Market Wrap 2026-02-16

Today's US Market Wrap — Key Points

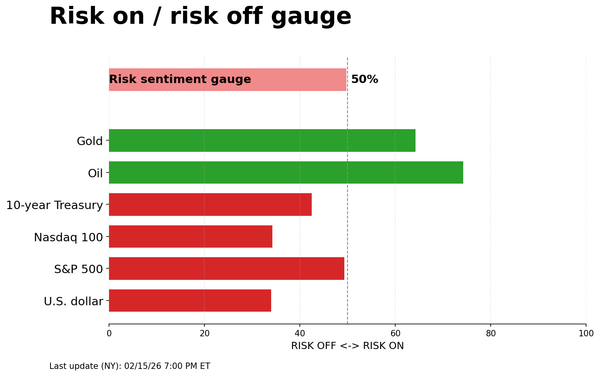

- Stocks declined amid AI disruption concerns, boosting Treasuries.

- Oil fell on risk-off sentiment and IEA demand forecast cut.

- Dollar strengthened; haven currencies outperformed.

- Focus shifts to upcoming US CPI data release.

Already a member? Sign in to unlock the full wrap

MARKET OVERVIEW

- SNAPSHOT: Stocks declined, Treasury yields increased, crude oil prices decreased, the U.S. dollar strengthened, and gold prices fell.

- RECENT DEVELOPMENTS: Algorhythm Holdings' platform raised concerns in the logistics sector. Federal Reserve officials Miran and Hammack offered differing views on potential interest rate adjustments. The International Energy Agency (IEA) lowered its 2026 global oil demand growth forecast. A reported Russian memo suggested a return to the USD system in a pitch to Trump. A U.S. 30-year bond auction was well-received. Trump stated the need for a deal with Iran, suggesting a possible agreement within the next month.

- UPCOMING EVENTS: Data releases include Indian WPI (Jan), German Wholesale Prices (Jan), Swiss CPI (Jan), Eurozone Preliminary Employment (Q4), Eurozone GDP 2nd Estimate (Q4), and US CPI (Jan). Scheduled speakers include Fed officials Miran and Logan, BoJ's Tamura, ECB's de Guindos, and BoE's Pill. Supply announcements are expected from Australia. Earnings reports are due from Moderna, Safran, and NatWest.

MARKET WRAP

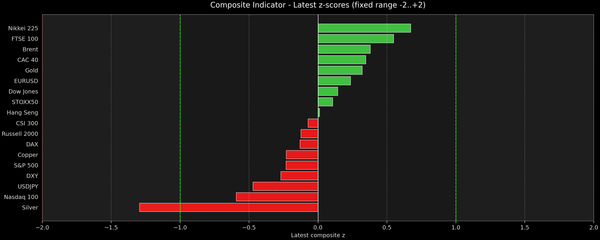

Thursday's trading session was characterized by risk aversion, with equity declines seemingly driven by ongoing concerns about AI disruption. Stocks experienced selling pressure from the U.S. market open through the European close. Attention focused on an update from Algorhythm Holdings (RIME), an AI penny stock, indicating that its SemiCab platform enables customers to increase freight volumes by 300-400% without increasing headcount. This particularly impacted the logistics/industrials sector, but sectors exposed to AI disruption (software, gaming, financials) also declined, while sectors less exposed (consumer staples) performed relatively better. The risk-off sentiment boosted Treasury notes, with the yield curve flattening, particularly at the long end, following a strong 30-year auction. Crude oil prices also decreased, tracking risk sentiment, but settled slightly above their lows. Geopolitically, Trump reiterated the need for a deal with Iran, suggesting a possible agreement within a month, but warning of negative consequences for Iran if no deal is reached. Equity weakness extended to gold, silver, and cryptocurrencies, which have shown similar performance patterns recently, especially during volatile periods. The FX market was relatively calmer, with haven currencies (Yen, Franc, and Dollar) outperforming and cyclical currencies lagging, particularly the Australian dollar. Market focus is now largely on the U.S. CPI report on Friday.

US

CLAIMS: Initial Jobless Claims for the week ending February 7th decreased to 227k from 232k, but exceeded the forecast of 222k. The four-week average rose to 219.5k from 212.25k. Unadjusted data showed a 4.5k decrease in initial claims to 248k, while seasonal factors anticipated a 1.1k increase. Continuing claims for the preceding week increased to 1.862 million from 1.844 million, surpassing the forecast of 1.85 million. Pantheon Macroeconomics suggests the data indicates a labor market as subdued as last year, casting doubt on the sustainability of January's payroll increase. However, the firm acknowledges that heavy snow in late January may have marginally increased claims. Looking ahead, Pantheon Macroeconomics expects layoffs to remain relatively low in the coming months, but hiring is likely to remain weak as well.

