Market Wrap 2026-02-09

Today's US Market Wrap — Key Points

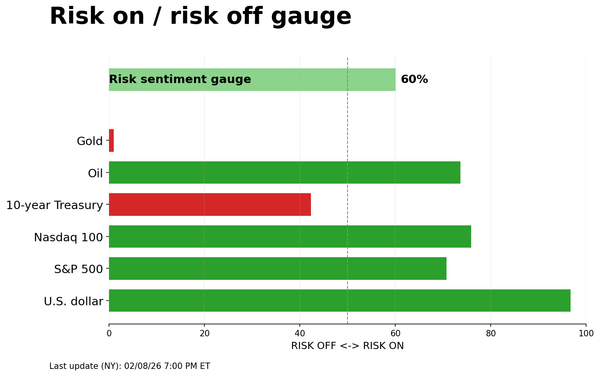

- Stocks rose, led by tech. Treasury yields were flat. Dollar weakened.

- Focus shifts to US NFP, CPI data, and Treasury supply this week.

- Key events: BoE, RBA, ECB minutes. Earnings from Coke, Ford, Spotify.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

- SNAPSHOT: Stocks increased, Treasury yields were relatively unchanged to slightly lower, crude oil prices rose, the U.S. dollar weakened, and gold prices increased.

- REAR VIEW: The New York Fed's Survey of Consumer Expectations showed a decrease in one-year inflation expectations, while three- and five-year expectations remained steady. Japan's PM Takaichi secured a significant election victory. Reports indicated that China is advising banks to reduce their exposure to U.S. Treasuries. Iran's Atomic Chief stated that Tehran might dilute its highly enriched uranium if all sanctions are lifted. Qatar is reportedly delaying the start of its LNG expansion. UK PM Starmer received support from PM & cabinet ministers. Alphabet is planning to raise USD 20 billion through a dollar bond sale.

- COMING UP: Economic data releases include Norwegian CPI (January), US NFIB (January), Weekly ADP employment report, ECI (Q4), and Retail Sales (December). Events include the EIA STEO report. Scheduled speakers are Fed officials Hammack and Logan. Supply announcements are expected from Australia, Japan, the Netherlands, the UK, Germany, and the US. Earnings reports are due from Coca-Cola, S&P, Gilead, Robinhood, Welltower, Duke Energy, Datadog, Ford, AIG, Xylem, Spotify, AstraZeneca, BP, Barclays, Ferrari, Mediobanca, and Kering.

- WEEK AHEAD: Key events include the US NFP and CPI releases, the Japanese Election, UK GDP data, and China Inflation figures.

- CENTRAL BANK WEEKLY: A review of the minutes from the BoE, RBA, ECB, RBI, Banxico, and Riksbank meetings.

- WEEKLY US EARNINGS ESTIMATES: The earnings season continues with reports from CVS, CSCO, and AMAT.

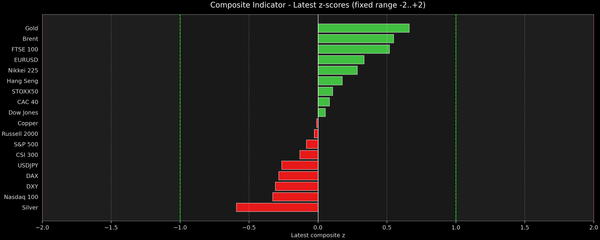

Stocks continued their upward trend, led by the technology sector, with semiconductors showing particularly strong performance. Nvidia (NVDA) shares experienced a rally, seemingly continuing to benefit from increased capital expenditure plans announced alongside earnings from AMZN, META, and GOOGL. The Nasdaq outperformed, while the Dow lagged. Most sectors were up, with Technology and Materials leading, while Consumer Staples and Healthcare underperformed. T-Notes largely recovered earlier losses, which were initially triggered by weakness in Japanese Government Bonds (JGBs) following the Japanese election and further declines after reports that China is urging banks to curb US Treasury exposure. Alphabet (GOOGL) also entered the market with an upsized USD 20 billion bond offering, although T-Notes settled relatively flat. In the FX market, the Yen was among the top performers after the Takaichi victory in the election, which increased expectations of rate hikes from the BoJ due to her pro-growth policies. The Yen's strength and reports of China reducing UST exposure contributed to Dollar weakness, supporting G10 currencies. Metals continued to recover, with gold reclaiming USD 5,000/oz. In the UK, the political situation continued to influence UK assets, with Gilts and the Pound rebounding from morning lows after PM Starmer's cabinet publicly supported him in response to calls for his resignation. This week, attention will be focused on the US NFP report on Wednesday and CPI data on Friday, while bond traders will be monitoring 3, 10, and 30-year supply. Energy traders will be watching for further talks between the US and Iran, with crude oil prices settling higher, primarily due to Dollar weakness.

