Market Wrap 2025-10-20

- In China, the People's Bank of China (PBoC) held Loan Prime Rates (LPRs) steady as anticipated. Chinese GDP, Industrial Production, and Retail Sales either met or exceeded projections. The Communist Party of China (CPC) Central Committee is holding a closed-door meeting for four days, concluding on Thursday.

- European stock exchanges began trading with gains but have since retreated from their highest levels amid ongoing Amazon Web Services (AWS) outages. Amazon has indicated it is observing signs of recovery. US equity futures are also showing gains.

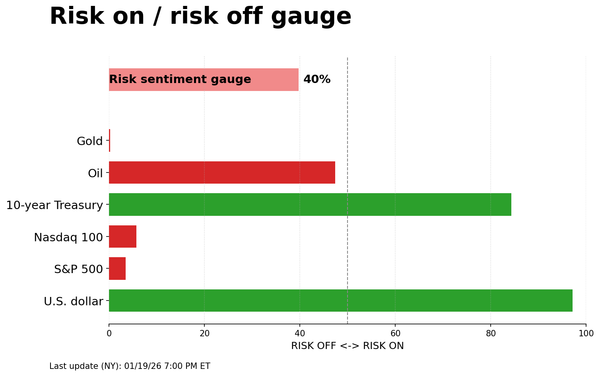

- The US Dollar Index (DXY) is stable to slightly lower in quiet trading. The Japanese Yen is reacting to overnight Japanese politics and Bank of Japan (BoJ) commentary.

- Global fixed income securities are declining due to the overall risk appetite. French bonds (OATs) are underperforming after S&P downgraded France's credit rating.

- Crude oil prices are declining despite heightened tensions following a meeting between Trump and Zelensky and after Israel's strikes on Gaza over the weekend. Trump states the ceasefire remains in effect.

- Upcoming events include Canadian Producer Prices (September), US Leading Index (September), New Zealand Trade (September), the CCP 4th Plenum (October 20th-23rd), and speeches from ECB's Schnabel and RBA's Jones. Zions Bancorp is scheduled to release earnings.

TARIFFS/TRADE

- US President Trump stated his desire for China to purchase soybeans in at least the same quantity as before. He believes China will agree to a soybean deal. He added that the US could lower tariffs for China, but China must also reciprocate. The US does not want China to restrict rare earth exports.

- US President Trump signed a proclamation on Friday addressing national security threats from imports of medium and heavy-duty vehicles, parts, and buses. An official announced that Trump will impose 25% tariffs on heavy-duty trucks effective November 1st and 10% tariffs on imported buses, while also providing significant tariff relief for US-based automakers.

- The Trump administration is reportedly easing some tariffs and has exempted more products from US tariffs recently. According to the WSJ, the US offered to exempt hundreds of additional farm products when countries reach deals with the US.

- US Treasury Secretary Bessent and Chinese Vice Premier He Lifeng had candid, in-depth, and constructive discussions regarding trade and will meet in person in the coming week to continue their discussions.

- Dutch Economy Minister Karremans stated the Nexperia intervention was necessary due to the former CEO's actions. He will speak with a Chinese government official about Nexperia within days. He also said that both China and Europe have an interest in resolving issues surrounding Nexperia and commented that China incorrectly believes the Netherlands and the US are "teamed up" on Nexperia.

- South Korea anticipates a higher likelihood of a trade agreement with the US by the APEC summit.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (+0.6%) opened higher across the board but have since moved off their highest levels as markets assess the ongoing AWS outages.

- European sectors generally show a positive bias. Defense stocks are leading, driven by increased geopolitical tensions between Israel/Hamas and Russia/Ukraine. Specifically, BNP Paribas (-9%) is declining as traders consider a recent Sudan ruling and its potential implications, along with S&P's unscheduled downgrade of France. Conversely, Kering (+3.8%) is gaining after agreeing to sell its beauty division to L'Oreal (+0.5%).

- US equity futures (ES +0.3% NQ +0.4% RTY +0.7%) are trading higher across the board, although slightly below their highest levels amid the ongoing AWS outages. Amazon has stated it is seeing signs of recovery.

