Market Wrap 2025-10-27

MARKET SNAPSHOT

- Equities are up, Treasuries are flattening, Crude is down, the Dollar is down, and Gold is down.

REAR VIEW

- The US and China have agreed on a framework for a deal.

- China is expected to delay new rare earth export controls.

- The US has signed trade deals with Vietnam, Thailand, Cambodia, and Malaysia.

- Zelensky says Ukraine will expand strikes against Russian refineries.

- There was a soft US 2yr note auction and a strong 5yr auction.

- Trump says he might sign a final deal on TikTok on Thursday.

- The German Ifo data was mixed.

- QCOM unveiled AI chips.

- KDP beat expectations.

COMING UP

- Data releases scheduled: German GfK (Nov), Richmond Fed (Oct).

- Suspended Releases: US Consumer Confidence (Oct).

- Events scheduled: ECB SCE (Sept); US President Trump to meet Japanese PM Takaichi.

- Speakers scheduled: RBNZ's Richardson.

- Supply: Australia, Italy, UK, Germany, US.

- Earnings releases scheduled: Bloom Energy, Visa, Electronic Arts, PPG Industries, UnitedHealth, SoFi, PayPal, UPS, DR Horton, VF Corp, HSBC, BNP Paribas, Novartis, Logitech, Iberdrola, and ASM International.

MARKET WRAP

US indices were higher, supported by risk-on sentiment at the start of the week, following reports that the US and China agreed on a framework for a trade deal ahead of the Trump/Xi meeting later this week. Spot gold was sold and fell below USD 4k/oz as a result, while crude oil was initially bid but later sold off to settle in the red. In FX, the Dollar was mostly flat, with the Aussie outperforming and havens lagging due to the trade updates. The Loonie was flat, with USD/CAD trading in a narrow range despite Trump imposing an additional 10% tariff amid the latest anti-tariff advert. T-Notes flattened in risk-on trade and front-loaded supply, with mixed 2- and 5-year auctions today, ahead of the 7-year on Tuesday, before the FOMC on Wednesday. Newsflow was light to start the week but will increase with Fed, BoJ, ECB, and BoC meetings this week, the Trump/Xi meeting, and earnings reports from 5 of the Mag-7 companies. Sectors were mostly green, with Communications leading gains, followed by Tech and Discretionary, while Consumer Staples and Materials were the only sectors in the red. Qualcomm (QCOM) surged after announcing the launch of Qualcomm AI200 and AI250 chip-based accelerator cards and racks for data centers.

FIXED INCOME

T-NOTE FUTURES (Z5) SETTLED HALF A TICK LOWER AT 113-13+

T-Notes flattened in risk-on trade and front-loaded supply. At settlement, 2-year notes were +1.3bps at 3.497%, 3-year notes were +1.2bps at 3.500%, 5-year notes were +0.9bps at 3.611%, 7-year notes were 0.0bps at 3.783%, 10-year notes were -0.6bps at 3.991%, 20-year notes were -1.6bps at 4.540%, and 30-year notes were -2.0bps at 4.566%.

INFLATION BREAKEVENS: 1-year BEI +0.1bps at 3.121%, 3-year BEI -1.3bps at 2.579%, 5-year BEI -1.3bps at 2.328%, 10-year BEI -2.2bps at 2.273%, 30-year BEI -0.1bps at 2.221%.

THE DAY: T-Notes started the session lower amid risk-on trade following optimism from US/China talks over the weekend, ahead of the Presidential meeting on Thursday. However, the long-end managed to recover to see the 10yr settle flat with the curve flatter on the session. There had also been a plethora of corporate issuance on Monday, while the Treasury sold 2 and 5-year notes (more below), ahead of the 7-year issuance on Tuesday before the FOMC on Wednesday. The Federal Reserve decision and US/China talks are the key focus of traders this week, with the FOMC expected to cut rates by 25bps while it is also expected to make alterations to its balance sheet process. Meanwhile, on trade after the optimism expressed over the weekend, the US and China agreed on the framework of a potential trade deal that will be discussed between Xi and Trump on Thursday. This includes a final deal on TikTok's US operations and a deferral on China's tightened rare earth controls. This has set up expectations for an extension of the current trade truce between the US and China, providing the talks go well on Thursday.

