Market Wrap 2025-10-17

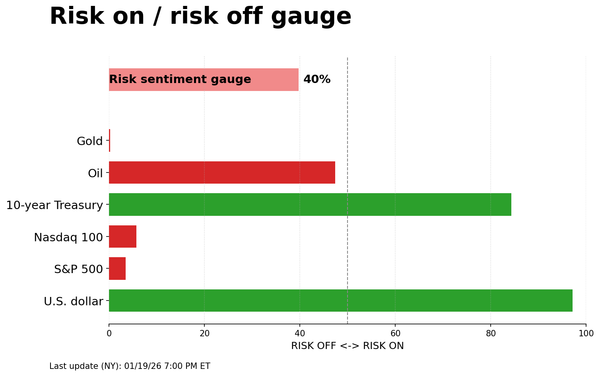

- European and US equity futures are declining across the board, influenced by concerns surrounding US regional banks; KRE is down 2% in pre-market trading.

- The DXY is slightly lower; traditional safe-haven assets (JPY, CHF) are benefiting from the risk-off sentiment, while the Australian dollar is underperforming.

- Global fixed income is rising as traders remain cautious about US regional banks.

- Crude oil is continuing its decline from Thursday, while XAU is experiencing choppy trading amid debt concerns.

- Upcoming events include speeches from BoE’s Pill, Greene & Breeden, Fed’s Musalem, ECB's Nagel, and earnings reports from Ally Financial, SLB, American Express, and State Street. US Building Permits/Housing Starts (Sep), Industrial Production (Sep) releases are suspended.

TARIFFS/TRADE

- The US State Department reported that Secretary of State Rubio and USTR Greer met with Brazil's Foreign Affairs Minister Vieira and had productive discussions on trade and ongoing bilateral issues. They agreed to collaborate on scheduling a meeting between President Trump and President Lula as soon as possible.

- The US State Department stated that China's sanctions against Hanwha Ocean's (042660 KS) US-linked units are attempts to undermine US-South Korea cooperation and coerce South Korea.

- According to Yonhap, the South Korean Finance Minister stated that it is 'uncertain' whether US President Trump will accept Korea's position against an 'upfront' USD 350bln payment related to their tariff/trade agreement.

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -1.8%) opened in negative territory and declined further shortly after the open, before stabilizing at current levels. The ongoing concerns about US regional banks remain a primary focus for traders.

- All European sectors are negative. Banks/Financial Services are underperforming, due to the aforementioned banking concerns. Additionally, European defense stocks are under pressure after the White House indicated that the recent Trump-Putin conversation was positive and constructive.

- US equity futures (ES -1% NQ -1.2% RTY -1.6%) are extending losses from the previous session, consistent with the risk-off sentiment. The Regional Banking ETF (KRE) is down approximately 2% in US pre-market trading.

FX

- The DXY is net lower, with the USD exhibiting divergent performance against its peers due to risk aversion triggered by recent selling in US regional banks. The USD is weaker against safe-haven currencies (CHF, JPY) and stronger against risk-sensitive currencies (AUD, NZD). The market is assessing whether selling pressure in Zions and Western Alliance Bancorp (due to exposure to fraudulent loans) represents a systemic issue or a limited contagion, similar to the SVB situation in 2023. The DXY reached a new weekly low of 98.02 (coinciding with the 50DMA) before rebounding.

- The EUR is up against the USD for a fourth consecutive session due to market aversion to bidding up the USD amid regional banking concerns and continued optimism regarding developments in French politics. With Lecornu surviving two no-confidence motions and the odds of legislative elections by year-end decreasing to 27% (from over 50% earlier in the week), attention is shifting to the upcoming budget debate and potential passage, as well as Moody's rating on France next Friday. Headline EZ HICP Finals were unrevised and had limited impact on the EUR/USD, which has surpassed its 50DMA at 1.1692.

