Market Wrap 2026-02-20

- According to reports, US President Trump is considering a limited strike to pressure Iran into a nuclear agreement; the President is evaluating various military options but states that diplomacy is still his preferred approach.

- European stock markets are recovering from losses experienced on Thursday, with Moncler providing support to the luxury goods sector; US stock futures are gaining momentum from their Eurozone counterparts.

- The USD is slightly stronger, the GBP is seeing modest gains due to robust Retail Sales/PMIs, and the JPY is weaker following CPI data.

- A UK surplus is bolstering Gilts, while Bunds are declining from their peaks as Manufacturing returns to growth.

- Crude oil is slightly lower as attention remains on the US and Iran; Precious metals are maintaining their strength amid geopolitical uncertainty.

- Upcoming key events include the US S&P Flash PMIs (Feb), US PCE/GDP (Dec/Q4), Canadian Retail Sales (Jan), and potential SCOTUS Opinions day (possible decision on President Trump's IEEPA tariffs). Scheduled speakers include Fed’s Logan & Bostic.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (STOXX 600 +0.5%) have rebounded from Thursday's sell-off, with the FTSE MIB (+1.0%) and CAC 40 (+0.7%) showing the largest gains. The FTSE 100 (+0.7%) is also up, supported by strong January retail sales and a PSNB surplus figure that significantly exceeded expectations.

- European sectors are generally positive; Consumer Products and Services (+1.7%) are leading, closely followed by Chemicals (+1.4%). Conversely, the decline in oil prices is affecting the Energy sector (-0.6%). Moncler (+11.9%) reported positive FY earnings, surpassing revenue and net income estimates. This is boosting other luxury companies like LVMH (+3.0%) and Kering (+1.2%).

- US equity futures (ES/RTY +0.2%, NQ +0.3%) are mostly positive, recovering after Thursday's losses in the Financial sector, which followed reports that Blue Owl halted redemptions at its private credit fund. The company has since stated that it is not halting investor liquidity. Attention is now focused on US GDP/PCE data due later.

- Anglo American (AAL LN) reported the following FY 2025 figures (USD): Revenue 18.5bln (previous 17.7bln Y/Y), Adj. Profit 610mln (expected 710.8mln), Adj. EBITDA 6.4bln (expected 6.34bln). The company took a pre-tax impairment charge of USD 2.3bln related to De Beers. It also anticipates USD 1.8bln in run-rate cost savings.

- NVIDIA (NVDA) is reportedly nearing a USD 30bln investment in OpenAI, which would replace the previous unfinished USD 100bln deal, according to the FT.

- Samsung Electronics (005930 KS) is likely to win an exclusive HBM4 deal for NVIDIA's (NVDA) top Vera Rubin GPU, according to ChosunBiz.

FX

- The DXY is slightly firmer, trading in a range of 97.84 to 98.07, with the day's high matching the week's best; it is currently holding around its 50 DMA at 97.96. Focus remains on the geopolitical situation between the US and Iran. President Trump stated that 15 days is the maximum deadline to reach an agreement with Iran, or it will be “unfortunate” for them. Recent reports suggest that Trump is considering a “limited” strike to force Iran into a deal. Attention will be on US data, including US GDP and PCE.

- The GBP is slightly firmer/flat. Retail Sales data was exceptionally strong, with the upside attributed to strong “artwork and antiques sales, alongside continued strong sales from online jewellers”. Other components also showed a pick-up in more conventional figures such as household goods store sales, with clothing sales also rising. The PSNB was in surplus in January and exceeded expectations, although the figure is subject to the usual caveats for the period (tax filings). The GBP initially moved higher but then pared that move; thereafter, a strong set of PMI metrics took Cable to a session high of 1.3478. Despite the strong metrics, the inner report suggested that “ongoing worrying labour market weakness will likely result in a growing call for further rate cuts”. Market pricing for the BoE meeting was little moved, with the chance of a March cut priced in at 88% whilst April is fully priced.

