Market Wrap 2025-10-31

Market Update

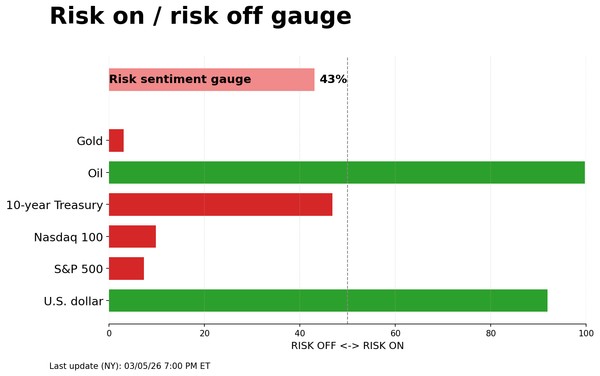

- European stock exchanges are experiencing downward pressure, while US equity futures are showing mixed performance. The Nasdaq Composite (NQ) is gaining strength due to positive earnings reports from Amazon (AMZN +12.8%) and Apple (AAPL +1.7%).

- Amazon's earnings exceeded expectations, driven by strong growth in its cloud computing division. Apple reported solid results and anticipates a surge in iPhone sales during the holiday season.

- The US Dollar Index (DXY) remains strong following the Federal Open Market Committee (FOMC) meeting. The Australian dollar (AUD) is underperforming after the release of Chinese Purchasing Managers' Index (PMI) data.

- Commodity markets are relatively quiet as the market awaits the OPEC+ meeting.

- Bonds are facing slight pressure due to the positive risk sentiment in the US, fueled by earnings reports, and a bond issuance by Meta. Commentary from Federal Reserve officials is anticipated.

- The upcoming economic calendar includes the Dallas Fed Manufacturing Survey (September), Chicago PMI (October), and the ECB Bulletin. Speeches are scheduled from Fed officials Logan, Bostic, Miron, and Schmid. Earnings releases are expected from AbbVie, AON, and Intesa Sanpaolo.

Tariffs/Trade

- Chinese President Xi Jinping advocated for the protection of multilateral trade at the APEC summit, urging members to embrace genuine multilateralism. He called on APEC to maintain stable industrial and supply chains, promote an open regional economic environment, and advance trade and investment liberalization. He also encouraged members to jointly foster the digitalization and greening of free trade.

- Li Chenggang, China's top trade negotiator, stated that China will study international standards, economic and trade regulations, and continue to meet green standards. He noted that the export volume of photovoltaic products has exceeded CNY 200 billion for four consecutive years, and the export volume of electric vehicles surpassed 2 million units for the first time last year. He added that green vehicles, such as locomotives, have also maintained strong growth, and China will continue to adapt to the global trend of green and low-carbon development.

- South Korean President Lee stated that the world is at a critical turning point in the global order, and global trade uncertainty is increasing.

- EU officials will be informed today about a visit by US Commerce Secretary Lutnick to the EU on November 24th for trade talks, according to Politico.

- Japanese PM Takaichi told Chinese President Xi she would like to confirm the basic direction of Japan-China relations, including building constructive and stable ties.

European Trade

Equities

- European stock markets (STOXX 600 -0.4%) opened mostly lower and have traded with a negative bias throughout the morning.

- Most European sectors are showing negative performance, with only a few managing to stay afloat. Banks are supported by gains in companies like Danske Bank (+1.8%) and Caixabank (+1.4%) following their earnings reports. The Construction & Materials sector is underperforming, pressured by losses in Saint-Gobain (-1.9%) after it missed its Q3 revenue figure.

- US equity futures are mixed (ES +0.6%, NQ +1.4%, RTY -0.1%), with the tech-heavy NQ showing clear outperformance, while the RTY is around the unchanged mark. The NQ's outperformance is driven by pre-market strength in Apple (+2.5%) and Amazon (+12.8%). Apple's reported headline beats, with its Q1 revenue growth guidance also above expectations. CEO Cook also added that the company will return to growth in Q1 in China, driven by iPhone sales. Amazon's shares are rising sharply after very strong Q3 headline metrics, with particular focus on cloud growth.

- NVIDIA (NVDA) CEO Huang says China makes plenty of AI chips and that the Chinese military have access to chips made in China. Adds that China has blocked H20 and they have plenty of chips themselves, in terms of national security; signalling that China doesn't want US chips.

