TSMC (TSM) Q4 2025 Earnings — Core Brief Edition

Headline: Q4 beat its own guidance on margin and leading-edge mix, then guided Q1’26 to another step-up with 63–65% GM and +38% YoY revenue growth (midpoint), while raising AI-accelerator growth outlook to mid–high-50% CAGR (2024–2029).

Key Metrics

- Q4 revenue (USD): $33.7B (+1.9% QoQ), slightly above guidance.

- Q4 gross margin: 62.3% (+2.8ppt QoQ).

- Q4 operating margin: 54.0% (+3.4ppt QoQ).

- Q4 EPS (NT$): NT$19.50; ROE: 38.8%.

- 2025 revenue (USD): $122B (+35.9% YoY).

- 2025 gross margin: 59.9% (+3.8ppt YoY).

- 2025 operating margin: 50.8% (+5.1ppt YoY).

- 2025 EPS (NT$): NT$66.25 (+46.4% YoY); ROE: 35.4% (+5.1ppt YoY).

- Q4 node mix (wafer rev.): 3nm 28%, 5nm 35%, 7nm 14%; 7nm & below: 77%.

- FY25 node mix (wafer rev.): 3nm 24%, 5nm 36%, 7nm 14%; 7nm & below: 74%.

- Q4 platform mix: HPC 55%, Smartphone 32%, IoT 5%, Auto 5%, DCE 1%.

- FY25 platform mix: HPC 58%, Smartphone 29%, IoT 5%, Auto 5%, DCE 1%.

- Cash & marketable securities (Q4 end): NT$3.1T (≈ $98B).

- Q4 capex (USD): $11.5B.

- FY25 operating cash flow: NT$2.3T; FY25 capex: $40.9B (or NT$1.3T); FY25 free cash flow: NT$1.0T (+15.2% YoY).

- FY25 dividends paid: NT$467B (+28.6% YoY); div/share FY25: NT$18 (from NT$14 in FY24); at least NT$23 in 2026.

Segment & Strategy Highlights

- Leading-edge strength: Growth and Q4 beat driven by “strong demand for leading-edge process technologies,” plus high utilization and cost improvements.

- HPC remains the engine: FY25 HPC 58% of revenue; management emphasized robust AI-related demand and broad customer pull.

- Non-AI demand: PC/smartphone unit growth expected “very minimal” due to higher memory prices, but TSMC says it’s concentrated in high-end segments that are less price-sensitive.

Product, Tech, AI / Advanced Packaging

- AI accelerators: AI-accelerator revenue was high-teens % of total revenue in 2025; management raised AI accelerator revenue growth outlook to mid–high-50% CAGR for 2024–2029.

- Advanced packaging: Revenue contribution in 2025 was “close to 10%,” specifically ~8%; expected “slightly over 10%” in 2026. Investment focus is demand-led across advanced packaging areas (3DIC/SoIC referenced by analyst; company affirmed continued investment where customers need it).

- Nodes:

- N2: CEO said N2 entered high-volume manufacturing in Q4’25; expects fast ramp in 2026 with strong smartphone + HPC/AI pull.

- N2P: Volume production planned 2H’26.

- A16: On track for 2H’26 volume production (positioned for certain HPC designs; mentions advanced power delivery).

- Key theme: Energy-efficient computing (low power + high performance) is driving rapid migration to leading-edge nodes despite rising cost-per-transistor.

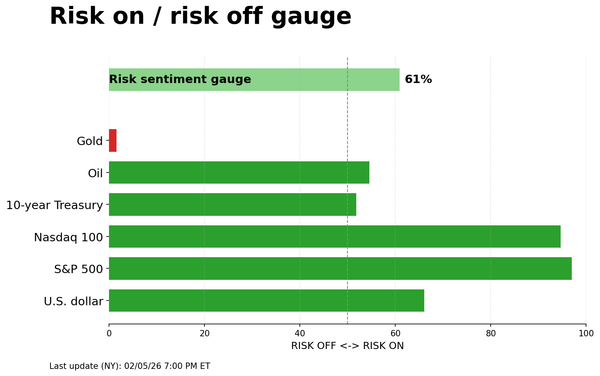

Credit & Risk

- Macro/policy risk: Management flagged uncertainties from tariff policies and rising component prices—especially for consumer/price-sensitive segments.

- AI “bubble” concern addressed: CEO acknowledged being “nervous,” but cited direct discussions with cloud service providers showing AI is improving customer economics and driving durable demand signals.

Balance Sheet & Capital

- Capex step-up: 2026 capex guided to $52B–$56B, tied to multi-year demand from AI/HPC, 5G, and broader megatrends.

- Allocation: 70–80% advanced process, ~10% specialty, 10–20% advanced packaging/testing/mask/other.

- Depreciation: Expected to rise high-teens % YoY in 2026, driven by leading-edge ramps (incl. N2).

- Profitability framework: Management reiterated long-term targets of 56%+ gross margin through the cycle and high-20s % ROE through the cycle, while noting near-term margin dilutions.

Guidance / Outlook

- Q1 2026 revenue: $34.6B–$35.8B (midpoint implies +4% QoQ / +38% YoY).

- Q1 2026 gross margin: 63–65% (midpoint 64%, +1.7ppt vs Q4 midpoint commentary).

- Q1 2026 operating margin: 54–56%.

- FX assumption: $1 = NT$31.6.

- Tax rate: 2025 effective tax 16%; 2026 expected 17–18%.

- 2026 topline: Foundry 2.0 industry seen +14% YoY in 2026; TSMC expects its own revenue to grow close to 30% YoY in USD.

Margin puts & takes (FY26):

- Tailwinds: higher utilization, productivity gains, improving economics at overseas fabs over time (Arizona GM expected to “cross over to corporate average” sometime in 2026).

- Headwinds: overseas fab dilution ~2–3ppt early stage, widening ~3–4ppt later; N2 ramp dilution expected ~2–3ppt for FY26 (starting 2H’26); FX sensitivity.

Bottom Line

TSMC is leaning into a multi-year AI-driven demand cycle with a major capex step-up ($52B–$56B in 2026), while still printing elite profitability (Q4 GM 62.3%, OM 54.0%). Management’s message is consistent: the near-term bottleneck remains wafer supply, and the plan to narrow the gap relies on productivity + node optimization in 2026–27, with bigger capacity relief pushed into 2028–29.