- The JPY is slightly weaker, succumbing to broader USD strength and following the region’s inflation report, which had a dovish skew. National CPI printed at 1.5% (expected 1.6%), core was in-line, while the supercore metric was slightly below consensus. PMIs printed better-than-expected, benefiting from increased optimism following Takaichi’s landslide victory. Following the inflation data, Pantheon Macro wrote that the inflation report “justifies” the BoJ taking time on a rate hike. USD/JPY is in a 154.87-155.64 range.

- Other G10 currencies are broadly lower against the USD. The Aussie is managing to stay afloat, while the EUR is moving slightly lower. ECB's Lagarde said her baseline is finishing the ECB term, while she added that she has accomplished a lot but needs to make sure it is solid. EZ PMIs continue to confirm the modest recovery picture in the EZ. The strong German report spurred fleeting EUR strength.

FIXED INCOME

- USTs are near enough flat in thin 112-29+ to 113-02 parameters. Specifics for the space are somewhat light thus far as we count down to a packed 13:30GMT data docket and await any further insight on US-Iran tensions before potential SCOTUS opinion(s) at 15:00GMT.

- Gilts had two leads to digest at the open. Stronger-than-expected retail sales, though with caveats, were a bearish driver as the data doesn't push BoE's Bailey (or any of the hawks, particularly focused on Mann) towards voting for a cut in March vs April; however, ultimately, the data will have little impact on that discussion. Separately, a larger-than-expected government PSNB surplus in January served as a bullish driver. Gilts came off best levels alongside EGBs into the morning's UK PMIs, a series that printed above consensus across the board. Within the series, S&P's Williamson wrote that "relatively modest price pressures being signalled and ongoing worrying labour market weakness will likely result in a growing call for further rate cuts".

- Bunds spent the morning firmer, with gains of 20 ticks at best, notching a 129.45 peak, strength that seemed to just be a continuation of recent gains. Thereafter, the benchmark fell from best and moved to near-enough unchanged on the session at a 129.28 trough following the morning's PMIs, which were generally strong and particularly so for manufacturing, which unexpectedly returned to expansionary territory for Germany for the first time in over 3.5 years.

- Australia sold AUD 800mln 3.25% April 2029 bonds, b/c 3.89, avg. yield 4.3014%.

COMMODITIES

- Crude benchmarks are pausing, with both WTI and Brent trading subdued, though still near highs for the week, due to the heightening geopolitical tension between the US and Iran. US President Trump yesterday reiterated that Iran has 10-15 days to strike a deal, or else something bad will happen. However, during a report by the WSJ, which stated that Trump is reportedly weighing a limited strike to force Iran into a nuclear deal. WTI and Brent are trading at the lower end of USD 65.86-67.03/bbl and 71.10-72.34/bbl, respectively.

- In the precious metal space, spot gold was aided by the ongoing geopolitical tension, with the yellow metal crossing the USD 5,000/oz mark to the upside overnight. The dollar has waned from its best levels throughout the European session after finding resistance at Thursday's high, thus underpinning gold prices. XAU and XAG are trading at the upper range of USD 4,981.58-5,042.37/oz and USD 77.47-81.20/oz, respectively.

- Copper prices are also firmer, tracking broader risk sentiment in the European session. Otherwise, a fresh macro catalyst has been lacking for the red metal, especially with the Chinese market on holiday. 3M LME copper trades at the upper range of USD 12.781-12.895k/t.

- The Iranian Oil Minister said cooperation with the US on oil is possible.

- The Hungarian government will release 250k tonnes of crude oil from its strategic reserves after Druzhba oil flow stopped.

- The US ambassador to India said active negotiations are underway with India's Energy Ministry on the import of Venezuelan oil.

- Goldman Sachs sees significant upside to gold price forecasts on further private sector diversification when expressed through call option structures.

- US President Trump said 50mln bbls of Venezuelan oil are on the way to Houston and US-Venezuela energy cooperation is going well.

TRADE/TARIFFS

- India's Trade Minister said they expect the US to issue a notice on lowering the import tariff to 18% during February.

