Market Wrap 2025-10-28

- US President Trump and Japanese PM Takaichi finalized an agreement concerning the US-Japan alliance and a framework designed to secure the supply of critical minerals and rare earths.

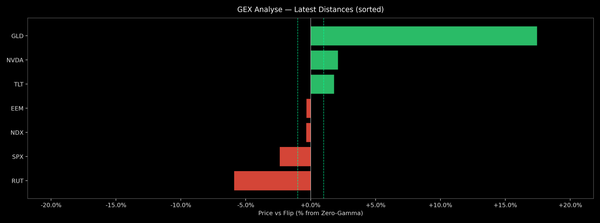

- European stock exchanges are mostly trading lower; ES/NQ futures are unchanged, while RTY futures are slightly lower as earnings season continues.

- The USD is mostly unchanged to slightly lower, while the JPY has gained strength due to US-Japan trade developments and some safe-haven demand; GBP is underperforming slightly.

- Bonds are firmer due to the risk-averse sentiment; USTs are awaiting new supply.

- XAU briefly fell below USD 3.9k/oz, with base metals also generally declining; the crude oil complex is lower, partly due to reports that OPEC+ is considering another increase in oil production.

- The upcoming economic calendar includes the US Richmond Fed index (Oct), US Case-Shiller Home Prices (Aug), US Consumer Confidence (Oct), and US Treasury supply.

- Earnings reports are expected from Visa, Electronic Arts, PPG Industries, SoFi, and PayPal.

TARIFFS/TRADE

- US President Trump and Japanese PM Takaichi signed an agreement regarding the US-Japan alliance and a framework to secure the supply of critical minerals and rare earths. The White House stated that the US and Japan intend to use economic policy tools and coordinated investment to accelerate the development of diversified, liquid, and fair markets for critical minerals and rare earths. Furthermore, within six months of the framework's effective date, Japan and the US plan to take measures to support projects that generate end products for delivery to buyers in the US, Japan, and allied nations, while working to secure their critical minerals and rare earths supply chains by addressing non-market policies and unfair trade practices.

- A senior Japanese government official indicated that Japan and the US are preparing to release a fact sheet that includes potential investment projects in the US, with power generation and automobile-related products listed as potential investment projects. The fact sheet is expected to include company names such as Mitsubishi Heavy Industries.

- China and ASEAN signed a free trade area 3.0 upgrade protocol, according to Xinhua.

EUROPEAN TRADE

EQUITIES

- European stock markets opened mostly lower, continuing the subdued sentiment observed in the APAC session. Trading activity has been fairly choppy within a narrow range, as traders await key risk events this week.

- European sectors initially opened with mixed performance but now show a predominantly negative trend; Utilities are outperforming, followed by Banks, while Basic Resources is lagging due to declines in metals prices. Key movers include HSBC (+2.5%, driven by solid Q3 figures and increased RoTE guidance), BNP Paribas (-2.3%, which missed expectations on bad loans), and Novartis (-3.9%, whose core EPS fell short of some analyst expectations).

- US equity futures are mixed (ES unchanged, NQ unchanged, RTY -0.3%), with ES and NQ trading near unchanged levels, while RTY is subdued. The DJIA experienced modest gains following strong Q3 results from UnitedHealth, which exceeded headline metrics and raised its FY guidance.

- UnitedHealth Group Inc (UNH) reported Q3 2025 results (USD): Adj. EPS of 2.92 (exp. 2.84), Revenue of 113.2bln (exp. 113.05bln), and raised its FY Adj. EPS guidance to 16.25 (previously 16.00).

- United Parcel Service Inc (UPS) reported Q3 2025 results (USD): Adj. EPS of 1.74 (exp. 1.3), Revenue of 21.40bln (exp. 20.79bln); and expects Q4 revenue to be around 24bln (exp. 23.87bln).