- Amazon's (AMZN) AWS stated, "We can confirm significant error rates for requests made to the DynamoDB endpoint in the US-EAST-1 Region. This issue also affects other AWS Services in the US-EAST-1 Region as well." Most recently, AWS said, "We are seeing significant signs of recovery."

FX

- The USD is flat to slightly lower in early European trading on Monday after range-bound price action overnight. This comes amid a mostly risk-on mood to start the week and following recent softer comments from US President Trump on China, who noted on Friday that 100% tariffs are unsustainable and that he will be meeting with Chinese President Xi in two weeks. Technically, the DXY found support at its 50-day moving average (DMA) on Friday (50 DMA at 98.04 today), with today's current range between 98.39-98.67.

- The EUR has a mild upward bias after rebounding from Friday's low but remains below the 1.1700 level. Gains are limited as recent comments from ECB officials provided little impetus, and after S&P surprisingly lowered France's sovereign credit rating to 'A+' from 'AA-'. There was little reaction following German PPI, which eased more than expected. EUR/USD is trading in a 1.1652-1.1680 range, within Friday's 1.1650-1.1728 band, with the 100 DMA at 1.1651 today.

- USD/JPY has a mild upward bias after briefly topping 151.00 overnight to a 151.20 peak before declining. Initial upside was facilitated by the positive APAC risk tone, while Japan's LDP leader is on course to win the PM vote in parliament tomorrow. The pair was later weighed down by hawkish comments from BoJ's Takata, who said monetary policy remains accommodative even as the achievement of the inflation target is in sight and the initial fear over the impact of tariffs has diminished. Fleeting price action was seen on reports that BoJ is reportedly likely to maintain the view that the economy is on course for moderate recovery, despite headwinds from US tariffs. USD/JPY resides in a 150.34-151.20 range, within Thursday's 150.20-151.40 range, but after falling to 149.37 on Friday.

- Trading in GBP has been uneventful thus far, with newsflow also quiet for the UK. There has been little overall move seen to BoE Governor Bailey suggesting Brexit is to have a negative impact on UK economic growth for the foreseeable future. Meanwhile, BoE's Greene said on Friday that core and services inflation are going sideways and noted indications that the disinflation process is slowing, while she is concerned about second-round effects and stated that firms are more sensitive to upside inflation surprises. GBP/USD resides in a narrow 1.3406-1.3443 range, within Friday's 1.3391-1.3472 range, with the 50 DMA at 1.3475 today.

- There is a mild upward bias amid the positive sentiment seen in APAC markets, although this sentiment is somewhat limited in European trade, with AWS outages reported in the US East region, affecting global firms. Nonetheless, US President Trump said Friday that talks with China are progressing. Overnight, the PBoC maintained LPRs as expected, while Chinese GDP, Industrial Production, and Retail Sales either matched or topped forecasts, in turn keeping a mild upward bias in copper.

FIXED INCOME

- Japanese Government Bonds (JGBs) are under modest pressure, down to a 135.89 trough, taking out the 136.02 base from Friday. Downside comes amid a constructive global risk tone, weighing on the fixed income space broadly, a tone that saw strength in Japanese stocks overnight. Elsewhere, the weekend saw coalition building updates as Ishin and the LDP came to an agreement; this should allow LDP’s Takaichi to secure premiership at Tuesday’s vote. Note, Ishin+LDP leaves Takaichi a few votes shy of the majority threshold.

- French bonds (OATs) are in the red alongside peers but lagging at most points. Pressure comes after S&P cut France on Friday to A+ from AA-, remarking that uncertainty over France’s finances remains elevated and that unless a significant deficit-reducing measure is unveiled, the consolidation will be slower than previously thought. An update that has sent OATs to a 122.74 base with losses of just over 40 ticks at most. While lower, the benchmark remains comfortably clear of last week’s 121.82 base and the 120.61 low from the week before that. As such, the OAT-Bund 10yr yield spread has widened but remains within familiar levels; at a 80bps peak.

