Market Wrap 2025-10-30

MARKET CONDITIONS

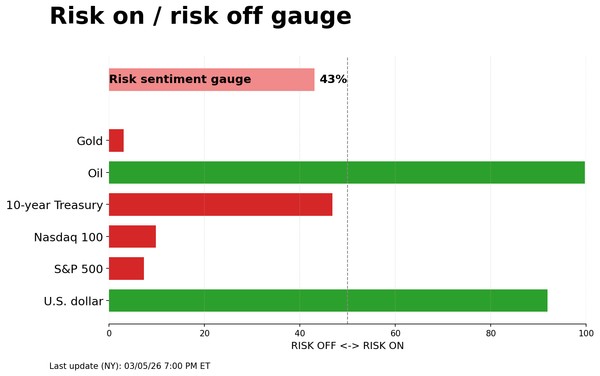

- SNAPSHOT: Equities are down, Treasuries are down, Crude is flat, the Dollar is up, and Gold is up.

- PREVIOUS TRADING DAY: Alphabet (GOOG) exceeded expectations; Microsoft (MSFT) provided mixed guidance; Meta (META) reported a profit miss; the US will reduce reciprocal and fentanyl tariffs on China; China will delay rare earth export controls on the US; the Bank of Japan (BoJ) held rates as expected, signaling no imminent hike; the European Central Bank (ECB) held rates as expected; German inflation was high; Meta (META) is looking to raise at least USD 25 billion in a bond sale, which saw strong demand.

- UPCOMING: Data releases include Chinese NBS/Composite PMIs (October), German Import Prices (September), Retail Sales (September), Eurozone Flash HICP (October), Italian CPI, Dallas Fed (September), and Chicago PMI (October). Suspended releases include US PCE (September) and Employment Costs (Q3). Events include the BoJ Outlook for Economic Activity and Prices (October 2025) and the ECB Bulletin. Speakers include the Fed’s Logan and Bostic, and RBNZ's Gai. Supply events are scheduled for Australia and Japan. Earnings reports are expected from Exxon Mobil, Chevron, AbbVie, AON, CaixaBank, and Intesa Sanpaolo.

MARKET WRAP-UP

Stocks experienced further downward pressure on Thursday, influenced by hawkish comments from Powell. Shares of Meta (META) and Microsoft (MSFT) declined following their earnings reports, while Alphabet (GOOGL) saw gains. Attention is now focused on Apple (AAPL) and Amazon (AMZN). Regarding trade, the overall tone of the Trump/Xi meeting was positive, with both sides agreeing to a one-year trade truce. The US will also halve fentanyl-related tariffs on China and delay tech export controls for a year. In return, China will pause the latest rare-earth export curbs for a year and purchase US soybeans. Most sectors were down, with Consumer Discretionary, Communications, and Technology underperforming, while Real Estate, Financials, and Healthcare outperformed. Treasury notes were sold across the curve, particularly at the long end, after Meta (META) announced a USD 25 billion bond sale in 5-40-year bonds. Oil prices were volatile but ultimately settled flat. In FX, the Dollar outperformed, continuing its upward trend after Powell's comments, while the Yen lagged after the BoJ decision. The euro was affected by the rising dollar, but the ECB rate decision had little impact as it was widely anticipated. The Pound faced pressure due to concerns surrounding the Chancellor and growing calls for her resignation amid a house rental scandal, although PM Starmer reiterated his full support for her.

GLOBAL ECONOMIC CONDITIONS

ECB:

The ECB decided to keep the Deposit Rate unchanged at 2.0%, as expected. This decision was based on the lack of significant changes in data since the September meeting and confidence that indicators of underlying inflation align with the ECB's target. The ECB maintained its meeting-by-meeting and data-dependent approach. President Lagarde stated that policy is in a "good place" but it is not a fixed point and the GC will do whatever is necessary to stay in a good place. The decision was unanimous. Lagarde noted that some downside risks to growth have lessened, but the same cannot be said for inflation. Despite risks surrounding the Eurozone outlook (US trade policies, EUR appreciation, French politics), the ECB remains confident in the bloc's growth outlook but is cautious of potential upside inflation risks. The bar for a rate cut in the near term remains high. Market pricing reflects just 1bp of loosening expected for the December meeting. The next key point will likely be the next round of macro projections in December, which will include the debut 2028 forecast. Reuters, citing sources, reported that ECB policymakers are preparing for a December debate on inflation and rates; some believe the 2028 inflation projection would warrant a rate cut discussion, while others favor giving little weight to any small undershooting three years ahead.

