Market Wrap 2025-10-27

- The United States and China have established a framework for discussions between President Trump and President Xi this week. A planned increase in US tariffs on Chinese goods has been avoided, and China has reportedly agreed to postpone a new licensing system for rare earth exports for one year.

- The United States is set to immediately increase tariffs on Canadian goods by an additional 10%.

- US President Trump stated that he will not meet with Russian President Putin until he believes a peace plan is feasible.

- European stock markets are showing gains, although they have receded from their highest points. US equity futures are rising as investors react to the latest commentary on US-China trade.

- Currencies with higher risk profiles are being supported by optimism surrounding US-China relations, while the Canadian dollar is not reacting significantly to US tariffs.

- US Treasury and German Bund yields are declining due to the risk-on sentiment and reports of EU bond issuance. French bonds are outperforming, following Moody's decision to maintain France's rating at Aa3 but revise the outlook from stable to negative.

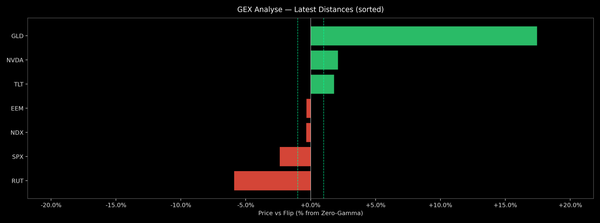

- Optimism regarding US-China trade is putting downward pressure on gold (XAU) and pushing copper prices near all-time highs. Crude oil initially benefited from the risk-on sentiment but has since declined.

- Upcoming events include the US Dallas Fed survey for October, suspended releases of US Durable Goods data for September, the Atlanta Fed GDPNow forecast, supply data from the US, and earnings reports including NXP Semiconductor.

- The UK switched back to GMT over the weekend, resulting in a 4-hour time difference between London and New York until the US changes its clocks on Sunday, November 2nd.

TARIFFS/TRADE

CHINA

- US President Trump anticipates a fair meeting with Chinese President Xi and is optimistic about a potential agreement with China. He also mentioned the possibility of conducting good business with President Xi and having numerous topics to discuss.

- US President Trump indicated that a final agreement on TikTok might be signed on Thursday, with provisional approval from Chinese President Xi.

- US Treasury Secretary Bessent stated that China is prepared to make a trade deal and that a framework for talks between President Trump and President Xi is in place. Bessent added that the final decisions will be made by President Trump and President Xi. Bessent also commented that the planned tariff increase on China was averted and that China agreed to delay a new rare earths export licensing regime for a year. Bessent also expects China to resume substantial purchases of US soybeans soon and that US soybean farmers will benefit from upcoming soybean seasons when the Trump-Xi trade deal is announced. The details of the TikTok deal are being finalized, with President Trump and President Xi potentially completing the transaction in South Korea on Thursday.

- China’s top trade negotiator, Li, reported reaching a consensus with the US and discussing tariffs and export controls. He added that they will enhance communication with the US and discussed 301 port fees, trade expansion, and fentanyl.

- Chinese Vice Premier He stated that China and the US should jointly implement the consensus reached and find ways to address each other’s concerns through equal dialogue and consultation.

- The USTR announced on Friday that it initiated a trade investigation into China's implementation of the Phase One agreement with the US. China’s embassy to the US stated that it opposes false accusations related to investigation measures and that US actions have seriously damaged US-China ties and economic and trade relations, urging the US to correct wrong practices promptly.

- Chinese Premier Li met with European Council President Costa and stated that China is willing to work with the EU to keep bilateral relations on the right track, according to Xinhua. Costa expressed strong concern about expanding export controls on critical raw materials and urged Li to restore fluid, reliable, and predictable supply chains as soon as possible. He also expressed expectations that China helps to end Russia’s war against Ukraine and stressed the need for concrete progress following the EU-China summit.

- US President Trump says they will come away with a deal with China.

CANADA

- US President Trump announced that the US is immediately raising tariffs on Canada by another 10% due to a fraudulent ad misrepresenting Ronald Reagan’s view on tariffs. Trump stated that Canada has been taking advantage of the US for a long time and that this will no longer be tolerated.