EXISTING HOME SALES: Existing home sales for January decreased to 3.91 million from 4.27 million, falling short of the expected 4.18 million. The inventory of homes for sale was 1.22 million units, representing 3.7 months' worth (previously 3.3 months' worth). The national median home price for existing homes increased by 0.9% year-over-year to USD 396,800. NAR Chief Economist Dr. Lawrence Yun noted that below-normal temperatures and above-normal precipitation in January make it difficult to assess the underlying drivers of the decrease and determine if the numbers are an aberration. Yun added that affordability is improving due to wage gains outpacing home price growth and lower mortgage rates compared to a year ago. However, supply remains low.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 16+ TICKS HIGHER AT 112-25+

T-Notes were bid in risk-off trade amid concerns about AI disruption. At settlement, the 2-year yield decreased by 4.4bps to 3.468%, the 3-year yield decreased by 5.8bps to 3.511%, the 5-year yield decreased by 7.1bps to 3.670%, the 7-year yield decreased by 7.5bps to 3.873%, the 10-year yield decreased by 7.7bps to 4.106%, the 20-year yield decreased by 8.1bps to 4.676%, and the 30-year yield decreased by 8.3bps to 4.731%.

THE DAY: T-Notes traded within a 7-tick range throughout the Asian, European, and early U.S. sessions, with some upside as U.S. players entered and some marginal downside after the jobless claims data, despite exceeding expectations. However, T-Notes rose after the U.S. equity opening bell, supported by risk-off trade. Equities were sold on concerns about AI disruption, with the logistics/industrial sector appearing to be the next affected. T-Notes increased from the U.S. opening bell to the close of European cash equity trade, before fluctuating ahead of the 30-year auction. The auction was strong, further boosting Treasuries into settlement. The next scheduled risk event is the U.S. CPI on Friday, which will influence expectations for Federal Reserve rate cuts. The strong January jobs report led several banks to delay their forecasts for Fed rate cuts, with money markets now fully pricing in the next rate cut by July.

SUPPLY

Bills

- The U.S. will sell USD 90 billion of 6-week bills, USD 89 billion of 13-week bills, USD 77 billion of 26-week bills, and USD 52 billion of 52-week bills on February 17th, all settling on February 19th.

- The U.S. sold USD 105 billion of 4-week bills at a high rate of 3.630%, with a bid-to-cover ratio of 3.63x, and USD 95 billion of 8-week bills at a high rate of 3.630%, with a bid-to-cover ratio of 2.88x.

Notes

- The U.S. Treasury sold USD 25 billion of 30-year bonds at a high yield of 4.750%, stopping through the when-issued by 2.1bps, the largest stop-through since April 2025. This was stronger than the 0.1bps stop-through in January and better than the six-auction average of a 0.5bps tail. The bid-to-cover ratio increased to 2.66x from 2.36x, above the 2.34x average. The strong auction was driven by a rise in indirect demand to 69.9% from 65.4%, above the 63.7% average. Direct demand rose to 24.2% from 23.5%, above the 23.9% average. Dealers were left with 5.9% of the auction, a better sign of demand compared to the prior 11.2% and 12.4% average.

- The U.S. Treasury will sell USD 16 billion of 20-year bonds on Wednesday, February 18th, and USD 9 billion of 30-year TIPS on Thursday, February 19th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 1.3bps (previous 0.0bps), April 4.2bps (previous 4.2bps), June 16.9bps (previous 16.4bps), December 52.3bps (previous 51bps).

- NY Fed RRP operation demand was at USD 2.844 billion (previous 1.05 billion) across 10 counterparties (previous 6).

- The NY Fed stated that the desk plans to conduct approximately USD 40 billion in additional reserve management purchases and approximately USD 13.4 billion in reinvestment purchases between February 13th and March 12th.

- The EFFR was at 3.64% (previous 3.64%), with volumes at USD 104 billion (previous 92 billion) on February 10th.

- The SOFR was at 3.65% (previous 3.63%), with volumes at USD 3.194 trillion (previous 3.132 trillion) on February 10th.

