activity, with the labor market weakening. He argued that underlying inflation is close to 2%, expectations remain well-anchored, and tariffs are merely a one-time price level shock. He stated that he sees no factors likely to accelerate inflation and expects that no upcoming data, including the jobs report, would change his view that another cut is warranted.

FIXED INCOME

T-NOTE FUTURES (Z5) SETTLED 3+ TICKS HIGHER AT 112-20+

T-Notes experienced slight upside due to risk-off sentiment, but gains were limited by Amazon's bond sale.

At settlement: 2-year -0.6bps at 3.608%, 3-year -0.8bps at 3.607%, 5-year -1.3bps at 3.721%, 7-year -1.7bps at 3.904%, 10-year -1.3bps at 4.135%, 20-year -1.1bps at 4.710%, 30-year -0.7bps at 4.739%.

INFLATION BREAKEVENS:

1-year BEI -4.8bps at 2.731%, 3-year BEI -1.9bps at 2.476%, 5-year BEI -2.1bps at 2.304%, 10-year BEI -1.1bps at 2.274%, 30-year BEI -0.8bps at 2.236%.

THE DAY:

T-Notes moved slightly higher, but upside was capped by Amazon's corporate bond sale. Amazon increased its USD 12 billion offering to USD 15 billion, marking its first US bond sale since 2022. US yields were lower by 1-3bps, with the belly of the curve experiencing the greatest losses. The overall tone was risk-off, with AI valuation concerns impacting sentiment and paring pre-market gains in US equity futures. As stocks sold off, T-Notes were bid, but the USD 15 billion Amazon bond offering limited gains ahead of 20-year and 10-year TIP supply this week. This week's focus is on the September NFP report on Thursday and the FOMC Minutes on Wednesday. The NY Fed manufacturing survey was solid, with rising activity, expansionary employment, and a slower pace of price increases. Construction Spending saw a surprise gain in August, leading to an upgrade of the Atlanta Fed GDP Now estimate for Q3 to 4.1% from 4.0%. The ADP will release its weekly report on Tuesday, showing the average weekly employment change over the last four weeks. Fed Vice Chair Jefferson reiterated that the Fed needs to proceed slowly as it approaches the neutral rate, reiterating that policy is still somewhat restrictive. Governor Waller reiterated his support for a 25bps rate cut in December.

SUPPLY:

Notes

- US to sell USD 16 billion of 20-year bonds on November 19th, to settle December 1st.

- US to sell USD 19 billion of 10-year TIPS on November 20th, to settle November 28th.

Bills

- US sold USD 86 billion of 3-month bills at a high rate of 3.795%, B/C 2.79x; sold USD 77 billion of 6-month bills at a high rate of 3.710%, B/C 2.80x.

- US to sell USD 95 billion of 6-week bills on Nov 18th, to settle on Nov 20th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: Dec 10bps (previous 10bps), January 21bps (previous 21bps), March 30bps (previous 30bps).

- NY Fed RRP op demand at USD 3.2 billion (previous 1.6 billion) across 7 counterparties (previous 10).

- NY Fed Repo Op demand at USD 5.57 billion across two operations today (previous 0.02 billion).

- EFFR at 3.88% (previous 3.88%), volumes at USD 72 billion (previous 78 billion) on November 14th.

- SOFR at 3.95% (previous 4.00%), volumes at USD 3.195 trillion (previous 3.197 trillion) on November 14th.

CRUDE

WTI (Z5) SETTLED USD 0.18 LOWER AT 59.91/BBL; BRENT (F6) SETTLED USD 0.19 LOWER AT 64.20/BBL

Crude oil was choppy and settled marginally lower amid thin newsflow. Reports of Israeli warplanes targeting areas in southern Lebanon boosted the energy sector in the European morning. Geopolitical rhetoric had little impact. Former President Trump warned that countries doing business with Russia will face sanctions, potentially including Iran. Goldman Sachs forecasts Brent to decline to USD 56/bbl (previous 63) and WTI to USD 52/bbl (previous 60) in 2026, citing a large 2.0 million BPD surplus due to strong global ex-Russia supply. The bank anticipates oil prices will rise in 2027 as low prices impact non-OPEC supply. WTI traded between USD 59.32-60.44/bbl and Brent between USD 63.67-64.72/bbl.