- US Treasuries (USTs) are in the red, weighed on by the general risk tone after the trade updates from Trump. In brief, the US President commented that 100% tariffs are not sustainable and that he will be meeting with Chinese President Xi. Furthermore, Treasury Secretary Bessent spoke with Chinese VP He, a talk described as constructive and ahead of a meeting in the near term. Trade aside, US updates are a little light with the shutdown still going and geopolitics dominating a lot of the newsflow. While the shutdown is on and data remains suspended, we will get the September CPI release on Friday for social security adjustment purposes. Down to a 113-10 low with losses of five ticks.

- German Bunds are pressured, and with little driving things for the complex so far. Bunds down to a 129.76 base at worst; similarly to peers.

- Over in the UK, Gilts are marginally outperforming versus peers, seemingly thanks to weekend press reports around the upcoming budget, with pension firms making commitments and further chatter around measures Reeves could take. Furthermore, BoE’s Greene said the rate cutting cycle is not over. Updates that have seemingly tempered the bearish bias seen globally, but only marginally.

- Orders for Italy's new 7yr BTP Valore have reached EUR 1bln.

- The EU sold 2028, 2033, and 2045 bonds: the 2028 average yield was 2.128%, the 2033 average yield was 2.680%, and the 2045 average yield was 3.709%.

COMMODITIES

- Crude oil benchmarks are falling lower despite reports over the weekend that Hamas violated the ceasefire agreement. WTI and Brent briefly extended Friday’s high on the open, peaking at USD 57.43/bbl and USD 61.55/bbl respectively before falling back into Friday’s range and troughing at USD 56.57/bbl and USD 60.68/bbl respectively.

- Spot gold (XAU) is oscillating in a USD 4219-4274/oz band as precious metals consolidate following Friday’s selloff that saw XAU and silver (XAG) drop as much as 3.3% and 5.9% respectively.

- Base metals are trading higher after the latest Chinese data (GDP, industrial production, and retail sales) either matched or exceeded expectations. In addition, the country’s National Bureau of Statistics said the FY target of 5% growth is still on track. 3M LME Copper extended Friday’s high during the APAC session, forming a peak at USD 10.73k/t, before falling to USD 10.65k/t and oscillating between these parameters.

NOTABLE DATA RECAP

- UK House Price Rightmove MM (Oct) 0.30% (Prev. 0.40%); YY (Oct) -0.10% (Prev. -0.10%)

- German Producer Prices MM (Sep) -0.1% vs Exp. 0.0% (Prev. -0.5%); YY (Sep) -1.7% vs. Exp. -1.5% (Prev. -2.2%)

- EU Current Account SA, EUR (Aug) 11.9B (Prev. 27.7B); Current Account NSA,EUR (Aug) 13.0B (Prev. 35.0B)

NOTABLE EUROPEAN HEADLINES

- BoE Governor Bailey said Brexit is to have a negative impact on UK economic growth for the foreseeable future.

- UK Energy Secretary Miliband suggested the government is looking at the possibility of cutting the rate of VAT on energy bills but said that he would not speculate ahead of the Chancellor's Budget in November.

- Three pension giants in the UK have made a fresh GBP 3bln wave of commitments to invest in rental homes, infrastructure, and fast-growing companies, ahead of a government-backed meeting to discuss how they can work to boost investment, according to FT.

- France’s wealthy are reportedly investing record amounts in Luxembourg-based annuities and shifting other funds to perceived havens such as Switzerland amid concerns about political turmoil at home, according to FT.

- S&P lowered France to 'A+' from 'AA-'; Outlook Stable, while it cited heightened risks to budgetary consolidation.

NOTABLE US HEADLINES

- The US said on Friday that about 1,400 workers will be furloughed at the Nuclear Weapons Security Agency as of Monday due to the government shutdown.

- Microsoft (MSFT) leaders are reportedly worried that meeting OpenAI's rapidly expanding computing demand could lead to overbuilding servers that might not generate a financial return, according to The Information. It was separately reported on Friday that new analysis of download trends and daily active users provided by Apptopia showed that ChatGPT’s mobile app growth may have hit its peak as estimates indicate that new user growth, measured by percentage changes in new global downloads, slowed after April, according to TechCrunch.