- India's Trade Minister said they expect the trade deal with the UK to come into effect by April.

- The Indonesian Government said they will get 19% tariffs on most goods, with 0% on coffee, chocolate and rubber in the US trade deal. Deal also will not involve any third country when asked about China trans-shipment concerns.

- Japan's Trade Minister Akazawa said not set the timing on the second set of US investment projects, adds want to make sure PM Takaichi's US trip in March is fruitful.

- The White House releases a fact sheet on the Trump administration finalizing the trade deal with Indonesia that will provide Americans with unprecedented market access and unlock major breakthroughs for America’s manufacturing, agriculture, and digital sectors.

- US President Trump accused China of flooding the US market with subsidized goods.

- US President Trump said steel tariffs have been a game-changer.

NOTABLE EUROPEAN DATA RECAP

- UK S&P Global Services PMI Flash (Feb) 53.9 vs. Exp. 53.5 (Prev. 54.0, Low. 52.8, High. 54.2).

- UK S&P Global Manufacturing PMI Flash (Feb) 52.0 vs. Exp. 51.5 (Prev. 51.8, Low. 51, High. 52.5).

- UK S&P Global Composite PMI Flash (Feb) 53.9 vs. Exp. 53.3 (Prev. 53.7, Low. 52.8, High. 53.9).

- UK Retail Sales MoM (Jan) M/M 1.8% vs. Exp. 0.2% (Prev. 0.4%, Low. -0.6%, High. 1.0%).

- UK Retail Sales ex Fuel MoM (Jan) M/M 2.0% vs. Exp. 0.2% (Prev. 0.3%, Low. -0.1%, High. 0.9%).

- UK Retail Sales YoY (Jan) Y/Y 4.5% vs. Exp. 2.8% (Prev. 1.9%, Rev. From 2.5%, Low. 2.4%, High. 3.6%).

- UK Retail Sales ex Fuel YoY (Jan) Y/Y 5.5% vs. Exp. 3.6% (Prev. 2.5%, Rev. From 3.1%, Low. 3.2%, High. 4.2%).

- UK Public Sector Net Borrowing Ex Banks (Jan) 30.4B surplus vs. Exp. 23.8B surplus (Prev. -11.58B borrowing).

- EU HCOB Manufacturing PMI Flash (Feb) 50.8 vs. Exp. 50 (Prev. 49.5, Low. 49.4, High. 50.5).

- EU HCOB Services PMI Flash (Feb) 51.8 vs. Exp. 51.9 (Prev. 51.6, Low. 51.4, High. 52.3).

- EU HCOB Composite PMI Flash (Feb) 51.9 vs. Exp. 51.5 (Prev. 51.3, Low. 51.3, High. 52). "

- German HCOB Services PMI Flash (Feb) 53.4 vs. Exp. 52.3 (Prev. 52.4, Low. 51.8, High. 53).

- German HCOB Composite PMI Flash (Feb) 53.1 vs. Exp. 52.3 (Prev. 52.1, Low. 51.8, High. 52.7).

- German HCOB Manufacturing PMI Flash (Feb) 50.7 vs. Exp. 49.5 (Prev. 49.1, Low. 49.2, High. 50.2).

- French HCOB Services PMI Flash (Feb) 49.6 vs. Exp. 49.2 (Prev. 48.4, Low. 48.2, High. 49.7).

- French HCOB Composite PMI Flash (Feb) 49.9 vs. Exp. 49.7 (Prev. 49.1, Low. 49.1, High. 50.5).

- French HCOB Manufacturing PMI Flash (Feb) 49.9 vs. Exp. 51 (Prev. 51.2, Low. 51, High. 51.5).

- German PPI YoY (Jan) Y/Y -3.0% vs. Exp. -2.1% (Prev. -2.5%, Low. -2.4%, High. -1.9%).

- German PPI MoM (Jan) M/M -0.6% vs. Exp. 0.3% (Prev. -0.2%, Low. -0.1%, High. 0.5%).

