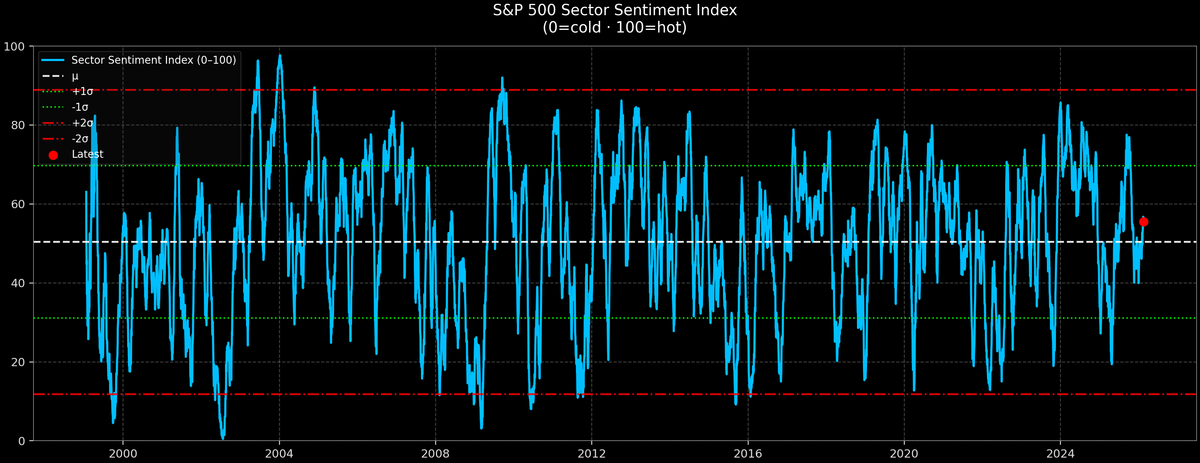

S&P 500 Sector Sentiment — 2026-02-17

S&P 500 Sector Sentiment — 2026-02-17

Current tone: neutral

Latest score: 55.5/100

Cross-sector dispersion: 96.9 pts

The Sector map is highlighting a clear divide between leaders and laggards, with Energy and Industrials taking the reins. Energy and Industrials are driving the momentum, while Technology and Financials are struggling to keep pace. A closer look at the Forward return playbook reveals a complex landscape, with different sectors poised to make their mark. As the market continues to evolve, it's essential to stay attuned to the shifting dynamics between these sector leaders and laggards.

Scan the Forward return playbook for context, then the Sector map for leadership and laggards.

Leaders include Energy, Industrials.

Laggards include Technology, Financials.

Forward return playbook (SPX)

Historical medians and hit ratios from past dates that looked similar to today (conditional on the sentiment regime + a tight score band).

| Horizon | Median SPX | Hit Ratio | N |

|---|---|---|---|

| 1M | 0.5% | 56.7% | 360 |

| 3M | 1.2% | 59.2% | 360 |

| 6M | 1.5% | 60.8% | 360 |

| 12M | 6.2% | 67.2% | 360 |

Sector map (0=cold, 100=hot)

Leading / Hot

- Energy: 99.9/100

- Industrials: 95.7/100

- Materials: 94.7/100

Lagging / Cold

- Technology: 3.0/100

- Financials: 8.2/100

- Consumer Disc.: 8.6/100

Neutral

- Real Estate: 93.8/100

- Consumer Staples: 90.6/100

- Utilities: 76.4/100

- Health Care: 28.2/100

- Comm. Services: 11.8/100

Read-through

- Higher dispersion usually means stock selection and factor tilts matter more than pure index direction.

- Use the playbook as a bias check, then size risk around the sector map (leaders vs laggards).