SUPPLY

Notes

- The US Treasury sold USD 69bln of 2-year notes at a high yield of 3.504%, a lower yield when compared to the prior 3.571%. This tailed the when issued by 0.1bps, marking the first tail in the 2-year issuance since April. The bid-to-cover was in line with the six auction average at 2.59x, above the 2.51x prior, while direct demand rose slightly to 34.8% from 30.8%, above the 30.1% average, with indirect demand slipping to 53.7% from 57.7%, below the 58.4% average. This left dealers with an in line 11.6%. Overall, a relatively average auction, despite the tail.

- The US Treasury sold USD 70bln of 5-year notes at a high yield of 3.625%, a lower yield when compared to the September offering. However, it stopped through the when issued by 0.1bps, an improvement when compared to the prior and six-auction average of a 0.1bps tail. The B/C also saw slight improvements, to 2.38x from 2.34x, above the 2.36x average. Within the breakdown, direct demand fell to 23.9% from 28.6%, below the 25.1% average. However, indirect demand rose to 66.8% from 59.4%, above the 64.2% average. This left dealers with just 9.3% of the auction. An improvement when compared to the prior 11.9% and 10.7% average. Overall, a solid auction.

- The US will sell USD30bln in 2-year FRN's on October 29th, to settle October 31st.

Bills

- The US sold USD 81bln of 6-month bills at a high rate of 3.640%, B/C 3.06x.

- The US sold USD 91bln of 3-month bills at a high rate of 3.730%, B/C 3.07x.

- The US will sell USD 95bln in 6-week bills and USD 50bln in 52-week bills on October 28th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: Oct 24bps (prev. 24bps), Dec 49bps (prev. 50bps), January 61bps (prev. 64bps).

- NY Fed RRP Op demand at USD 10.6bln (prev. 2.4bln) across 13 counterparties (prev. 4).

- NY Fed Repo Operation Demand at USD 8.4bln (5.4bln MBS, 3.0bln Treasury) (prev. 0.00bln on Friday).

- EFFR at 4.11% (prev. 4.11%), volumes at USD 90bln (prev. 93bln) on October 24th.

- SOFR at 4.24% (prev. 4.24%), volumes at USD 3.000tln (prev. 3.002tln) on October 24th.

CRUDE

WTI (Z5) SETTLED USD 0.19 LOWER AT 61.31/BBL; BRENT (Z5) SETTLED USD 0.32 LOWER AT 65.62/BBL

The crude complex was choppy, but ended with mild losses. To start the week, WTI and Brent began on the front foot to hit highs of USD 62.17/bbl and 66.64/bbl, respectively, as the benchmarks were buoyed by risk-on sentiment as US/China agreed a framework deal ahead of Trump/Xi meeting on Thursday. Nonetheless, WTI and Brent soon reversed this move, albeit on no headline driver, to hit troughs in the European morning of USD 60.67 and 65.06/bbl, respectively. Meanwhile, the Iraqi oil minister said there are talks to adjust Iraq's quota within the available production capacity, and suggested Iraq's current production capacity is 5.5mln BPD, but they are committed to the OPEC quota of 4.4mln BPD. Separately, source reports noted that OPEC+ is leaning towards another modest oil output increase at Sunday's meeting, and could be the third monthly increase of 137k BPD. Finally, Ukrainian President Zelensky said Ukraine to expand strikes against Russian refineries. There is plenty of risk ahead this week, including the FOMC rate decision, five Mag-7 earnings, and Trump/Xi trade talks.

EQUITIES

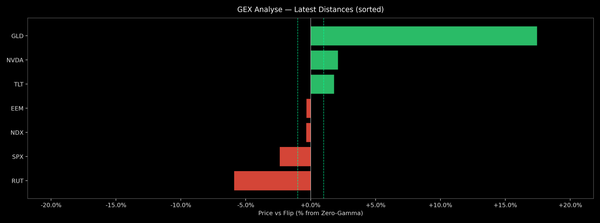

CLOSES: SPX +1.23% at 6,875, NDX +1.83% at 25,822, DJI +0.71% at 47,545, RUT +0.28% at 2,520.

SECTORS: Communication Services +2.29%, Technology +2.01%, Consumer Discretionary +1.52%, Industrials +0.60%, Financials +0.35%, Utilities +0.29%, Energy +0.29%, Health +0.27%, Real Estate +0.26%, Consumer Staples -0.27%, Materials -0.27%

EUROPEAN CLOSES: Euro Stoxx 50 +0.63% at 5,710, Dax 40 +0.28% at 24,309, FTSE 100 +0.09% at 9,654, CAC 40 +0.16% at 8,239, FTSE MIB +1.00% at 42,912, IBEX 35 +0.87% at 16,000, PSI -0.21% at 8,352, SMI -0.39% at 12,519, AEX +0.31% at 982.

