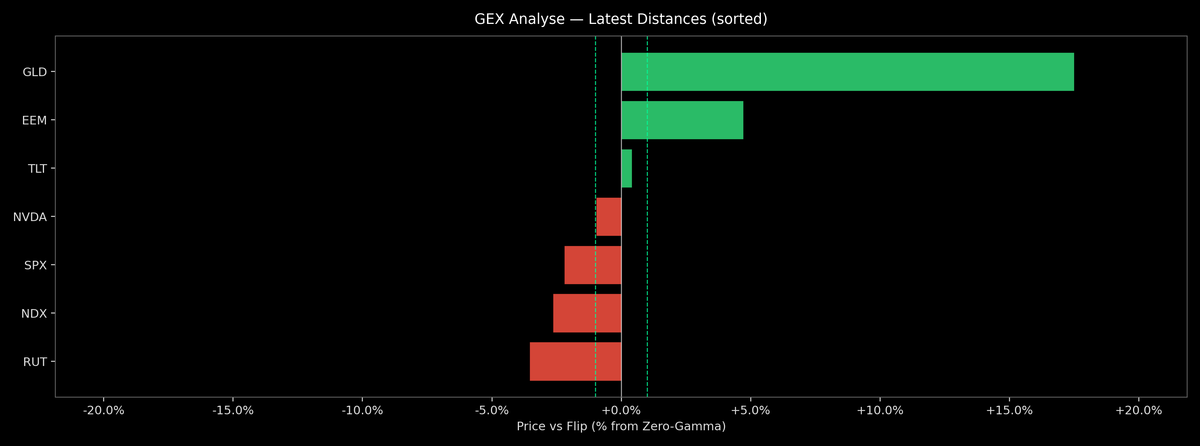

Price / Gamma Flip — 2026-02-05

This dashboard ranks each asset by where price sits relative to its options gamma ‘flip’ (zero-gamma) level. Names above the flip (green) tend to see dealer hedging dampen moves; below the flip (red) can see moves amplified. These dynamics can evolve quickly as open interest shifts. Top above-flip: GLD (+17.5%), EEM (+4.7%), TLT (+0.4%) Top below-flip: RUT (-3.5%), NDX (-2.6%), SPX (-2.2%), NVDA (-1.0%) Click any ticker to view its strike-by-strike Net GEX with a scaled gamma profile, spot and flip markers.