Market Wrap 2025-10-21

- Asia-Pacific equities followed Wall Street's upward trend, with market sentiment focused on US-China trade relations and some optimism stemming from US President Trump's remarks indicating China's respect.

- US President Trump reiterated the November 1st deadline for additional tariffs and confirmed his intention to meet with Chinese President Xi, expressing confidence in reaching a 'fantastic deal'.

- In Japan, Takaichi, a leader within the LDP, secured a majority in the lower house vote (237 out of 465 seats) and is expected to become Japan's first female PM.

- European equity futures suggest a slightly positive opening for cash markets, with Euro Stoxx 50 futures increasing by 0.1% following Monday's 1.3% gains in the cash market.

- Upcoming events include UK Public Sector Net Borrowing (PSNB) figures for September, Canadian CPI data for September, the NBH Policy Announcement, the CCP 4th Plenum (October 20th-23rd), speeches from ECB's Nagel, Lane, and Lagarde, Fed's Waller, and BoE's Bailey and Breeden, as well as supply updates from the UK and Germany.

- Earnings reports are expected from Netflix, Intuitive, Texas Instruments, Capital One Financial, Coca-Cola, GE Aerospace, Elevance Health, Lockheed Martin, Philip Morris, RTX, General Motors, 3M, Nasdaq, and Danaher.

SNAPSHOT

Newsquawk in 3 steps:

- Subscribe to the free premarket movers reports

- Listen to this report in the market open podcast (available on Apple and Spotify)

- Trial Newsquawk’s premium real-time audio news squawk box for 7 days

LOOKING AHEAD

- Key events on the horizon include UK PSNB (Sep), Canadian CPI (Sep), NBH Policy Announcement, CCP 4th Plenum (20th-23rd), Speakers including ECB’s Nagel, Lane & Lagarde, Fed’s Waller, BoE's Bailey & Breeden, Supply from UK & Germany, Earnings from Netflix, Intuitive, Texas Instruments, Capital One Financial, Coca-Cola, GE Aerospace, Elevance Health, Lockheed Martin, Philip Morris, RTX, General Motors, 3M, Nasdaq & Danaher.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

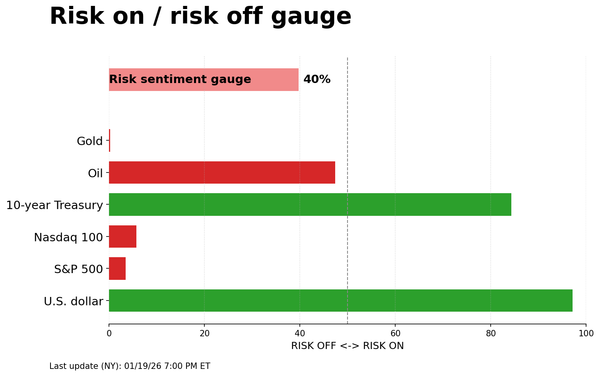

- US equities experienced gains in a risk-on trading environment, despite limited news flow at the start of the week due to the Fed blackout and the absence of US data resulting from the government shutdown. Market activity was generally subdued, and US President Trump's comments largely echoed previous statements, reaffirming his intention to meet with Chinese President Xi and noting that a failure to reach a deal with China would result in 100% tariffs (existing tariffs plus an additional 100% tariff threat) on November 1st.

- SPX rose 1.07% to 6,735, NDX increased 1.30% to 25,141, DJI advanced 1.12% to 46,707, and RUT climbed 1.95% to 2,500.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump stated that China has been respectful and mentioned that potential 155% tariffs could be implemented on November 1st unless a trade agreement is reached, adding that he will be meeting with Chinese President Xi in South Korea.

- US President Trump suggested the possibility of threatening China on other matters, including airplanes, and expressed his intention to visit China early next year to finalize arrangements. Trump emphasized the need for the US and China to prosper together and expressed his desire for China to purchase soybeans.

- US President Trump and Australian PM Albanese signed an agreement regarding critical minerals. President Trump noted the absence of "games" with Australia, while Australian PM Albanese highlighted that the agreement includes a joint venture on processing between the US and Australia, as well as projects with Japan.

- A White House Fact Sheet on the Critical Minerals Deal with Australia indicated that both governments are set to invest over USD 3 billion in the next six months, with recoverable resources estimated at USD 53 billion.

- US Trade Representative Greer announced plans to take action regarding Nicaragua's labor rights policies and proposed additional duties of up to 100% on Nicaragua following a Section 301 investigation. He also proposed suspending all of Nicaragua's benefits under the Central America-Dominican Republic Free Trade Agreement, either immediately or phased in over 12 months.

NOTABLE HEADLINES

- A US appeals court authorized US President Trump to deploy troops to Portland, Oregon. Separately, the state of Illinois requested the US Supreme Court to hear the case to block Trump's plan to deploy National Guard troops to Chicago.

- US Director of Federal Housing Pulte stated that the Trump administration is evaluating a potential offering for Freddie and Fannie, which could occur as early as the end of 2025.

