Weekly Market Wrap — Nov 3–7, 2025

Key takeaways

- AI is now a macro factor, not just a stock story. Earnings, regulation and geopolitics around AI are moving entire indices, not just a handful of names.

- The labour-market signal is getting noisier. With official data disrupted, markets are leaning on alternative indicators – and they’re pointing to a gradual cooling that can amplify swings in Fed expectations.

- Positioning is fragile. Markets are flipping quickly between higher-for-longer fears and growth-scare cuts: the same week delivered both a bear-steepening and a duration rally.

- Geopolitics and energy remain key second-order risks. Ongoing tensions in the Middle East and Eastern Europe, plus shifting OPEC+ policy and US critical-minerals strategy, can accelerate risk moves when sentiment is already fragile.

4 November – Big tech props up an uneven tape

US equities finished mixed, with the Nasdaq 100 outperforming while the Dow and small caps lagged. Strength in mega-cap tech masked broader fragility:

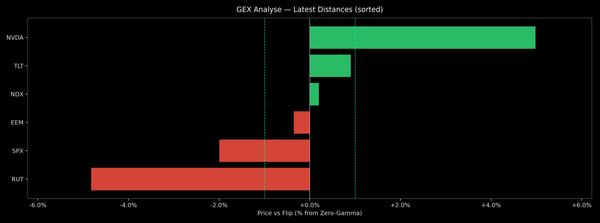

- Big tech in focus: the stand-out headline was Amazon’s reported USD 38bn AI-chip deal with OpenAI using NVIDIA hardware, which helped keep the NDX bid even as the equal-weight S&P sold off.

- Bonds & FX: US Treasuries were little changed after a choppy session, steepening slightly after a USD 17.5bn multi-tranche bond sale from Alphabet added to long-dated supply. The dollar eked out modest gains as markets kept pricing for another Fed cut but questioned how fast policy can normalise.

- Macro data: US ISM Manufacturing stayed in contraction, reinforcing the “slow but not collapsing” narrative. In Europe, manufacturing PMIs were mixed and did little to move FX.

- Commodities: OPEC+ confirmed a modest 137k bpd output increase from December and signalled scope to pause or reverse that in Q1 2026. Oil ended slightly higher, with officials pushing back against the idea of an imminent “peak demand”.

The takeaway: a classic “index vs breadth” day – AI and mega-caps carried the benchmarks while underlying risk appetite stayed cautious.

5 November – PLTR valuation hangover hits AI and high-beta risk

The tone flipped on Tuesday as valuation worries in AI triggered a broader de-risking:

- Palantir at the centre: Palantir delivered another strong quarter and raised guidance, but the stock still fell around 8% as investors balked at the multiple. NVIDIA slid roughly 4%, and weakness spread into other richly-priced themes (uranium/nuclear, rare earths, high-growth software).

- Haven bid in rates: US Treasuries caught a mild safe-haven bid, with 10-year yields slipping back towards 4.09%. The move was driven more by equity risk-off than by data, with the US government shutdown limiting the macro flow.

- Stronger dollar, stronger JPY: The DXY index pushed above 100 for the first time since August, supported by a reassessment of how far the Fed can cut next year and by risk aversion. Interestingly, JPY led G10 gains on safe-haven demand and sporadic verbal intervention from Japanese officials.

- UK in the spotlight: In the UK, Chancellor Reeves’ pre-Budget remarks reassured on fiscal rules but stopped short of ruling out tax hikes, weighing on GBP into the 26 November Budget.

- Oil: Crude weakened, with WTI slipping back towards the low-60s as risk-off sentiment dominated, despite Libya and others still signalling plans to ramp up production over coming years.

The message from 5 November was clear: AI isn’t immune to valuation gravity, and when that complex wobbles, broader high-beta risk can suffer.

6 November – Hot ADP & ISM Services revive “higher-for-longer” fears

Wednesday saw a sharp reversal as hotter US data reignited the “resilient growth, sticky inflation” narrative:

- Equities rebound: US indices bounced back, with the S&P 500 up ~0.4% and the Nasdaq 100 ~0.7%. Communication Services and Consumer Discretionary led, while Technology and Real Estate lagged slightly but were close to flat.

- Data surprises:

- ADP private employment rose by 42k versus expectations of +28k and a prior print of -29k.

- ISM Services jumped back into solid expansion (~52.5), with new orders accelerating and the prices-paid index hitting a three-year high, underlining sticky services inflation.

- Rates & FX: Treasuries sold off across the curve, with 10-year yields pushing back above 4.15% and the curve bear-steepening after the Quarterly Refunding Announcement hinted at larger auction sizes further out. The dollar spiked on the data, then faded into the close as profit-taking set in and higher-beta FX recovered.

- Oil & commodities: Oil started the day firmer but reversed lower after EIA data showed a ~5.2m barrel crude inventory build, reinforcing concerns about demand at current price levels. Precious metals firmed but gold still failed to mount a decisive challenge to the USD 4,000/oz mark.

Net effect: markets swung back toward a “higher-for-longer” Fed narrative, with rates up, cyclicals better bid and the previous day’s AI pain partially absorbed.

7 November – Soft job proxies and fresh AI worries drive risk-off

By Thursday, the pendulum had swung again – this time decisively back to risk-off:

- Equities sink: US indices rolled over, with the S&P 500 down ~1.1% and the Nasdaq 100 off almost 2%. Losses were broad-based, led by Tech and Consumer Discretionary, while defensives such as Health Care and Utilities outperformed on a relative basis.

- Labour-market proxies crack: With official data delayed by the government shutdown, markets focused on private indicators:

- Challenger job-cut announcements jumped to a seven-month high (~153k).

- RevelioLabs’ NFP proxy pointed to a modest net job loss in October.

- The Chicago Fed unemployment estimate ticked higher as hires slowed and separations rose.

Together, these signalled a cooling jobs market just as policy remains restrictive, boosting pricing for further Fed cuts.

- AI anxiety 2.0: AI was back in focus for the wrong reasons. NVIDIA’s CEO warned that China could ultimately win the AI race, re-igniting concerns about export controls, supply chains and the geopolitics of compute. At the same time, OpenAI’s trillion-dollar expansion chatter and talk of potential government support (later walked back) unsettled investors already nervous about AI-infrastructure capex.

- Bonds, FX & commodities:

- Treasuries rallied, with yields 5–7 bps lower across the curve as investors rotated back into duration.

- The dollar weakened on the softer labour signal, with EUR and GBP grinding higher, while JPY strengthened again on safe-haven demand and lower US yields.

- Oil traded choppily but settled in the red, with broader risk-off outweighing headlines such as the US adding uranium, copper and silver to its critical minerals list. Middle East and Ukraine headlines remained a simmering but secondary driver.

By the end of 7 November, the week had come full circle: AI remained the hero and the villain, while the labour-market narrative oscillated between “too hot” and “worryingly soft.”

For deeper charts, levels and cross-asset dashboards, check the full Core-Brief pack.