Market Wrap 2026-01-20

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

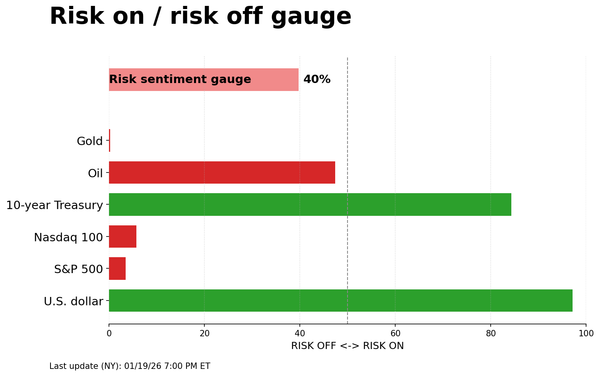

- Equities are down, Treasuries are down, Crude oil is up, the Dollar is down, and Gold is up.

REAR VIEW

- President Trump threatened France with 200% tariffs on wine and champagne.

- Japanese Government Bonds (JGBs) were impacted by Japanese fiscal concerns.

- The UK jobs report sent mixed signals.

- Germany's ZEW economic sentiment index showed better-than-expected improvement.

- A Danish pension fund plans to exit the US market.

- A Kazakhstan oil field experienced a temporary suspension of production.

- The weekly ADP employment change figure eased from the prior reading.

- Russian press reported that US Envoy Witkoff said talks with Russian Envoy Dmitriev were "very positive."

COMING UP

- Data releases scheduled: UK CPI (December), US Atlanta Fed GDPNow, Japanese Trade Balance (December).

- Events scheduled: IEA Oil Market Report (OMR); Supreme Court case US President Trump vs Fed's Cook (Voter, Neutral).

- Speakers scheduled: ECB President Lagarde, Villeroy, Nagel; NVIDIA CEO Huang; US President Trump.

- Supply: UK, Germany, US.

- Earnings reports expected from: Kinder Morgan, Johnson & Johnson, Ally Financial, Charles Schwab.

WEEK AHEAD

- Key highlights for the week include: US PCE, BoJ policy decision, China Activity Data, Flash PMIs, and Inflation figures from the UK, Japan, and Canada.

CENTRAL BANK WEEKLY

- A preview of the Bank of Japan (BoJ) meeting, People's Bank of China (PBoC) Loan Prime Rate (LPR) announcement, ECB Minutes release, Norges Bank policy decision, and Central Bank of the Republic of Turkey (CBRT) policy decision.

WEEKLY US EARNINGS ESTIMATES

- A large number of earnings reports are expected, with highlights from Netflix (NFLX), Johnson & Johnson (JNJ), Charles Schwab (SCHW), Procter & Gamble (PG), and Intel (INTC).

More information available in two steps:

- Subscribe to the free premarket movers reports.

- Trial the premium real-time audio news service for 7 days.

