Market Wrap 2026-02-22

Today's US Market Wrap — Key Points

- Trump implements new tariffs after IEEPA ruling; Section 232 & 301 tariffs remain.

- Q4 GDP soft, impacted by shutdown; December PCE hotter than expected.

- Flash PMIs & UoM survey disappoint; New Home Sales exceed expectations.

- Treasury supply & corporate debt issuance in focus next week.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

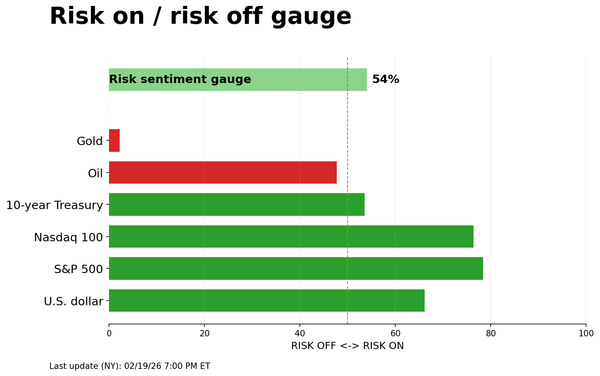

Equities mostly ended higher, gaining ground after the Supreme Court struck down the Trump administration's IEEPA tariffs. In response, President Trump implemented a 10% global tariff under Section 122 (legally capped at 150 days). Section 232 and 301 tariffs remain unchanged, and the US will conduct Section 301 probes on nations over five months (150 days), after which a "fair" 301 tariff rate will be enforced. These measures are expected to offset lost IEEPA tariff revenue. The Treasury anticipates tariff revenue in 2026 will remain consistent with previous estimates. T-notes initially sold off due to concerns about income loss and potential tariff refunds but recovered on expectations that Trump would enforce tariffs through other means, which was later confirmed. The Dollar initially weakened but pared losses to end slightly lower. The Australian Dollar outperformed, while safe-haven currencies lagged. Crude prices were flat in choppy trading, with overnight gains offset by reports that Trump is considering a limited strike on Iran. Silver and Gold prices increased, and Bitcoin also saw buying interest. US data included soft Q4 GDP, impacted by the government shutdown, and a hotter-than-expected December PCE report. S&P Global Flash PMI data and the University of Michigan (UoM) survey underwhelmed, but new Home Sales exceeded expectations. Price action was primarily driven by trade updates.

US

TARIFFS: Following the Supreme Court's ruling against Trump's IEEPA tariffs, the President immediately implemented a 10% global tariff (under Section 122) and confirmed that all Section 232 and 301 tariffs remain in place. Trump emphasized his intention to impose tariffs through other means, citing five options: the Trade Expansion Act of 1962 (Section 232); the Trade Act of 1974 (Sections 122, 201, and 301); and the Tariff Act of 1930 (Section 338). He noted that Section 338 takes longer to implement. Trump stated that the ruling clarifies what the US can and cannot do. He also announced Section 301 probes to protect the US, lasting five months, to determine a fair tariff rate. Regarding refunds, Trump suggested potential litigation lasting five years. He also noted that some trade deals negotiated under IEEPA are no longer valid, but stressed that nothing has changed with India. Invalid trade deals will be replaced by other tariffs. The President stated he would take an even stronger approach and charge more than before, expecting tariff income to increase. A US official later stated that the US expects countries to honor trade frameworks. Treasury Secretary Bessent said that the use of sections 122, 232, and 301 tariffs is projected to result in virtually unchanged tariff revenue in 2026, offsetting any lost revenue from the absence of IEEPA tariffs.

PCE (DEC): The headline PCE rose 0.4% in December, up from 0.2% previously and above the 0.3% forecast, bringing PCE prices to 2.9% Y/Y, above the 2.8% expectation and the prior reading. Core prices also rose 0.4% M/M, above the 0.3% forecast and up from November’s 0.2%. Core Y/Y increased to 3.0% from 2.8%, exceeding the 2.9% forecast. Personal Income rose 0.3%, in line with forecasts but easing from 0.4% previously, while spending increased 0.4%, matching forecasts and the prior reading. The firm inflation reading is a concern, but January CPI data, which was slightly softer, has helped alleviate some worries. Core PCE remains the Fed’s preferred gauge, and Fed Chair Powell indicated December Core PCE would rise 3.0%, with headline at 2.9%, aligning with Fed expectations and unlikely to significantly alter its stance. Recent data show stabilization in the labor market, and the Fed minutes noted that most members saw signs of stabilization and diminished downside labor risks. This shifts greater focus to inflation, which remains above target, supporting the case for holding rates for now. Pantheon Macroeconomics expects inflation data to cool decisively in May, prompting the FOMC, likely under new Chair Kevin Warsh, to ease policy at its June, July, and September meetings.