- Amazon (AMZN) announced organizational changes across the company that will affect some employees, with a reduction in the corporate workforce of approximately 14k roles. The company stated, "We expect to continue hiring in key strategic areas while also finding additional places we can remove layers, increase ownership, and realize efficiency gains."

- PayPal (PYPL) signed a deal with OpenAI to become the first payments wallet in ChatGPT, according to CNBC.

- Axios suggests that the focus is shifting to three AI firms, Oracle (ORCL), Broadcom (AVGO), and Palantir (PLTR), as Wall Street's attention moves away from the "Mag 7" companies.

FX

- The DXY is essentially flat, trading near the upper end of a 98.56 to 98.79 range. Initial European trading saw slight pressure on the Dollar, influenced by strength in the JPY and a lower USD/CNY fix. Trade-related headlines have primarily focused on US-Japan developments, and traders are now awaiting the Fed policy announcement on Wednesday. Before that, attention will be on US Consumer Confidence and the S&P Case-Shiller house price index later today.

- The JPY is the clear G10 outperformer today, driven by three main factors: 1) safe-haven demand due to the subdued risk tone (also reflected in modest CHF gains), 2) verbal intervention from the Japanese Economy Minister, who emphasized the importance of avoiding rapid, short-term fluctuations in foreign exchange rates, and 3) positive US-Japan trade developments. Regarding the latter, US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and a framework to secure the supply of critical minerals and rare earths. Trump expressed satisfaction with the meeting, offering Takaichi "anything you want." USD/JPY is trading near the midpoint of a 151.77-152.87 range.

- The EUR is flat against the Dollar. Focus today has been on the latest ECB SCE, where the 1-year inflation expectation was revised slightly lower, while the 3-year and 5-year expectations remained unchanged. The ECB BLS highlighted that "Demand for loans to firms increased slightly, but is still weak overall." Traders are now awaiting the ECB policy decision on Thursday, but it is unlikely to be eventful, as markets have almost fully priced in no change to the current rate. EUR/USD is trading in a 1.1645 to 1.1667 range.

- The GBP is slightly weaker against the Dollar. It began the European session flat but experienced some pressure shortly after. There was no specific catalyst for the downside, but it may be related to a recent FT article highlighting that the OBR is expected to cut its trend productivity growth forecast by about 0.3%, potentially resulting in a GBP 20bln hit to UK public finances. The move could also be technical, with EUR/GBP breaking above the 0.8750 level, reaching a peak at 0.8764.

- Antipodean currencies are essentially flat, showing little reaction to the subdued risk tone and pressure in the metals sector.

- The PBoC set the USD/CNY midpoint at 7.0856 vs exp. 7.1029 (Prev. 7.0881)

FIXED INCOME

- USTs started the day firmer, but only modestly so. USTs reached a peak of 113-18+, surpassing Monday's peak of 113-16 and approaching the cluster of highs from last week between 113-20+ and 113-29. The upside comes as equities fail to sustain yesterday's momentum, benefiting FX havens and fixed income, although XAU continues to decline. JPY is also influenced by overnight trade developments. Specific fixed income news has been light since Monday's auctions. The 2yr sale passed without impact, featuring an in-line cover but the first tail, 0.1bps, for a 2yr tap since April. The 5yr tap stopped through by 0.1bps vs when issued, improving from the last outing. The b/c marginally surpassed the six-auction average. USD 44bln of 7yr notes are due.

- Bunds were firmer early, in line with USTs. This move has continued, as European equity sentiment remains tepid. Bunds reached a peak of 129.73, surpassing Monday's 129.64 peak and approaching the cluster of highs from last week between 130.02 and 130.38. The latest ECB SCE passed without impact, with the 3yr and 5yr inflation views maintained while the 1yr view eased to 2.7% (prev. 2.8%). A German Bobl tap is ahead.

- France remains in focus as the debate around potential wealth taxes continues. The results will likely determine whether Lecornu’s 2nd attempt at government lasts or not in the near-term, as the Socialist Party have made clear that a workable compromise on wealth taxes is a key condition for their support.