- The JPY is outperforming major peers due to a safe-haven bid alongside selling in global equity markets. USD/JPY has fallen below 150 for the first time since October 6th. Domestically, focus remains on the political landscape, with the JIP co-head announcing "big progress" in discussions with the LDP party and stating that they are entering the finalization stage. Regarding the BoJ, Governor Ueda's recent comments reiterated the Bank's view of raising rates if its economic forecasts are realized, while Assistant Governor Shimzu noted the Bank must proceed cautiously. USD/JPY has fallen as low as 149.39, with the next downside target ahead of the 149 mark coming via the 6th October low at 149.04.

- The GBP's recovery against the USD has stalled due to the broader risk-off sentiment. This week in the UK has been characterized by soft labor market data and sluggish growth, which has been acknowledged by several BoE speakers. Next week's flash PMI and retail sales metrics are likely to be affected by ongoing budget-related concerns. Today's speaker slate includes BoE’s Pill, Greene & Breeden.

- Both the AUD and NZD are lower against the USD due to the risk-averse market tone, with the AUD continuing to lag following yesterday's weak jobs data from Australia.

- The PBoC set the USD/CNY mid-point at 7.0949 vs exp. 7.1154 (Prev. 7.0968)

FIXED INCOME

- USTs are firmer, as the US regional banking backdrop remains a key market focus. USTs peaked at 114-02 early, pushing the US 10yr yield below 4% for the first time since April; the April low was 3.86%. The benchmark has since pulled back to just below 114-00 but maintains gains of approximately 5 ticks for the session and around 25 for the week.

- Bunds are bid, given the general risk tone and FTQ seen after the US regional banking flareup on Thursday. Bunds peaked at 130.59 early before seeing a relatively sharp pullback as the European morning got underway, to a 130.22 low; but, still firmer on the session. European specific newsflow of note for fixed income a little light, aside from largely unrevised headline HICP metrics. The docket ahead features ECB’s Nagel and Rehn.

- Gilts gapped higher by 46 ticks , acknowledging the upside seen in peers on Thursday after the Gilt close as the US regional banking situation reverberated to the broader risk tone. Opened at 93.10 and extended to a 93.17 peak, notching a new high for the week and taking the benchmark to its highest since July when Gilts briefly traded above 93.50. Amidst this, the UK 10yr yield found itself under pressure and to a 4.45% low; the lowest since July when 4.41% printed. Ahead, we have a handful of BoE speakers due. On the hawkish side, Pill and Greene feature and are followed by the usually more neutral Breeden.

COMMODITIES

- WTI and Brent are under pressure today amidst the ongoing risk-off sentiment, and as traders digest the latest constructive commentary surrounding the latest Trump-Putin call. The White House described that call as "good and productive" and have agreed to convene a meeting of high-level staff next week. WTI and Brent are currently trading towards the lower end of their respective USD 56.73-57.56/bbl and USD 60.30-61.11/bbl range.

- Spot gold continues to advance and remains at top end of the day's range (USD 4,279.10-4,380.79/oz). Price action this morning fairly rangebound, but ultimately at elevated levels given the risk-off environment.

- Base metals are lower across the board, pressured by the risk tone; 3M LME Copper currently off by around 1.6% in a USD 10,461.6-10,637.5/t range.

NOTABLE DATA RECAP

- EU HICP Final YY (Sep) 2.2% vs. Exp. 2.2% (Prev. 2.2%); HICP Final MM (Sep) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

- Swedish Unemployment Rate (Sep) 8.3% (Prev. 8.4%)

NOTABLE EUROPEAN HEADLINES

- BoE's Mann said the UK labour market is loosening but not falling off a cliff, while she added that the UK yield curve now provides a more appropriate financial condition for the UK economy.

- ECB's Scicluna said the ECB must not rush further interest rate action, because the effects of higher US tariffs on prices aren't yet clear, according to Bloomberg.

NOTABLE US HEADLINES

- Fed Governor Miran said the downside of tariffs has been nowhere near what people predicted and that tariffs have had no material signs of growth drag or inflation spike, while he doesn't think the cost of tariffs will be passed onto consumers.

