Market Wrap 2025-10-15

- European stock markets are trading positively; LVMH is up 14% and ASML is up 3.6%, both after releasing earnings; US equity futures are also increasing.

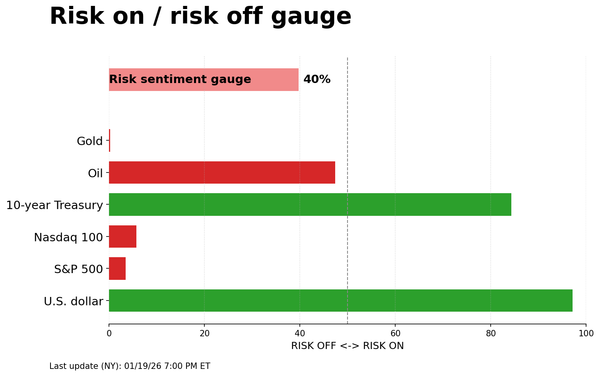

- The USD is extending losses into a second session, while the EUR is supported by optimism surrounding France.

- US Treasury securities are slightly firmer, and French government bonds (OATs) are gaining as traders assess the recent suspension of pension reforms.

- XAU (gold) exceeds USD 4200/oz, while crude oil benchmarks are muted amid heightened trade tensions.

- Upcoming events include the NY Fed Manufacturing Index (October), Cleveland Fed CPI (September), US Military Pay Date, Fed Beige Book, (Suspended Releases: US CPI), speeches from the BoE’s Breeden, ECB’s Lane & Lagarde, Fed’s Miran, Bostic, Waller & Schmid, and RBA’s Bullock & Kent.

- Earnings reports are expected from Bank of America, Morgan Stanley, Dollar Tree, and Progressive.

TARIFFS/TRADE

- Chinese Foreign Ministry Spokesperson Lin stated that the US and China should engage in discussions.

- China has filed a complaint with the WTO regarding India's subsidies for EVs and batteries, asserting that these measures harm China's interests and vowing to take resolute steps to protect its domestic industry.

EUROPEAN TRADE

EQUITIES

- European equities began the trading day higher, boosted by positive updates from ASML and LVMH. The CAC 40 (+2.4%) is leading the gains after LVMH (+13.4%) exceeded Q3 revenue expectations and political stability improved in France.

- Most European sectors are trading positively, with Consumer Products & Services (+5.9%) leading due to strong performance from luxury brands (LVMH, Kering, Hermes). Healthcare (-0.3%) is lagging due to cyclical rotation. Media (+1.7%) and Technology (+1.6%) are also firm, with ASML’s results and resilient Chinese demand supporting sentiment.

- US futures indicate a positive opening (ES +0.5%, RTY +0.8%, NQ +0.7%) as dovish comments from Fed Chair Powell improve sentiment and ASML’s update supports tech. Focus is now on US-China trade tensions, Fed speakers, and data releases including MBA mortgage applications, NY Fed manufacturing, Cleveland Fed CPI, and the Beige Book.

- Synchrony Financial (SYF) reported Q3 2025 results (USD): EPS at 2.86 (expected 2.24), Revenue at 3.82bln (expected 4.73bln), and NII at 4.7bln.

NOTABLE EUROPEAN EQUITY NEWS

- ASML (ASML NA) reported Q3 2025 results (EUR): Revenue at 7.516bln (expected 7.790bln), Net at 2.13bln (expected 2.08bln), and Net order bookings at 5.4bln (expected 5.36bln). The company projects Q4 revenue between 9.2bln and 9.8bln (expected 9.23bln/9.48bln) and does not anticipate FY26 total net sales to be below FY25. Gross Margin was 51.6% (expected 51.4%). An interim dividend of EUR 1.60 per ordinary share will be payable on November 6, 2025. The company intends to announce a new share buyback program in January 2026. Weightings: 29.8% in Tech (largest), 4.76% in Euro Stoxx 50 (2nd largest), 2.28% in STOXX 600 (2nd largest).

- ASML (ASML NA) CFO stated that the company is prepared for rare earth export controls and has sufficient materials for the coming months. The number of customers in China is increasing. Steel and aluminum tariffs have "a bit" of an impact on costs. Customer uncertainty regarding tariffs and the trade war has partially decreased since July. The Chinese chip market may see some consolidation. The expected decline in China sales is not due to previous stockpiling. ASML requires limited quantities of rare earth materials.

