Weekly Market Wrap — Oct 20–24, 2025

WEEKLY SNAPSHOT

Equities chopped but ultimately firmed into week-end; Treasuries were mixed with a bearish tilt as oil rallied; crude jumped on Russia-related sanctions headlines; the Dollar was broadly stable; gold saw a violent mid-week drawdown before stabilizing.

WEEK IN BRIEF

- US–China: Markets traded headline-to-headline around a slated Trump–Xi meeting next Thursday. The US is weighing export controls on goods to China made with/containing US software and is also said to probe China’s 2020 trade deal compliance.

- Russia sanctions & energy: US sanctioned Rosneft and Lukoil; reports said some Chinese state oil firms paused seaborne Russian buys; Europe is preparing further measures (incl. LNG). Oil surged; Energy led equities.

- Fed & data: With the government shutdown curbing releases, Friday’s US CPI stands out as the key print into next week’s FOMC (markets lean to -25 bps and chatter about ending QT soon). 5-yr TIPS auction was soft; 20-yr auction was solid earlier in the week.

- Japan: Takaichi confirmed as PM; unions (RENGO) target ~5% wage rises in 2026 Shuntō; BoJ watchers focused on CPI and the Oct 30 meeting.

- Europe/UK: Macron urged use of the EU anti-coercion tool vs China; EZ consumer confidence beat; UK CPI cooled, pushing BoE expectations more dovish.

- Turkey/EM: CBRT cut 100 bps to 39.50% as flagged; EMFX moves followed risk tone and commodities (LatAm mixed; CLP/COP traced copper/oil).

- Sector/earnings color: TSLA reversed post-earnings losses; MOH guidance cut weighed on managed-care; Industrials/Staples had bright spots (GE, 3M, KO impairment one-offs); SMCI prelims disappointed; LVS boosted buybacks/dividend; QS shipped B1 samples; NVDA–UBER AV collab buzz; NFLX/TXN guidance underwhelmed.

MACRO & POLICY

- US housing: Existing Home Sales rose +1.5% m/m to 4.06mn in Sep; inventory 4.6 months; median price $415.2k (+2.1% y/y). Pantheon sees scope for a further (rate-driven) sales recovery but expects activity to stay below pre-COVID and looks for modest home-price declines to restore affordability.

- Rates expectations / STIRs (late-week marks): Oct ~24 bps, Dec ~49 bps, Jan ~65 bps of cumulative cuts priced. EFFR ~4.11%; SOFR ~4.21%. RRP usage stayed de minimis; repo take-up ticked from zero mid-week to modest.

- Balance sheet: Fed rhetoric kept QT-end speculation alive as reserves approach “ample”; baseline market take is UST reinvestments resuming while MBS continues to roll off.

FIXED INCOME

- USTs: Oil-led bear-flatteners mid/late-week; 5-yr TIPS tailed (soft); 20-yr auction was strong earlier; curve moves modest net on the week with a bearish bias vs Tue. Thursday settlements (indicative): 2y ~3.48%, 10y ~3.99%, 30y ~4.58%.

- Breakevens: BEIs firmed a few bps across the curve into CPI (10y near 2.29% late-week).

- Supply (next): 2s/5s/7s (Oct 27–28) and 2-yr FRN (Oct 29); bills heavy as usual.

EQUITIES

- US:

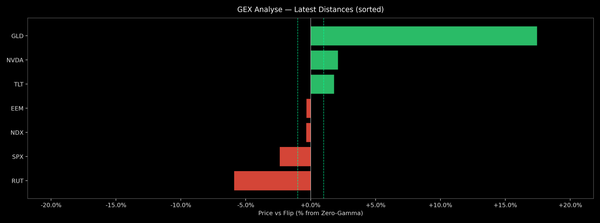

- Indices: After mid-week risk-off on export-control chatter, stocks rebounded Thu with SPX/NDX up and RUT outperforming cyclicals.

- Leaders/laggards: Energy and Industrials outperformed on oil and select earnings; Health Care underperformed on MOH; Tech mixed (cloud decel at IBM, SMCI prelim miss vs NVDA ecosystem headlines). TSLA staged a full reversal of the initial earnings hit.

- Single-names: Upside beats/guidance lifts at GE, 3M, HON, LVS, MEDP, AAL; underwhelming at NFLX, TXN, ROP, and MRNA (CMV miss). Corporate actions/theme: LVS buyback/dividend hike; WBD M&A chatter; QS B1 sample shipments; KO flagged a Q4 impairment on African bottling stake sale.

- Europe: Bourses chopped with Energy strength offset by France-specific credit hangover early week; UK supported by dovish CPI impulse; DAX/EuroStoxx range-bound; FTSE 100 benefited from defensives/energy.

- APAC: Nikkei 225 printed fresh ATHs on political clarity and risk appetite; China/HK firmed on in-line/beat macro prints and LPR on hold.

COMMODITIES

- Crude: WTI Dec vaulted from high-50s to low-60s, settling late-week near $61.8/bbl; Brent Dec near $66/bbl. Drivers: US sanctions on Russian majors; reports of Chinese state buyers pausing Russian seaborne purchases; Europe mulling extra curbs; EIA drew on crude/gasoline; OPEC signals willingness to offset shortages; Ekofisk 2/4 K outage noted. JPM estimated China added ~160mb to reserves in 2024 (largest since 2020).

- Gold: From fresh highs to the largest single-day drop on record early week, then stabilization into Friday as real yields/breathless positioning cooled.

- Base metals: Copper held gains on steadier China activity beats.

FX

- Dollar: Range-bound; higher UST yields didn’t translate to a broad USD breakout with risk improving late-week.

- G10: JPY softened on yield differentials and equity strength; EUR little changed; GBP lagged on soft CPI/BoE repricing; AUD/NZD rallied with risk and China headlines; CAD tracked oil but ended roughly flat vs USD.

- EMFX: MXN/BRL/CLP/COP moved with commodities and local data (MXN retail beat; CLP/COP levered to copper/oil); TRY saw mild gains post-CBRT -100 bps.

THEMES TO WATCH (Next Week)

- FOMC: -25 bps baseline; watch QT-end signaling and balance-sheet composition (UST vs MBS).

- US CPI follow-through: trend vs shelter/core services; implications for cuts path into Q1.

- Trump–Xi meeting: scope for de-escalation vs incremental export-control frictions; watch anti-coercion responses out of the EU.

- Energy policy & sanctions: durability of crude rally; OPEC response cadence; European LNG stance.

- Earnings micro: guidance quality and inventory/pricing commentary across cyclicals, semis supply chain, and managed care.

APPENDIX — Notable Late-Week Marks & Color

- UST settlements (Thu): 2y 3.48%, 10y 3.99%, 30y 4.58%; BEI 10y ~2.29%.

- Crude settlements (Thu): WTI Dec $61.79, Brent Dec $65.99.

- STIRs: Oct ~24 bps, Dec ~49 bps, Jan ~65 bps cuts priced.

Operations: RRP ~$7bn across ~15 c/ps; repo ~$3bn; EFFR 4.11%, SOFR 4.21% (Oct 22).