MARKET WRAP

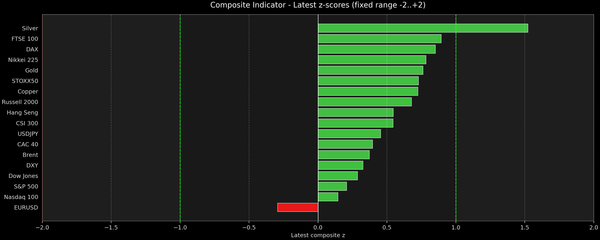

US indices experienced losses as market participants returned after the US market holiday. Sentiment was affected by ongoing EU-US tensions and concerns regarding President Trump's interest in Greenland. President Trump threatened to impose 200% tariffs on French wines and Champagne following France's intention to decline the invitation to join his 'Board of Peace’. A White House official stated that the President will not travel to Paris for the emergency G7 summit. The Davos forum is currently underway, with highlights on Wednesday including appearances by President Trump and NVIDIA CEO Huang. All sectors, except for Consumer Staples, were down, with Technology, Consumer Discretionary, and Communications sectors lagging. All "Magnificent Seven" stocks were down. Micron (MU) (+0.8%) was a positive performer, supported by price target upgrades. There were no Federal Reserve speakers due to the blackout period, and there was a lack of Tier 1 US data. The weekly ADP employment change figure was 8,000 (previous 11,750). In the foreign exchange market, the Dollar faced pressure, benefiting G10 currencies. The Swiss Franc outperformed, while the Yen underperformed due to domestic political issues. Treasury yields rose across the curve, showing weakness after the Danish pension fund Akademikerpension announced its intention to exit the US market. The fund later stated that the decision to divest US Treasuries was due to poor US government finances, not directly related to the US-Europe rift. Prior to this, global fixed income was already down, following pressure in JGBs due to fiscal concerns driving Yen action. Crude oil prices increased, supported by the temporary suspension of output at Kazakhstan’s oil fields. Chevron's Tengizchevroil cancelled loading of five CPC blend oil cargoes scheduled for January to February, with oil production reportedly remaining shut for an additional 7-10 days amid the supply issues. Regarding US-Russia relations, the Russian press reported that US Envoy Witkoff remarked that talks with Russian Envoy Dmitriev were "very positive" at Davos, and Dmitriev echoed this, noting dialogue was constructive with US envoys, and more and more people understand the fairness of the Russian position. Precious metals gained, with spot gold reaching another all-time high, surpassing USD 4,700/oz.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 10+ TICKS LOWER AT 111-13+

T-Notes steepened as the US-EU conflict worsened and JGB downside impacted global debt. At settlement, the 2-year yield was +1.3bps at 3.599%, the 3-year yield was +2.2bps at 3.678%, the 5-year yield was +4.8bps at 3.859%, the 7-year yield was +5.8bps at 4.073%, the 10-year yield was +7.6bps at 4.295%, the 20-year yield was +8.5bps at 4.878%, and the 30-year yield was +8.5bps at 4.920%.

THE DAY: US yields across the mid- and long-end were pressured in APAC and EU trade, with the global fixed downside led in JBGs. Driving JGB downside was the increasing belief of unsustainable fiscal policy, which may be enlarged given the fiscal commentary from political parties, as well as the upcoming snap election in the lower house. T-Note downside on the long end continued after concerns of decreased EU investment in US-assets grew after the Danish pension fund Akademikerpension was reported to exit the US. That said, the fund-led downside was short-lived, likely due to its relatively small holdings of US Treasuries, as well as the fund later noting the decision was due to poor US government finances, not the ongoing trade dispute between the US and the EU. T-Notes hit lows of 111-09 on the initial report before swiftly paring to then trade sideways into settlement. Many trade updates came amid a day without tier 1 US data and Fedspeak. Ultimately, the conflict has increased since the start of the week, with Trump now threatening 200% tariffs on French champagne/wine over its refusal to join the Gaza peace board. Fitch Ratings on US credit, said the outlook is broadly benign entering 2026, supported by AI-led capex, easing monetary policy and strong fiscal support

SUPPLY

Bills

- The US sold USD 86 billion of 3-month bills at a high rate of 3.590%, with a bid-to-cover ratio of 2.84x; and sold USD 77 billion of 6-month bills at a high rate of 3.520%, with a bid-to-cover ratio of 2.95x.

- The US sold USD 85 billion of 6-week bills at a high rate of 3.63%, with a bid-to-cover ratio of 2.42x; and sold USD 50 billion of 52-week bills at a high rate of 3.39%, with a bid-to-cover ratio of 3.42x.

- The US will sell USD 69 billion of 17-week bills on January 21st; and will sell USD 105 billion of 4-week bills and USD 95 billion of 8-week bills on January 22nd; all to settle on January 27th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 0bps (previous 0bps), March 4.5bps (previous 3.3bps), April 9.3bps (previous 8.2bps), December 45.7bps (previous 47.4bps).

- The NY Fed RRP operation saw demand at USD 3.506 billion (previous 1.222 billion) across 16 counterparties (previous 6).

- The EFFR was at 3.64% (previous 3.64%), with volumes at USD 84 billion (previous 91 billion) on January 16th.

- The SOFR was at 3.65% (previous 3.66%), with volumes at USD 3.163 trillion (previous 3.201 trillion) on January 16th.

