Market Wrap 2026-02-15

Today's US Market Wrap — Key Points

- Mixed equity performance; Russell 2000 outperformed.

- Softer US CPI; services inflation remains a concern.

- Treasuries bull steepened; markets eye Fed rate cuts.

- OPEC+ considers output increase; crude prices flat.

- Focus shifts to US PCE, GDP, FOMC Minutes next week.

Already a member? Sign in to unlock the full wrap

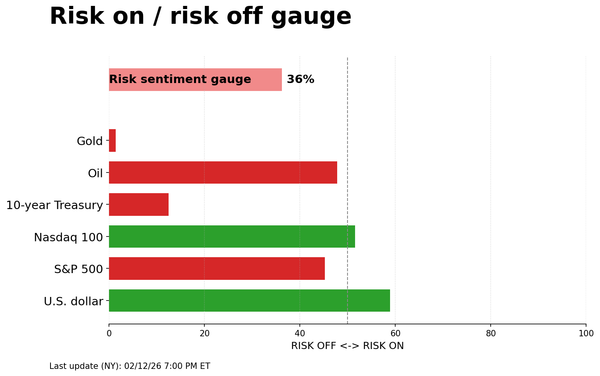

MARKET SNAPSHOT

- Equities: Mixed

- Treasuries: Up

- Crude: Flat/Up

- Dollar: Flat

- Gold: Up

MARKET REAR VIEW

- The January US CPI report was slightly softer than anticipated.

- OPEC+ sources indicated a leaning towards resuming oil output increases in April, though a final decision is pending.

- Fed's Goolsbee expressed ongoing concerns regarding service sector inflation.

- Reports suggest Trump intends to reverse tariffs on metal and aluminum products.

- Germany is considering a debt brake exemption to bolster a raw material fund.

- AMAT exceeded earnings expectations.

UPCOMING EVENTS

- Desk Coverage: Newsquawk will begin APAC coverage on Sunday, February 15, 2026, followed by EU coverage on Monday, February 16. The desk will close at 18:00GMT/13:00ET and reopen for APAC coverage at 22:00GMT/17:00ET.

- Holiday: US Presidents Day; Chinese Spring Festival Golden Week.

- Data: Japanese Industrial Production Final (Dec), Swedish Unemployment (Jan), Eurozone Industrial Production (Dec).

- Events: Japan PM Takaichi to meet with BoJ Governor Ueda.

- Speakers: Fed’s Bowman.

WEEK AHEAD

- Key events include US PCE and GDP data, FOMC Minutes, RBNZ meeting, Flash PMIs, and UK, Canadian, and Japanese inflation figures. A detailed report is available via a provided link.

CENTRAL BANK WEEKLY

- A preview of the RBNZ meeting, FOMC Minutes, and RBA Minutes is provided, along with a review of the BoC Minutes. A detailed report is available via a provided link.

WEEKLY US EARNINGS ESTIMATES

- The earnings season continues, with retailer WMT as a highlight. A detailed report is available via a provided link.

MARKET WRAP

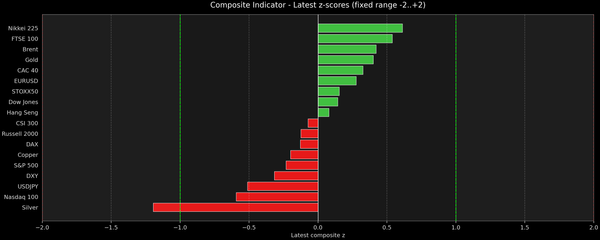

Friday saw mixed performance in equities, with the Russell 2000 outperforming, rising 1.2%. The equal-weight ETF also experienced strong gains, and most sectors were positive, indicating broad market participation. However, the heavy-weight sectors (Communication Services, Technology, and Consumer Discretionary) weighed on overall index performance. The CPI report was the main event, with the headline figure coming in softer than expected, while the core reading matched forecasts. Goods prices supported the view that tariff-related inflation is largely behind us, but services inflation continued to accelerate, raising concerns for Fed's Goolsbee. Treasury notes were firmer across the curve in response to the inflation data, with the front end leading the gains, resulting in a bull steepening of the curve. In FX, GBP outperformed while the Aussie lagged, with other currency pairs showing relatively muted price action. Crude prices settled flat to slightly higher, paring earlier losses after reports that OPEC+ is considering resuming output increases from April. US-China relations were in focus after the Pentagon initially added several Chinese companies to a list of firms accused of aiding the Chinese military, although this list was later removed. Gold and Silver prices continued to rise, along with Bitcoin.