- Gilts gapped higher, acknowledging the modest bullish bias in EGBs that emerged into the European cash equity open. Opened higher by 18 ticks and then climbed another 13 to a 93.96 peak. UK newsflow remains focused almost exclusively on the budget. The FT reported that the OBR is expected to cut its trend productivity growth forecast by about 0.3pps, a cut which equates to around a GBP 21bln hit to the fiscal situation. Reports in recent weeks had generally been looking for a 0.2pps cut to the productivity view, equating to a GBP 14bln hit. If correct, the Chancellor will need to find another GBP 7bln from tax rises and/or spending cuts in the Autumn Budget.

- The UK sold GBP 1.5bln of 1.125% 2035 I/L Gilt: b/c 2.94x (prev. 3.09x) & real yield 1.571% (prev. 1.673%).

- Italy sold EUR 2.0bln vs exp. EUR 1.75-2bln 2.10% 2027 BTP Short Term & EUR 1.5bln vs exp. EUR 1-1.5bln 1.80% 2036 BTPei.

COMMODITIES

- WTI and Brent are significantly lower today, but without a clear driver. The complex began the European session with very mild losses, but then extended lower as the morning progressed. Geopolitics have been a little more tense (oil positive), with Israeli PM Netanyahu reportedly to hold an emergency meeting related to Hamas's "violations" of the Gaza ceasefire. Perhaps more focus on the recent Bloomberg report, which suggested that OPEC+ is leaning towards another small oil output increase. Brent Dec'25 is currently trading just off lows in a USD 64.08-65.76/bbl range.

- Spot gold is also posting hefty losses, down by around USD 90/oz thus far; the yellow metal has slipped below the USD 3.9k mark and trades at the bottom-end of a USD 3,894.86-4,019.72/oz range. Nothing fresh is really driving the pressure today, but very much a continuation of the pressure seen over the past few days for the metal.

- Base metals are entirely in the red, as the complex pares back some of its recent advances and given the subdued risk-tone overnight. 3M LME is currently at the lower end of a USD 10,864.35-11,052.4/t confine.

- Indian companies will not buy oil from Rosneft and Lukoil supplied by traders, according to Reuters, citing Indian government sources.

- IEA chief Birol said a significant chapter for LNG is starting soon and that 300bcm of LNG is to hit markets in the next five years. Birol said that, absent major geopolitical tensions, oil and gas prices are expected to be lower, while he added that sanctions could push oil prices upward, but the effect is likely to be limited due to surplus capacity and slowing demand.

- Venezuela's President Maduro announces immediate suspension of energy agreements with Trinidad and Tobago.

- Russia's Kremlin, on US President Trump’s statements that countries should cease buying Russian oil, says many say they will figure it out for themselves, partners will make up their own mind about whether or not to buy top-quality Russian energy product.

NOTABLE DATA RECAP

- UK BRC Shop Price Index YY (Sep) 1.0% vs Exp. 1.6% (Prev. 1.4%)

- German GfK Consumer Sentiment (Nov) -24.1 vs. Exp. -22.0 (Prev. -22.3, Rev. -22.5)

- Italian Consumer Confidence (Oct) 97.6 vs. Exp. 97.0 (Prev. 96.8); Mfg Business Confidence (Oct) 88.3 vs. Exp. 87.5 (Prev. 87.3, Rev. 87.4)

NOTABLE EUROPEAN HEADLINES

- The UK is to stop disclosing the identity of stock market short sellers, with the FCA overhauling regulations in a break from EU rules to be more in line with the US, according to the FT.

- UK Chancellor Reeves says too much cost trading with the EU is pushing inflation up; sees "huge benefits" in rebuilding some EU relationships.