US

NY FED: The NY Fed's Survey of Consumer Expectations indicated a slight improvement in expectations for earnings, job loss, and job finding. The median one-year ahead inflation expectation decreased to 3.1% from 3.4%, while the three- and five-year expectations remained unchanged at 3.0%. Earnings growth expectations increased by 0.2% to 2.7%, mainly driven by households with incomes below USD 50,000. Regarding employment, the mean expected probability of losing one's job in the next twelve months decreased by 0.4% to 14.8%, slightly above the trailing 12-month average of 14.6%. The mean expected probability of finding a job in the next three months if current jobs were lost increased by 2.5% to 45.6%, remaining below the trailing 12-month average of 48.6%. Perceptions of households' current financial situations worsened, with more respondents reporting a worse financial situation compared to a year ago. Year-ahead expectations for households' financial situations also deteriorated, with fewer respondents expecting to be better off a year from now and more expecting to be worse off.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 2+ TICKS HIGHER AT 112-06

T-Notes settled flat despite early weakness on reports China is to curb UST exposure. At settlement, 2-year yields decreased by 1.0bps to 3.485%, 3-year yields decreased by 1.2bps to 3.555%, 5-year yields decreased by 1.2bps to 3.743%, 7-year yields decreased by 0.9bps to 3.964%, 10-year yields decreased by 0.8bps to 4.198%, 20-year yields decreased by 0.6bps to 4.791%, and 30-year yields decreased by 0.7bps to 4.848%.

THE DAY: T-Notes opened lower on Sunday night, influenced by JGBs after PM Takaichi's election victory, which gave the government full legislative control. T-Notes gradually recovered somewhat overnight, but fresh lows were reached early in the European morning after reports that China is urging banks to curb their exposure to US Treasuries. However, the dip was bought once again. Some additional pressure was felt after Alphabet (GOOGL) announced a seven-part issuance, initially announced to fund up to USD 15 billion, before being upsized to USD 20 billion following strong demand with bids exceeding USD 100 billion. Subsequently, the move reversed again, tracking Gilts higher as UK debt moved off lows following vocal support for UK PM Starmer from key members of his team, including Angela Rayner and Wes Streeting. T-Notes ultimately settled flat, with attention turning to Treasury supply this week (3, 10, and 30-year) and key economic data: NFP and CPI, both of which will influence Fed rate expectations, with markets not pricing in any more rate cuts until the summer, but with two rate cuts now fully priced. Although rate cuts are priced further out the year, some of that likely reflects the change in Fed leadership, with Warsh the nominee to replace Chair Powell when his term (as Chairman) expires in May.

SUPPLY

Bills

- US to sell USD 90 billion of 6-week bills on February 10th; to settle on February 12th

- US sold 3-month bills at a high rate of 3.60%, B/C 2.76x; Sold 6-month bills at a high rate of 3.500%, B/C 2.76x

Notes

- US to sell USD 58 billion in 3-year notes on February 10th, USD 42 billion in 10-year notes on February 11th, and USD 25 billion in 30-year bonds on February 12th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 3.7bps (prev. 1.3bps), April 8.2bps (prev. 5.3bps), June 23.2bps (prev. 16.8bps), December 55.7bps (prev. 49.2bps).

- NY Fed RRP op demand at USD 1.3 billion (prev. 3.11 billion) across 10 counterparties (prev. 6)

- EFFR at 3.64% (prev. 3.64%), volumes at USD 106 billion (prev. 110 billion) on February 6th

- SOFR at 3.64% (prev. 3.65%), volumes at USD 3.195 trillion (prev. 3.228 trillion) on February 6th.

