Market Wrap 2026-02-11

Today's US Market Wrap — Key Points

- Stocks declined amid soft data; focus shifts to jobs report.

- Treasuries rallied on weak retail sales, employment costs.

- Dollar stabilized; Yen strengthened post-election.

- Oil slightly down; Trump's Iran comments noted.

- Upcoming: NFP, CPI, central bank speakers, earnings.

Already a member? Sign in to unlock the full wrap

MARKET OVERVIEW

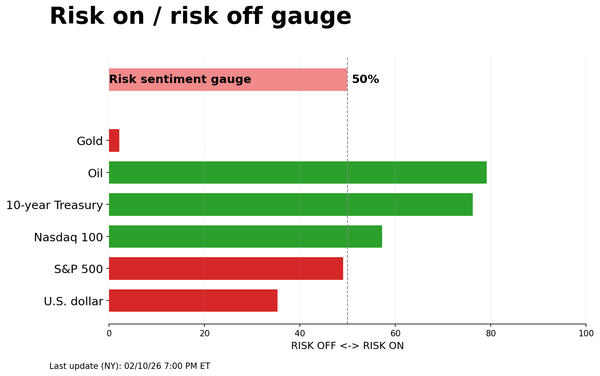

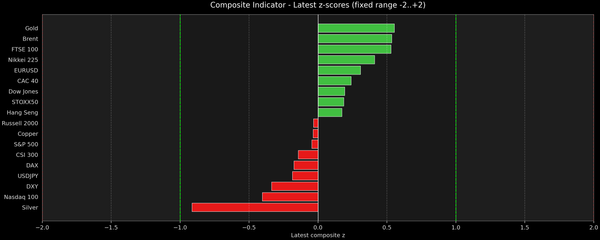

- SNAPSHOT: Stock markets declined, Treasury prices increased, crude oil prices decreased, the US dollar was stable, and gold prices fell.

- RECENT EVENTS: US Retail Sales data was weaker than expected. Import prices and the Employment Costs Index were also soft, while export prices were higher. There was a report that Trump might send a second aircraft carrier to strike Iran if talks fail. Lutnick commented that the dollar's current level is appropriate. There was an average US 3-year note auction. Fed officials Hammack and Logan made hawkish remarks. A NY Fed survey indicated that consumer delinquencies have risen to their highest level since 2017. The EIA increased its world oil production outlook for 2026 and 2027. DataDog (DDOG) earnings were impressive. Norwegian inflation was hotter than anticipated.

- UPCOMING EVENTS: Data releases include Chinese Inflation (January), the ECB Wage Tracker, US NFP (January), and Japanese PPI (January). Events include the BoC Minutes (January) and the OPEC MOMR. Speakers include RBA’s Hauser; ECB’s Cipollone, Schnabel, Fed's Schmid, Bowman, and Hammack. Supply events include auctions from Australia, Germany, and the US. Earnings releases include T-Mobile, McDonalds, AppLovin, Equinix, Motorola Solutions, Hilton, Kraft Heinz, TotalEnergies, Dassault Systemes, Michelin, Siemens Energy, Commerzbank, and Heineken.

- NFP PREVIEW: The expected headline NFP is 70k (previous 50k), and the unemployment rate is expected to remain unchanged at 4.4%.

MARKET WRAP

US stock indices experienced broad declines on Tuesday, although within limited ranges, as market participants await the US jobs report on Wednesday and the CPI data on Friday. Tuesday's data was generally subdued, with retail sales falling short of expectations and the weekly ADP report showing only 6.5k jobs added per week over the last four weeks. Import and export prices saw the former meet expectations, while the latter was slightly lower, along with soft employment costs. Sector performance was mixed, with Utilities, Real Estate, and Materials outperforming, while Financials and Communications lagged, with further weakness in Alphabet weighing on the latter. Within Financials, names such as Charles Schwab and Interactive Brokers Group saw significant sell-offs in the US afternoon, although without a clear catalyst, but some attributed it to Altruist adding AI tax planning to its Hazel platform. DataDog (+11%) earnings were a stock-specific highlight, supporting other software names. The Dollar recovered some of its earlier losses, halting the decline from Monday, with the Yen outperforming among G10 currencies, continuing to benefit post-election. CAD saw slight gains, while other G10 currencies experienced losses to varying degrees. Oil prices were slightly lower, remaining within tight ranges, with the main news being Trump's statement to Axios that he is considering sending a second aircraft carrier strike group to the Middle East to prepare for military action if negotiations with Iran fail, adding that either a deal will be made or a tough response will be necessary. Spot gold prices decreased, falling below USD 5,050/oz, and Treasury prices rose after the weak retail sales and ECI data, with little reaction to an average 3-year auction. Additionally, Fed officials Logan and Hammack made hawkish comments, expressing satisfaction with current interest rate levels. The latest NY Fed survey revealed that consumer delinquencies have risen to their highest level since 2017, with mortgage defaults surging in lower-income areas and student loan delinquencies reaching a record high.