CRUDE

WTI (H6) SETTLED USD 0.90 HIGHER AT 60.34/BBL; BRENT (H6) SETTLED USD 0.98 HIGHER AT 64.92/BBL

The crude oil complex was firmer, supported by the temporary suspension of output at Kazakhstan’s oil fields. Kazakh oil producer Tengizchevroil said on Monday it had temporarily halted production at the Tengiz and Korolev oilfields after an issue. Further to that, and aiding oil upside today, was an update that Chevron's Tengizchevroil cancelled loading of five CPC blend oil cargoes scheduled for January to February, with oil production reportedly remaining shut for an additional 7-10 days amid the supply issues. As such, WTI and Brent saw swift upside and inched higher throughout the duration of the session and hovered around peaks until settlement. Of course, and despite having little sway on the crude complex today, geopolitics and the continued US-Europe fallout continue to be front and centre of newsflow, albeit with little new development on Greenland on Tuesday. Meanwhile, a White House official said Trump will not travel to Paris for the emergency G7 summit in Paris. On the US/Russia footing, Russian press reported that US Envoy Witkoff remarked talks with Russian Envoy Dmitriev were "very positive" at Davos. The weekly private inventory figures are due after-hours, whereby current expectations are (bbls): Crude +1.8mln, Distillate -0.2mln, Gasoline +2.5mln. For the record, WTI traded between USD 58.53-60.51/bbl and Brent USD 63.38-65.15/bbl.

EQUITIES

CLOSES : SPX -2.06% at 6,797, NDX -2.12% at 24,988, DJI -1.76% at 48,489, RUT -1.21% at 2,645.

SECTORS: Technology -2.94%, Consumer Discretionary -2.82%, Financials -2.23%, Communication Services -2.05%, Industrials -1.99%, Real Estate -1.95%, Utilities -1.03%, Materials -0.78%, Health -0.20%, Energy -0.16%, Consumer Staples +0.12%.

EUROPEAN CLOSES : Euro Stoxx 50 -0.52% at 5,895, Dax 40 -1.08% at 24,690, FTSE 100 -0.67% at 10,127, CAC 40 -0.61% at 8,063, FTSE MIB -1.07% at 44,713, IBEX 35 -1.34% at 17,429, PSI -1.14% at 8,464, SMI -0.68% at 13,174, AEX -0.16% at 991

STOCK SPECIFICS:

- China expanded an investigation into PDD Holdings (PDD) after clashes between its employees & regulators.

- 3M (MMM): FY EPS guidance light.

- D.R. Horton (DHI): EPS & revenue topped, but Q2 revenue guidance fell short.

- Fastenal (FAST): Sales missed expectations.

- Netflix (NFLX) amended offer to acquire Warner Bros. Discovery (WBD) to an all-cash transaction.

- Enphase Energy (ENPH) was upgraded at Goldman Sachs.

- Fifth Third (FITB): Profit surpassed expectations.

- A US judge allowed an injunction against prediction market Kalshi from offering sports-event contracts in Massachusetts.

- Qiagen (QGEN) is said to weigh strategic options amid fresh interest.

FX

Dollar weakness continued amid growing tensions between US President Trump and EU leaders. President Trump threatened France with 200% tariffs on its wine and champagne after French President Macron refused to join Trump's Gaza peace board. The move highlights the unpredictable nature of US trade policy, and as such, participants have continued to look for alternatives via USD selling or USD hedges. At the top of the pile, CHF and EUR were favoured while JPY still experienced relative underperformance amid its own political uncertainty. Davos is the main topic this week, with the conversation shifting from Ukraine to Greenland. Trump is expected to speak tomorrow a couple of times, where any escalation or TACO intimations will be watched ahead of the February 1st deadline for the Greenland-motivated tariffs to go ahead on several European nations. The DXY slightly bounced off 98.246 lows to around 98.59 at the time of writing.

As mentioned, CHF and EUR were preferred liquidity alternatives to USD, with little domestic updates to report. A better-than-expected ZEW reading in Germany had little bearing on EUR/USD, but did see some pressure in Bunds. In the UK, GBP was only slightly firmer amid broad USD weakness, likely with the November jobs report limiting strength. The Unemployment Rate unexpectedly remained at 5.1% (exp. 5.0%), but was accompanied by better-than-expected job growth (act: 82k vs exp. 27k) and slightly hotter-than expected wages (act: 4.7% vs exp. 4.6%). The data is likely to keep the narrative alive of further BoE easing in 2026; Cable now resides ~1.3432.

JPY again underperformed G10 currencies despite trade uncertainty diminishing USD attractiveness. Concerns grew over fiscal sustainability as participants prepared for the upcoming snap election and commentary surrounding fiscal plans. The move was most present in JGBs, which were slammed. USD/JPY hovers around 158.20.