Market Wrap 2025-10-14

- China's MOFCOM announced countermeasures against five US-linked firms, stating the US cannot hold talks while threatening new restrictions.

- According to La Tribune, the French government, led by PM Lecornu, will present a budget aiming to reduce the deficit to 4.7% by the end of 2026.

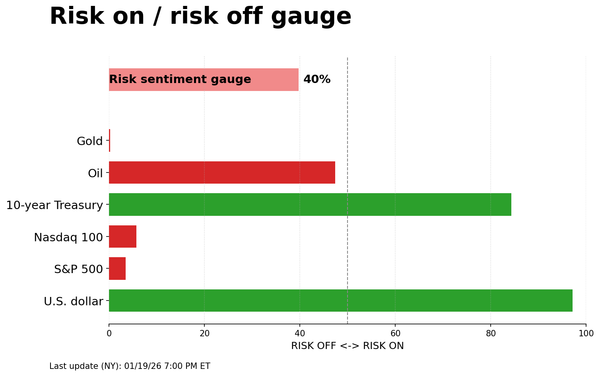

- Equities are broadly lower as markets assess China's latest trade escalations against the US, and as traders await US earnings reports.

- The JPY is benefiting from a haven bid, the GBP is impacted by soft jobs data, and Antipodean currencies are weakened by risk aversion.

- Global paper is firmer amid the weakened risk tone, Gilts are leading after data releases, and OATs are awaiting PM Lecornu's address.

- Crude benchmarks are declining as Middle East tensions ease, and XAU is pulling back from new all-time highs (ATHs).

- The upcoming schedule includes the US NFIB (Sep), Fed Discount Rate Minutes, and speeches from ECB’s Villeroy and Kocher, BoE’s Bailey and Taylor, Fed’s Powell, Waller, Collins and Bowman, BoC’s Rogers, RBA’s Hunter and Hauser, and RBNZ’s Conway. Earnings are expected from JPMorgan, Goldman Sachs, Citi, Wells Fargo, Johnson & Johnson, and LVMH.

TARIFFS/TRADE

- China officially implemented special port fees for US ships. Earlier reports indicated China issued implementation rules on port fees for US ships and exempted China-made ships owned by US companies from these fees, while planning to adjust special port fees on US ships as needed.

- China's MOFCOM responded to the US proposal for talks after rare earth restrictions, stating that the US cannot engage in talks while threatening intimidation and new restrictions, which is not conducive to a positive relationship. MOFCOM urged the US to correct its "wrong practices" and demonstrate sincerity in talks. It clarified that export curbs are not an export ban and do not prohibit exports. Working-level talks were held on Monday, and both sides have maintained communication under the China-US economic and trade consultation mechanism. However, MOFCOM later announced countermeasures against five US-linked firms.

- China's Transport Ministry initiated an investigation into the impact of US 301 tariffs on China's shipping industry.

- China's Commerce Ministry urged the US to rectify mistakes and expressed hope to resolve concerns through dialogue.

- According to Reuters sources, China is increasing oversight of export license applications for rare earth magnets.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.4%) are generally lower, with sentiment affected by the ongoing US-China dispute. Overnight, China's MOFCOM announced countermeasures against five US-linked firms.

- European sectors exhibit a strong negative bias. Telecoms is performing best, boosted by post-earnings strength in Ericsson (+13%) after it exceeded profit expectations and raised guidance. Basic Resources is at the bottom, impacted by broader weakness in underlying metals prices.

- US equity futures (ES -0.8%, NQ -1.1%, RTY -0.9%) are lower, mirroring the trend in Europe. Focus is on bank results, which will begin the Q3 earnings season.

- BP (BP/ LN) Q3'25 Trading Statement: Upstream Production in Q3 is expected to be higher compared to the prior quarter, but weaker trading into Q3 was noted.

- BlackRock Inc (BLK) Q3 2025 (USD): Adj. EPS 11.55 (exp. 11.24), Revenue 6.51bln (exp. 6.23bln); AUM 13.464tln (exp. 13.37tln).