- The WSJ writes that a breakout for AWS in the coming quarters could easily be in the cards for Amazon (AMZN), something its acceleration to 20% revenue growth in the third quarter, its best since 2022, seemed to preview.

- Amazon.com Inc (AMZN) Q3 2025 (USD): EPS 1.95 (exp. 1.57), Revenue 180.2bln (exp. 178.08bln)

- Apple Inc (AAPL) Q4 2025 (USD): EPS 1.85 (exp. 1.78), Revenue 102.5bln (exp. 102.14bln), iPhone revenue 49.03bln (exp. 50.2bln), iPad revenue 6.95bln (exp. 6.98bln), Mac revenue 8.73bln (exp. 8.59bln), Services 28.75bln (exp. 28.17bln), Wearables 9.01bln (exp. 8.5bln), China revenue 14.49bln (exp. 16.24bln)

FX

- The DXY is slightly firmer and currently trading at the mid-point of a 99.41-99.66 range. The mild strength comes amid elevated yields in the aftermath of the hawkish Powell press conference. Focus for the day will be on the Chicago PMI and commentary from Fed’s Logan and Bostic; Miran and Schmid will also likely explain their recent dissent. As a reminder, Miran voted for a 50bps cut, whilst Schmid opted for U/C.

- The EUR is flat versus the USD, trading in a tight 1.1556-1.1577 range. The single-currency was little moved on the ECB decision itself, and President Lagarde lacked surprises at her press conference thereafter. Following the announcement, Reuters sources suggested that ECB policymakers are preparing for a December showdown on inflation and rates. Some favor a cut, to prevent undershooting in 2028 whilst others give little weight to longer-term outlooks. Turning to this morning, a few ECB members have provided commentary; Rehn said keeping rates steady was justified due to uncertainty, Muller said current interest rates are appropriate and Kazaks suggested the ECB should not be “jumpy” adding that growth is still weak. On data, little move to the EZ HICP, whereby the headline printed in-line with expectations at 2.1% (prev. 2.2%); core and super-core metrics remained unchanged from the prior, defying the forecast for a slight moderation.

- The GBP is a touch softer versus the broadly firmer Dollar; currently trading within a narrow 1.3126-1.3164 range. Really not much by way of fresh in terms of the UK’s Budget, but traders are now weighing up possibilities of a Budget without Chancellor Reeves. In more detail, in the last few days, Reeves reportedly breached renting-related rules, forcing her to apologise for the mistake. There were calls for her to resign, though PM Starmer poured cold water on those suggesting that there is “no need” for further action. GBP did sour a touch in recent sessions, but has since stabilised as PM Starmer backed his Chancellor.

- The JPY is a touch lower today and trades within a 153.66 to 154.41 range. Overnight the pair saw modest pressure following a hotter-than-expected Tokyo CPI report, which saw the Y/Y jump to 2.8% (exp. 2.4%, prev. 2.4%). Also in focus for the Yen was some jawboning from the Japanese Finance Minister Katayama who said he has been recently seeing one-sided, rapid moves, adding that, he is closely watching foreign exchange moves with a high sense of urgency.

- Antipodeans are underperforming today, continuing the pressure seen in the APAC session. Downside which follows on from subdued Chinese Manufacturing PMI, and amidst a tentative risk tone in Asia and into the European session.

- PBoC set USD/CNY mid-point at 7.0880 vs exp. 7.1171 (Prev. 7.0864)

Fixed Income

- US Treasuries (USTs) are under modest pressure early amid the constructive performance of US equity futures as numbers from Amazon and Apple drive the region, and particularly the NQ, higher. Additionally, the debt space has been hit by Meta announcing USD 30bln of issuance, the largest corporate HG offering this since 2023 and the largest Meta has ever tapped the market for. Newsflow this morning has been light as we await upcoming Fed speakers. Into those, UST are towards the trough of a 112-17+ to 112-23+ band with downside of 5+ ticks at most. The low is just a tick above Thursday’s 112-16 post-Powell base. The Fed docket begins with Logan (2027), Bostic (2027) and Hammack (2026); however, the topics don’t appear to be directly pertinent to current/future monetary policy. Instead, the main focus will likely be on the dissent texts from Miran (voted for a 50bps cut, again) and Schmid (voted for U/C).