US

CPI:

The January inflation report was on the soft side. The headline figure increased by 0.171%, below the 0.3% forecast and slowing from the previous 0.298%. The year-over-year increase was 2.4%, below the 2.5% forecast and down from 2.7% in December. Core metrics were in line with expectations. Headline core inflation rose 0.295% month-over-month, slightly up from 0.233% in December, with the year-over-year increase at 2.5%, down from 2.6% previously. Within the report, core goods inflation was nearly non-existent again (0.04% vs 0.03% prior), while core services accelerated to 0.39% from 0.27%. The supercore reading increased to 0.58% from 0.23%. Oxford Economics noted that the data reinforces their view that tariff-induced price increases on the goods side are largely behind us. The desk's preliminary estimate for headline and core PCE is 0.19% and 0.265%, respectively, for January. It stated that the data is welcome news for the Fed, but it does not change its baseline forecast for monetary policy based on a single inflation reading. "Lingering distortions from the shutdown in the price data, prospects for solid growth this year, and a stabilising job market will keep the central bank on hold until June."

FED’s GOOLSBEE

(2027 voter): Stated that high services inflation remains a concern and was evident in the CPI data. Goolsbee reiterated that rates could still be lowered, but progress on inflation is necessary, as he believes it is not on a path back to 2% but is stuck around 3%. “If we're at 2% inflation, we can have several more cuts.” He did acknowledge encouraging aspects within the CPI data. The Chicago Fed President noted the job market has been steady, with only a modest cooling. He is uncertain about the restrictiveness of Fed policy and suggested consumers should remain cautious if the job market is stable and inflation eases. Goolsbee reiterated his dissent at the December meeting (preferring to hold vs cut), stating, “Would have been wiser to wait in December 2025”.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 12 TICKS HIGHER AT 113-05+

Treasury notes experienced a bull steepening after the soft CPI report, led by the short-end.

At settlement:

- 2-year: -5.4bps at 3.412%

- 3-year: -6.0bps at 3.450%

- 5-year: -5.9bps at 3.609%

- 7-year: -5.8bps at 3.814%

- 10-year: -4.8bps at 4.056%

- 20-year: -3.3bps at 4.643%

- 30-year: -3.1bps at 4.698%

THE DAY:

Treasury notes were lower across the curve on Friday, particularly in the long-end, resulting in a bull steepening of the curve. Price action was largely influenced by the US CPI report, which showed core metrics in line with forecasts but headline figures lower than expected. Treasury notes experienced choppy trading in response to the data but ultimately moved higher and maintained those gains. However, the soft CPI report was insufficient for banks to move forward their Fed rate cut expectations, with many pushing back expectations after the strong January NFP report. Nevertheless, money markets have become more optimistic about 2026 rate cuts, pricing in approximately a 40% chance of a third 25bps Fed rate cut this year. An economy demonstrating a robust labor market and cooling inflation is positive news for the Fed. With inflation still above target and the labor market holding up, the Fed can continue its pause in rate cuts. Markets anticipate rate cuts will resume in the Summer, when Warsh (if successfully nominated by the Senate) takes over from Fed Chair Powell. A key risk is whether Fed Chair Powell decides to remain as governor after his term as Chair expires in May, a decision he has not yet hinted at. Next week, attention will focus on GDP and PCE data (for December due to government shutdowns), as well as 20-year supply and 30-year TIPS.

SUPPLY

Bills

- The US will sell USD 90bln of 6-week bills, USD 89bln of 13-week bills, USD 77bln of 26-week bills, and USD 52bln of 52-week bills on February 17th, all settling on February 19th.

Notes

- The US Treasury will sell USD 16bln of 20-year bonds on Wednesday, February 18th, and USD 9bln of 30-year TIPS on Thursday, February 19th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 1.3bps (previous 1.3bps), April 6.2bps (previous 4.2bps), June 21.2bps (previous 16.9bps), December 62.2bps (previous 52.3bps).

- NY Fed RRP operation demand at USD 0.4bln (previous 2.84bln) across 3 counterparties (previous 10).

- EFFR at 3.64% (previous 3.64%), volumes at USD 97bln (previous 101bln) on February 12th.

- SOFR at 3.65% (previous 3.65%), volumes at USD 3.205tln (previous 3.167tln) on February 12th.

CRUDE

WTI (H6) SETTLED USD 0.05 HIGHER AT USD 62.89/BBL; BRENT (J6) SETTLED USD 0.23 HIGHER AT USD 67.75/BBL

The crude complex ended the day flat, but experienced initial weakness following OPEC reports.