FX

- After a soft start, where the DXY was pulled lower by the haven bid into the JPY, the Greenback gained support at the expense of risk-sensitive currencies and the GBP (post-jobs data). Risk aversion was triggered by China's decision to take countermeasures against five US-linked firms, diminishing hopes from the previous session. A WSJ report stated that "people close to the Trump administration say the US side likely will demand that China rescind, not merely delay or water down the rare-earth export rule." Focus is on the US NFIB Small Business Optimism index, and speeches from Fed Chair Powell, Waller, Collins & Bowman. The DXY reached as high as 99.47, with the next target at last week's peak of 99.56.

- After initially appearing to test 1.16 overnight, EUR/USD was dragged lower by the broader USD pickup. In the Eurozone, focus remains on France, with PM Lecornu scheduled to present his budget at 14:00BST, aiming to reduce the deficit to 4.7% by the end of 2026. Politico reports that additional measures, beyond those previously expected, will include a tax on the wealthiest. Even with Socialist support, the governing coalition needs additional votes in the Assembly, which is challenging given that the Far Right and Left are expected to table a no-confidence motion on Lecornu. Elsewhere in Europe, German ZEW data showed misses for both metrics, with the current conditions component declining further. EUR/USD has been as low as 1.1543 and is holding above last week's low at 1.1542.

- The JPY is the only major currency to outperform the USD due to its safe-haven status. It was supported in early European trade as investors reacted to increased US-China tensions. USD/JPY fell to 151.63 from an earlier high of 152.61. A USD pickup has since seen the pair return to the 152 level. The macro story for Japan remains dominated by domestic politics following the collapse of the ruling coalition. The LDP party has proposed October 21st for an extraordinary Diet session.

- The GBP was impacted in early European trade following the latest UK labour market report, viewed as dovish. Pantheon Macroeconomics highlighted the unexpected rise in the unemployment rate and the decline in 3M/YY ex-bonus average earnings, which will influence MPC thinking. BRC retail sales slowed to 2.0% Y/Y in September from 2.9% as consumers remain cautious ahead of next month's fiscal event. Cable has fallen to 1.3255, levels not seen since early August.

- Antipodean currencies are both weaker against the USD and at the bottom of the G10 leaderboard. Without significant domestic updates, AUD and NZD are influenced by broader risk dynamics, driven by US and Chinese trade tensions.

FIXED INCOME

- USTs are bid, firmer by over 10 ticks to a 113-16+ high. Strength this morning is due to the downbeat risk tone as China retaliates. This has driven the benchmark to a fresh high for the month, with resistance at 113-21, 113-25+, and then the 113-29 September peak. China's MOFCOM announced countermeasures against five US-linked firms and stated that the US cannot hold talks while new restrictions are threatened. The docket includes Fed speakers Bowman, Waller, Chair Powell, and 2025 voter Collins.

- OATs are firmer today, in line with peers. The main update this morning came from the French fiscal watchdog HCFP on the 2026 budget draft, consistent with overnight sources. HCFP described the draft as relying on overly optimistic scenarios and ambitious spending restraint that would be difficult to implement. PM Lecornu’s General Policy Statement is scheduled for 14:00BST, lasting no more than 90 minutes, followed by responses from other party leaders. The French Socialist Party will not vote against PM Lecornu's government, instead opting for its own motion of no confidence if unsatisfied with the proposal.

- Bunds are bid, given the market narrative outlined in USTs. No revision to final German HICP for September. The main event for Bunds was the October ZEW, which came in softer than expected and sparked modest upside, though within earlier parameters. No move to a new Schatz auction which was fairly weak.

- Gilts are outperforming after the morning’s jobs data. Opened higher by 45 ticks before climbing to a 91.81 peak with gains of 57 ticks at best, stopping a tick shy of the 91.82 September peak. If the move continues, there is a gap before the 92.70 August high. The morning’s data saw an unexpected jump in the unemployment rate, contradicting the MPC statement that there is less immediate risk of a rapidly loosening labour market, serving as a dovish impetus. However, this is caveated by the elevated wage figure (incl-bonus), attributed by the ONS to the public sector, as some pay rises were awarded earlier than in 2024.