- Bunds are weighed on in-fitting with the above. Down to a 129.16 trough into the flash EZ HICP print, posting losses of c. 20 ticks at worst. Little move on the EZ HICP, whereby the headline printed in-line with expectations at 2.1% (prev. 2.2%); core and super-core metrics remained unchanged from the prior, above expectations. Ultimately, the print does not change the narrative for the ECB that inflation remains near target and the outlook is broadly unchanged. As a reminder, post-ECB Reuters sources added to the known narrative around December; that the 2028 inflation forecasts could spark a ‘showdown’ on inflation and by extension interest rates, as the 2028 projection could print in favour of easing.

- Gilts opened lower by 18 ticks at the benchmark reacted to the overnight pressure from US earnings and Meta issuance. Thereafter, Gilts fell another 10 to a 93.44 trough but still clear of Thursday’s 93.29 base and the WTD low of 93.15 from Monday. Specifics for the UK are relatively light, domestic press remains focussed on the rental blunder by Chancellor Reeves. As it stands, PM Starmer is standing by her but the scandal could ultimately lead to her dismissal; given how close we are to the Autumn Budget, if that occurs before the replacement would likely be a continuity-appointment to essentially deliver Reeves’ budget.

Commodities

- Crude benchmarks are on the backfoot but remain rangebound as the market waits for the OPEC+ meeting at the weekend. Currently, WTI and Brent are oscillating in a tight USD 60.02-60.53/bbl and USD 63.83-64.33/bbl range respectively. On the Gaza ceasefire, it was reported that the US has allowed Israel to enforce the ceasefire and fire at Hamas targets behind the yellow line where the IDF holds in Gaza. Artillery shelling has been reported inside the yellow line east of Gaza city. However, this news has not shifted crude prices.

- Spot XAU followed on from Thursday’s rebound, extending to a peak of USD 4046/oz in the early hours of the APAC session before falling back lower to a trough of USD 3988/oz. XAU remains above USD 4k/oz, currently trading at 4003/oz, as the market digests a week of central bank announcements.

- Base metals continue to fall despite the positive China-US talks held in the early hours of Thursday’s session. Following Thursday’s selloff weighed on by dollar strength, 3M LME Copper rebounded in the latter hours of Thursday’s session and peaked at USD 10.98k/t as the APAC session got underway. The red metal fell to a trough of USD 10.86k/t and oscillated in a tight c. USD 40/oz before extending on the day’s losses. Thus far, 3M LME Copper remains near session lows at USD 10.83k/t.

- Oman December crude OSP at USD 65.06/bbl (prev. USD 70.01 M/M), via GME data.

- China Iron and Steel Association said China’s apparent steel consumption from January to September fell 5.7% Y/Y to 649mln metric tons, while it added that apparent steel consumption in 2025 is expected to fall for a fifth straight year.

Notable Data Recap

- EU HICP Flash YY (Oct) 2.1% vs. Exp. 2.1% (Prev. 2.2%); services 3.4% (prev. 3.2%); HICP-X F&E Flash YY (Oct) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- EU HICP Excluding Food, Energy, Alcohol & Tobacco Flash YY (Oct) 2.4% vs. Exp. 2.3% (Prev. 2.4%)

- UK Lloyds Business Barometer (Oct) 50 (Prev. 42)

- UK Nationwide House Price MM (Oct) 0.3% vs Exp. 0.0% (Prev. 0.5%); YY 2.4% vs. Exp. 2.3% (Prev. 2.2%)

- German Retail Sales MM Real (Sep) 0.2% vs. Exp. 0.2% (Prev. -0.2%); YY Real (Sep) 0.2% vs. Exp. 1.9% (Prev. 1.8%, Rev. 1.4%)

- German Import Prices MM (Sep) 0.2% vs. Exp. -0.2% (Prev. -0.5%); YY (Sep) -1.0% vs. Exp. -1.4% (Prev. -1.5%)

- French CPI Prelim YY NSA (Oct) 0.9% vs. Exp. 1.0% (Prev. 1.2%); MM NSA (Oct) 0.1% vs. Exp. 0.1% (Prev. -1.0%)

- French CPI (EU Norm) Prelim YY (Oct) 0.9% vs. Exp. 1.0% (Prev. 1.1%); MM (Oct) 0.1% vs. Exp. 0.1% (Prev. -1.1%)

Notable European Headlines

- ECB's Rehn says keeping interest rate unchanged is justified due to uncertainty about inflation outlook in the coming years. The impact of tariffs on inflation appears to be disinflationary.

- ECB's Muller says economic situation has gradually improved and current interest rates level is appropriate.