- ECB Consumer Expectation Survey: 1-year CPI 2.7% (prev. 2.8%), 3-year 2.5% (prev. 2.5%), 5-year 2.2% (prev. 2.2%)

- ECB October 2025 euro area bank lending survey: Small, unexpected net tightening of credit standards for loans to firms, Credit standards unchanged for housing loans and moderately tighter for consumer credit. Demand for loans to firms increased slightly, but still weak overall. Housing loan demand continued to increase strongly.

- Nexperia's owner Wingtech says the Co. faces an "existential threat" after the Netherlands took control of management, via FT; hundreds of jobs potentially at risk.

NOTABLE US HEADLINES

- US President Trump says he will send in "more than the National Guard" into US cities if required.

GEOPOLITICS

MIDDLE EAST

- Palestinian TV reported that Israeli vehicles fired on the eastern areas of Gaza City, according to Sky News Arabia.

- Israeli PM Netanyahu is to hold an emergency meeting today to discuss Hamas' "violations" of the Gaza ceasefire, via Sky News Arabia.

- "Channel 12 quoted an Israeli official: We will take steps against Hamas' violation of the agreement to return the bodies", via Al Jazeera.

OTHER

- Russia's Kremlin, on Ukraine peace negotiations, says Russia cannot assess the prospects and Kyiv caused the pause; says there are foreign fighters at the front line in Ukraine and "we shall destroy them". Military overhears foreign languages spoken repeatedly at the front line in Ukraine.

- A US State Department senior official said the US expects Thailand will work with Cambodia to begin the release of 18 soldiers immediately, while the official added that US policy towards North Korea remains aimed at denuclearisation, and that US policy on Taiwan has not changed.

- North Korea said Foreign Minister Choe met with Russian President Putin and discussed many businesses to strengthen bilateral relations, while Choe and Russia's Foreign Minister Lavrov agreed on all points while holding strategic discussions on global issues. Furthermore, the North Korean side expressed support for Russian measures to remove the root of the Ukraine conflict, and the Russian side expressed support for North Korean efforts to protect its current position, security interests, and sovereign rights, according to KCNA.

- Ukrainian President Zelensky says Ukraine will ‘take no steps back’ on the battlefield to cede territory; Ukraine is ready for peace talks anywhere besides Russia and Belarus if it ends the war.

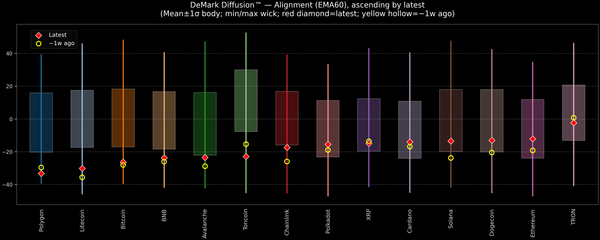

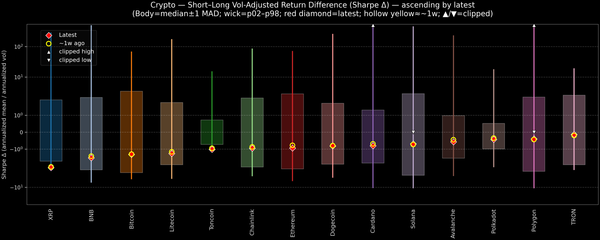

CRYPTO

- Bitcoin is a little lower and trades around USD 114.5k, with Ethereum also on the backfoot and trades just above USD 4.1k.

- JPMorgan (JPM) CEO Dimon says crypto is real, and will be used by "all of us".

APAC TRADE

- APAC stocks failed to sustain the momentum from the record highs on Wall St and were mostly subdued amid some profit taking and positioning ahead of this week's upcoming risk events.

- The ASX 200 retreated in the absence of major catalysts and was dragged lower by weakness in healthcare, tech, and miners.

- The Nikkei 225 pulled back from all-time highs amid a firmer currency and despite US President Trump's visit to Japan, where he met with PM Takaichi and signed an agreement on US-Japan alliance and securing supply of critical minerals and rare earths.