APAC TRADE

EQUITIES

- APAC stocks followed the lead of Wall Street's rally, with attention remaining on US-China trade and some optimism generated by US President Trump's comments indicating China's respect. While he continued to mention the November 1st deadline for additional tariffs, he also reaffirmed his intention to meet with Chinese President Xi and expressed confidence in reaching a 'fantastic deal'.

- The ASX 200 reached a new record high, driven by gains in the mining and resources sectors following the signing of a critical minerals agreement between Australia and the US, and with mining giant BHP advancing after its quarterly production update.

- The Nikkei 225 rallied, briefly approaching the 50k level before paring some gains. Attention was focused on the PM vote in parliament, where Abe-protege Takaichi was elected as Japan's first female PM, a development seen as potentially delaying or slowing the BoJ's rate hikes.

- The Hang Seng and Shanghai Comp were higher amid hopes for improved US-China trade relations and the ongoing plenum where China is expected to outline its next five-year plan.

- US equity futures maintained recent gains, but further upside was limited as earnings season is set to intensify.

- European equity futures suggest a modestly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.3% on Monday.

FX

- The DXY held onto the previous day's slight gains in rangebound trading amid limited news flow and the Fed's blackout period. The lack of US data due to the ongoing government shutdown persisted, although White House Economic adviser Hassett suggested the shutdown is likely to end this week, without providing specific reasons. He added that if the shutdown continues, the White House will consider stronger measures. Nevertheless, the focus remained on US-China trade amid hopes for improved trade ties after President Trump remarked that China has been respectful. While he warned of potential 155% tariffs on November 1st unless a deal is reached, he also reaffirmed his intention to meet with Chinese President Xi and expressed confidence in reaching a strong trade deal.

- EUR/USD lacked direction, with the single currency remaining near the previous day's low and showing little reaction to comments from ECB officials, including Nagel, who stated they can remain in a wait-and-see mode on rates.

- GBP/USD marginally weakened, breaching the 1.3400 level to the downside in the absence of any UK-specific catalysts.

- USD/JPY edged higher, returning to the 151.00 territory amid fresh record highs in Tokyo stocks and focus on the parliamentary vote in which LDP leader Takaichi won to become Japan's first female Prime Minister.

- Antipodeans did not benefit from the positive risk appetite, with NZD/USD underperforming after slightly weaker exports and credit card spending data.

FIXED INCOME

- 10yr UST futures were contained amid the Fed blackout and absence of data, while attention remained on US-China trade.

- Bund futures traded with little change near the 130.00 level amid a lack of haven demand and ahead of issuances.

- 10yr JGB futures remained afloat with mild upside amid the Japanese PM vote at the Diet which LDP leader Takaichi won, while participants also digested a 10-year Japan Climate Transition Bond auction which resulted in a slightly higher bid-to-cover than previous.

COMMODITIES

- Crude futures were subdued after recent choppy performance and with very light fresh catalysts.

- The Kazakhstan Energy Ministry stated that the suspension of operations at the Orenburg gas processing plant did not affect gas supplies to Kazakhstan, and gas reception at the Orenburg gas processing plant is expected to resume soon.

- The Iraqi PM's office announced that Iraq will sign an agreement with Excelerate Energy (EE) to supply US gas to Iraq.

- Spot gold marginally pulled back from record highs after advancing yesterday amid rate cut bets for next week's FOMC.

- Copper futures lacked conviction despite the positive risk appetite, with upside contained following the prior day's swings.

CRYPTO

- Bitcoin retreated throughout the session and approached the 108k level to the downside.

NOTABLE ASIA-PAC HEADLINES

- Japanese LDP leader Takaichi won the lower house vote (237 votes out of 465-seats) to become Japan's first female PM, as expected. Separately, it was reported that Takaichi is to appoint Satsuki Katayama as Finance Minister and Kimi Onoda as Economic Security Minister, while she will appoint Ryosei Akazawa as Trade Minister and Shinjiro Koizumi as Defence Minister, according to FNN.

GEOPOLITICS

MIDDLE EAST

- US President Trump stated that the Hamas situation will be taken care of quickly and that many steps are being taken to maintain the ceasefire. Trump stated they are going to eradicate Hamas if they have to, but haven't told Israel to go back in yet, and will give Hamas a chance.

RUSSIA-UKRAINE

- US President Trump commented on the war in Ukraine, stating that he thinks they'll get there, while adding that Ukraine could still win it, but he doesn't think they will and noted anything could happen. Furthermore, Trump said they are in the process of trying to make a deal and that he talked to Russian President Putin about attacks on civilians and said to stop.

- US President Trump's hopes for a quick meeting with Russian President Putin may be stalled, and the anticipated meeting between US Secretary of State Rubio and Russian Foreign Minister Lavrov has been put on hold, according to CNN citing a White House official.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves will announce the government is cutting red tape for businesses in an attempt to boost growth.

- ECB's Nagel said they can remain in wait-and-see mode on rates.

More

markets stories on ZeroHedge