STOCK SPECIFICS:

- Qualcomm (QCOM) announced the launch of Qualcomm AI200 and AI250 chip-based accelerator cards and racks for data centers. Expected to be commercially available in 2026 and 2027, respectively.

- The US Department of Energy formed a USD 1bln partnership with AMD (AMD) to build two new supercomputers.

- Amazon (AMZN) reportedly targets as many as 30k job cuts, according to Reuters sources.

- Google (GOOGL) announced a new partnership with NextEra Energy (NEE) to restart Iowa’s only nuclear power plant, according to Fox Business.

- NVIDIA (NVDA) and Deutsche Telecom (DTE GY) are reportedly planning a EUR 1bln data centre in Germany, according to Bloomberg

- Keurig Dr Pepper (KDP): Revenue topped expectations and raised FY net sales growth outlook.

- Carter's (CRI): Sales and operating margin missed expectations.

- Snowflake (SNOW): Reaffirmed Q3 and FY26 revenue guidance.

- Cadence Bank (CADE) is to be acquired by Huntington Bancshares (HBAN) for USD 7.4bln.

- American Water Works (AWK) and Essential Utilities (WTRG) are to merge in an all-stock deal worth c. USD 63bln, including debt.

- Janus Henderson (JHG) confirmed acquisition proposal from Trian and General Catalyst, and the board will appoint a special committee for proposal review; the proposal is worth USD 46/shr in cash.

- Avidity Biosciences (RNA) agreed to be acquired by Novartis in a $12bln all-cash transaction.

- Microsoft (MSFT) was upgraded at Guggenheim from 'Neutral' to ‘Buy'.

- The PT was raised at Alphabet (GOOGL) to USD 300 from 265 at KeyBanc, who keep its 'Overweight' rating.

- Cantor Fitzgerald raised Tesla (TSLA) PT to USD 510 from 355.

FX

The Dollar saw slight weakness to start the week as modest upticks in GBP and EUR were offset by downticks in havens. The US-China talks in Malaysia sparked a risk-on tone across markets, leaving US and China equities higher, as the two countries agreed on a trade framework ahead of Trump/Xi meeting later this week. Nonetheless, the Dollar didn't get much traction, as perhaps participants are also awaiting the Fed statement and Chair Powell on Wednesday to gain a clearer picture on the domestic front to better gauge the dollar's next move. As it stands on trade, the US says additional tariffs on China will not be imposed, while China will delay its new rare earth export licensing for a year. DXY traded within a narrow range of 98.729-999. Barclays' proprietary month-end rebalancing model indicates weak USD selling against all majors at the end of October.

USD/CAD continues to trade around levels seen prior to US President Trump terminating talks with Canada over a "fake" advertisement which criticised tariffs. Despite Trump over the weekend increasing tariffs on Canada by 10%, the pair is unfazed, trading flat on the day.

Antipodeans outperformed as risk appetite grew for high-beta FX, given the more sanguine view over their exposure to trade with China as ties with the US have improved over the weekend. At the RBA, Governor Bullock described rates as still a bit restrictive and on labour, said the unemployment rate could come down once again in the next month. AUD/USD rose to 0.6559 from 0.6527 lows, and NZD/USD rose to 0.5786 from 0.5748 lows.

In Germany, the Ifo Business Climate Index rose to 88.4 in October (exp. 87.9) from 87.7. Expectations also rose to 91.6 (prev. 89.9) above the expected 89.9, while Current Conditions unexpectedly fell to 85.3 (exp. 85.5, prev. 85.7). The Ifo President writes, “Companies remain hopeful that the economy will pick up in the coming year. However, the current business situation was assessed as slightly worse”. EUR/USD was unreactive to the update, as well as the EU addressing its concerns to China over the expansion of export controls on critical raw materials.

CNY was firmer following the US-China trade optimism. Additionally, the PBoC favoured the Yuan for the second consecutive time with a lower fix, setting the USD/CNY mid-point at 7.0881 beneath the expected 7.1146 (prev. 7.0928). ING writes that a stronger renminbi is normally supportive for global EM currencies and a mild dollar negative.