Shutdown Panic vs Market History: What Actually Happens to the S&P 500?

Every time Washington edges toward a government shutdown, the same headlines hit:

“Market chaos ahead”, “Investors brace for turmoil”, “Risk-off mode”.

So we asked a simple question: what has actually happened to the S&P 500 after past shutdowns?

Instead of trading the narrative, we let the data speak.

Which shutdowns did we look at?

We focused on modern U.S. government shutdowns that involved furloughs – periods when parts of the federal government really did shut their doors and workers were sent home.

The sample includes:

- 1980 – Jimmy Carter (FTC shutdown)

- 1981 – Ronald Reagan

- 1984 – Ronald Reagan

- 1986 – Ronald Reagan

- 1990 – George H. W. Bush

- 1995 (Nov) – Bill Clinton

- 1995–96 – Bill Clinton

- 2013 – Barack Obama

- 2018 (Jan) – Donald Trump

- 2018–19 – Donald Trump (longest shutdown on record)

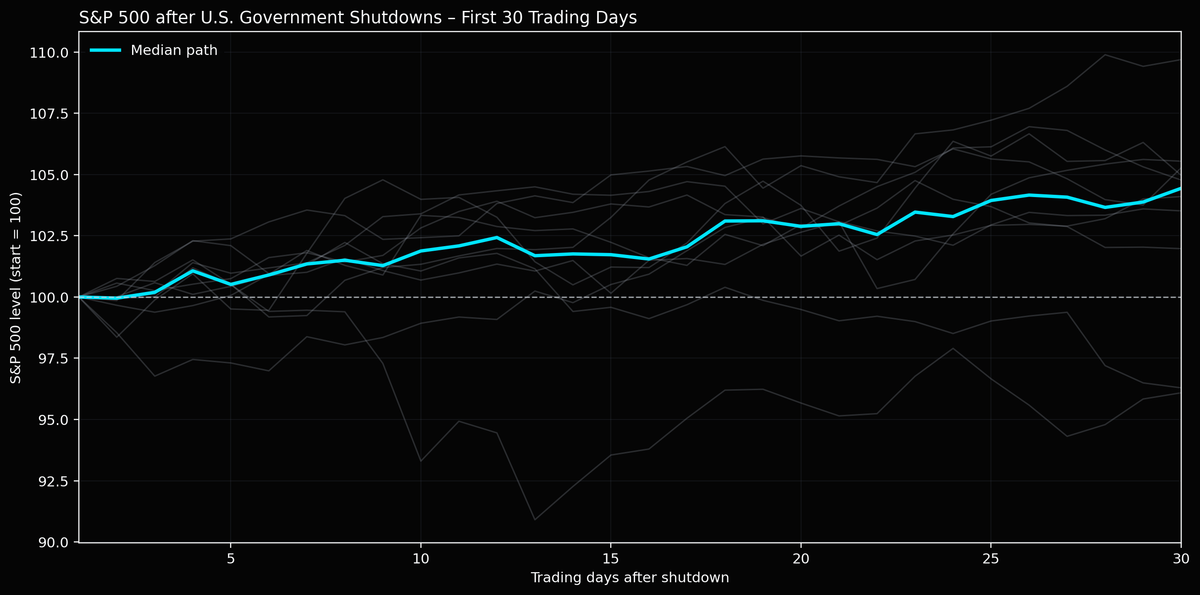

For each episode we took the day the shutdown ended, then tracked the S&P 500 from the first trading day after re-opening.

Method: 30 trading days after the re-opening

To make the paths comparable:

- For each shutdown, we tracked the S&P 500 for the next 30 trading days.

- We rebased each path to 100 on Day 1, so the chart shows percentage-style moves rather than index levels.

- All individual shutdown paths are plotted as faint grey lines.

- On top, we plotted the median path as a bright cyan line – this is the “typical” market reaction across all episodes.

No fancy factors, no model complexity – just price history after every major shutdown.

What the chart shows

The result is surprisingly calm:

- The median S&P 500 path drifts higher, not lower.

- Over the 30-day window, the median line ends roughly 4–5% above its starting point.

- Some episodes were clearly weak (you can see those grey lines dipping), but they’re the exception, not the rule.

- The bulk of shutdowns were followed by orderly grind-ups, not crash regimes.

In other words: historically, shutdowns have looked more like “noise” than structural regime shifts for equities.

Why might markets behave this way?

A few reasons why the historical reaction is milder than the headlines:

- Shutdowns are usually well telegraphed.

By the time the government actually closes, markets have already priced much of the risk. - Most shutdowns end with a deal.

The moment there’s a pathway to compromise, investors quickly refocus on growth, earnings and the Fed. - The real economy impact is often temporary.

While painful for workers and agencies, the macro hit has usually been small and later reversed.

That doesn’t mean shutdowns are irrelevant – especially for confidence and politics – but the S&P 500 has historically treated them as short-term noise rather than a lasting shock.

The important caveats

A few things to keep in mind before anyone turns this into a “shutdown strategy”:

- The sample size is small (a handful of episodes over ~40 years).

- Each shutdown happened in a different macro backdrop – inflation regimes, Fed policy and valuations were not the same.

- The worst paths in the chart remind us that not every episode was friendly for risk assets.

History is a guide, not a guarantee.

Takeaway

When the next wave of shutdown headlines hits your feed, remember what the data says:

Across the modern era, the “typical” S&P 500 reaction after a U.S. government shutdown has been a slow grind higher – not a collapse.

That doesn’t remove risk, but it does frame the narrative.

Use the panic, respect the data, and always size your risk accordingly.