FX

- The DXY (US Dollar Index) declined after starting the week strong, influenced by a rise in the EUR, US-China trade tensions, and dovish comments from Fed Chair Powell. The key takeaway from Powell's comments was the continued acknowledgment of softness in the labor market, which could be worsened by the ongoing US shutdown and potential federal layoffs. Today's Fed Beige Book will provide anecdotal evidence on the US economy's performance. ING suggests the Beige Book played a key role in the Fed’s 50bp cut in September 2024. NY Fed Manufacturing and Cleveland CPI data are also due. The DXY has fallen to 98.73, with the next target at the October 9th trough of 98.69.

- The EUR remains supported following Tuesday's French-driven increase, which saw EUR/USD reclaim 1.16. Markets reacted positively to PM Lecornu's announcement to suspend pension reform. While not economically prudent, the move has been well-received by Socialists, who will not support any motion to censure the government. Recent ECB communications have not significantly impacted market pricing, and this is likely to remain the case with upcoming remarks from Villeroy, de Guindos, Lane, and Lagarde. EUR/USD has reached as high as 1.1644.

- The Yen's gains against the USD have extended into a second session, supported by safe-haven demand and US-China trade tensions. However, the domestic situation remains challenging due to political tensions. Following the collapse of the ruling coalition, opposition parties are attempting to present a credible alternative to Takaichi. Japan's Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st, as proposed by the LDP. Comments from the DPFP leader suggest ongoing discussions with the CDP, with a potential meeting on October 20th if issues can be resolved. USD/JPY briefly reached 150.91 before returning to 151.

- After a brief decline against the USD following a dovish labor market report, the Pound has stabilized and briefly reached a new weekly high of 1.3373. BoE Governor Bailey stated that the jobs report supports his view of a softening labor market. Taylor also indicated that a "bumpy" landing is now more likely than a soft landing. The November 26th budget is a significant source of uncertainty for the MPC. UK Chancellor Reeves stated in an interview that she is considering both tax increases and spending cuts for next month. The next upside target for Cable (GBP/USD) is 1.34.

- Both Antipodean currencies are gaining against the USD, with the AUD slightly outperforming due to a strong Yuan fix by the PBoC and hawkish comments from RBA Assistant Governor Hunter, who noted that recent data has been stronger than expected and inflation is likely to be higher than forecast in Q3.

FIXED INCOME

- US Treasury securities are marginally firmer (+1 tick at 113-14), extending Tuesday’s gains amid lingering haven demand and cautious sentiment following renewed US-China trade tensions after Trump threatened to end cooking oil business with China; support also comes from dovish Fed commentary, with Powell signaling rising job market risks, nearing the end of balance sheet runoff, and justification for a September rate cut, while today’s focus turns to Fed speakers and the Beige Book.

- Bunds are trading higher (+17 ticks at 129.85) within a 129.68–129.95 range, supported by dovish ECB comments from Villeroy suggesting the next move is more likely a cut. A relatively poor 2050/2056 Bund auction sparked little move on price action. Elsewhere, OATs are outperforming after France’s Socialist Party backed PM Lecornu’s temporary pension reform suspension, tightening the OAT-Bund spread to 78.32 from Tuesday's peak of 84.50.

- Gilts are outperforming global peers (+36 ticks at 92.31), holding near highs of 92.39 with potential to retest early-August levels (92.66), supported by reports that Chancellor Reeves may halve the annual tax-free ISA allowance to boost UK equity investment, while broader budget discussions point to potential tax rises and spending cuts ahead of remarks from BoE’s Breeden.

- The UK sold GBP 1.5bln of 0.125% 2031 I/L Gilt: bid-to-cover ratio of 3.49x, real yield of 0.889%.

- Germany sold EUR 0.757bln (vs expected EUR 1bln) of 0.0% 2050 Bund and EUR 1.182bln (vs expected EUR 1.5bln) of 2.90% 2056 Bund.

COMMODITIES

- Crude oil benchmarks are trading rangebound, oscillating in a c. USD 0.50/bbl band. WTI and Brent remain below USD 59/bbl and USD 62.50/bbl, respectively, as markets await delayed weekly Private Inventory data following the US holiday on Monday. Russian Deputy PM Novak stated that the current oil price reflects the existing balance in the energy market and that Russia has the potential to increase oil production.

- Spot XAU (gold) has continued its historic rally, breaking beyond USD 4,200/oz, as Fed Chair Powell signals another cut this month. The yellow metal is currently trading at USD 4,218/oz, with a broad consensus that XAU could reach USD 5,000/oz in 2026.

- Base metals remain choppy but are paring back most of Tuesday’s losses as the dollar weakens on dovish Powell comments. 3M LME Copper peaked at USD 10.75k/t and is currently trading off its best levels despite a lack of newsflow.

