Market Wrap 2026-01-19

Today's US Market Wrap — Key Points

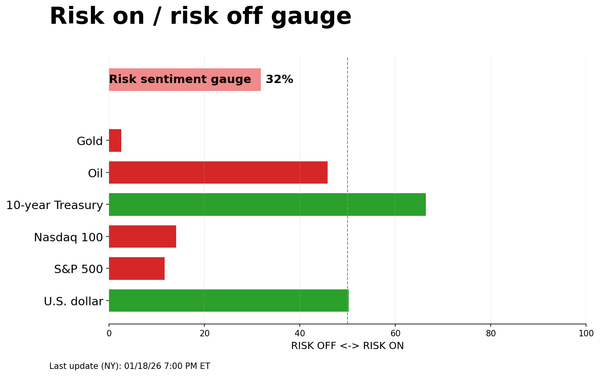

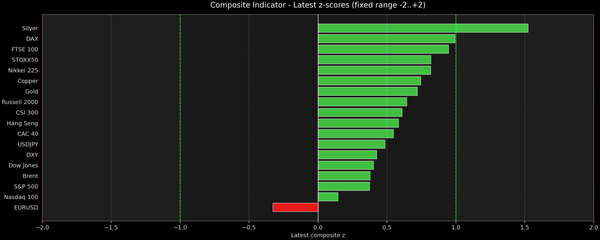

- Mixed equity performance; Treasuries down, oil up, dollar stable.

- Trump comments impact Fed Chair speculation, Treasury yields.

- Key data ahead: EZ/CA CPI, China GDP, BoC conditions.

- Week ahead: US PCE, BoJ meeting, global PMIs, earnings.

- Fed Governor Bowman advocates for further interest rate cuts.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

- SNAPSHOT: Equities showed mixed performance, Treasuries declined, Crude oil advanced, the Dollar was stable, and Gold decreased.

- REAR VIEW: President Trump wants to retain Hassett at the National Economic Council (NEC), downplaying the possibility of him becoming the next Federal Reserve Chair. Trump expressed gratitude to Iran for cancelling scheduled hangings. Fed Governor Bowman advocated for further interest rate cuts, citing risks in the job market. Fed Governor Jefferson stated that interest rates have reached a level consistent with a neutral stance. Trump threatened tariffs on countries not cooperating with the Greenland situation. Japan's Finance Minister indicated that foreign exchange intervention remains a potential option under the US-Japan agreement. Canada announced it would allow up to 49,000 Chinese electric vehicles (EVs) into the market. China adjusted trading limits for silver and nickel futures.

- COMING UP: The US market is closed for the Martin Luther King Jr. (MLK) Day holiday. The Newsquawk desk will open for Asia-Pacific (APAC) coverage on Sunday, January 18th, at 22:00 GMT/17:00 EST, as usual. European (EU) coverage will begin on Monday, January 19th, at 06:30 GMT/01:30 EST, as usual. The desk will then close at 18:00 GMT/13:00 EST and reopen later that day for APAC coverage at 22:00 GMT/17:00 EST. Economic data releases include the Eurozone (EZ) Final Harmonized Index of Consumer Prices (HICP) for December, Canadian Consumer Price Index (CPI) for December, Chinese Gross Domestic Product (GDP) for the fourth quarter, and Retail Sales for December. The Bank of Canada (BoC) will release its Summary of Economic Conditions (SCE).

- WEEK AHEAD: Key events include the US Personal Consumption Expenditures (PCE) data, the Bank of Japan (BoJ) meeting, Chinese activity data, Flash Purchasing Managers' Indexes (PMIs), and inflation figures from the UK, Japan, and Canada. Click here for the full report.

- CENTRAL BANK WEEKLY: A preview of the BoJ, People's Bank of China (PBoC) Loan Prime Rate (LPR), European Central Bank (ECB) Minutes, Norges Bank, and Central Bank of the Republic of Turkey (CBRT) meetings. Click here for the full report.

- WEEKLY US EARNINGS ESTIMATES: A busy week for earnings releases, with notable reports from Netflix (NFLX), Johnson & Johnson (JNJ), Charles Schwab (SCHW), Procter & Gamble (PG), and Intel (INTC). Click here for the full report.