- Canadian PM Carney says that Canada is ready to sit down with the US, hasn't had contact with US President Trump since Thursday.

OTHER

- The US and Vietnam announced a framework for an agreement on reciprocal, fair, and balanced trade, which will provide exporters from both countries with unprecedented access to each other’s markets. The joint statement noted that the US will maintain a 20% tariff on Vietnam but will identify products and potential tariff adjustments for aligned partners to receive a 0% reciprocal tariff rate.

- The US signed a trade deal with Thailand, Cambodia, and Malaysia in which the US would maintain a tariff rate of 19% on exports from all three countries under the deals, while the deal with Malaysia enhances US access to rare earths.

- The US and Malaysia joint statement noted that Malaysia has committed to provide significant preferential market access for US industrial goods exports and committed to address non-tariff barriers that affect bilateral trade in priority industrial areas.

- The US and Thailand joint statement noted that the US will maintain a 19% tariff on Thailand, but will identify products and potential tariff adjustments for aligned partners to receive a 0% reciprocal tariff rate.

- The US and Cambodia joint statement noted that Cambodia commits to eliminating tariffs on 100% of US industrial goods and US foods and agricultural products exported to Cambodia.

- US President Trump said that they are going to make a deal with Brazil, while he also commented that they may reduce Brazil's tariffs and are pretty close on a South Korean deal.

- South Korean President Lee said South Korea and the US trade talks are still deadlocked over USD 350bln investment in the US, while a South Korean presidential advisor said they find it difficult to reach a tariff agreement between South Korean President Lee and US President Trump during the APEC period.

- Brazil's President Lula said decisions against Brazil by the US are wrong, but noted he had a very good impression at the meeting with US President Trump, while he added that he respects Trump and Trump respects him, and he handed Trump a written agenda. Furthermore, Lula said they will reach a deal with the US and that Trump was the most enthusiastic in the meeting, while he is convinced in a few days they will reach a solution and is sure everything is going to work out well.

- Brazil’s Foreign Minister Vieira said US President Trump and Brazilian President Lula had a happy conversation and the meeting was positive, while he stated that Trump gave the instruction to start a bilateral negotiation process. Furthermore, he said they will have conversations targeting a tariffs suspension, and the first step of negotiations was with USTR Greer, Commerce Secretary Lutnick and Secretary of State Rubio on Sunday.

- UK Chancellor Reeves is to hold Gulf trade talks in a push for pro-growth policies with Reeves to conduct trade talks in Riyadh on Monday, according to FT.

- Japanese PM Takaichi says she is looking forward to seeing US President Trump on Tuesday, and having a positive discussion on strengthening their alliance.

EUROPEAN TRADE

EQUITIES

- European stock markets (STOXX 600 U/C) opened higher across the board, with sentiment boosted by the constructive US-China trade talks over the weekend, whereby the two countries reached a framework for Trump-Xi talks. However, some indices did pare off best levels as the morning progressed, albeit still remain mostly firmer in Europe.

- European sectors opened with a strong positive bias, but are now mixed. Basic Resources leads, followed closely by Tech ; the pair boosted by the aforementioned trade optimism. To the bottom of the pile resides Chemicals and Consumer Products .

- US equity futures (ES +0.9% NQ +1.3% RTY +1.0%) are stronger across the board, as traders cheer the latest US-China trade talks and now await the Trump-Xi meeting this Thursday; markets now expect a potential formal announcement on soybean purchases, and an extension to the existing tariff pause.

FX

- The DXY is flat, trading in a range of 98.77 to 98.99. There has been limited movement despite the US reaching a consensus with China ahead of the Trump-Xi talks on Thursday and signing several trade agreements with Southeast Asian partners during President Trump's visit to the region, including a rare earths deal with Malaysia. Dollar traders may be focusing on key risk events this week, including policy announcements from the Fed, BoC, BoJ, and ECB, as well as the Trump-Xi meeting on Thursday. Regarding trade, the US raised tariffs on Canada by another 10% following a recent advertising dispute. USD/CAD is currently slightly higher, trading at the upper end of a 1.3974 to 1.4010 range.

