Mastercard Q3 2025 Earnings | Core-Brief

1. Core print

- Net revenue: up +15% y/y (cc).

- Value Added Services & Solutions (VAS): up +22% y/y (≈19% organic, +3ppt from Recorded Future/Minoa).

- Operating expenses: +14% (partly M&A, partly infra, products, marketing).

- EPS: $4.38, helped by $3.3B buybacks (another $1.2B after Sept. 30).

- GDV: +9% globally; U.S. +7%, non-U.S. +10%.

- Cross-border volume: +15% — still very resilient.

- Switch transactions: +10%; contactless = 77% of in-person switched purchase txns (up 6ppt y/y).

- Company says consumer + business spending “remains healthy”; wealth effect and labor market still supportive.

2. What drove the quarter

- Payments network revenue +10% → more domestic/cross-border transactions + some pricing.

- VAS is the growth lever: fraud / cyber / digital identity, tokenization services, consulting, loyalty, data & marketing, and now Merchant Cloud. Mastercard keeps pushing services because it’s a $165B serviceable market and it’s less cyclical than carded spend.

- Acquisitions added 1ppt to revenue growth.

3. Strategic wins

- Kept winning/renewing co-brands and bank portfolios: Japan Airlines, Volaris (Mexico), Uni-President (Taiwan), Nordea, Nubank US debit, FAB (UAE), Saudi National Bank, Doha Bank, C6 (Brazil) — lots of affluent portfolios, which support cross-border and fee yield.

- Continued to open closed-loop → open-loop in transit (Italy, Japan, Chile, Chengdu, Guangzhou): tap-to-ride is now a transaction multiplier. Open-loop transit GDV +25% y/y.

- Building card rails into digital wallets (Alipay+, GCash, Kakao Pay, PhonePe) so wallet users can ride on Mastercard’s global acceptance.

4. Agentic commerce = the “new payments rail” angle

- Mastercard is positioning itself as the trusted acceptance layer when AI agents start buying things for people.

- Mastercard Agent Pay: registers/certifies AI agents, passes trust to merchants, and lets any Mastercard merchant participate with almost no extra integration (“no-code”).

- Already did the first agentic transaction on the network; U.S. Bank and Citi cards work now; U.S. rollout completes in November, global in early 2026.

- Why it matters: when agents split one purchase into 3–4 micro-purchases, total transactions go up → Mastercard wants to capture that incremental volume.

- Mastercard says its security, identity, tokenization, dispute/chargeback intelligence (Ethoca) are exactly what you need when a bot, not a human, pressed “buy.”

5. Stablecoins & cross-border

- Mastercard continues to treat stablecoins = another funding method if they’re regulated and safe.

- ~130 crypto co-brand programs live; volume “growing at a healthy clip.”

- Mastercard Move (disbursements + remittances) did +35% transactions and now supports stablecoin → fiat and pre-funding in EMEA.

- Mastercard thinks combining agentic commerce + tokenization + stablecoins is a long runway.

6. B2B / SMB

- Small-business cards in market +10% y/y via banks and alternative distributors (Zagal India, RTS US, Instacart SMB card).

- Virtual cards keep expanding via travel/B2B platforms in LatAm and Europe; suppliers get paid faster, buyers get spend control.

- Flexible-rate B2B programs in the U.S. have almost doubled customers in 2 years → they’re scaling this globally.

7. New services / media

- On-demand decisioning: issuers can change authorization rules live.

- Merchant Cloud: one platform for gateway, tokenization, fraud, insights.

- Mastercard Commerce Media: uses 500M permissioned consumers + 25K merchants to give advertisers purchase-level attribution — “every $ should be tied to an actual buy.”

- Early interest from advertisers/publishers, but it’s still early.

8. Outlook / guide

- Q4 2025: net revenue growth expected at the high end of low-teens (cc, ex-M&A); FX +4–4.5ppt tailwind; M&A +1–1.5ppt.

- Opex Q4: low-teens (cc, ex-M&A); M&A adds 4–5ppt.

- Full-year 2025: net revenue low-teens (cc) incl. M&A; opex at low end of low-teens (cc, ex-M&A).

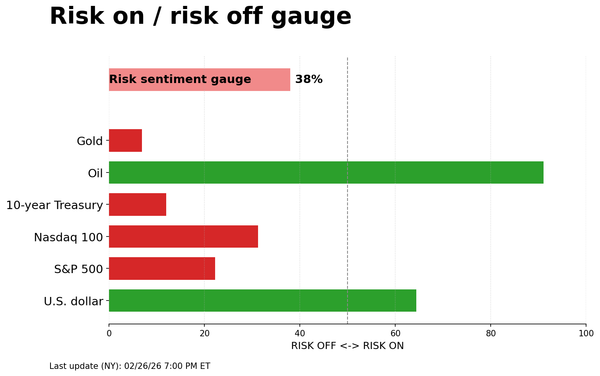

- Macro they see today = still supportive, but they flagged geopolitical and economic uncertainty as usual.

9. Capital One / Discover debit migration

- U.S. switched volume in early Oct. stepped down because of Capital One debit migration and tough weather comps from 2024.

- 2025 impact is not material; 2026 will show more of the debit loss, partly offset by contractual items; 2027 will show the full headwind when those offsets roll off.

- Mastercard reminded everyone: they have 27,000 bank partners globally — so one U.S. migration doesn’t break the growth story.

10. Core-Brief angle

- This was a “everything is working” quarter: consumer spend ok, cross-border ok, VAS accelerating, and pipeline in transit/wallets/B2B.

- What’s new is not the P&L — it’s how assertive they were on agentic commerce. Mastercard wants to be the network that AI agents trust. That’s the real story.