- ECB EZ Indicator of Negotiated Wages (Q4) 3.00% (exp. 2.9%)

CENTRAL BANKS

- Fed's Daly (2027 voter) said policy is in a good place and labour market is in a better position after 75bps of cuts, adds inflation continues to decline outside goods sector. said:We have more work to do to get inflation down, but don't want to get behind, or over our skis.

- ECB's Lagarde said her baseline is finishing the ECB term, according to WSJ.

- ECB President Lagarde called for cooperation to 'save global order' in award acceptance speech in New York.

- RBNZ Governor Breman noted that although central bank remains forward focus, monetary policy will adapt based on new information instead of following a predetermined path. The path back to 2% inflation has been bumpy, but expects inflation to be within the target range in Q1. Central bank is confident inflation will return to 2% midpoint over the next 12 months. NZD is not too far from fair value right now.

NOTABLE US HEADLINES

- US President Trump wants to ban investors that own more than 100 homes from buying more, which could potentially ban hundreds of investment firms, according to WSJ.

- US President Trump said regarding affordability 'we've solved it' and will talk about inflation in the State of the Union next week.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin reiterates that there's no confirmed date set for a new round of talks with Ukraine.

- Ukraine's President Zelensky said he's ready to discuss with the US about compromises.

- Next round of Russia-Ukraine talks is reportedly possible next week, via TASS.

MIDDLE EAST

- US President Trump reportedly weighs limited strike to force Iran into nuclear deal, according to WSJ; President considers a range of military options but said he still prefers diplomacy. Trump is considering an initial limited military strike on Iran to force it to meet his demands for a nuclear deal, in an attempt to pressure Tehran into an agreement but fall short of a full-scale attack that could see a major retaliation. Sources add, the opening fire, which if authorized, could come within days, would target a few military or government sites. If Iran still refused to comply with Trump’s directive to end its nuclear enrichment, the US would respond with a broad campaign against regime facilities.

- Semafor, on US President Trump reviewing his options regarding Iran, writes "He hasn’t made a decision yet, though people close to the president see an attack as growing more likely by the day."

- Iran said in letter to UN Secretary General and members of the Security Council that if they are attacked, all bases, facilities and assets of hostile force in the region will constitute legitimate targets within the framework of Iran's defensive response.

- Palestinian media reported Israeli warplanes launched a raid on the Al Tufar neighbourhood in Gaza City, according to Sky News Arabia.

OTHERS

- Russia's Foreign Minister Lavrov discusses Iranian nuclear program with Iranian counterpart, TASS reported.

- China is monitoring US military aircraft movements over Yellow Sea, according to Global Times.

- NORAD said it detected and tracked two Tu-95s and two Su-35s and one A-50 operating Alaskan ADIZ on February 19th, while it launched several aircraft to intercept and positively identify, and escort the aircraft until they departed the Alaskan ADIZ.

- New Zealand provides a Russia sanctions update which includes a designation of 23 individuals, 13 entities, and 100 vessels, while it lowered the oil price cap on Russian oil from USD 47.60/bbl to USD 44.10/bbl.

CRYPTO

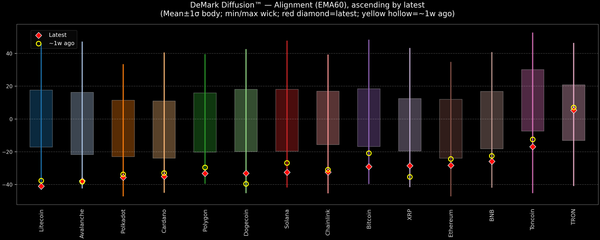

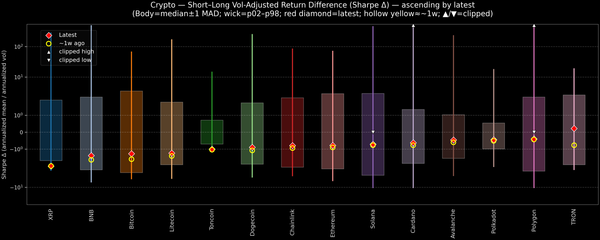

- Bitcoin rebounds back above USD 68,000 while Ethereum trades rangebound below USD 2,000.