- The EUR is essentially flat or slightly firmer against the USD. The single currency showed little reaction to the latest German Ifo data, which was mixed. The Business Climate index rose slightly above expectations, the Current Conditions index fell slightly short of consensus, while the Expectations index surpassed the top end of the forecast range. The Ifo head stated that expectations are increasing in all sectors and that the German economy has not yet lost hope for a recovery. Elsewhere, the latest ECB SAFE release indicated that inflation expectations remained unchanged across horizons. Overnight, ECB's Escriva suggested that current interest rates are appropriate. Late on Friday, Moody’s maintained France’s rating at Aa3 but revised the outlook to negative from stable, citing heightened risks associated with political fragmentation that could limit France's ability to reduce its deficit. EUR/USD is currently trading in a 1.1618-1.1647 range.

- The JPY is slightly firmer against the Dollar, trading within a 152.66 to 153.25 range. Overnight, USD/JPY hovered around 153.00. Initial price action saw some pressure in the JPY due to the risk-on sentiment, but this was offset by firmer-than-expected Services PPI data from Japan. Yen traders will be mindful of Trump's meeting with the Japanese Emperor later today and his meeting with PM Takaichi. Recent reports suggest that the Japanese PM is willing to purchase US pickups, soybeans, and gas but may avoid Trump's new defense spending targets. She recently stated that she is looking forward to having a positive discussion with the POTUS.

- The GBP is mildly firmer, with the high-beta currency supported by overall risk appetite across the markets. Comments from UK Chancellor Reeves, speaking in Riyadh, had little effect on Sterling, with less than a month to go until the Autumn Budget. Regarding trade, the Chancellor suggested taking US President Trump seriously was key in the UK-US trade deal, while the UK had really good meetings around a UK-GCC trade deal in Riyadh, and she's confident that she can get the deal over the line. GBP/USD trades within Friday's 1.3287-1.3364 range, in a current 1.3311-1.3339 parameter.

- Antipodean currencies are outperforming due to their high-beta statuses and China exposure amid US-China trade optimism. The PBoC also set the strongest USD/CNY reference rate in just over a year. The AUD is supported by a surge in base metals amid the aforementioned optimism, with RBA Governor Bullock saying little to move the Aussie this morning. AUD/USD is in a 0.6528-0.6555 range, with the 100 DMA at 0.6536 and the 50 DMA at 0.6552. NZD/USD sees shallower gains amid the AUD/NZD cross' rise above 1.1350.

- Barclays' proprietary month-end rebalancing model indicates weak USD selling against all majors at the end of October. October saw heightened policy uncertainty and mixed markets, driven by the US government shutdown, limited data releases, and global political shifts, though sentiment improved late in the month as US-China tensions eased.

- PBoC set USD/CNY mid-point at 7.0881 vs exp. 7.1146 (Prev. 7.0928)

FIXED INCOME

- USTs are firmer today, with upside facilitated by the latest US-China trade optimism . In brief, the US and China have come to a framework for Thursday’s leader-level talks, a US tariff increase on China has been averted which, in-turn, resulted in a one year delay to China’s new rare earth licensing regime being agreed. Updates that sent USTs to a 113-04 base, taking out last week’s 113-09 trough. Since, as the risk tone eases marginally from best, the complex has lifted off lows taking USTs to a 113-09 high, but still very much in the red. For today, the docket is light and the discussed trade points are likely to remain in focus into/after a frontloaded supply slate on account of the Fed with USD 139bln due across 2yr and 5yr notes. Elsewhere, the PBoC has announced that they will be resuming bond activity in the open market . As a reminder, the PBoC suspended such activity at the start of 2025 after beginning it in 2024 as a policy tool for liquidity management purposes. A resumption that comes after growing speculation over the last few weeks that the PBoC could recommence such activity, potentially in Q4-2025.