GDP (Q4): The Q4 2025 data were weak. Headline GDP grew 1.4%, below the 3.0% forecast and slower than the prior 4.4%. The government shutdown was attributed to much of the downside, with the BEA estimating it subtracted about 1% from real GDP growth in Q4. Even excluding this effect, growth would have been soft. Growth was driven by increases in consumer spending and investment, partly offset by declines in government spending and exports. The GDP price index rose 3.7%, above the 2.8% forecast and matching the prior. Headline PCE rose 2.9% from 2.8%, above the 2.8% forecast, while core PCE increased 2.7%, down from 2.9% previously but above the 2.6% forecast. Despite the weak headline figure, ING said GDP is set to rebound, noting that underlying consumer and investment data remain firm.

S&P GLOBAL FLASH PMIs (FEB): S&P Global Flash PMIs disappointed, with Manufacturing falling to 51.2 from 52.4, below the expected 52.6, and Services dipping to 52.3 (exp. 53, prev. 52.7), leaving the composite at 52.3 (prev. 53.0). The Flash PMI metrics indicate the slowest business growth for ten months amid weak demand, high prices, and bad weather. S&P Global chief economist Chris Williamson noted that customer demand growth has softened, and the PMI data so far this year are indicative of GDP rising at an annualized rate of just 1.5%, signaling a marked cooling of the economy in Q1 vs. the robust growth rates seen in H2 ’25. Williamson added that companies suggest that at least some of this slowdown may prove temporary, partly as extreme weather passes, with business growth expectations rising sharply to the highest for just over a year in February. However, confidence remains subdued overall, as companies worry about the political environment and the impact of policies such as tariffs.

MICHIGAN (FEB): Consumer Sentiment in February rose to 56.6 from 56.4 in January, below the expected and preliminary 57.3. Current Conditions rose to 56.6 from 55.4, beneath the expected 57.7 and down from the 58.3 preliminary. Consumer Expectations rose to 56.6 from 57.0 as expected, in line with the preliminary report. Inflation expectations were mixed; the 1yr saw a notable decline to 3.4% from 4.0%, below the 3.5% forecast and preliminary. The 5yr inflation projection was unchanged at 3.3%, below the 3.4% consensus and preliminary print. Surveys of Consumers Director Joanne Hsu wrote that overall, consumers do not perceive any material differences in the economy from last month. Oxford Economics believes that despite sentiment remaining near historically low levels, consumption will continue to grow at a solid pace of 2.5% in 2026.

NEW HOME SALES: The November and December reports were both released due to lagged effects from the government shutdown. Sales of new single-family homes fell to 745k from 758k in December but were still above the expected 730k. This represents a supply of 7.6 months at the current sales rate, -1.3% M/M, -7.3% Y/Y. The median sales price of new houses sold in December 2025 was USD 414.4k, +4.2% M/M, +2% Y/Y. Oxford Economics said that lower mortgage rates and plentiful supply are driving a recovery in new home sales that it expects will continue this year. However, the firm adds that the overhang of inventory will remain a drag on new construction for a while longer.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 1 TICK LOWER AT 112-30

T-notes were negatively impacted as the Supreme Court struck down Trump's tariffs but pared losses on expectations that Trump would offset lost tariff revenue through other tariff measures, which was later confirmed. At settlement, 2-year +1.2bps at 3.482%, 3-year +0.5bps at 3.503%, 5-year +0.1bps at 3.648%, 7-year +0.3bps at 3.846%, 10-year +0.8bps at 4.083%, 20-year +1.6bps at 4.670%, 30-year +1.8bps at 4.722%.