CRUDE

WTI (H6) SETTLED USD 1.79 LOWER AT 62.84/BBL; BRENT (J6) SETTLED USD 1.88 LOWER AT 67.52/BBL

The crude oil complex declined amid broad risk-off sentiment and a strengthening U.S. dollar. The energy sector was largely range-bound overnight and initially through the European morning, with WTI and Brent reaching peaks of USD 65.10/bbl and 69.85/bbl, respectively. Benchmarks then weakened, coinciding with the latest IEA forecasts, which lowered the 2026 global oil demand growth forecast to 850k BPD (previous 930k BPD) and the 2026 global oil supply growth forecast to 2.4 million BPD (previous 2.5 million BPD). Oil prices continued to decline before succumbing to the overall shift in risk sentiment and the strengthening dollar, falling to session lows and settling around those levels. There was little crude-specific news behind the drop, just broader AI concerns fueling risk-off trade. A report by Axios stating that Israeli PM Netanyahu said the conditions Trump is setting on Iran, combined with their understanding they made a mistake last time by not reaching a deal, could lead Iran to accept a good deal, did aid a few downticks. Recently, US President Trump said they have to make a deal with Iran, and could reach deal over the next month, but will be very traumatic for Iran if they do not agree to a deal. The U.S. CPI report on Friday is the key event ahead.

EQUITIES

CLOSES: SPX -1.55% at 6,834, NDX -2.04% at 24,688, DJI -1.34% at 49,452, RUT -2.15% at 2,612

SECTORS: Utilities +1.50%, Consumer Staples +1.28%, Real Estate +0.31%, Health -0.17%, Industrials -1.20%, Communication Services -1.46%, Materials -1.49%, Consumer Discretionary -1.58%, Financials -1.99%, Energy -2.17%, Technology -2.65%.

EUROPEAN CLOSES: Euro Stoxx 50 -0.27% at 6,019, Dax 40 -0.11% at 24,828, FTSE 100 -0.67% at 10,402, CAC 40 +0.33% at 8,341, FTSE MIB -0.62% at 46,223, IBEX 35 -0.82% at 17,897, PSI -0.49% at 9,026, SMI -0.21% at 13,543, AEX -2.02% at 989.

STOCK SPECIFICS:

- Applovin (APP): Results were impressive, but fell short of buy-side estimates.

- Cisco (CSCO): Issued guidance that only met expectations, disappointing traders, despite reporting better-than-anticipated quarterly results.

- Equinix (EQIX): Provided a strong outlook for the next quarter and fiscal year.

- iPhone (AAPL): Experienced growth in China in January.

- Kioxia: Issued a stellar outlook, reflecting a surge in NAND flash memory prices and strong demand for data storage needed for AI. This is relevant for MU, SNDK, STX, and WDC.

- McDonald's (MCD): Reported impressive EPS, revenue, and comparable sales.

- Motorola (MSI): Reported better-than-expected EPS and revenue, with a stronger-than-expected fiscal year outlook.

- Tyler Tech (TYL): Reported light top and bottom lines, as well as a light fiscal year revenue midpoint guide.

- Google (GOOGL): Updated Gemini 3 deep think in close partnership with scientists and researchers to tackle research challenges.

- Algorhythm Holdings (RIME): Announced that its SemiCab platform in live customer deployments is enabling its customers' internal operations to scale freight volumes by 300-400% without an increase in headcount.

FX

The Dollar Index showed only marginal strength on Thursday, but is well off the earlier lows. The dollar reversed course as risk sentiment deteriorated during the U.S. afternoon. While movements in the FX space were more contained than in equities and precious metals, the dollar reversed earlier losses as fears of further AI disruption emerged. As a result, AUD, CAD, and NZD weakened, while haven currencies, Yen and CHF, outperformed, with USD/JPY falling to approximately 152.35 from approximately 153.75 before the AI-induced fallout. Regarding dollar-specific news, initial jobless claims marginally decreased to 227k from 231k, but were above the expected 222k, although this had little impact on the Greenback. All participants await the U.S. CPI on Friday, which will provide a gauge of inflation following the strong jobs market report on Wednesday. The latter has led many banks to push back their forecasts for the resumption of Fed rate cuts, with money markets now pricing in the first 25bps reduction by July, compared to June before the non-farm payrolls data.

As mentioned, haven currencies topped the G10 breakdown, and high-beta FX lagged as risk sentiment soured. This occurred after Algorhythm Holdings announced that its SemiCab platform in live customer deployments is enabling its customers' internal operations to scale freight volumes by 300-400% without an increase in headcount, causing the Industrials sector to be the latest to suffer from AI disruption. More broadly, this seemed to ignite existing concerns in other sectors, such as software, gaming, and brokerage, regarding new AI platforms. Prior to this, the Kiwi led G10 gains while the Aussie lagged slightly, consolidating after recent outperformance as moves were dollar-driven, with no major domestic catalysts for either currency. For the Yen, overall conditions remain supportive as markets continue to price faster BoJ normalization.

EUR and GBP were flat in a choppy day, as the Pound saw a mixed reaction to the latest GDP data. The December month-over-month figure printed in line, while the year-over-year and Q4 preliminary figures undershot expectations, briefly weighing on Cable before swiftly reversing.