SP500 Low-10 Monthly Portfolio

Auto-updated • Data as of 2026-02-26 • Benchmark: ^GSPC

Latest rebalance signal: 2026-01-30 • Portfolio effective from: 2026-02-02

Current Holding Set (Top 10 — Low Alignment)

PYPL NFLX PODD HPQ NOW TTD DVA BBY TYL ZS

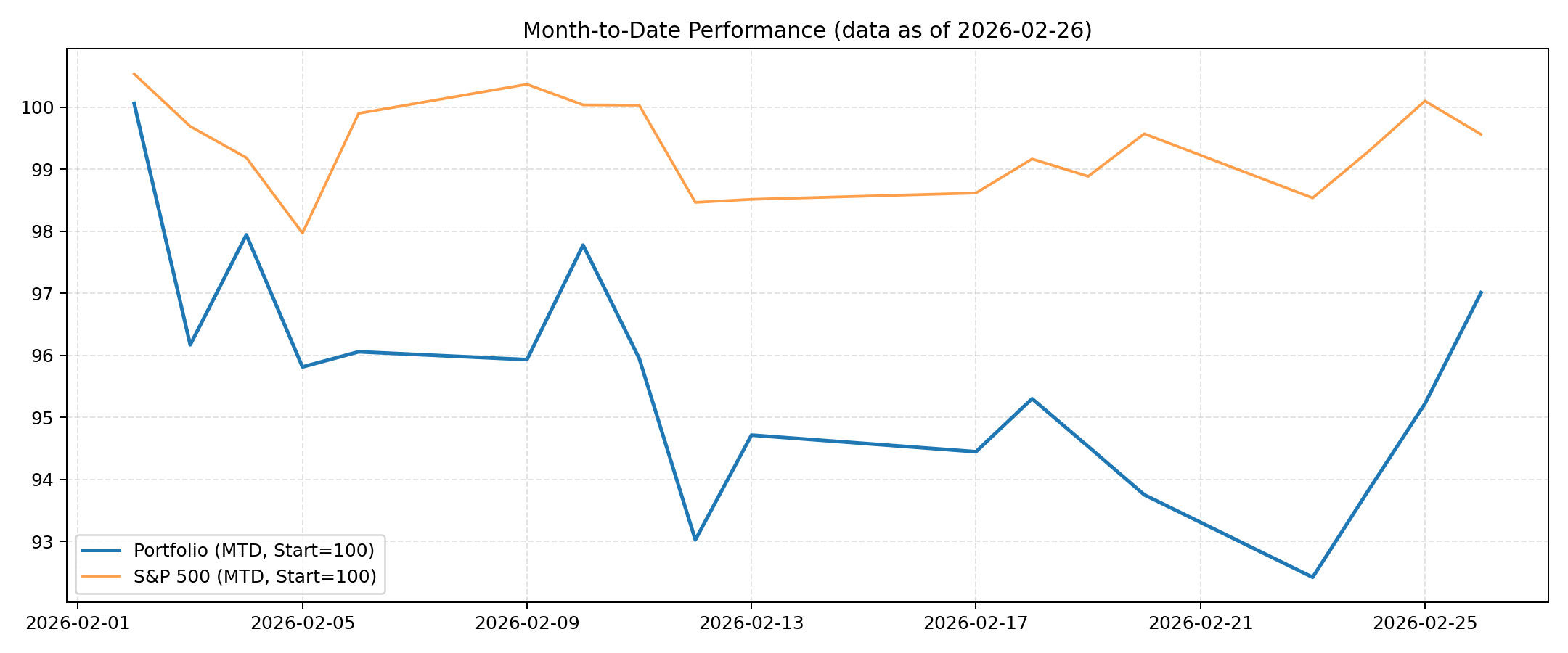

MTD Performance (month of latest data)