US

RETAIL SALES: The December Retail Sales report was weak, with the headline unchanged compared to November, despite expectations of a 0.4% increase and a slowdown from the prior 0.6% pace in November. Excluding autos, sales were also unchanged, below the 0.3% forecast, and slower than the prior 0.5%. The control group, a key indicator of consumer spending within the GDP report, also fell by 0.1% after rising 0.1% in the previous month, missing expectations of a 0.4% increase. Across sectors, the only real strength was in building materials, rising 1.2%, while sporting goods rose 0.4% and gasoline stations +0.3%. Conversely, miscellaneous and furniture stores declined by 0.9%, with other businesses remaining relatively flat. Pantheon Macroeconomics suggests that weak underlying sales may be a sign of things to come, noting that this data, combined with other leading indicators, points to a 0.1% increase in real consumer spending in December and slight downward revisions to spending growth in October and November. This suggests, with a meaningful margin of error, a 2.5% spending growth in Q4, slower than the 3.5% in Q3.

IMPORT/EXPORT PRICES: Import prices rose 0.1% in December, in line with analyst forecasts, easing from the prior 0.4% pace seen from September to November. Export prices rose 0.3%, above the 0.1% forecast but cooler than the prior 0.5%. Oxford Economics highlights that weak fuel prices continue to weigh on headline import prices, but prices for other goods continue to rise, including capital goods, reflecting strong business investment. They also note that a weaker Dollar poses an upside risk to import prices in the months ahead. Nonetheless, Oxford Economics still expects inflation to moderate throughout 2026, allowing the Fed to cut rates in June and September.

EMPLOYMENT COSTS INDEX: The Q4 Employment Cost Index rose 0.7%, slightly below the 0.8% forecast and prior reading. Wages and salaries rose 0.7%, while benefits costs also increased 0.7%, compared to the prior 0.8%. Pantheon Macroeconomics summarizes the data by stating that labor cost growth is continuing to moderate despite solid productivity gains, which opens the door to further easing from the FOMC later this year. They highlight that "With 2% growth in productivity looking sustainable, unit labor costs are rising at a mere 1.5% pace, easily low enough to return core PCE inflation to the 2% target."

FED

HAMMACK (2026 voter): Stated that the Fed is in a good position with policy ‘to see how things play out’ and that the current Fed target rate is ‘in the vicinity of neutral’ (Powell has previously said in a plausible range of neutral, albeit towards the higher end), adding that Fed rate policy could be on hold 'for quite some time’. Regarding inflation, the Cleveland Fed President remarked that it is ‘still too high’ and tariff issues are still in play, expecting it to ease as the year progresses, but that this is just a forecast. She added that there is a risk inflation could stick at 3% this year and needs to come down, expressing concerns that inflation could become entrenched, but expectations are currently contained, and that it is important to get to 2% inflation before changing rates again. On the labor market, Hammack said the job market has stabilized into a low hire, low-fire landscape. She further added that she is 'cautiously optimistic’ about the economic outlook. In the Q&A section, Hammack reiterated that interest rates could remain on hold for an extended period while economic data is assessed, and flexibility will be maintained to raise rates if needed.

LOGAN (2026 voter): Said that in the coming months, if inflation falls and the labor market stays stable, no further rate cuts will be needed. On inflation, Logan is more worried about inflation remaining stubbornly high and is not fully confident that inflation is heading all the way back to 2%, anticipating progress on inflation this year and having already seen some tentative signs. On the other side of the mandate, if Logan sees further material cooling in the labor market, cutting rates could be appropriate. The labor market is stabilizing, and downside risks have meaningfully dissipated. Regarding policy, she believes that the current policy stance may be very close to neutral, providing little restraint. The 2026 voter is cautiously optimistic that the current policy stance will bring inflation down to 2% and sustain a balanced labor market. The real FFR now sits squarely within the range of neutral rate estimates. The Dallas Fed President has taken note of growth in Treasury cash-futures basis trade and sees vulnerabilities if there's stress, with the potential to de-lever rapidly.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 10+ TICKS HIGHER AT 112-16+

T-notes experienced a bid after soft US Retail Sales and Employment Costs data. At settlement, the 2-year yield decreased by 2.9bps to 3.454%, the 3-year yield decreased by 3.8bps to 3.515%, the 5-year yield decreased by 4.5bps to 3.698%, the 7-year yield decreased by 5.2bps to 3.912%, the 10-year yield decreased by 5.5bps to 4.143%, the 20-year yield decreased by 6.5bps to 4.727%, and the 30-year yield decreased by 6.4bps to 4.785%.