- ECB's Kazaks says ECB will move when needed but shouldn't be 'jumpy', growth is still weak with high uncertainty. Should not overinterpret 2028 inflation outlook.

Notable US Headlines

- US President Trump posted "….BECAUSE OF THE FACT THAT THE DEMOCRATS HAVE GONE STONE COLD “CRAZY,” THE CHOICE IS CLEAR — INITIATE THE “NUCLEAR OPTION,” GET RID OF THE FILIBUSTER"

- US President Trump's administration fired Fannie Mae ethics officials, according to WSJ.

- NVIDIA (NVDA) CEO Huang told reporters that he hopes to sell the Blackwell chip to China, but as it stands there are no plans to do so. Sales were not a topic of discussion during the meeting with China's Council for the Promotion of Trade. Co. has been growing quickly, but in the last six months this has accelerated "quite substantially".

- BofA Flow Show: USD 17.2bln into equities, USD 17bln into bonds, USD 36.5bln into cash, USD 600mln into crypto, USD 7.5bln out of gold.

Geopolitics

Middle East

- Palestinian media reports Israeli raids targeted Khan Younis in the southern Gaza Strip, according to Sky News Arabia.

Russia/Ukraine

- US reportedly cancelled the Trump-Putin meeting after Moscow sent a memo to Washington, as the Russian Foreign Ministry’s maximalist demands for ending the Ukraine war led to the US scrapping the planned meeting in Budapest, according to FT.

- Russia's Kremlin on FT report that US President Trump and Russia's President Putin meeting is cancelled says "I'd refer you to Russia's Foreign Ministry statement, not newspapers reports".

Other News

- US President Trump's administration identified targets in Venezuela that include military facilities used to smuggle drugs, according to WSJ citing US officials familiar with the matter. Furthermore, the officials stated that if Trump decided to move forward with airstrikes, the targets would send a clear message to Venezuelan leader Maduro that it is time to step down.

- US Secretary of Defense Hegseth met with Chinese counterpart Dong Jun, which he said was a good and constructive meeting, while he highlighted the importance of maintaining the balance of power in the Indo-Pacific. Furthermore, he highlighted US concerns about China’s activities in the South China Sea and said the US will continue to stoutly defend its interests.

Crypto

- Bitcoin is a little lower and trades just shy of USD 110k, whilst Ethereum is extending losses below USD 4k.

APAC Trade

- APAC stocks traded mixed as the region digested recent earnings releases and a data deluge at month-end.

- ASX 200 was flat as gains in mining, materials and resources were offset as defensives lagged.

- Nikkei 225 outperformed and climbed above the 52,000 level to print a fresh all-time high after recent currency weakness and the lack of immediate rate hike signals from the BoJ, while participants digested a slew of data, including a higher Unemployment Rate, hot Tokyo CPI and a rebound in Industrial Production.

- Hang Seng and Shanghai Comp were amid losses in tech stocks, and after Chinese Manufacturing PMI data missed expectations and showed a faster pace of contraction in factory activity

Notable Asia-Pac Headlines

- Japanese Finance Minister Katayama said discussions on lowering gasoline prices have progressed, including sources for funding, while she added that the Bank of Japan’s recent decision was extremely reasonable and that monetary policies are up to the BoJ to decide. Katayama also commented that they are recently seeing one-sided and rapid moves, as well noted, it is important for currencies to move in a stable manner reflecting fundamentals and they are closely watching foreign exchange moves with a high sense of urgency.

Data Recap

- Chinese NBS Manufacturing PMI (Oct) 49.0 vs. Exp. 49.6 (Prev. 49.8); Non-Mfg PMI (Oct) 50.1 vs. Exp. 50.1 (Prev. 50.0)

- Chinese Composite PMI (Oct) 50.0 (Prev. 50.6)

- Japanese Industrial Production Prelim. MM SA (Sep) 2.2% vs. Exp. 1.6% (Prev. -1.5%)

- Japanese Retail Sales YY (Sep) 0.5% vs. Exp. 0.7% (Prev. -1.1%, Rev. -0.9%)

- Japanese Unemployment Rate (Sep) 2.6% vs. Exp. 2.5% (Prev. 2.6%)

- Tokyo CPI YY (Oct) 2.8% vs Exp. 2.4% (Prev. 2.5%); Ex. Fresh Food YY (Oct) 2.8% vs Exp. 2.6% (Prev. 2.5%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Oct) 2.8% vs Exp. 2.6% (Prev. 2.5%)