- Russia's Deputy Prime Minister Novak says the current oil price reflects the existing balance on the energy market and that Russia has the potential to raise oil production. There is no plan for Russia to submit new oil output without a compensation plan to OPEC. Demand for global energy is growing, especially for electric power. Demand for oil is also rising and is on par with 2024.

- Russian Deputy PM Novak says Russian gas accounts for some 19% of European gas imports and Russia is ready for discussions on gas supplies to Europe.

- Russian Deputy PM Novak, regarding US President Trump's remarks about gasoline shortages in Russia, says Russia has stable domestic market supply.

NOTABLE DATA RECAP

- EU Industrial Production MM (Aug) -1.2% vs. Exp. -1.6% (Prev. 0.3%)

- EU Industrial Production YY (Aug) 1.1% vs. Exp. -0.2% (Prev. 1.8%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves says she is looking at both tax rises and spending cuts in the budget, via Sky News. When asked if the economy is in a "doom loop", says, "Nobody wants that cycle to end more than I do".

- French Socialist Party (PS) Faure says the Zucman tax will be reintroduced.

NOTABLE US HEADLINES

NOTABLE US EQUITY HEADLINES

- Apple (AAPL) CEO Cook reportedly pledged to boost investment in China during a visit, according to Bloomberg. Cook met China's MIIT Minister Li Lecheng on Wednesday, according to an agency post on its official WeChat account. Cook reportedly said Apple will boost cooperation with China.

- Apple (AAPL) shipped 10.8mln units in Q3, +0.6% Y/Y, according to IDC data

- Amazon (AMZN) is preparing to cut as much as 15% of its human resources staff, with additional layoffs likely in other divisions, according to sources cited by Fortune.

- Microsoft (MSFT) and NScale contracts some 200k NVIDIA (NVDA) GPUs to deliver AI infrastructure across Europe and the US.

GEOPOLITICS

MIDDLE EAST

- "Israel's Channel 12: It is being investigated that one of the four bodies of the hostages handed over does not belong to an Israeli hostage", according to Sky News Arabia.

- "Israeli Security: The Rafah Crossing will not be opened today for logistical reasons", via Al Arabiya. "Technical checks before opening the Rafah crossing "take time", Israeli security says.

CRYPTO

- Bitcoin is a little firmer today and trades around USD 112.5k whilst Ethereum outperforms and climbs back above USD 4k.

APAC TRADE

NOTABLE ASIA-PAC HEADLINES

- Japan Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st.

- Japan's DPP Leader Tamaki suggested another party leader's meeting on Monday if things can be sorted; still some distance with the CDP. Understood that LDP leader Takaichi is proposing to form coalition with DPP.

- RBA Assistant Governor Hunter said recent data has been a little stronger than expected and inflation is likely to be stronger than forecast in Q3, while she added the labour market and economic conditions might be tighter than assumed. Furthermore, she stated that employment growth has slowed by more than expected and uncertainty about the global outlook remains elevated, as well as noted that the Board will adjust policy as appropriate as new information comes to hand.

- RBNZ Chief Economist Conway said they do not expect to use additional monetary policy (AMP) tools again anytime soon, while he added they will continue to update their approach to remain as prepared as possible to help New Zealand weather whatever economic storms come their way. Conway also announced that the RBNZ reviewed the frequency of its monetary policy decision announcements and acknowledged the perception that the gap between the November MPS and February MPS is too long, while they are to reduce that gap over the 2026/2027 period.

- S&P affirms New Zealand at AA+ foreign currency rating.

- China's state planner issues action plan for developing EV charging infrastructure; aiming to establish 28mln charging facilities nationwide by end-2027.

- RBI sees rupee under speculative attack and will intervene further, according to Bloomberg.

DATA RECAP

- Chinese CPI MM (Sep) 0.1% vs. Exp. 0.2% (Prev. 0.0%)

- Chinese CPI YY (Sep) -0.3% vs. Exp. -0.2% (Prev. -0.4%)

- Chinese PPI YY (Sep) -2.3% vs. Exp. -2.3% (Prev. -2.9%)

- Japanese Capacity Utilisation MM SA (Aug) -2.3% (Prev. -1.1%)

- Japanese Industrial O/P Rev YY SA (Aug) -1.6% (Prelim. -1.3%)

- Japanese Industrial O/P Rev MM SA (Aug) -1.5% (Prelim. -1.2%)

LATAM

- US President Trump said he had a productive meeting with Argentina's Milei and hopes the people of Argentina understand how good a job he is doing.