THE DAY: T-notes generally fluctuated throughout the overnight and morning sessions, but upside momentum developed following the release of US data showing weak December Retail Sales and Q4 Employment Costs, which helped T-notes move higher. Retail Sales missed expectations across the board, contributing to concerns about a consumer slowdown, with the control group, a good gauge for consumer spending in the GDP report, declining by 0.1%, below the 0.4% forecast. The focus this week remains largely on the US NFP on Wednesday and CPI data on Friday to help shape Fed rate cut expectations - the data is also for January, more timely than the delayed December Retail Sales report. After the data today, the Atlanta Fed GDP Now estimate was downgraded to 3.7% from 4.2%.

For treasuries specifically, supply will also be in focus after the three-year auction today was relatively in line with recent averages. With the majority of earnings behind us, corporate supply continues to ramp up with Google (GOOGL) entering global debt markets after its USD 20bln launch on Monday. Today, it added GBP 5.5bln in UK markets, including a 100-year bond, and CHF 3.0455bln in Swiss markets. Elsewhere, Disney (DIS), Loews (L), Pulte (PHM), Alexandria Real Estate (ARE), Cencora (COR), Sysco (SYY), Disney (DIS) and Tyson Foods (TSN) also entered the market. The slew of issuance didn't seem to have any direct downward impact, but it perhaps limited gains post-data, particularly with 10- and 30-year Treasury supply due this week.

Elsewhere, the latest NY Fed survey saw consumer delinquencies rise to 4.8% of household debt in Q4, the highest since 2017, while mortgage defaults surged in lower-income areas, with student loan delinquencies rising to a record. Delinquencies in credit cards and auto loans also rose.

Fed speak saw 2026 voter Hammack, who said policy is in a good position to see how things play out, noting the current target range is in the vicinity of neutral and the Fed could be on hold for quite some time.

SUPPLY

Bills

- The US sold 6-week bills at a high rate of 3.635%, with a bid-to-cover ratio of 2.96x.

- The US will sell USD 90bln of 6-week bills on February 10th, to settle on February 12th.

Notes

- The US sold USD 58bln of 3-year notes with a high yield of 3.518%, stopping through the when issued by 0.1bps, matching the prior auction but not as strong as the six auction average 0.5bps stop through. The bid-to-cover fell slightly to 2.62x from 2.65x, below the 2.68x average. However, the breakdown saw direct demand rise to 31.92% from 29.5%, above the 24.7% average. Indirect demand also rose, to 57.15% from 56.5%, but below the 63.7% average. This left dealers with 10.94% of the auction, an improvement from the prior 14% and slightly better than recent averages, 11.6%.

- The US will sell USD 42bln in 10-year notes on February 11th, and USD 25bln in 30-year bonds on February 12th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 4.9bps (previous 3.7bps), April 10.7bps (previous 8.2bps), June 25.7bps (previous 23.2bps), December 57.9bps (previous 55.7bps).

- NY Fed RRP op demand at USD 1.45bln (previous 1.31bln) across 5 counterparties (previous 10).

- EFFR at 3.64% (previous 3.64%), volumes at USD 92bln (previous 106bln) on February 9th.

- SOFR at 3.63% (previous 3.64%), volumes at USD 3.132tln (previous 3.195tln) on February 9th.

CRUDE

WTI (H6) SETTLED USD 0.40 LOWER AT 63.96/BBL; BRENT (H6) SETTLED USD 0.24 LOWER AT 68.80/BBL

The crude complex experienced slight losses, albeit within tight parameters, as US/Iran tensions remain in focus. The main update came in the US afternoon, as President Trump told Axios in an interview that he is considering sending a second aircraft carrier strike group to the Middle East to prepare for military action if negotiations with Iran fail. He added that either a deal will be made or a tough response will be necessary, and he expects the second round of US-Iran talks to take place next week. No reaction was seen in oil, as traders await to see how this plays out. On the supply side of things, reports noted that Venezuela's largest refinery, Amuay (645k BPD), is restarting basic operations after a power blackout. Elsewhere, headline-specific newsflow was light and highlighted by WTI traded between a contained USD 63.65-64.71/bbl and Brent USD 68.44-69.49/bbl. Despite saying that, we got the monthly STEO, which saw 2026 world oil demand unchanged at 104.8mln BPD and 2027 unchanged at 106.1mln BPD. After-hours, we await the weekly private inventory metrics, whereby current expectations are (bbls): Crude +0.8mln, Distillates -1.3mln, Gasoline -0.4mln.

