Market Wrap 2026-02-17

Today's US Market Wrap — Key Points

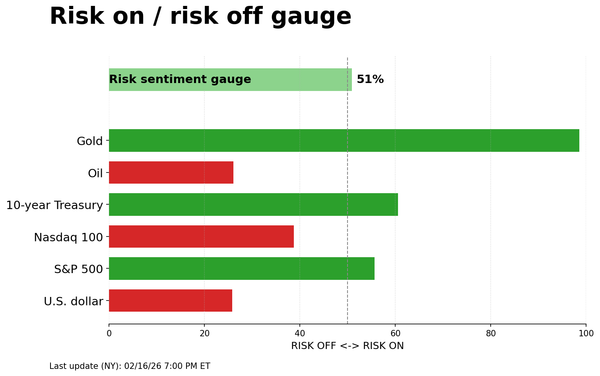

- Mixed market performance amid geopolitical news and Fed commentary.

- US data mixed; housing weak, manufacturing slightly better.

- Focus shifts to PCE, GDP data, FOMC Minutes, and RBNZ.

- Crude oil declines on US/Iran understanding.

- Dollar mixed; Antipodeans, Yen gain; Pound weakens.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

- SNAPSHOT: Equities and Treasuries showed mixed performance, Crude oil prices declined, the Dollar strengthened, and Gold prices decreased.

- REAR VIEW: Iran's Foreign Minister indicated an understanding on key principles with the US has been reached, but a final agreement is not imminent. Russia-Ukraine talks are reportedly strained, with Ukraine rejecting any deal involving unilateral withdrawal from the eastern Donbas region. Fed Governor Barr suggested stable interest rates for an extended period. Fed Governor Daly stated 75bps remain to reach a neutral rate. The UK unemployment rate increased. The US NAHB index fell short of expectations, while the NY Fed Manufacturing Index slightly exceeded forecasts. Canadian CPI data was somewhat soft.

- COMING UP: Holiday: Chinese Spring Festival Golden Week (February 17-24). Data: Australian Wage Price Index (Q4), UK CPI (January), US Durable Goods, Industrial Production (January), Housing Starts (November/December), Atlanta Fed GDP. Events: RBNZ Policy Announcement; FOMC Minutes (January); US-Ukraine-Russia talks (February 17-18). Speakers: RBNZ’s Bremen; ECB’s Cipollone, Schnabel; Fed's Bowman. Supply: Australia, Germany, US. Earnings: Analog, Carvana, DoorDash, Booking Holdings, Moody's, Garmin, Glencore.

- WEEK AHEAD: Key events include US PCE and GDP data, FOMC Minutes, RBNZ announcement, Flash PMIs, and inflation data from the UK, Canada, and Japan.

- CENTRAL BANK WEEKLY: A preview of the RBNZ and FOMC Minutes, and a review of the BoC Minutes.

- WEEKLY US EARNINGS ESTIMATES: Earnings season continues, with WMT as a key highlight.

US indices experienced volatility but closed with slight gains. Indices declined after the US equity market opened, led by the Mag-7 stocks (excluding Apple), but recovered during the afternoon. Wedbush commented that Apple's recent selloff was unjustified, anticipating Apple's entry into the AI sector in 2026. Weaker-than-expected NAHB data and a slightly better-than-expected NY Fed Manufacturing Index (with steady internals) put some pressure on T-Notes. Geopolitical updates regarding US/Iran and US/Russia/Ukraine meetings dominated trading. Crude oil prices weakened after the Iranian Foreign Minister announced an understanding on main principles with the US, but cautioned that a final agreement is not imminent. US VP Vance later noted that Iran talks progressed well in some respects, but the Iranians are not yet willing to acknowledge some of Trump's red lines. Regarding the trilateral meeting, Zelensky stated that the Ukrainian people would reject any peace deal involving Ukraine unilaterally withdrawing from the eastern Donbas region and ceding it to Russia. The main point of contention is control of the Donbas, and talks in Geneva are expected to continue. The Dollar Index saw marginal gains, with the Antipodeans and Yen strengthening and the Pound weakening due to a soft UK jobs report. Treasuries showed mixed performance, with the short-end weakening and the long-end declining. Spot gold prices decreased, trading below USD 4.9k/oz. The FOMC Minutes and a 20-year bond auction are anticipated.

US

NY FED: The Empire State Manufacturing Survey decreased to 7.1 from 7.7, exceeding the expected 7.0. Business activity increased modestly; new orders, inventories, unfilled orders, and employment increased, while shipments and supply availability remained steady. Input prices rose, selling price increases picked up, and capital spending plans strengthened. Richard Deitz, Economic Research Advisor at the NY Fed, stated that firms remained optimistic about continued improvement, with employment expected to grow.