CRUDE

WTI (H6) SETTLED USD 0.81 HIGHER AT 64.36/BBL; BRENT (J6) SETTLED USD 0.99 HIGHER AT 69.04/BBL

Crude oil prices began the week higher, supported by broader risk sentiment and Dollar weakness. Overnight, WTI and Brent edged lower to USD 62.62/bbl and 67.02/bbl, respectively, before rising during the European morning on reports that Qatar pushed the start of its LNG expansion to the end of 2026. Subsequently, reports from ISNA indicated that Iran's Atomic Chief Eslami remarked that Tehran could dilute its highly enriched uranium if all sanctions are lifted, initiating some downticks. Following this, oil prices generally increased, with WTI and Brent reaching peaks of USD 64.88/bbl and 69.45/bbl as risk-on sentiment supported prices, as well as heavy selling of the Dollar. On the supply side, Tengiz plans to return to peak production of 120k T per day by February 23rd, while separate reports noted Venezuela's crude production nears 1 million BPD following output cut reversal; sources also reported that output at the main oil region, Orinoco belt, gained more than 100k BPD to some 500k BPD after PDVSA's cut reversal.

EQUITIES

CLOSES: SPX +0.42% at 6,961, NDX +0.77% at 25,268, DJI +0.04% at 50,136, RUT +0.68% at 2,689.

SECTORS: Technology +1.59%, Materials +1.44%, Energy +0.83%, Communication Services +0.80%, Real Estate +0.59%, Industrials +0.33%, Utilities +0.31%, Consumer Discretionary -0.35%, Financials -0.62%, Consumer Staples -0.86%, Health -0.86%.

EUROPEAN CLOSES: Euro Stoxx 50 +1.02% at 6,059, Dax 40 +1.15% at 25,005, FTSE 100 +0.16% at 10,386, CAC 40 +0.60% at 8,323, FTSE MIB +2.06% at 46,823, IBEX 35 +1.40% at 18,195, PSI +1.13% at 8,991, SMI +0.06% at 13,521, AEX +0.37% at 999

STOCKS SPECIFICS

- Kroger (KR): Plans to appoint former Walmart executive Greg Foran as its next CEO.

- Kyndryl Holdings (KD): Missed EPS, disclosed internal control weaknesses, filed a non-timely 10-Q, and announced CFO changes.

- Nexstar (NXST), Tegna (TGNA): Trump expressed support for a potential merger between Nexstar & Tegna.

- Eli Lilly (LLY): To acquire Orna Therapeutics w/ transaction valued at $2.4bln.

- Block (XYZ): Cutting up to 10% of its workforce as part of a broader efficiency & business overhaul.

- Meta (META): EU Commission has notified META of possible interim measures to reverse exclusion of third-party AI assistants from WhatsApp.

- Cleveland-Cliffs (CLF): Revenue light. Becton, Dickinson (BDX): Q4 metrics strong, but revised FY profit view much lower.

- Hims & Hers Health (HIMS): Will stop selling a copycat version of Novo Nordisk’s Wegovy weight-loss pill.

FX

The Dollar Index experienced significant selling pressure, benefiting global currencies, initially driven by Yen strength post-election and reports that China is urging banks to curb UST exposure amid market risk. These factors hindered the Greenback, with the latter reviving the "Sell America" theme. Broader risk-on sentiment also weighed on the Dollar. On Monday, there was a lack of tier 1 data and Fed speak as participants await the US jobs report (Wed) and CPI (Fri). January’s NY Fed Survey of Consumer Expectations saw the 1yr ahead inflation expectations revised lower to 3.1% from 3.4% in December, with both 3yr and 5yr ahead left unchanged at 3%.

All G10 currencies saw gains against the Dollar, with the AUD and CHF outperforming, and the GBP underperforming, albeit still strengthening. The Pound is currently influenced by domestic political turmoil, with continued calls for PM Starmer to resign. However, some of the immediate risk has subsided after cabinet ministers backed him to stay in office, which now favors the narrative that he will remain until at least the May local elections. Cable hit a low of 1.3587 against a high of 1.3700.

AUD was supported by risk sentiment and gains in precious metals, with the Yen seeing support from the Japanese election overnight. USD/JPY topped out at 157.72 upon the reopening of trade, before reversing sharply as JPY buying accelerated, with USD/JPY eventually hitting a low of 155.52 as drivers included expectations of an LDP landslide, higher JGB yields, jawboning from Finance Minister Katayama, rising April BoJ hike odds (~60%), and PM Takaichi’s commitment to fiscal discipline. Ahead, Barclays brought forward its expected 25bps BoJ hike to April and lifted its terminal rate forecast to 1.5%.