Portfolio: -2.99% | S&P 500: -0.43%

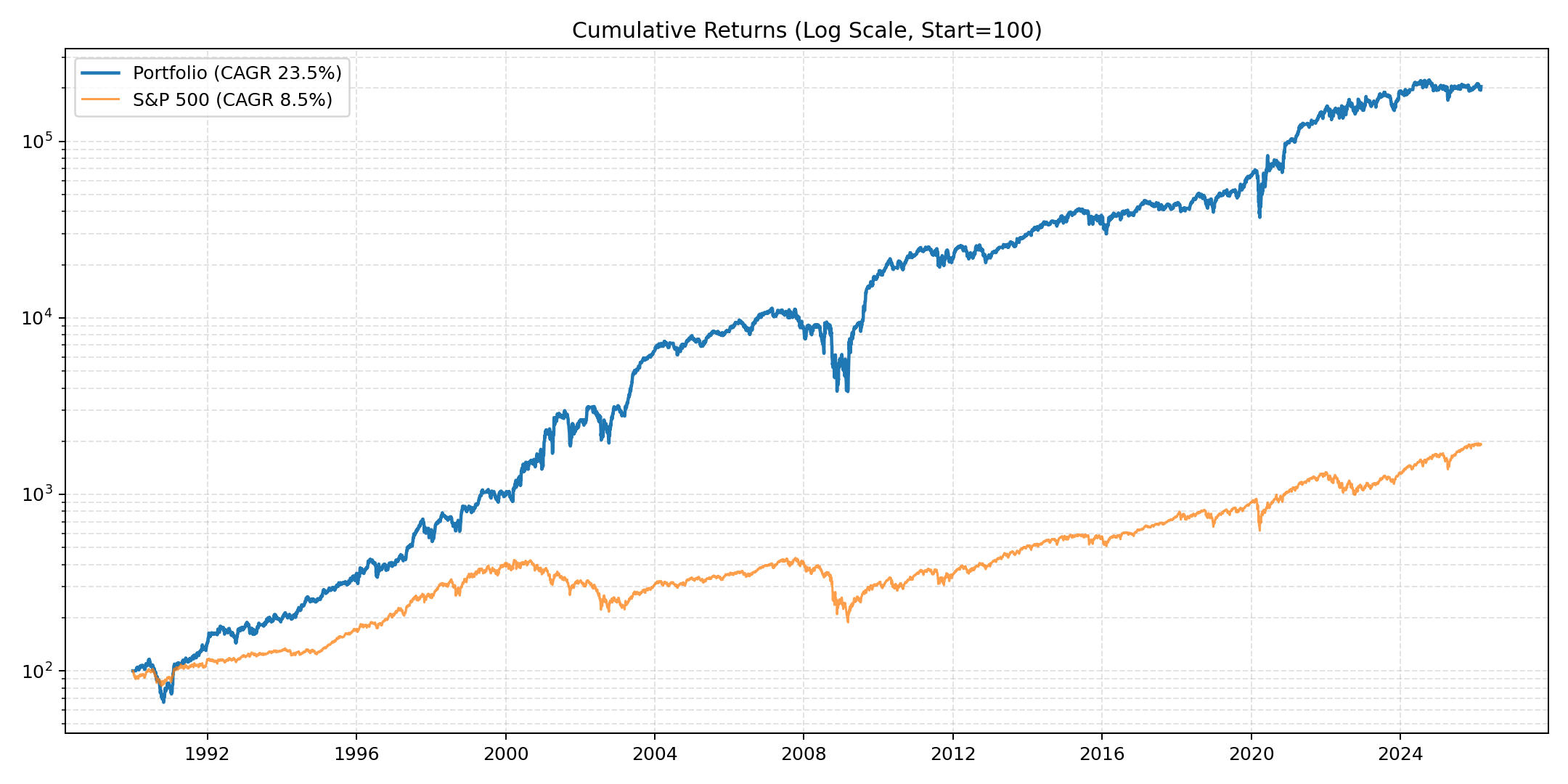

Cumulative Returns (Log, Start=100)