Benchmarks were largely rangebound on Friday, but the aforementioned sources took WTI and Brent from near highs to daily lows. To recap, the sources indicated that OPEC+ is leaning towards resuming oil output increases from April, although no decision has been made, and discussions will continue leading up to the next meeting on March 1st. Aside from this, there was little new information as traders digested the cooler-than-expected US inflation report, which had little impact on views regarding the next FOMC meeting. Regarding geopolitics, despite no market reaction, Trump stated that Zelensky needs to take action in the war in Ukraine, and Russia wants a deal. On Iran, he noted that if they have a deal, US carriers will be leaving soon. He reiterated his desire to make a deal with Iran, but they have been difficult. The weekly Baker Hughes rig count showed oil down 3 at 409, natural gas up 3 at 133, with the total unchanged at 551. WTI traded between USD 62.14-63.26/bbl, and Brent traded between USD 66.89-68.05/bbl.

EQUITIES

CLOSES

- SPX: +0.05% at 6,836

- NDX: +0.18% at 24,733

- DJI: +0.10% at 49,500

- RUT: +1.18% at 2,647

SECTORS:

- Communication Services: -0.76%

- Technology: -0.52%

- Consumer Discretionary: -0.08%

- Financials: -0.07%

- Consumer Staples: +0.19%

- Energy: +0.55%

- Industrials: +0.83%

- Health: +1.01%

- Materials: +1.10%

- Real Estate: +1.48%

- Utilities: +2.69%

EUROPEAN CLOSES

- Euro Stoxx 50: -0.44% at 5,985

- Dax 40: +0.20% at 24,903

- FTSE 100: +0.42% at 10,446

- CAC 40: -0.35% at 8,312

- FTSE MIB: -1.71% at 45,431

- IBEX 35: -1.25% at 17,672

- PSI: -0.30% at 8,999

- SMI: +0.71% at 13,626

- AEX: +0.59% at 994

STOCK SPECIFICS

- The US removed a document listing firms linked to the Chinese military; the US agency requested the withdrawal via the Federal Register. Companies briefly listed included: Alibaba (BABA), Baidu (BIDU), Cosco, BYD (BYDDY), Huawei, Nio (NIO), SMIC, Tencent, and more.

- Airbnb (ABNB): Revenue beat expectations with strong guidance for the next quarter and fiscal year.

- Applied Materials (AMAT): EPS and revenue exceeded expectations and issued guidance well above expectations, supported by accelerating AI-driven investment and record segment revenues.

- Arista Networks (ANET): Quarterly metrics beat expectations with a stellar outlook.

- Coinbase (COIN): Top line fell short of expectations.

- DraftKings (DKNG): Fiscal year outlook disappointed as it plans heavy investment to expand into prediction markets.

- Pinterest (PINS): EPS and revenue were light, and issued weaker-than-expected guidance, with management citing tariff-related headwinds impacting large retail advertisers and pressuring revenue.

- Rivian Automotive (RIVN): Solid Q4 numbers and guided to a significant increase in vehicle deliveries this year.

- Roku (ROKU): EPS and revenue surpassed Wall Street consensus.

- Vertex Pharmaceuticals (VRTX): Profit was light.

FX

The Dollar Index was unchanged as GBP strength was offset by marginal JPY weakness, with a muted Euro in the background. The US January CPI report was the highlight, with headline gauges coming in cooler-than-expected, while core metrics matched forecasts. The DXY pared modest overnight gains on the report amid US yields moving lower across the curve as markets increased their bets on Fed rate cuts in 2026, now pricing in approximately a 40% chance of a third 25bps rate cut.

G10 FX saw mixed performance, with winners and losers against the dollar only seeing marginal/modest moves. GBP led strength, followed by NZD, while CHF and EUR were flat, and AUD led losses. The Euro was little moved by EZ GDP second estimates and employment data that were broadly in line with expectations. EUR/USD traded in a narrow intraday range of 1.1847-1.1884, while AUD/USD inched lower to around 0.7075 but was firmer from the 0.7013 seen at the end of last week.

JPY was unfazed by remarks from BoJ's Tamura, who reiterated that rates will be raised in the future if the outlook is met. He added that recently inflation has become sticky and they may be able to judge that BoJ's price goal has been achieved as early as this spring. USDJPY sits around 152.80 but is notably lower than 157.56 seen at the start of the week.

CHF was modestly firmer against the Euro with in-line Y/Y inflation of 0.1% erasing earlier weakness. The print is in line with the SNB's Q1 average forecast.