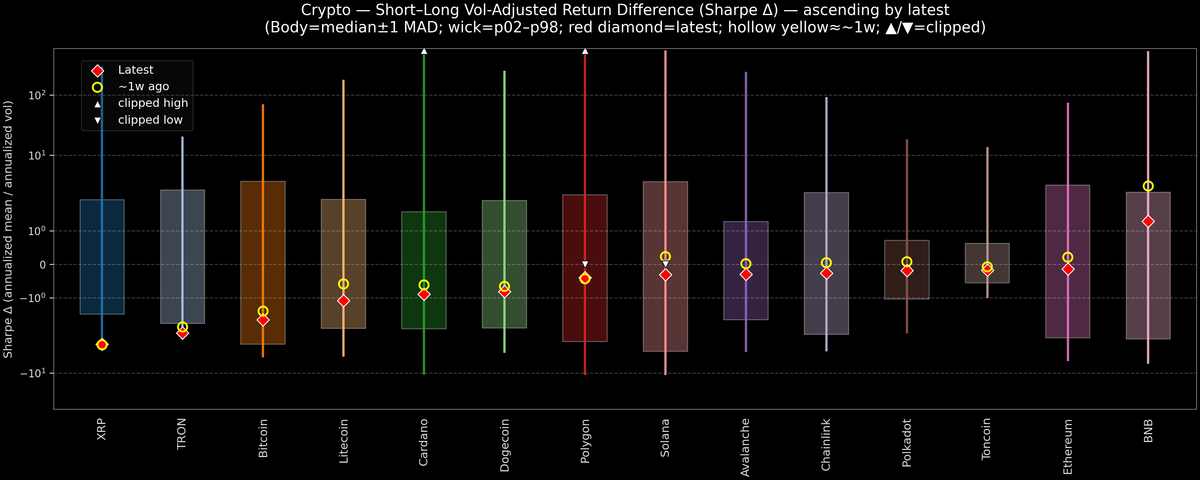

Crypto — Short–Long Vol-Adjusted Return Difference — 2025-11-04

This crypto snapshot compares short-term versus long-term performance on a risk-adjusted basis for major coins. We use log-return annualization, winsorized returns, a dynamic volatility floor, and robust statistics (median/MAD) to avoid outlier distortion. Positive readings indicate short-term strength outpacing the long-term trend; negative values suggest the opposite. Assets are ordered by the latest reading; bodies show median ±1 MAD while wicks span each coin’s p02–p98 range. Use the selector to explore each coin without clutter.