- Bunds in the red throughout the early morning , down to a 129.26 trough with losses of 20 ticks at most, hit by the risk tone following the trade progress (see USTs) and also potentially weighed on by talk of joint issuance. Since, as the risk tone deteriorates from best, benchmarks generally have climbed off worst and for Bunds this has been sufficient to bring them to highs of 129.45 and near the unchanged mark . Even if the benchmark moves into the green, there is some way to go before the best levels from last week’s sessions are tested, between 130.02 and 130.38. On the joint issuance report, Politico writes that EU nations could be called upon to raise 10s of billions of Euros of joint debt to support Ukraine. A backup plan following the use of frozen Russian assets being blocked by Belgium due to legal concerns.

- Gilts opened lower by 22 ticks before falling a little further to a 92.15 low , acknowledging the pressure seen in peers given the trade tone. Since, the benchmark has lifted off that low and holds around the 93.30 mark, just off a 93.36 peak. If the move continues and Gilts manage to get into the green then resistance lies at 93.60, 93.80 and 93.93 from last week. For the UK, specifics a little light after last week’s packaged data agenda. As such, the benchmark is following the direction set out by USTs/EGBs thus far. Weekend press reports remain focussed on the approaching budget. The Times outlined that Chancellor Reeves is set to increase the National & Real Living Wages, adjustments that have unsurprisingly drawn critique from some.

- OATs are outperforming post-Moody's . On Friday, France narrowly avoided losing its final AA rating. Moody’s kept France at Aa3, but cut the outlook to negative (prev. stable) . Commentary in the review was similar to the last assessment, but also highlighted the fresh concern around the postponement of pension reform until the next presidential cycle. Amidst all this, OATs trade a little better than their German peer, benefitting from Moody’s and an extra day of talks on wealth tax adjustments. As such, the OAT-Bund 10yr yield spread is a little narrower down to just below the 80bps mark after climbing incrementally over it last week.

COMMODITIES

- Crude is currently lower after spending most of the overnight session on a firmer footing. Nothing really behind the recent dip in prices, but does come as market sentiment wanes a touch - perhaps as focus turns back to oversupply concerns. WTI and Brent trade in a USD 60.98-62.17/bbl and USD 65.37-66.64/bbl range. In geopols, US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan .

- Spot gold is on the backfoot today , with haven assets generally shunned as traders focus on the latest trade optimism. On that, US and China agree on a framework of a trade deal ahead on the Trump-Xi meeting on Thursday. The US Trade Sec described it as a "positive framework". XAU has gradually dipped throughout the session, and currently resides at the lower end of a USD 4,039.11-4,109.08/oz range.

- Base metals are mixed, but with some clear strength in copper prices today, as traders cheer the latest US-China trade developments. 3M LME currently trading in a USD 11,005.75-11,096/t range.

- Iraqi oil minister says there are talks to adjust Iraq's quota within the available production capacity ; says Iraq's current production capacity is 5.5mln BPD but they are committed to the OPEC quota of 4.4mln. BPD Crude oil exports from Kurdistan region at around 195k BPD. Total oil exports at 3.6mln BPD. Fire in Iraq's Zubair oilfield has not affected exports.

- At least 5 workers were seriously injured in an oil pipeline fire in Iraq’s Zubair oilfield, while the fire has not affected production from the oilfield, which stands at 400k bpd.

- US Energy Secretary Wright said the US is to double natural gas exports in the next five years, and could double it again in another five to ten years if demand is there.

- TotalEnergies (TTE FP) is ready to restart the USD 20bln Mozambique LNG project four years after it was halted due to a terrorist attack, according to FT.

NOTABLE DATA RECAP

- German Ifo Expectations New (Oct) 91.6 vs. Exp. 89.9 (Prev. 89.7, Revised 89.8); Ifo Current Conditions New (Oct) 85.3 vs. Exp. 85.5 (Prev. 85.7); Ifo Business Climate New (Oct) 88.4 vs. Exp. 87.9 (Prev. 87.7); Ifo head says, expectations are increasing in all sectors. The German economy has not yet lost hope for upwards recovery. Slight glimmer of hope for industrial orders - decline in order seemed to have stopped.