GEOPOLITICS

MIDDLE EAST

- Israel’s Channel 12 reported that Israel was attacking Gaza, while the Israeli military said Hamas carried out multiple attacks against Israeli forces beyond the ‘yellow line’, violating the ceasefire. It was separately reported by Axios that US and Israeli sources said that Israel notified the US administration in advance of the strikes in Gaza, while the Israeli military said it began a wave of attacks against Hamas targets in southern Gaza but later said it is resuming enforcement of the Gaza ceasefire after it was ‘violated’ by Hamas.

- An Israeli government spokesperson said Israel has continued to fulfill its obligations to the ceasefire and noted that they are in a ceasefire, but soldiers can act to defend themselves.

- Israeli PM Netanyahu instructed that the Rafah crossing will not be opened until further notice, while an opening will be considered based on whether Hamas returns deceased hostages and implements the agreed-upon framework. It was separately reported by Israeli media that Israel is to halt the supply of aid to Gaza until further notice, while an Israeli official said aid into Gaza was halted due to the truce breach by Hamas.

- The US informed the guarantor nations of the peace agreement of credible reports indicating an imminent ceasefire violation by Hamas against the people of Gaza, according to the State Department, which stated that if Hamas proceed with this attack, measures will be taken to protect the people of Gaza and preserve the integrity of the ceasefire.

- A US official cited by Axios stated that Israel told the US it will open the crossing to Gaza on Monday morning, while the Palestinian embassy in Egypt earlier stated that the Rafah border crossing with Egypt is to reopen on Monday, which will allow Palestinians residing in Egypt to return to Gaza.

- Israeli PM’s office said Israel received the bodies of two hostages from the Red Cross in Gaza.

- Qatar’s Foreign Ministry said Pakistan and Afghanistan have agreed to an immediate ceasefire during talks mediated by Turkey and Qatar in Doha.

- "According to Arab media reports, a number of people were killed and wounded during the Israeli army's shooting in eastern Gaza", according to Iran International.

RUSSIA-UKRAINE

- US President Trump told Ukrainian President Zelensky in a tense meeting on Friday that he doesn’t intend to provide missiles, at least for now, according to Axios. It was separately reported that Trump urged Zelensky to accept Russian President Putin’s terms and said that Putin warned he would “destroy” Ukraine if it did not agree, according to FT.

- US President Trump said he did not discuss Ukraine ceding the Donbas region to Russia, and the region should stay as it is now, with Russia having some 78% of it.

- Russian President Putin reportedly demanded during a phone call with US President Trump that the territory of the Donetsk region must completely come under the control of the Russian army to end the war, but with Russia now ready to give up “parts” of the territories of Zaporizhzhia and Kherson in exchange for it, according to The Washington Post.

- Russia said its forces captured Pleshchivka in Ukraine’s Donetsk region, while Russian forces also captured Chunyshyne and Poltavka in eastern Ukraine, according to RIA.

- The IAEA said work has begun to repair damaged off-site power lines to the Zaporizhzhia nuclear power plant after a four-week outage, following the establishment of local ceasefire zones to allow work to proceed.

- UK PM Starmer said the UK would continue to step up its support and would ensure Ukraine was in the strongest possible position, according to a Downing Street spokesperson.

- Ukraine President Zelensky is expected to partake in a top-level meeting in Brussels this week, via Politico citing sources; diplomats add the Trump-Zelensky meeting was not as "bleak as reported".

- Ukrainian President Zelensky, when asked about Tomahawk missiles, says in his view, US President Trump does not want escalation with Russia until he has had a chance to have another meeting with Moscow.

OTHER

- China said it found evidence of a US cyberattack on a Chinese state agency.

- US President Trump officials are quietly discussing the idea of a meeting with North Korea’s leader Kim during an upcoming Asia trip, according to CNN.

- US President Trump said they destroyed a very large drug-carrying submarine that was navigating towards the US on a well-known narcotrafficking transit route, while US intelligence confirmed the vessel was loaded up with mostly fentanyl.

- US President Trump called Colombian President Petro a ‘drug dealer’ and announced the US would end “large-scale payments and subsidies”, according to The Sunday Times.

- US Republican Senator Graham said President Trump will be announcing major tariffs against Colombia, while President Trump confirmed Senator Graham's statement on Colombia tariffs and said he will announce more regarding this on Monday.