APAC TRADE

- APAC stocks followed suit to the predominantly negative mood on Wall Street, where risk appetite was subdued amid private credit fund concerns and geopolitical risks related to the US and Iran following Trump's latest threat and 10-15 day ultimatum.

- ASX 200 was lacklustre amid underperformance in the tech, telecoms and consumer sectors, while participants continued to digest a slew of earnings, although downside was stemmed by resilience in utilities and the top-weighted financial industry.

- Nikkei 225 stumbled back beneath the 57,000 level with the index pressured despite recent currency weakness and the softer inflation data, which essentially provides the BoJ with more policy space, while tech and autos were among the industries notably represented in the list of worst-performing stocks.

- Hang Seng retreated upon returning from the Lunar New Year holidays with the big tech names leading the declines in the index, while mainland markets and the Stock Connect remained shut and won't open until next Tuesday.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi said there is a dearth of domestic investment in Japan and will stop trend of austerity and lack of investment. She pledges to drive a significant investment via multi-year budgets and long-term funding strategies and affirms that essential expenditures will be maximised through the initial budget allocation. Affirms commitment to prudent fiscal policies to maintain market confidence. Aims for swift approval of crucial legislation, including tax reform, by the end of FY26/27. Government will unveil an investment roadmap for 17 strategic sectors beginning next month. Announced acceleration of nuclear reactor restarts.

- Japan PM Takaichi to promote measures to spur private spending and outline plans for increased strategic investment, active but responsible fiscal policy, and more assertive diplomacy in parliamentary address, according to Bloomberg.

NOTABLE APAC DATA RECAP

- Japanese National CPI Ex. Fresh Food YY (Jan) 2.0% vs Exp. 2.0% (Prev. 2.4%).

- Japanese National CPI Ex. Fresh Food & Energy YY (Jan) 2.6% vs Exp. 2.7% (Prev. 2.9%).

- Japanese National CPI YY (Jan) 1.5% vs Exp. 1.6% (Prev. 2.1%).

- Japanese S&P Global Services PMI Flash (Feb) 53.8 (Prev. 53.7).

- Indian HSBC Composite PMI Flash (Feb) 59.30 (Prev. 58.40, Rev. From 58.4).

- Indian HSBC Services PMI Flash (Feb) 58.4 (Prev. 58.5).

- Indian HSBC Manufacturing PMI Flash (Feb) 57.5 (Prev. 55.4).

- Australian S&P Global Composite PMI Flash (Feb) 52.0 (Prev. 55.7).

- Australian S&P Global Services PMI Flash (Feb) 52.2 (Prev. 56.3).

- New Zealand Exports (Jan) 6.21 (Prev. 7.51, Rev. From 7.65).

- New Zealand Imports (Jan) 6.73 (Prev. 7.60, Rev. From 7.6).

- New Zealand Balance of Trade (Jan) -519B vs. Exp. -0.745B (Prev. -88B, Rev. From 0.052B).

- US President Trump reportedly weighs limited strike to force Iran into nuclear deal, according to WSJ; President considers a range of military options but says he still prefers diplomacy.

- European equities rebound from Thursday's losses, Moncler supports the luxury sector; US equity futures taking impetus from its EZ counterparts.

- USD slightly firmer, GBP mildly benefits on strong Retail Sales/PMIs, JPY weaker post-CPI.

- A UK surplus supports Gilts while Bunds fade from highs as Manufacturing returns to expansion.

- Crude slightly softer as focus remains on US and Iran; Precious metals maintain their shine amid geopolitical uncertainty.

- Looking Ahead, highlights include US S&P Flash PMIs (Feb), US PCE/GDP (Dec/Q4), Canadian Retail Sales (Jan), SCOTUS Opinions day (potential decision on President Trump's IEEPA tariffs). Speakers include Fed’s Logan & Bostic.