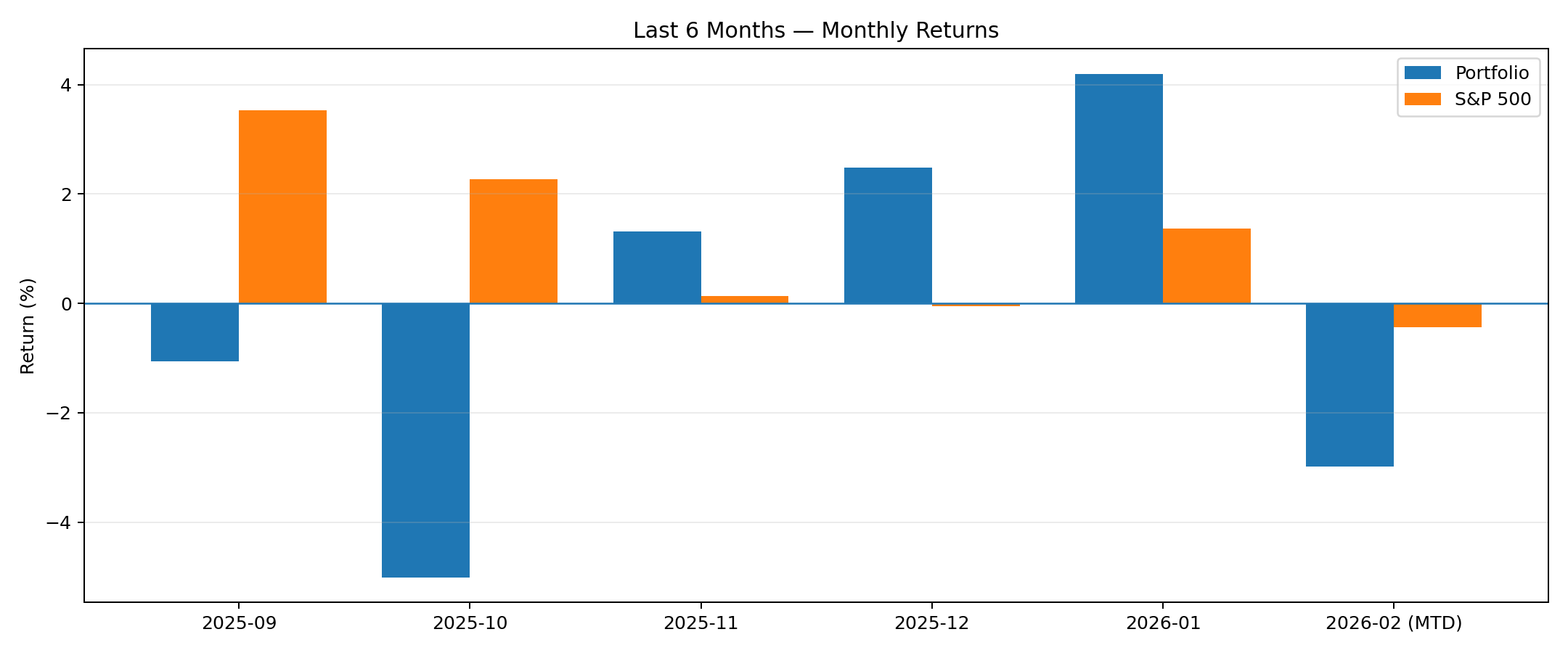

Last 6 Months — Monthly Returns

| Month | Portfolio | S&P 500 |

|---|---|---|

2025-09 | -1.06% | 3.53% |

2025-10 | -5.01% | 2.27% |

2025-11 | 1.31% | 0.13% |

2025-12 | 2.48% | -0.05% |

2026-01 | 4.20% | 1.37% |

2026-02 (MTD) | -2.99% | -0.43% |

Strategy: Monthly rebalance (BME). Buy & Hold within month (weights drift). Transaction cost: 0.04% applied on first holding day after signal.