CRYPTO

- Bitcoin is gaining and is now back above the USD 110k mark; Ethereum is also firmer and tops USD 4k.

APAC TRADE

- APAC stocks were higher amid tailwinds from recent trade-related rhetoric including US President Trump's comments on Friday that 100% tariffs are not sustainable and that he will be meeting with Chinese President Xi, while it was also reported that US Treasury Secretary Bessent and Chinese Vice Premier He engaged in candid, in-depth and constructive discussions regarding trade and will meet in person in the week ahead to continue their discussions.

- The ASX 200 marginally gained amid strength in tech and industrials, although the index notably lagged behind regional peers amid weakness in the commodity-related sectors.

- The Nikkei 225 surged to a fresh all-time high above the 49,000 level amid a reignition of the Takaichi trade with the LDP leader on track to become Japan's first female PM following an agreement to form a coalition with Japan's Innovation Party.

- The Hang Seng and Shanghai Comp joined in on the positive mood with the Hong Kong benchmark led higher by strength in tech, and as participants digested the latest Chinese data releases, including GDP, Industrial Production and Retail Sales which either matched or topped forecasts, while the CPC Central Committee is also holding a four-day closed-door meeting through to Thursday to discuss the five-year development plan.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Oct) 3.00% vs. Exp. 3.00% (Prev. 3.00%)

- Chinese Loan Prime Rate 5Y (Oct) 3.50% vs. Exp. 3.50% (Prev. 3.50%)

- PBoC Governor Pan said on Friday that the Chinese economy remains on track with positive signs and noted that prices remain stable with Core CPI picking up, while he also said that monetary policy will remain appropriately loose.

- Chinese tech giants paused stablecoin plans after Beijing raised concerns about the rise of currencies controlled by the private sector, according to FT.

- Japan’s LDP and the Japan Innovation Party agreed to form a coalition government. It was separately reported that Japan’s Innovation Party (Ishin) is considering staying out of the Cabinet and cooperating from outside, while Ishin party leader Yoshimura is to meet LDP leader Takaichi at 10:00BST/05:00EDT to finalise the coalition agreement.

- BoJ's Takata said monetary policy remains accommodative even as the achievement of the inflation target is in sight and the initial fear over the impact of tariffs has diminished, while he added they must be mindful of the risk Japan may see inflation overshoot expectations. Takata stated that the BoJ must communicate with markets on the assumption inflation target has been roughly achieved and they need to discuss monetary policy on assumption the price target has already been achieved, as well as noted that the BoJ needs to gradually shift policy in several stages, as Japan's economy is on the cusp of seeing a "true dawn".

- Japan LDP Leader Takaichi intends to appoint Toshimitsu Motegi as Foreign Minister, via Kyodo, looking to appoint Minoru Kihara as Chief Cabinet Secretary.

- The BoJ is reportedly likely to maintain the view that the economy is on course for moderate recovery, despite headwinds from US tariffs, and may slightly revise up economic growth forecast for FY25 at the October meeting, according to Reuters sources.

- Japan's LDP leader Takaichi and Innovation Party Yoshimura sign agreement to form coalition government (as expected)

DATA RECAP

- Chinese GDP QQ SA (Q3) 1.1% vs. Exp. 0.8% (Prev. 1.1%, Rev. 1.0%); YY (Q3) 4.8% vs. Exp. 4.8% (Prev. 5.2%)

- Chinese Industrial Output YY (Sep) 6.5% vs. Exp. 5.0% (Prev. 5.2%)

- Chinese Retail Sales YY (Sep) 3.0% vs. Exp. 3.0% (Prev. 3.4%)

- Chinese Urban Investment (YTD) YY (Sep) -0.5% vs. Exp. 0.1% (Prev. 0.5%)

- Chinese House Prices MM (Sep) -0.4% (Prev. -0.3%); YY (Sep) -2.2% (Prev. -2.5%)

- New Zealand CPI QQ (Q3) 1.0% vs. Exp. 1.0% (Prev. 0.5%); YY (Q3) 3.0% vs. Exp. 3.0% (Prev. 2.7%)