FIXED INCOME MARKETS

T-NOTE FUTURES (M5) SETTLED 6+ TICKS LOWER AT 112-22+

T-note weakness extended following the Fed's comments, with the Meta bond sale also contributing. At settlement, 2-year notes were up 2.6bps at 3.612%, 3-year notes were up 2.6bps at 3.613%, 5-year notes were up 2.3bps at 3.722%, 7-year notes were up 3.1bps at 3.899%, 10-year notes were up 3.7bps at 4.095%, 20-year notes were up 4.9bps at 4.629%, and 30-year notes were up 5.0bps at 4.649%.

INFLATION BREAKEVENS: 1-year BEI was down 2.5bps at 2.880%, 3-year BEI was down 0.5bps at 2.526%, 5-year BEI was up 0.5bps at 2.324%, 10-year BEI was unchanged at 2.282%, and 30-year BEI was down 0.3bps at 2.229%.

MARKET ACTIVITY: T-Notes experienced further pressure due to the hawkish signal from Fed Chair Powell. The Meta (META) bond sale, seeking to raise at least USD 25 billion, also added to the pressure, reportedly drawing over USD 125 billion in demand. The bond issuance, mainly focused on the long end of the curve (5-40-year bonds), led to a steepening of the curve. The BoJ rate decision was perceived as dovish following comments from Governor Ueda, who stated that there is no pre-set path regarding the next rate hike, and the statement avoided overly hawkish signals. The ECB rate decision was largely uneventful and in line with expectations, but sources suggest there will be debate in December over inflation projections and interest rates. There were mixed views on the Trump/Xi meeting; initial caution was seen after the meeting ended quickly with no immediate readout. However, both sides later announced positive results and a one-year trade truce. Next week will see the ADP data and Challenger Layoffs data, but NFP or JOLTS will not be released due to the government shutdown. The next financing estimates will be released on Monday, followed by the quarterly refunding announcement on Wednesday.

SUPPLY

Bills

- The US sold USD 110 billion of 4-week bills at a high rate of 3.910%, with a bid-to-cover ratio of 2.64x; it also sold USD 95 billion of 8-week bills at a high rate of 3.89%, with a bid-to-cover ratio of 2.88x.

- The US will sell USD 77 billion of 26-week bills and USD 86 billion of 13-week bills on November 3rd; it will also sell USD 95 billion of 6-week bills on November 4th; all will settle on November 6th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: December 18bps (previously 17bps), January 27bps (previously 27bps), March 35bps (previously 36bps).

- NY Fed RRP op demand was at USD 19.1 billion (previously 19.5 billion) across 18 counterparties (previously 15).

- NY Fed Repo Op demand was at USD 6.2 billion (previously 10.2 billion) across two operations.

- EFFR was at 4.12% (previously 4.12%), with volumes at USD 98 billion (previously 92 billion) on October 29th.

- SOFR was at 4.27% (previously 4.31%), with volumes at USD 3.061 trillion (previously 3.067 trillion) on October 29th. It remains above the top-end of the Fed Funds target range on that date.

CRUDE OIL MARKETS

WTI (Z5) SETTLED USD 0.09 HIGHER AT 60.57/BBL; BRENT (Z5) SETTLED USD 0.08 HIGHER AT 65.00/BBL

The crude complex settled flat after a volatile day of trading within contained ranges. The main factors influencing the market were hawkish comments from Powell, Mag-7 earnings, and the Trump/Xi meeting, where the latter noted the meeting was amazing and lots of decisions were made. Trump rated it a 12/10 and confirmed that the US and China agreed on a 1-year trade truce. Energy-specific news was limited, with Hamas/Israel tensions continuing. Hamas said it would hand over the bodies of two dead hostages, which it did. Ahead of Baker Hughes and earnings from Chevron and Exxon, WTI traded between USD 59.64-60.79/bbl and Brent between USD 64.06-65.15/bbl.

EQUITIES MARKETS

CLOSES : SPX was down 0.99% at 6,822, NDX was down 1.47% at 25,735, DJI was down 0.23% at 47,522, and RUT was down 0.76% at 2,466.

SECTORS: Real Estate was up 0.66%, Financials were up 0.34%, Health was up 0.25%, Consumer Staples were up 0.02%, Industrials were down 0.22%, Utilities were down 0.38%, Energy was down 0.68%, Materials were down 0.99%, Technology was down 1.38%, Communication Services were down 2.08%, and Consumer Discretionary was down 2.51%.

EUROPEAN CLOSES : Euro Stoxx 50 was down 0.15% at 5,697, Dax 40 was up 0.06% at 24,139, FTSE 100 was up 0.04% at 9,760, CAC 40 was down 0.53% at 8,157, FTSE MIB was down 0.09% at 43,202, IBEX 35 was down 0.72% at 16,034, PSI was up 0.73% at 8,446, SMI was down 0.10% at 12,301, and AEX was up 0.64% at 982.