EQUITIES

CLOSES : SPX -0.33% at 6,942, NDX -0.56% at 25,128, DJI +0.10% at 50,188, RUT -0.34% at 2,680

SECTORS: Communication Services -0.84%, Financials -0.75%, Health -0.63%, Consumer Staples -0.63%, Technology -0.58%, Energy -0.08%, Industrials +0.12%, Consumer Discretionary +0.45%, Materials +1.29%, Real Estate +1.39%, Utilities +1.59%.

EUROPEAN CLOSES : Euro Stoxx 50 -0.18% at 6,048, Dax 40 -0.12% at 24,986, FTSE 100 -0.31% at 10,354, CAC 40 +0.06% at 8,328, FTSE MIB -0.04% at 46,803, IBEX 35 -0.43% at 18,118, PSI -0.42% at 8,953, SMI -0.05% at 13,511, AEX +0.51% at 1,004

STOCK SPECIFICS:

- Datadog (DDOG): EPS, revenue and operating income exceeded expectations, although guidance was weak.

- Spotify (SPOT): EPS, MAUs and total premium subs topped expectations with strong guidance.

- TSMC (TSM): January revenue increased by 37% Y/Y to USD 12.7bln

- DuPont (DD): Anticipates FY sales and profit above expectations after Q4 metrics beat, helped by higher sales in healthcare segment & by business restructuring

- Hasbro (HAS): Top & bottom line surpassed expectations.

- Quest Diagnostics (DGX): EPS, revenue beat with better than expected FY outlook.

- Amazon (AMZN) plans to launch an AI content marketplace, allowing publishers to sell content to AI firms.

- Coca-Cola (KO): Revenue fell short.

- Fiserv (FISV): FY profit guide midpoint was shy of Wall St. expectations.

- On Semiconductor (ON): Mixed next quarter guidance.

- S&P Global (SPGI): Profit weak with disappointing FY outlook.

- The Trump administration plans tariff carve-outs for US hyperscalers, including AMZN, GOOG, and MSFT linked to TSMC’s US investment commitments.

- Altruist has launched AI-powered tax planning within Hazel, enabling Advisors to create personalised tax strategies by analysing clients’ 1040s, pay stubs, account statements and other financial documents; the news sparked AI disruption concerns within the space, Charles Schwab (SCHW), Raymond James (RJF), LPL Financial (LPLA) were hit the hardest.

- Paramount SkyDance (PSKY) is enhancing its USD 30/shr all-cash offer for Warner Bros Discovery (WBD) to add a USD 0.25/shr "ticking fee", payable to WBD shareholders for each quarter its transaction has not closed beyond December 31st 2026.

FX

The Dollar was mainly bid against major peers as the notable weakness seen in the last two trading days took a breather, as repositioning was likely at play ahead of NFP on Wednesday. In the background, data came in soft, highlighted by an underwhelming Retail Sales report, with the headline unexpectedly showing no growth in December despite expectations of +0.4% with the core gauge, Retail Control, unexpectedly declining 0.1%, albeit marginally. This sent US yields across the curve lower, but with the dollar seeing notable selling pressure since Friday, further weakness seemed exhausted. Earlier in the week, a Bloomberg report noting that China is urging banks to curb UST exposure had renewed some concerns over international demand for US assets. That said, today's US 3yr note auction saw an uptick in indirect demand, suggesting foreign buyers aren't going anywhere, at least for now. As mentioned, NFP is to be the highlight on Wednesday, expected to show +70k payroll growth with an unemployment rate seen steady at 4.4%. DXY was only modestly lower, trading at ~96.80 from earlier 97.007 highs as strong JPY gains largely offset weakness in other G10 currencies.

JPY was the clear outperformer amongst G10 currencies vs USD, also seeing strength across other peers. Optimism has continued to build following PM Takiachi's landslide victory in the Lower House, with JGB yields on the long end continuing to ease while the 2yr yields remain firmer than pre-election levels as bets over a faster BoJ normalisation help JPY's bull case. USD/JPY now trades around 154.30 from the 157.56 seen at the start of the week.

EUR/NOK traded lower in response to hotter-than-expected Norwegian inflation. Core Y/Y printed 3.4% in January above the expected 3.0% (Norges Bank exp. 2.9%, prev. 3.1%). Nomura now sees one more cut (prev. three cuts) by the Norges Bank. EUR/NOK now trades around 11.3180 from earlier 11.4255 highs.

The Chinese Yuan was little changed vs USD. Latest updates from the PBoC showed the central bank is to continue implementing appropriately loose monetary policy and vows to expand the use of CNY in cross-border trade.