To access more Newsquawk information:

- Subscribe to the free premarket movers reports.

- Trial Newsquawk’s premium real-time audio news squawk box for 7 days.

US stock indices traded within a narrow range on Friday, ahead of the MLK Day holiday. Sector performance was mixed, with Real Estate leading and Health underperforming, amid a lack of significant US economic data. Despite limited data and Federal Reserve commentary, the Dollar strengthened and Treasuries weakened after President Trump suggested he would keep Hassett as NEC Director and would not select him as the next Fed Chair. Following Trump's comments, Treasury notes fell across the curve, as Hassett is considered a dovish candidate and less supportive of Fed independence, leading traders to reduce expectations of Fed rate cuts. FBN reported that those involved in the interview process for Rick Rieder as Fed chair viewed his lack of prior Federal Reserve experience as a positive. Markets now favor former Fed Governor Warsh as the next Fed Chair, with Kalshi assigning him a 59% probability, while Rieder's probability remains at 10%. The Dollar was flat overall, with the Yen outperforming after comments from BoJ sources and recent verbal interventions. Crude oil prices were relatively stable amid ongoing geopolitical activity, with energy settling higher but benchmarks paring some gains after Trump acknowledged Iran's cancellation of scheduled hangings. Spot silver was impacted by adjustments to trading limits for silver futures in China, while spot gold also experienced losses, though to a lesser extent. Fed Governor Bowman indicated that the Fed should not signal a pause in rate cuts, while Governor Jefferson stated that he does not want to prejudge the January rate-setting decision and that Fed rate cuts since 2024 have brought the policy rate into a range consistent with neutral. The Federal Reserve enters a blackout period ahead of the upcoming Federal Open Market Committee (FOMC) meeting.

US

BOWMAN:

Fed Governor Bowman maintained a dovish stance, stating that the Fed should be prepared to cut rates again due to risks in the job market and should not signal a pause in the rate cut campaign. She added that the risks to the Fed's mandate are asymmetric, and the Fed should be ready to cut again if the labor market requires it. She views monetary policy as modestly restrictive and believes policy should be forward-looking. She sees solid growth and lower inflation, which should stabilize the labor market, noting the economy has been resilient. However, she is concerned about labor market fragility, stressing that policy should focus on supporting the jobs market. She acknowledged the Fed has made considerable progress on lowering inflation, noting that underlying inflation is close to the Fed's 2% target. She also noted that inflation pressures are easing as the impact of tariffs diminishes.

JEFFERSON (voter):

Jefferson stated that he does not want to prejudge the January rate-setting decision. He believes that some upside risks remain but expects inflation to return to its path back to 2%. Jefferson views inflation as somewhat elevated, with the increase in core goods prices inconsistent with a return to 2% inflation. He is cautiously optimistic for 2026 but faces risks to both employment and price stability goals. The governor expects 2% economic growth in the near term and the unemployment rate to remain steady this year. He noted that Fed rate cuts since 2024 have brought the policy rate into a range consistent with neutral. The current policy stance allows them to determine how much and when to adjust the policy rate.

NAHB:

The National Association of Home Builders (NAHB) housing market index fell to 37 in January from 39, below the expected 40. Within the report, current sales conditions dipped to 41 (previous 40), while sales expectations in the next six months and traffic of prospective buyers both dropped by three points to 49 and 23, respectively. The report also indicated ongoing challenges for the housing market, with 40% of builders reporting price cuts in January, unchanged month-over-month, but the third consecutive month the share has been at 40% or higher since May 2020. The average price reduction was 6% in January (previous 5% month-over-month), and the use of sales incentives was 65% in January, marking the 10th consecutive month this share has exceeded 60%.