THE DAY: T-notes were ultimately little changed to slightly lower by settlement. The main focus of the day was the Supreme Court striking down US President Trump's IEEPA tariffs, immediately raising concerns on tariffs refund and a lack of income to the Treasury. This took T-notes to lows, but the move ultimately pared. The decision was expected, and Trump has since confirmed that he will be looking to implement tariffs through other means. The US will maintain Section 232 and 301 tariffs as they are but impose a flat 10% tariff globally under Section 122. The Section 122 tariff lasts for 150 days, unless extension is approved by Congress, but the US has also imposed Section 301 probes, which last five months (or c. 150 days). Once the 301 probes are completed, the US will announce fresh tariff rates on nations. The US Treasury expects tariff revenue to remain unchanged through 2026 due to these measures- hence the reversal in T-notes into settlement. Elsewhere, US data saw Q4 GDP heavily miss expectations, but it was distorted by government shutdown effects, albeit even with the 1.0% hit from the shutdown, the report was still soft with Q4 GDP growth at just 1.4%. Meanwhile, the December PCE report was released at the same time, which was hotter than expected. The data led to two-way trade in T-notes, but the main driver of price action was the tariff announcements from SCOTUS and US President Trump. Attention next week turns to Treasury supply, while dealers expect USD 50bln in high-grade corporate debt to be announced too.

SUPPLY

Bills

- US to sell USD 89bln of 13-week bills and USD 77bln of 26-week bills on February 23rd and USD 90bln of 6-week bills on February 24th; all to settle February 26th.

Notes

- US to sell USD 69bln of 2-year notes on February 24th, USD 70bln of 5-year notes on February 25th and USD 44bln of 7-year notes on February 26th; all to settle March 2nd

- US to sell USD 28bln of 2-year FRN's on February 25th; to settle February 27th

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: March 0bps (prev. 0bps), April 3.2bps (prev. 4.2bps), June 12.5bps (prev. 15.8bps), December 53.9bps (prev. 56.2bps).

- SOFR at 3.67% (prev. 3.73%), volumes at USD 3.238tln (prev. USD 3.258tln) on February 19th

- EFFR at 3.64% (prev. 3.64%), volumes at USD 100bln (prev. USD 104bln) on February 19th

- NY Fed RRP Op demand at USD 0.5bln (prev. 0.6bln) across 4 counterparties (prev 4)

CRUDE

WTI (J6) SETTLED USD 0.08 HIGHER AT 66.48/BBL; BRENT (J6) SETTLED USD 0.10 HIGHER AT 71.76/BBL

The crude complex was choppy to end the week but ultimately settled flat, as geopolitics, the Supreme Court tariff ruling, and data all dominated the macro landscape. WTI and Brent rose overnight to highs of USD 67.05/bbl and USD 72.34/bbl, respectively, before selling off through the European session to lows of USD 65.94/bbl and 71.06. Benchmarks then traded choppily within that range, as participants digested updates. Regarding US/Iran, which prompted fleeting downside, US President Trump confirmed reports that he is considering a limited strike on Iran, but nothing is confirmed. In Trump's IEEPA press conference, he reiterated, "Iran better negotiate a fair deal". Prior reports suggested that US military planning on Iran is highly advanced, with options ranging from targeting individuals to pursuing regime change, and participants will be watching for updates over the weekend. On Ukraine/Russia, Zelensky said they are counting on another round of negotiations as early as February, and that this can be truly productive, but there is no progress on territory discussions; he added all sides agreed on next meeting within 10 days and military talks are constructive. The weekly Baker Hughes Rig Count saw Oil unchanged at 409, Natgas unchanged at 133, and Total unchanged at 551.

EQUITIES

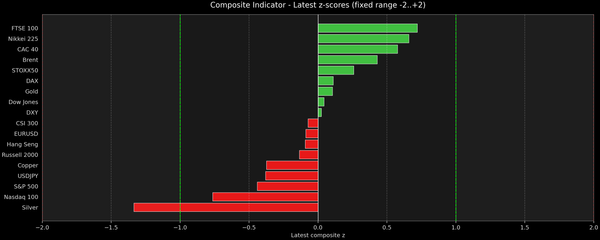

CLOSES: SPX +0.71% at 6,911, NDX +0.87% at 25,013, DJI +0.44% at 49,613, RUT -0.01% at 2,665.

SECTORS: Communication Services +2.63%, Consumer Discretionary +1.25%, Real Estate +0.77%, Financials +0.62%, Technology +0.51%, Utilities +0.41%, Industrials +0.40%, Materials +0.24%, Consumer Staples +0.07%, Health -0.33%, Energy -0.75%.

EUROPEAN CLOSES: Euro Stoxx 50 +1.21% at 6,133, Dax 40 +0.96% at 25,259, FTSE 100 +0.59% at 10,690, CAC 40 +1.39% at 8,515, FTSE MIB +1.47% at 46,470, IBEX 35 +0.90% at 18,180, PSI -0.05% at 9,091, SMI +0.45% at 13,862, AEX +0.99% at 1,018

STOCK SPECIFICS:

- Nvidia (NVDA): Reportedly close to a $30B investment in OpenAI, down from prev. $100B that failed to progress a memorandum.