- Germany sold EUR 4.25bln vs exp. EUR 5.5bln 2.00% 2027 Schatz: b/c 1.4x, average yield 1.91%, retention 22.7%.

- Italy sold EUR 8.5bln vs exp. EUR 6.75-8.5bln 2.35% 2029, 3.25% 2032, 2.80% 2028, 3.85% 2040 BTP.

- The UK will sell GBP 9bln of 5.25% 2041 Gilt via syndication, according to a bookrunner cited by Reuters.

COMMODITIES

- Crude benchmarks are trending lower as renewed trade worries, easing geopolitical tensions, and an oversupplied oil market weigh on prices. Benchmarks are steadily declining as the European session continues, with WTI and Brent currently c. USD 1.7/bbl lower and trading near lows at USD 58.20/bbl and USD 62.00/bbl, respectively.

- Precious metals extended to new ATHs during APAC trade, with XAU and XAG peaking at USD 4180/oz and USD 53.59/oz respectively, before selling off as US President Trump hints of total peace in the Middle East.

- Base metals have reversed Monday’s gains, with 3M LME Copper returning to USD 10.5k/t from a peak of USD 10.86k/t, as recent dollar strength weighs on the commodity space.

- IEA OMR: lowers 2025 world oil demand growth forecast to 710k BPD (prev. 740k BPD); leaves 2026 average oil demand growth forecast steady at 700k BPD.

- TotalEnergies (TTE FP) CEO says they are still quite bullish in medium term oil demand; CEO says there is no peak oil demand.

- US Energy Secretary Wright is set to announce the Trump administration's fusion roadmap at an industry gathering on Tuesday, via Axios citing DOE officials.

NOTABLE DATA RECAP

- UK ILO Unemployment Rate (Aug) 4.8% vs. Exp. 4.7% (Prev. 4.7%); Employment Change (Aug) 91k vs. Exp. 123k (Prev. 232k)

- UK Avg Wk Earnings 3M YY (Aug) 5.0% vs. Exp. 4.7% (Prev. 4.7%, Rev. 4.8%); Ex-Bonus (Aug) 4.7% vs. Exp. 4.7% (Prev. 4.8%)

- UK HMRC Payrolls Change (Sep) -10k vs. Exp. -10k (Prev. -8k); Claimant Count Unem Chng (Sep) 25.8k (Prev. 17.4k, Rev. -2.0k)

- UK BRC Retail Sales YY (Sep) 2.0% (Prev. 2.9%); Total Sales YY (Sep) 2.3% (Prev. 3.1%)

- German HICP Final YY (Sep) 2.4% vs. Exp. 2.4% (Prev. 2.4%); MM (Sep) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

- German ZEW Economic Sentiment (Oct) 39.3 vs. Exp. 41.0 (Prev. 37.3); Current Conditions (Oct) -80.0 vs. Exp. -74.8 (Prev. -76.4)

- EU ZEW Survey Expectations (Oct) 22.7 (Prev. 26.1)

NOTABLE EUROPEAN HEADLINES

- Barclays UK September Consumer Spending fell 0.7% Y/Y vs prev. 0.5% Y/Y increase in August.

- The tax elements of French PM Lecornu's draft finance bill reportedly include 30 articles, some already announced, but also the addition of a tax on "assets not allocated to an operational activity of property holding companies", via Playbook. Furthermore, Playbook, citing a source, reports that there is no question for the PS of "doing another round of negotiations on Wednesday, Thursday or Friday".

- The two motions of censure will be looked at on Thursday at 08:00 BST, but the Conference of Presidents on the National Assembly, via BFMTV.

- French fiscal watchdog HCFP says French government’s 2026 budget plan relies on overly optimistic economic assumptions; based on ambitious spending restraint that would be difficult to implement. France is at risk of under-delivering on spending and tax measures in 2026 budget. Budget bill includes belt-tightening measures worth over EUR 30bln, including EUR 13.7bln in taxes and EUR 17bln in spending cuts.

- French Socialist Party (PS) will not vote against PM Lecornu's government in the motions filed by LFI and RN, will instead file its own motion of no confidence in the scenario it is not satisfied with the budget proposals, via Reuters citing sources.