NAHB: The NAHB housing market index for February unexpectedly decreased to 36 from 37, falling short of the expected 38. Current sales conditions remained steady at 41, sales expectations for the next six months decreased to 46 from 49, and traffic of prospective buyers decreased to 22 from 24. Oxford Economics noted that the report suggests some downside risk to its forecast for housing starts to gradually improve over H1 ‘26. However, they believe that lower mortgage rates and stabilizing labor market conditions will eventually support an improvement in new home sales and housing construction, although builders will need to reduce existing inventory first.

FED's BARR: (voter): Stated that it is prudent for the Fed to take time and assess data before changing policy again. The outlook suggests the Fed will hold rates steady for some time, and they can afford to take their time on monetary policy. He wants to see more evidence that inflation is ebbing to the 2% target and still sees ‘significant risk’ inflation will stay over 2%, but believes it's reasonable to think price pressures will further cool. He noted that the labor market is in balance but vulnerable to shock, with recent data pointing to a stabilizing job market. Barr also said the AI boom is unlikely to lead to lower Fed interest rates and added that there is little evidence so far that AI is driving up unemployment. Further, Barr said R-star has risen slightly but not dramatically and that AI investment is 'wildly indifferent' to what the Fed rate target is.

FED's DALY: (2027 voter): Remarked that inflation is above target, and people are feeling stretched. Daly added that current policy is slightly restrictive, and has 75bps to get to neutral, and that they need to get inflation down.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 1+ TICK LOWER AT 113-04

T-notes were flat after the long weekend, with longer-end yields lower and front-end yields higher. At settlement, 2-year +2.9bps at 3.439%, 3-year +2.3bps at 3.472%, 5-year +1.4bps at 3.623%, 7-year +0.9bps at 3.823%, 10-year −0.2bps at 4.054%, 20-year −1.3bps at 4.631%, 30-year −1.6bps at 4.683%.

THE DAY: T-notes saw minor gains overnight before gradually declining in the European morning, with focus on geopolitical developments related to US/Iran talks. Meanwhile, Russia/Ukraine talks had also begun. The NY Fed Manufacturing Index was the key data release, largely in line with expectations, falling slightly to 7.1 from 7.7, vs the 7.0 forecast. This represents a modest increase in business activity, while new orders rose, shipments were steady. Inventories rose, and supply availability held steady. Employment and average work week increased slightly after falling last month. Both input prices and selling price increases picked up. Following the data, T-notes came under gradual pressure on the overall solid report - particularly with employment and inflation picking up, which bolsters the Fed's case for a pause. Fed Governor Barr noted it is prudent for the Fed to take time and look at data before adjusting policy, and noting the outlook suggests the Fed will hold rates steady for some time. Fed Governor Daly said they have 75bps to get to neutral. Attention this week turns to PCE and GDP data while 20-year and 30-year TIPS supply will also be in focus.

SUPPLY

Bills

- US sold 3-month bills at high-rate 3.600%, B/C 2.71x; sold 6-month at high-rate 3.500%, B/C 3.08x

- US sold 6-week bills at a high rate of 3.640%, B/C 2.75x; sold 52-week bills at a high rate of 3.345%, B/C 2.96x

- US to sell USD 69bln of 17-week bills on February 18th, and USD 95bln of 8-week bills and USD 105bln of 4-week bills on February 19th; all to settle on February 24th

Notes

- US Treasury to sell USD 16bln of 20-year bonds on Wednesday February 18th, and USD 9bln of 30-year TIPS on Thursday February 19th

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 1.3bps (prev. 1.3bps), April 5.3bps (prev. 6.2bps), June 19.1bps (prev. 21.2bps), December 59.2bps (prev. 62.2bps).

- NY Fed RRP op demand at USD 0.4bln (prev. 0.4bln) across 5 counterparties (prev. 3)

- EFFR at 3.64% (prev. 3.64%), volumes at USD 90bln (prev. 97bln) on February 13th

- SOFR at 3.66% (prev. 3.65%), volumes at USD 3.169tln (prev. 3.205tln) on February 13th

CRUDE

WTI (J6) SETTLED USD 0.49 LOWER AT 62.26/BBL; BRENT (J6) SETTLED USD 1.23 LOWER AT 67.42/BBL

The crude complex is set to finish the day lower as geopolitics dominated the tape, with both US/Iran and US/Russia/Ukraine. The main move in the energy space came as the Iranian Foreign Minister said that they have reached a general agreement on a set of principles with the US, which sparked immediate downside. The Foreign Minister added that the two parties will welcome potential agreement documents and exchange them, but this does not mean an agreement will be reached soon, although the path has started; a date for the next round of talks with the US has not yet been decided. Prior to the talks, the strait of Hormuz was closed for hours due to drills. Regarding the Russia/Ukraine/US trilateral talks, which added little new and were recently concluded, Zelensky stated that the Ukrainian people would reject a peace deal that involves Ukraine unilaterally withdrawing from the eastern Donbas region and turning it over to Russia. The main sticking point is control of the Donbas, around 10% of which is still in Ukrainian hands. Trilateral talks in Geneva are expected to continue. The talks on Ukraine settlement in Geneva were tense, and we await a US readout. Weekly private inventory data is delayed a day on account of the US holiday on Monday. WTI traded between USD 61.87-64.14/bbl and Brent USD 66.82-69.04/bbl.