- Blue Owl (OWL) reportedly failing to secure financing for a USD 4bln data centre project in Pennsylvania, with one lender saying the lack of interest was due to CoreWeave's (CRWV) creditworthiness.

- Comfort Systems (FIX): Rev. beat.

- Opendoor (OPEN): Q metrics beat.

- Consolidated Edison (ED): Revenue beat, but adj. net income missed.

- LyondellBasell (LYB): Cut Q div. by ~50% amid challenged markets.

- Akamai (AKAM): Issued weak guidance.

- Grail (GRAL): NHS-Galleri trial missed the primary endpoint of reducing late-stage cancers.

- Select Water Solutions (WTTR): Announced $175M class A common stock offering.

- Lucid Motors (LCID) cuts 12% of its US workforce.

- Claude Code Security, a new capability built into Claude Code on the web, is now available in a limited research preview. Of note for CrowdStrike (CRWD), Palo Alto (PANW), Zscaler (ZS).

FX

The Dollar Index was flat, with mixed performance against G10 peers as AUD and GBP saw the greatest gains, while havens, CHF and JPY, lagged. It was a busy day stateside, with a deluge of data, geopolitical updates, and the SCOTUS ruling on Trump's tariffs. The latter saw the Trump admin's IEEPA tariffs struck down, as expected, which the President was clearly unhappy about it. In a press conference after the decision, he remarked that effectively immediately, all national security tariffs under 232 and 301 remain in place, and 10% global tariff to be imposed on top of other tariffs. Note, Section 122 has a 15% tariff limit for 150 days. On the ruling, Wells Fargo wrote "We expect relief from the SCOTUS ruling to be temporarily risk positive mostly via lower uncertainty...The market will likely refocus on incoming data that continues to point to an economy and labour market that is recovering. This keeps the Fed firmly on the sidelines and limits further USD weakness in our view”. On today's data, Dec. PCE surpassed expectations across the board, Q4 rose 1.4%, well below the consensus 2.8%, S&P Global Flash for Feb underwhelmed, as did final UoM for Feb, but inflation expectations for both time horizons also came down.

As mentioned, AUD and GBP sat atop of the G10 breakdown, with both benefitting from the Dollar weakness in wake of the SCOTUS ruling. Prior to that, the Pound was marginally firmer in wake of a strong batch of UK data, as retail sales surged, as well as strong PMIs. Cable reached a high of 1.3515 against an earlier low of 1.3435.

EUR and NZD were ultimately flat, with broadly better than expected European Flash PMIs, whereby the solid German metrics provided fleeting Euro strength. For the Kiwi, overnight RBNZ Governor Breman said that although the central bank remains forward-focused, monetary policy will adapt based on new information instead of following a predetermined path.

For the Yen, overnight and through the first part of the session, it was weighed on by the broader Dollar strength and also Japanese CPI, which held a dovish skew. In summary, national CPI printed at 1.5% (exp. 1.6%), core was in-line whilst the supercore metric was a touch below the consensus. Elsewhere, PMIs printed better-than-expectations, benefiting from increased optimism following Takaichi’s landslide victory.

- SNAPSHOT : Equities up, Treasuries flat, Crude flat, Dollar down, Gold up.

- REAR VIEW : SCOTUS strikes down Trump IEEPA tariffs; In response, Trump announces new 10% global tariff & will go "even stronger"; Trump considers limited strike on Iran; Hotter-than-expected Dec. PCE report, Q4 PCE figures also hot; GDP Adv Q4 misses expectations, weighed by govt spending amid shutdown; US S&P Global Flash PMIs unexpectedly falls; UoM underwhelms, although inflation expectation also dip; Fed's Bostic thinks neutral is 25-50bps below current rate; Fed's Logan thinks policy is well positioned; Fed's Musalem says real FFR is at or below neutral rate; CRWV credit concerns arise after OWL fails to secure data centre financing.

- WEEK AHEAD: Highlights include NVDA earnings, Australian CPI, Tokyo CPI, PBoC LPR, and BoK.

- CENTRAL BANK WEEKLY: Previewing PBoC LPR, BoK; Reviewing RBNZ, FOMC Minutes, RBA Minutes, reports on the ECB President Job.

- WEEKLY US EARNINGS ESTIMATES: Tech behemoth NVDA the headliner.