STOCK SPECIFICS/EARNINGS

- Alphabet (GOOGL): EPS, revenue, and cloud revenue exceeded expectations.

- Microsoft (MSFT): EPS and revenue beat estimates, but there are concerns regarding capex; next quarter guidance was mixed.

- Meta (META): Profit fell short, including a one-time non-cash income tax charge of USD 15.93 billion; expects total expenses to grow significantly year-over-year.

- Cardinal Health (CAH): EPS and revenue beat estimates with better-than-expected FY25 EPS.

- Roblox (RBLX): Bookings beat estimates with strong guidance.

- Estee Lauder (EL): Top and bottom lines exceeded expectations; expanded operating margin for the first time in four years.

- Fox (FOXA): Strong earnings and announced a USD 1.5 billion share buyback program.

- Eli Lilly (LLY): Stellar report; EPS and revenue surpassed Wall Street expectations with upbeat guidance.

- ServiceNow (NOW): EPS, revenue, and subscription revenue exceeded expectations and authorized a five-for-one stock split; strong next quarter and FY subscription revenue guide.

- Comcast (CMCSA): All major metrics exceeded expectations and lost fewer domestic broadband customers than anticipated.

- Starbucks (SBUX): Profit was light and noted that Q margins were hurt by coffee prices, tariffs, and labor investments in turnaround.

- eBay (EBAY): Weak next quarter profit view.

- Chipotle Mexican Grill (CMG): Top line missed estimates and 2025 comparable restaurant sales guidance disappointed.

- FMC Corp (FMC): Revenue significantly missed estimates and slashed next quarter and FY outlook.

- Core Scientific (CORZ): Shareholders rejected the CoreWeave (CRWV) merger, failing to secure the required number of votes.

- Chewy (CHWY): To acquire Smartequine in an all-cash transaction, expected to be EBITDA margin accretive; reaffirmed FY25 guidance.

- DocuSign (DOCU) announced that Docusign's Intelligent Agreement Management (IAM) platform will soon be available in ChatGPT through the Model Context Protocol (MCP).

- Meta (META): Looking to raise at least USD 25 billion from a bond sale, according to Bloomberg; the bond sale drew a record USD 125 billion in demand.

- Canva: Announced the launch of its creative operating system, adding new AI tools; the news weighed on Adobe (ADBE).

- United Airlines (UAL): CEO said they are seeing some economic impact due to the government shutdown.

- GlobalStar (GSAT): Said to draw SpaceX interest in sales process; said to work with adviser and weigh potential suitors, Bloomberg reports.

- Upside in Moderna (MRNA) attributed to takeover chatter.

FOREIGN EXCHANGE MARKETS

The Dollar strengthened against peers as markets continue to reprice a conflicted Fed on a December policy decision. The outcome of the Trump-Xi meeting also supported the USD. The US is to lower its reciprocal and fentanyl tariffs on China, while China will delay its rare earth export controls for one year. DXY's gains were helped by broad strength in USD pairs, but JPY weakness played a major role. DXY is around 99.50, off earlier 99.724 highs.

JPY was the G10 underperformer after the BoJ refrained from explicitly guiding towards another hike in 2025. The central bank held rates as expected at 0.5%, with dovish interpretations having a greater influence on FX movement than the hawkish dissenters, Takata and Tamura, who proposed a 25bps rate hike. In the press conference, further downside was sparked in the Yen as Governor Ueda said there's no preset idea about the timing of the next rate hike. The BoJ continued to stress high uncertainty on trade policy and the impact on the economy, and views underlying consumer inflation as likely to stagnate due to slowing growth before gradually increasing. USD/JPY remains higher at ~154.0, markedly off the 152.2 lows.

The ECB's decision to hold rates at 2.00% was a non-event. The decision to do so was based on the lack of incremental shifts in data since the September meeting and confidence that indicators of underlying inflation are consistent with the ECB's target. The accompanying statement offered little as policymakers' views on the inflation outlook were broadly unchanged. EUR/USD was unfazed by the decision, trading lower at ~1.1570 on USD strength into overnight trade. ECB sources via Reuters said some think the 2028 inflation projection would warrant a rate cut debate, others favour giving little weight to any small undershooting three years ahead.

GBP and Gilts were briefly and modestly weighed by concerns over UK Chancellor Reeves' future as the PM spokesperson said they have received new information on Reeves' house rental error. The PM had previously ruled out the investigation but still has full confidence in Chancellor Reeves despite the recent development. Cable incurred its third consecutive day of losses, hitting lows of 1.3117, a level not seen since April.