INDUSTRIAL PRODUCTION:

Industrial Production rose 2% year-over-year in December, cooling from the prior 2.5% and missing the 2.7% forecast. Manufacturing production rose 2%, accelerating from the prior 1.9% and in line with forecasts. Month-over-month Manufacturing rose 0.2%, above the -0.2% forecast and up from the downwardly revised unchanged reading. Capacity utilization rose to 76.3% from 76.1%, above the 76% forecast. The report noted that most of the major market groups posted gains in the month. Oxford Economics stated that the data reinforce their view of a sustainable increase throughout the year. The consultancy says, "In 2026, a confluence of factors will allow manufacturing to fire on multiple cylinders. Better tax treatment of business investment, greater defense spending, more interest-rate relief, and an ongoing AI buildout will undergird further growth in factory production."

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 15 TICKS LOWER AT 111-24

Treasury notes sold off after President Trump suggested he will keep Hassett as NEC Director.

At settlement, the 2-year yield increased by 2.8 basis points to 3.595%, the 3-year yield increased by 3.9 basis points to 3.661%, the 5-year yield increased by 5.5 basis points to 3.822%, the 7-year yield increased by 5.7 basis points to 4.018%, the 10-year yield increased by 5.6 basis points to 4.227%, the 20-year yield increased by 4.2 basis points to 4.789%, and the 30-year yield increased by 3.8 basis points to 4.835%.

THE DAY:

Treasury notes traded sideways overnight before selling off as the US session began. Treasury notes then declined to lows across the curve after President Trump's comments suggested he would not appoint NEC Director Hassett as Fed Chair, stating he would like to keep him in his current role. The move was clearly lower across maturities, but it did turn quite choppy across the curve thereafter, with the two-year paring some of the losses and hovering into settlement, while the 30-year also pared a lot of the weakness, before resuming lower into settlement. With Hassett seen as the most dovish and less friendly for Fed independence, traders were pricing out rate cuts from the Fed. FBN reported that those involved in the interview process for Rick Rieder as Fed chair viewed his lack of prior Federal Reserve experience as a positive. Markets now favor former Fed Governor Warsh as the next Fed Chair, with Kalshi assigning him a 59% probability, while Rieder's probability remains at 10%. A definitive announcement is expected by the end of January. Fed Governor Bowman spoke and struck her usual dovish tone, stating the Fed should not signal a pause in January.

SUPPLY

Notes

Reports indicated that the US Treasury is asking dealers whether they should consider quarterly 7-year Treasury note auctions with reopenings.

Bills

The US will sell USD 85 billion of 6-week bills (previous 75 billion), USD 89 billion of 13-week bills (previous 86 billion), USD 77 billion of 26-week bills (previous 77 billion), and USD 50 billion of 52-week bills (previous 50 billion) on January 20th, to settle January 22nd.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 0 basis points (previous 0 basis points), March 3.3 basis points (previous 3.3 basis points), April 8.2 basis points (previous 8.2 basis points), December 43.2 basis points (previous 47.4 basis points).

- The New York (NY) Fed Reverse Repurchase (RRP) operation demand was at USD 1 billion (previous 2 billion) across 5 counterparties (previous 6). The Effective Federal Funds Rate (EFFR) was at 3.64% (previous 3.64%), with volumes at USD 92 billion (previous 93 billion) on January 15th.

- The Secured Overnight Financing Rate (SOFR) was at 3.66% (previous 3.64%), with volumes at USD 3.201 trillion (previous 3.148 trillion) on January 15th.

CRUDE

WTI (G6) SETTLED USD 0.25 HIGHER AT 59.44/BBL; BRENT (H6) SETTLED USD 0.37 HIGHER AT 64.13/BBL

The crude oil complex ended the day and week with gains amid heightened geopolitical risk.

Although oil finished in positive territory for the week, it was below earlier highs due to more constructive tones from President Trump regarding Iran in recent days. The most recent update, which caused a brief dip, was Trump noting he greatly respects the fact that all scheduled hangings, which were to take place yesterday (over 800 of them), have been cancelled by the leadership of Iran. News flow on Friday was fairly sparse, and participants likely wanted to reduce positions ahead of the MLK Day holiday. In the weekly Baker Hughes rig count, oil rigs rose to 410, natural gas rigs fell by 2 to 122, leaving the total down by 1 at 543.