- German Economy Ministry says current indicators do not point to economic recovery in Q3.

- Riksbank's Bunge says monetary policy must be forward looking; Inflation remains elevated, but with increased confidence that it will fall back, we were able to cut the policy rate to provide further support to the economy.

- EU Commission modifies drone wall proposals to suggest broader European drone defence initiative, via Reuters sources.

NOTABLE US HEADLINES

- Republicans on Capitol Hill and inside the Trump administration are said to be discussing potential pathways to prevent the tax credits from expiring at the end of the year, according to Politico. Some members of the House GOP leadership circle are having early, informal conversations with officials from the White House Office of Legislative Affairs and the Domestic Policy Council to develop a framework for a deal.

GEOPOLITICS

MIDDLE EAST

- US President Trump is said to have confirmed that Israeli PM Netanyahu will not annex any part of the West Bank, according to Al Arabiya.

- Iran's Foreign Ministry says US President Trump's desire for peace and dialogue is in conflict with US hostile and criminal behaviour against Iran.

- US President Trump posts "Gaza is only a part of it. The big part is, PEACE IN THE MIDDLE EAST!".

- Israeli's Defence Force says several suspects were identified crossing the yellow line and approaching IDF troops operating in the northern Gaza Strip, which constitutes a violation of the agreement; troops opened fire to remove the threat, via CGTN.

CRYPTO

- Bitcoin is a little lower and trades around USD 111.3k with Ethereum underperforming a touch, back below USD 4k.

APAC TRADE

- APAC stocks were mixed following the rebound on Wall St and with underperformance in Japanese markets as they reopened from the extended weekend and reacted to the recent US-China tariff tensions, as well as the Japanese ruling coalition split.

- ASX 200 struggled for direction as weakness in the financial and consumer-related sectors offset the gains in materials and miners, with the latter helped by the recent upside in metal prices and with Rio Tinto gaining following its quarterly activity update.

- Nikkei 225 underperformed as participants returned from the holiday closure and reacted to the recent US-China trade frictions and political uncertainty in Japan, while there were late headwinds after reports of China trade-related actions against the US.

- Hang Seng and Shanghai Comp are lower amid the backdrop of the tumultuous trade/tariff related headlines in which the recent softening in tone by the US on China was followed by reports overnight that China's MOFCOM is taking countermeasures against five US-linked firms and that China's Transport Ministry opened an investigation into US 301 tariffs impact on China shipping industry.

NOTABLE ASIA-PAC HEADLINES

- Monetary Authority of Singapore kept the prevailing rate of appreciation of the SGD NEER policy band, as well as made no change to the width and level at which the band is centred, as expected. MAS said it is in an appropriate position to respond effectively to any risk to medium-term price stability and MAS core inflation should trough in the near term but rise gradually over the course of 2026, while it added that Singapore’s economic growth has turned out stronger than expected and the output gap will remain positive in 2025.

- RBA Minutes from the September meeting stated the Board agreed no need for immediate reduction in the cash rate, while it added that future policy decisions are to be cautious and data dependent. RBA said the market path for the cash rate is within estimates of neutral but too imprecise to guide policy and it is important to see what Q3 data shows on the economy and supply capacity, as well as noted that policy is probably still a little restrictive, but this is difficult to determine and there are still risks on both sides for the economy.

- Japan's LDP proposes October 21st for extraordinary Diet, via FNN.

- China's Central Bank-backed Publication will continue to uphold decisive role of market in exchange rate formation and strengthen guidance of expectations.

DATA RECAP

- Singapore GDP QQ (Q3 A) 1.3% vs Exp. 0.5% (Prev. 1.4%); YY (Q3 A) 2.9% vs Exp. 1.9% (Prev. 4.4%)

- Australian NAB Business Confidence (Sep) 7.0 (Prev. 4.0); Business Conditions (Sep) 8.0 (Prev. 7.0, Rev. 8)

- Indian WPI Inflation YY (Sep) 0.13% vs. Exp. 0.5% (Prev. 0.52%)