EQUITIES

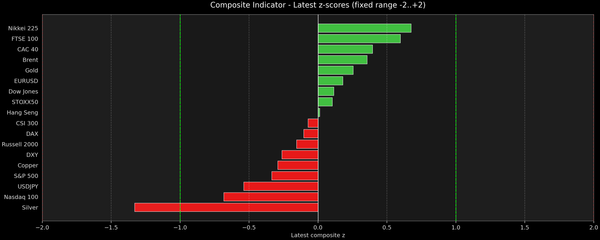

CLOSES : SPX +0.10% at 6,843, NDX -0.13% at 24,702, DJI +0.07% at 49,533, RUT +0.00% at 2,647

SECTORS: Consumer Staples -1.51%, Energy -1.37%, Materials -1.16%, Communication Services -0.60%, Utilities -0.37%, Health -0.19%, Consumer Discretionary -0.02%, Industrials +0.45%, Technology +0.49%, Financials +0.99%, Real Estate +1.03%.

EUROPEAN CLOSES : Euro Stoxx 50 +0.78% at 6,025, Dax 40 +0.82% at 25,005, FTSE 100 +0.79% at 10,556, CAC 40 +0.54% at 8,361, FTSE MIB +0.76% at 45,764, IBEX 35 +0.60% at 17,955, PSI +0.17% at 9,074, SMI +0.78% at 13,763, AEX +0.27% at 996

STOCK SPECIFICS:

- Apple (AAPL): Will hold a product launch on March 4th & preparing to announce several new devices in the coming weeks

- CNH Industrial (CNH): Profit light w/ disappointing FY EPS guidance.

- Fiserv (FISV): Jana Partners builds stake in the Co.

- General Mills (GIS): Cut annual sales & profit forecast.

- Genuine Parts (GPC): Top, bottom line light & confirmed plans to separate automotive and industrial businesses into two Cos.

- Infosys (INFY): Partnered with Anthropic.

- Masimo (MASI) to be acquired by Danaher (DHR) for $180/shr; note, closed Fri. at $130.15/shr.

- Micron (MU): WSJ article says MU is investing $200bln to expand memory-chip production.

- Norwegian Cruise Line Holdings (NCLH): Elliott Investment has built a stake >10% & plans to push for changes to improve performance.

- Warner Bros Discovery (WBD) sets shareholder vote date for Netflix (NFLX) bid on March 20th & unanimously recommends shareholders reject latest Paramount Skydance (PSKY) offer, but gives PSKY a week to negotiate a better deal.

- Apple (AAPL) reportedly ramps up work on AI glasses, pendant and camera airpods, according to Bloomberg.

- Anthropic is introducing Claude Sonnet 4.6.

FX

The Dollar was mixed vs. G10 peers on Tuesday, with DXY modestly firmer, extending on Monday's gains. In the background, US yields on the short-to-mid end were firmer as bets over Fed rate cuts by year-end were slightly trimmed. Fed Governor Barr signalled no urgency to resume easing, believing the outlook suggests the central bank will hold rates steady for some time. Both him and Goolsbee (2027 voter) said today they want to see more evidence on inflation ebbing to the 2% target before entertaining further easing. DXY came well off the earlier highs, with downside in precious metals on reduced geopolitical risks between the US and Iran likely giving the dollar a floor. Now, DXY trades around 97.16, down from the earlier 97.546 highs.

G10 FX was mixed. GBP lagged following a soft labour market report, which saw the unemployment rate unexpectedly rise to 5.2% from 5.1%, a smidge beneath the peak BoE forecast of 5.3%. Moreover, wage growth slowed across both key measures. Cable dropped as low as 1.3496 before recovering to ~1.3560.

JPY and Antipodes outperformed against the USD with the turnaround in risk sentiment supporting the latter, while there was little newsflow out of Japan. Ahead, the NZD/USD (trades ~0.6050) is in focus given the upcoming RBNZ policy announcement. Expectations are for the OCR to be unchanged at 2.25%, with money markets in agreement.

CAD reversed earlier weakness seen on a CPI report than leaned soft, finishing flat against USD. Headline Y/Y printed 2.3% (exp. 2.4%), Trimmed Mean Y/Y 2.4% (exp. 2.6%), while Median Y/Y matched expectations of 2.5%. Following the report, Oxford Economics expects the BoC will hold the policy rate at 2.25% until early 2027.