- EU Money-M3 Annual Growth (Sep) 2.8% vs. Exp. 2.8% (Prev. 2.9%); Loans to Non-Fin (Sep) 2.9% (Prev. 3.0%); Loans to Households (Sep) 2.6% (Prev. 2.5%)

NOTABLE EUROPEAN HEADLINES

- French lawmakers refrained from voting on a Socialist proposal for a wealth tax on Saturday, delaying a possible compromise in a budget debate which risks collapsing the fragile minority government, according to Bloomberg.

- ECB’s Escriva said the ECB is communicating in its statements after each meeting that inflation is truly at the target of 2% and they think it is a good time to look ahead and consider the current level of interest rates appropriate.

- Moody’s maintained France’s rating at Aa3, but revised the outlook to negative from stable.

- EU nations could be called upon to raise 10s of billions of Euros worth of joint debt as part of a backup plan to support Ukraine , via Politico citing sources.

- ECB Survey on the Access to Finance of Enterprises : Inflation expectations remained unchanged across horizons. Firms continue to report upside risks to their long-term inflation outlook, broadly unchanged compared with the previous round. Firms reported a small net tightening in bank loan interest rates as well as in other loan conditions related to both price and non-price factors. Financing needs, bank loan availability and the financing gap were broadly unchanged.

NOTABLE US HEADLINES

- US Treasury Secretary Bessent said overall inflation has come down since President Trump took office and he is confident that inflation will fall further towards the Fed’s 2% target, while Bessent also said that the government shutdown is starting to eat into the muscle of the US economy.

- US Transportation Secretary Duffy warned that travellers will face more flight delays and cancellations in the coming weeks amid the continuing shutdown, according to Bloomberg.

- Fed proposed changes to boost bank stress test transparency on Friday, with the Fed to disclose and solicit feedback on stress test models and scenarios for the first time under the new proposal. Fed Vice Chair for Supervision Bowman said the changes would improve bank capital planning, while Fed's Barr objected to the proposed changes and warned that it would weaken the test and lower bank capital.

- European rating agency Scope downgraded the US credit ratings from AA to AA-; outlook revised to stable from negative.

GEOPOLITICS

MIDDLE EAST

- Israel’s military said it conducted a targeted strike in central Gaza.

- US President Trump said on Saturday that Hamas must start returning the bodies of hostages and that they will be closely watching over the next 48 hours.

- US Secretary of State Rubio said the US team is working on a possible UN resolution or international agreement to authorise a multinational force in Gaza.

RUSSIA-UKRAINE

- US President Trump said he won’t meet with Russian President Putin until he thinks they have a peace plan.

- Kremlin said Russian armed forces will respond harshly in the event of strikes deep inside of Russia. It also stated that it is wrong to talk about the cancellation of the Putin-Trump summit and there is an understanding between Russia and the US that it would not be good to delay the meeting, according to RIA.

- Russian President Putin said Russian forces conducted training live launches of all three components of the strategic nuclear forces drill, while the strategic nuclear forces drill confirmed the reliability of Russia’s nuclear shield.

- Russia’s General Staff of the Armed Forces head Gerasimov said Russian forces are advancing in Ukraine’s Dnipropetrovsk and Zaporizhzhia regions, while he also stated that a successful test of the Burevestnik missile with a nuclear power unit was conducted on October 21st, according to Interfax.

- Russian President Putin's special envoy Dmitriev said on Friday that Russia-US dialogue is vital for the world and must continue with full understanding of Russia's position and respect for its national interests. Dmitriev said dialogue between Russia and the US is continuing despite recent 'unfriendly steps' from Washington, and such dialogue is only possible if Russia's interests are treated with respect, while he added that various forces, mainly the UK and Europeans, are trying to derail direct dialogue between Putin and Trump.

- Ukrainian President Zelensky called for sanctions on all Russian oil companies, the shadow fleet and oil terminals on Friday.

- UK PM Starmer said on Friday that the coalition of the willing is determined to go further than ever to ratchet up pressure on Russian President Putin, while he stated the meeting was clear that work on using frozen Russian assets needs to come to fruition quickly.