EQUITIES

CLOSES: S&P 500 (SPX) -0.06% at 6,940, NASDAQ 100 (NDX) -0.07% at 25,529, Dow Jones Industrial Average (DJI) -0.17% at 49,359, Russell 2000 (RUT) +0.12% at 2,678

SECTORS: Health -0.84%, Communication Services -0.72%, Utilities -0.51%, Materials -0.44%, Consumer Discretionary -0.17%, Consumer Staples 0.00%, Technology +0.09%, Financials +0.12%, Energy +0.21%, Industrials +0.65%, Real Estate +1.20%.

EUROPEAN CLOSES: Euro Stoxx 50 -0.25% at 6,026, DAX 40 -0.30% at 25,276, FTSE 100 -0.04% at 10,235, CAC 40 -0.65% at 8,259, FTSE MIB -0.11% at 45,800, IBEX 35 +0.39% at 17,711, PSI +0.43% at 8,639, SMI -0.50% at 13,409, AEX -0.08% at 1,010

EARNINGS:

- J.B. Hunt (JBHT): Q4 revenue missed expectations.

- Regions Financial (RF): Profit and net income missed expectations, and the company expects net interest income (NII) to fall 1-2% quarter-over-quarter in the next quarter. Following the results, Wells Fargo downgraded the stock to 'Underweight' from 'Equal Weight' due to "weaker-than-expected" guidance.

- PNC Financial (PNC): Earnings per share (EPS) and revenue exceeded expectations with a solid Q1 outlook.

STOCK SPECIFICS:

- AST SpaceMobile (ASTS) was awarded a prime contract position on the US Missile Defense Agency’s SHIELD IDIQ program.

- Intel (INTC) was upgraded at Citi.

- Micron (MU) Director Teyin Liu purchased 23,200 shares between January 13th and 14th for a total of USD 7.8 million.

- Mosaic (MOS) announced preliminary disappointing Q4 results amid a challenging market environment that significantly impacted Q4 performance.

- Riot Platforms (RIOT) announced the fee simple acquisition of land and its first data center lease with AMD (AMD) at the Rockdale site.

- Seagate Technology (STX) was upgraded at Susquehanna to 'Neutral' from 'Negative'.

- US President Trump stated that he had a great meeting on Healthcare this morning, and that government money must be paid directly to the people, not to the insurance companies, and that Healthcare will be provided at a substantially reduced cost.

- OpenAI is introducing ChatGPT Go, now available worldwide, for USD 8 per month in the US. ChatGPT now offers three subscription tiers globally and is not launching ads in ChatGPT yet.

- Genmab (GMAB) announced topline results for epcoritamab from the Phase 3 Epcore dlbcl-1 trial in patients with relapsed/refractory diffuse large B-cell lymphoma (DLBCL). The study's overall survival (OS) did not reach statistical significance, with a hazard ratio (HR) of 0.96.

- Intel (INTC) hired a Qualcomm (QCOM) executive to lead GPU engineering for data centers, according to CRN reports.

FX

The Dollar Index (DXY) was little changed, with overnight losses erased after US President Trump downplayed NEC Director Hassett as a potential Fed Chair replacement. Hassett had earlier highlighted that former Fed Governor Warsh and BlackRock's Rieder would be great Fed Chairs. Trump's comments sent both the dollar and US yields higher, as Hassett is seen as the most dovish and less friendly for Fed independence, leading participants to price out rate cuts from the Fed. Gold also experienced downward pressure. Conversely, Fed Governor Bowman called for continued rate cuts, noting concerns over job market risks and the need for policy to be forward-looking. The DXY hit lows of 99.16 before recovering to around 99.37.

The Japanese Yen (JPY) outperformed among G10 currencies following a couple of updates. Finance Minister Katayama said that foreign exchange intervention is a potential option under the US-Japan agreement and expressed readiness to take decisive action while keeping all options on the table. Further JPY strength was based on reports that some BoJ policymakers see scope to raise interest rates as soon as April due to the inflationary effect of a weaker JPY and are likely to raise its fiscal year 2026 economic and inflation forecasts. USD/JPY now trades around lows of 157.82. The Australian Dollar (AUD) and Canadian Dollar (CAD) underperformed in the space.