- Fed's Kashkari (2026 voter) said it is too soon to know the effect of tariffs on inflation and the impact of tariffs is taking longer to be felt than had guessed, while he expects services inflation to trend down and it is possible that goods inflation could spill over. Furthermore, he said the job market is slowing down and it is challenging to read signals without core government data because of the shutdown, as well as noted that most folks say they are still concerned about inflation.

- According to Axios, citing sources close to the agency, the Trump administration's slashing of the federal workforce amid the government shutdown is threatening AI work at the Commerce Department.

- US Senator Majority Leader Thune said the Senate is expected to vote next week on a bill to pay federal workers who have been forced to work without pay which would include the military, according to Punchbowl.

- According to Bloomberg, the US is nearing tariff relief for the auto industry after lobbying push and is to make an announcement as soon as Friday.

- Punchbowl, on US Obamacare credit extension, writes "it's true" that there are House Republicans who want to extend the credits; however, House Republican leadership does not want to, and their view is "hardening as the shutdown drags on"

GEOPOLITICS

MIDDLE EAST

- Hamas said the return of Israeli hostages' bodies may take time as some were buried in tunnels destroyed by Israel and others remain under rubble, while the retrieval requires equipment to remove rubble, which is currently unavailable due to Israel's entry ban on such tools. Furthermore, it stated that it remains committed to the Gaza agreement and is keen to hand over all remaining hostages' bodies.

- According to Sky News Arabia, "Israeli Foreign Minister: Israel is committed to Trump's plan, but Hamas is violating the agreement by holding the remains of 19 of our dead hostages"

RUSSIA-UKRAINE

- US President Trump said regarding Russian President Putin and Ukrainian President Zelensky, that they might do separate meetings, while he will probably meet Putin over the next two weeks. Trump commented that Tomahawks are also needed for the US, and he responded that he will speak to Senate Majority Leader Thune after House Speaker Johnson, about the Putin call and make the right determination, when asked about Russian sanctions.

CRYPTO

- Bitcoin is declining as risk assets are under pressure; Ethereum is underperforming, down to USD 3.7k.

- According to Bloomberg, Binance is among the crypto firms facing French money-laundering checks.

APAC TRADE

- APAC stocks were predominantly lower, following the losses on Wall Street, where risk sentiment was negatively impacted by renewed concerns about regional banks after loan fraud disclosures by Western Alliance and Zions Bancorp.

- The ASX 200 was led lower by underperformance in financials, energy, and tech, while gold miners were boosted by record highs in the precious metal.

- The Nikkei 225 retreated amid a firmer currency and as banking stocks suffered in sympathy with US counterparts, while uncertainty lingered ahead of next Tuesday's PM vote with the Japanese Innovation Party noting a 50-50 chance of a coalition with the LDP.

- The Hang Seng and Shanghai Comp conformed to the downbeat mood amid US-China frictions, with both sides blaming each other for the tensions.

NOTABLE ASIA-PAC HEADLINES

- Japan's LDP and CDP agreed to hold a vote to decide Japan's next PM on October 21st, while it was also reported that Japan Innovation Party co-leader Yoshimura said the chance of a coalition with the LDP is 50-50.

- Japan's Ishin Party (Innovation Party) Co-head Fujita announces big progress with the LDP following talks; will enter the stage of finalising details, final discussions are very delicate.

- According to Kyodo, Japan's Komeito party is reportedly arranging not to vote for the opposition PM candidate.

- BoJ's Uchida says Japan's economy is recovering moderately, although there are some weak signs. The BoJ will continue to raise interest rate if prices move in line with our forecast.

DATA RECAP

- Singapore Non-Oil Exports MM (Sep) 13.0% vs Exp. 9.0% (Prev. -8.9%)

- Singapore Non-Oil Exports YY (Sep) 6.9% vs Exp. -2.1% (Prev. -11.3%)