- Russia's Kremlin says Russia is guided by its own national interest in relation to US President Trump's comment. On the Burevestnik missile test, the Kremlin adds that there is nothing there to strain relations with the US and are only ensuring Russia's national security and thereby are just developing new weapons. Russia must do everything to ensure its security amid the militarist mood in Europe.

OTHER

- US President Trump responded that they will see, when asked about strikes in Venezuela. Trump also commented that he has a lot of respect for Taiwan, while he is not sure if he will meet with North Korean leader Kim during his Asia trip, but added that he likes Kim personally. It was separately reported that North Korea may possibly be preparing for a Trump-Kim meeting, although a South Korean presidential adviser said that they don't see a meeting between US President Trump and North Korea leader Kim likely to happen.

- US President Trump said he would like to meet North Korean leader Kim Jong Un , if the North Korean leader would like to meet; would extend his trip if it was possible to meet with the North Korean leader

- North Korea’s Foreign Minister is to visit Russia on October 26th-28th.

- US Secretary of State Rubio said Taiwan should not be concerned about US-China talks, while he added the US is not going to walk away from Taiwan in return for trade benefits with China.

- Thailand and Cambodia signed a peace deal on the sidelines of the ASEAN Summit in Kuala Lumpur, according to Nikkei.

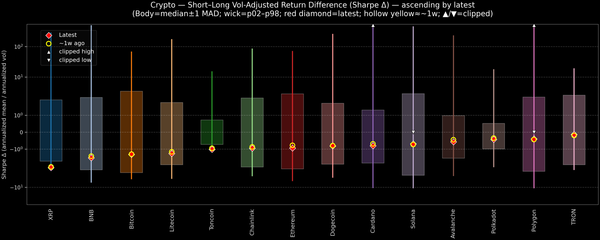

CRYPTO

- Bitcoin and Ethereum are both firmer by roughly 2.5% and 4.3% respectively, with the complex boosted by the latest US-China trade optimism; BTC trades around USD 115.2k currently.

- PBoC Governor says the Bank is to crack down on domestic crypto currency operations and speculations.

APAC TRADE

- APAC stocks were mostly higher amid trade-related optimism after the US and China reached a framework for Trump-Xi talks this week, with the US tariff increase on China averted, while China was said to have agreed to delay a new rare earth exports licensing regime for a year.

- ASX 200 gained as strength in tech, financials and industrials led the upside seen in most sectors, while defensives lagged.

- Nikkei 225 rallied to above the 50k level for the first time ahead of US President Trump's visit to Japan, where the sides are expected to ink a tech-cooperation MOU covering areas, including bio, quantum, nuclear fusion energy and space.

- Hang Seng and Shanghai Comp benefitted amid hopes of improving US-China ties, with the sides said to reach a consensus ahead of the Trump-Xi meeting on Thursday, while Industrial Profits data from China showed the fastest growth in two years.

NOTABLE ASIA-PAC HEADLINES

- PBoC Governor says they will resume government bond purchases and selling in the open market ; will continue to maintain supportive monetary policy stance; to implement properly loose monetary policy.

- Almost two dozen world leaders are visiting the Malaysian capital of Kuala Lumpur for the 47th ASEAN summit, which takes place from Sunday to Tuesday.

- US President Trump posted "Just leaving Malaysia, a great and very vibrant Country. Signed major Trade and Rare Earth Deals, and yesterday, most importantly, signed the Peace Treaty between Thailand and Cambodia. NO WAR! Millions of lives saved. Such an honor to have gotten this done. Now, off to Japan!!!"

- RBA's Bullock says that reducing inflation while maintaining employment levels is very satisfying; unemployment rate could come down once again in the next month. Board is cautious about policy, with rates still a bit restrictive. US tariffs could potentially be deflationary for Australia. Labour supply growth is not as fast as it was but will not fall off a cliff. Prepared to adjust policy if proven wrong on the labour market.

DATA RECAP

- Chinese Industrial Profits YY (Sep) 21.6% (Prev. 20.4%) ; YTD YY (Sep) 3.20% (Prev. 0.90%)

- Japanese Services PPI (Sep) 3.0% vs Exp. 2.8% (Prev. 2.7%)