EQUITIES

CLOSES: SPX -0.91% at 6,672, NDX -0.83% at 24,800, DJI -1.18% at 46,590, RUT -1.96% at 2,341

SECTORS:

Communication Services +1.13%, Utilities +0.84%, Health -0.04%, Real Estate -0.57%, Consumer Staples -0.59%, Consumer Discretionary -0.80%, Industrials -1.03%, Technology -1.43%, Materials -1.53%, Energy -1.87%, Financials -1.93%

EUROPEAN CLOSES:

Euro Stoxx 50 -0.85% at 5,645, Dax 40 -1.24% at 23,579, FTSE 100 -0.24% at 9,675, CAC 40 -0.63% at 8,119, FTSE MIB -0.52% at 43,767, IBEX 35 -1.06% at 16,173, PSI -0.04% at 8,247, SMI -0.39% at 12,586, AEX -0.69% at 945.

STOCK SPECIFICS:

- Apple (AAPL): Reportedly accelerating CEO succession planning, with Tim Cook potentially stepping down as early as 2026.

- Big tech/AI: Saba Capital Management has sold credit derivatives to lenders seeking protection from tech exposure, including credit default swaps on Oracle (ORCL), Microsoft (MSFT), Meta (META), Amazon (AMZN), and Alphabet (GOOGL).

- Aramark (ARMK): Missed EPS and revenue estimates with underwhelming guidance.

- Alibaba (BABA): Launched its revamped AI chatbot, Qwen.

- Dell (DELL): Double-downgraded.

- Google (GOOGL): Berkshire Hathaway initiated a new buy in the latest 13-F filing.

- Eli Lilly (LLY): Novo Nordisk is undercutting LLY on obesity drugs for cash-pay patients.

- Sealed Air (SEE): To be acquired by CD&R for $42.15/share in cash. SEE closed Friday at $43.28/share.

- EW Scripps (SSP): Sinclair Broadcast Group (SBGI) has built an approximately 8% stake and is vying to acquire the company.

- WPP (WPP): Attracting takeover interest, which was later denied by the CEO of Havas.

- Travel names (ABNB, EXPE, BKNG) were pressured after Google (GOOGL) announced new AI travel tools.

- Live Nation (LYV)/StubHub (STUB): The UK is expected to ban the resale of tickets above face value.

FX

The Dollar strengthened in light trading ahead of delayed US data and NVIDIA earnings later in the week. The NY Fed Manufacturing survey was largely strong, with improved current business conditions, new orders, and employment, and declining prices paid. However, six-month business conditions declined to 19.1 from 30.3. Fed Vice Chair Jefferson reiterated his remarks from early November, noting that the current Fed policy rate is "somewhat restrictive" and that the Fed needs to proceed slowly as monetary policy approaches the neutral rate. He also mentioned looking forward to reviewing the Beige Book next week. DXY traded between 99.291-579.

G10 FX experienced losses, largely due to the stronger Dollar. The Australian Dollar was the relative underperformer, while the British Pound and Canadian Dollar "outperformed." Japanese GDP for Q3 fell below zero, the first time in six quarters, but not as deeply as forecasted. There was plenty of ECB commentary, but little new information. The European Commission Autumn 2025 economic forecast revised GDP up for 2025 but down for 2026, with inflation moving up for both years. Swiss Q3 GDP fell -0.5% versus Q2's print of +0.1%.

CAD experienced slight two-way trade in response to the latest inflation metrics. Headline inflation eased but was slightly above consensus. Core inflation picked up in October, partially due to one-off factors like the annual increase in property taxes and a jump in cellular services prices.

EMFX was largely influenced by the Dollar amid a lack of newsflow. The BCB sold USD 1.25 billion in a dollar auction with a repurchase deal. The NBP's Janczyk said there is room for a small rate cut in the near future. The market anticipates the NBH will hold rates steady at 6.50% on Tuesday, focusing on forward guidance, especially after the increase in the planned public deficit. Hawkish guidance is widely expected, but there is limited possibility of a tougher tone compared to previous meetings, building some dovish risk.