- The Hang Seng and Shanghai Comp were choppy ahead of the major risk events later in the week including the central bank decisions and the Trump-Xi meeting, while participants also reflected on recent comments from PBoC Governor Pan that they will resume government bond purchases and sales in the open market, as well as continue to maintain a supportive monetary policy stance and implement a properly loose monetary policy.

NOTABLE ASIA-PAC HEADLINES

- China releases proposal for 15th five-year plan, according to Xinhua; says China faces difficult challenges in global trade order, economic growth potential to be fully released. Vows to strengthen national security barriers. To combine an efficient market with a proactive government. Tech self-reliance to be greatly improved. To deepen reform and continue high-quality development. Economic growth potential to be fully released. Domestic demand continues to play a stronger role. Economic growth remains within a reasonable range. Faces difficult challenges in the global trade order. To foster emerging sectors and future industries. To improve the level of tech self-reliance. To promote coordinated development of the economy, society. To drive reasonable economic growth in the next five years. Transformation to accelerate breakthroughs. To increase international influence significantly by 2035. To drive a significant consumption rate among residents. Vigorously boost consumption. To build a modernised infrastructure facilities system. Enhancing fiscal sustainability. Give full play to the role of proactive fiscal policy. To form growth model more driven by consumption and demand. To increase share of central government fiscal spending.

- Japanese PM Takaichi thanked US President Trump for his enduring friendship with late PM Shinzo Abe, while she added that President Trump contributed to Asia's peace, including the Thai-Cambodia deal, and stated that the Middle East deal was an unprecedented historical achievement. Takaichi said she highly values Trump's commitment to world peace and stability, as well as expressed readiness to promote further collaboration with the US to achieve a free and open Indo-Pacific. Furthermore, Takaichi said she will continue to strive as Japan’s leader to strengthen the nation’s power, including defence capabilities, and wants to realise a new golden age of the Japan-US alliance with President Trump.

- US President Trump said former PM Abe was a great friend of his and noted that the US has received Japan's orders of military equipment, which Trump appreciates, while Trump said they are signing a deal and that the US-Japan trade deal is a very fair deal. Furthermore, Trump said this will be a relationship that will be stronger than ever before and that the US is Japan's ally at the strongest level.

- US Treasury Secretary Bessent highlighted in a meeting with Japanese Finance Minister Katayama the important role of sound monetary policy formulation and communication in anchoring inflation expectations and preventing excessive exchange rate volatility. It was also stated that conditions are substantially different twelve years after the introduction of Abenomics, while Bessent was glad to hear Katayama’s perspective on Japanese fiscal measures under consideration and expressed eagerness to learn more as the full package is developed to better understand its potential impact.

- Japanese Economy Minister Kiuchi said foreign exchange moves are determined by various factors and it is important for foreign exchange moves to reflect fundamentals and remain stable, while he added it is important to avoid rapid, short-term fluctuations in foreign exchange moves.

- Japan and South Korea are coordinating to hold the first summit meeting between PM Takaichi and South Korean President Lee on October 30th on the sidelines of the APEC summit meeting in South Korea, according to Asahi.

- Japan's Finance Minister Katayama says there's been no direct talks about the direction of Japanese monetary policy when asked about US Treasury Secretary Bessent's readout. There's no change to US-Japan joint statement on Forex. Bessent wasn't urging BoJ to raise interest rate.

- Ping An Insurance (2318 HK) 9M (CNY) Net Income 132.9bln (prev. 119.2bln Y/Y), Revenue 901.7bln (prev. 861.8bln Y/Y).

- Bank of China (3988 HK) Q3 2025 (CNY): Net 60.1bln (prev. 57.2bln Y/Y), NII 111.0bln (prev. 109.2bln Y/Y).

DATA RECAP

- South Korean GDP QQ (Q3 A) 1.2% vs. Exp. 0.9% (Prev. 0.7%); YY (Q3 A) 1.7% vs. Exp. 1.5% (Prev. 0.6%)