COT Dashboard

Last Updated: February 22, 2026

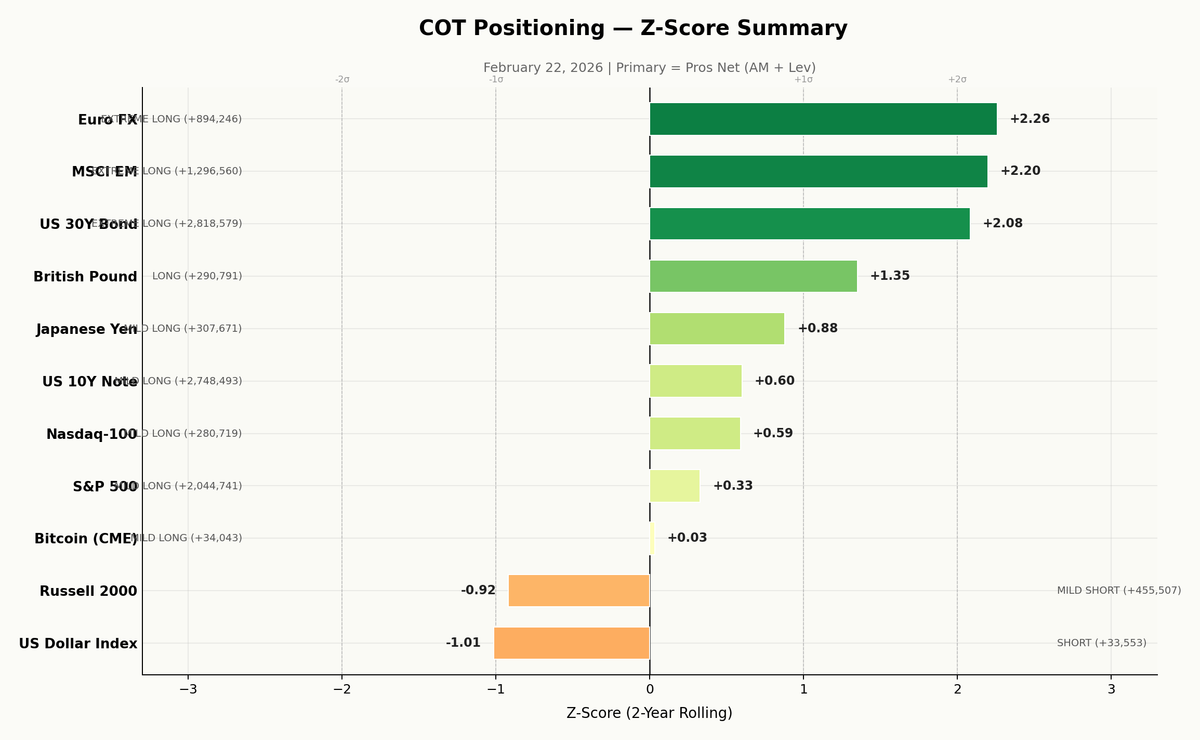

As of February 22, 2026, the current market sentiment is characterized by a net-long count of 11 and a net-short count of 0, with 3 assets having an extreme |Z|>2. The top extremes include the Euro FX, MSCI EM, and US 30Y Bond, all of which are exhibiting EXTREME LONG signals.

The Euro FX has a z_score of 2.26, with 894246 net contracts and a 13w delta of 83764. The MSCI EM has a z_score of 2.2, with 1296560 net contracts and a 13w delta of 63043. The US 30Y Bond has a z_score of 2.08, with 2818579 net contracts and a 13w delta of 132588.

Other notable assets include the S&P 500, which has a z_score of 0.33 and a 13w delta of -64059, and the US 10Y Note, which has a z_score of 0.6 and a 13w delta of -109911. The British Pound has a z_score of 1.35, with 290791 net contracts and a 13w delta of 22027, while the US Dollar Index has a z_score of -1.01, with 33553 net contracts and a 13w delta of -15239.

Positioning Summary

| Asset | Z-Score | Net | Δ13w | Signal |

|---|---|---|---|---|

| Euro FX | +2.26 | +894,246 | +83,764 | EXTREME LONG |

| MSCI EM | +2.20 | +1,296,560 | +63,043 | EXTREME LONG |

| US 30Y Bond | +2.08 | +2,818,579 | +132,588 | EXTREME LONG |

| British Pound | +1.35 | +290,791 | +22,027 | LONG |

| Japanese Yen | +0.88 | +307,671 | -28,735 | MILD LONG |

| US 10Y Note | +0.60 | +2,748,493 | -109,911 | MILD LONG |

| Nasdaq-100 | +0.59 | +280,719 | +1,882 | MILD LONG |

| S&P 500 | +0.33 | +2,044,741 | -64,059 | MILD LONG |

| Bitcoin (CME) | +0.03 | +34,043 | -14,873 | MILD LONG |

| Russell 2000 | -0.92 | +455,507 | -10,669 | MILD SHORT |

| US Dollar Index | -1.01 | +33,553 | -15,239 | SHORT |

Interactive Charts

Use the toggles to switch between assets.