Market Wrap 2025-10-21

MARKET SNAPSHOT

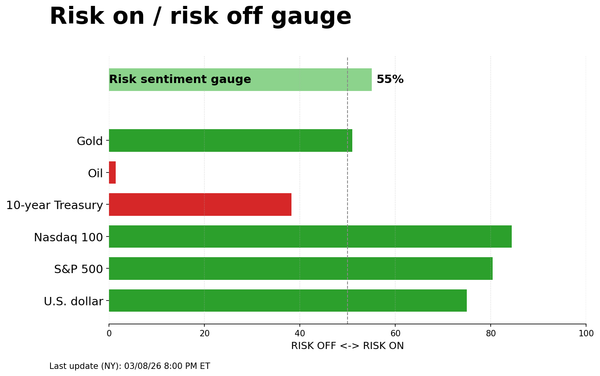

Equities displayed mixed performance, Treasury yields increased, crude oil prices rose, the U.S. dollar strengthened, and gold prices declined.

REAR VIEW

Key events and announcements included:

- Takaichi was confirmed as the new Prime Minister of Japan.

- Warner Bros. Discovery (WBD) has reportedly put itself up for sale.

- Zions (ZION) indicated that a significant loss was due to a limited number of problematic loans rather than widespread credit issues.

- Coca-Cola (KO), General Electric (GE), General Motors (GM), and 3M (MMM) reported earnings that exceeded expectations.

- Canadian CPI data came in higher than anticipated.

- A summit between Trump and Putin is reportedly "on hold."

- OpenAI announced the launch of a new browser.

- The U.S. plans to purchase 1 million barrels of oil for the Strategic Petroleum Reserve (SPR).

COMING UP

- Data releases scheduled: Japanese Trade Balance (September), UK CPI (September).

- Events to watch: CCP 4th Plenum (20th-23rd), Bank of Japan (BoJ) Summary of Opinions (SLOOS).

- Speakers: ECB's de Guindos and Lagarde, Fed's Barr.

- Supply: Australia, Germany, US.

- Earnings releases expected from: SAP, Barclays, Akzo Nobel, Tesla, IBM, Kinder Morgan, Alcoa, Lam Research, GE Vernova, Hilton, AT&T, and Thermo Fisher.

MARKET WRAP

On Tuesday, stock market performance was mixed. The S\&P 500 (SPX) and Nasdaq (NDX) ultimately showed little change after fluctuating trading, while the Dow Jones Industrial Average (DJI) gained and the Russell 2000 (RUT) advanced. Sector performance was varied amid numerous earnings reports. Consumer Discretionary and Industrials outperformed, driven by strong earnings from General Motors (GM), which boosted auto stocks, and gains in 3M (MMM) and RTX (RTX), although Lockheed Martin (LMT) and Northrop Grumman (NOC) earnings were disappointing. Utilities, Communications, and Materials underperformed, with the latter impacted by falling precious metal prices. Gold experienced its largest absolute drop on record, declining from near all-time high (ATH) levels of USD 4,375/oz to a low of USD 4,087/oz, attributed to profit-taking, easing credit concerns, and a more positive stance toward China from Trump. Treasury notes saw increased demand, particularly at the long end, possibly as investors sought a less volatile safe-haven asset amid the sharp decline in gold. In foreign exchange markets, the Yen weakened after Takaichi was elected as Prime Minister of Japan following the Liberal Democratic Party's (LDP) coalition with the Innovation Party. The Canadian dollar (CAD) was the strongest performer following a higher-than-expected CPI report. Crude oil prices were volatile, initially declining on Trump's opposition to a move into Gaza by Middle Eastern countries to address Hamas, but then rallying on reports that planning for a Trump/Putin meeting had been halted. Prices reached highs following reports that the U.S. would purchase 1 million barrels of oil for the SPR.

FIXED INCOME

T-NOTE FUTURES (Z5) SETTLED 5 TICKS HIGHER AT 113-24

Treasury note gains were led by the long end, while gold experienced its largest one-day decline on record. At settlement, key rates were:

- 2-year: -1.1bps at 3.453%

- 3-year: -1.6bps at 3.450%

- 5-year: -2.4bps at 3.555%

- 7-year: -3.1bps at 3.733%

- 10-year: -3.3bps at 3.955%

- 20-year: -3.4bps at 4.515%

- 30-year: -3.7bps at 4.542%

INFLATION BREAKEVENS:

- 1-year BEI: +0.9bps at 3.170%

- 3-year BEI: +1.4bps at 2.595%

- 5-year BEI: +1.4bps at 2.330%

- 10-year BEI: +0.6bps at 2.257%

- 30-year BEI: +0.0bps at 2.200%

THE DAY:

Treasury notes experienced increased demand on Tuesday, with gains led by the long end. This upside in Treasuries coincided with significant selling pressure in gold after its record rally to new all-time highs. Gold prices fell almost USD 300/oz from peak to trough in a single trading session. Typically, gold and Treasury notes would move in the same direction in a risk-driven scenario, but the day's price action in gold was exceptional, marking its largest one-day decline on record. The sharp outflows from the traditional haven metal may have led to inflows into U.S. Treasuries as flows shifted from one traditional haven to another following gold's record run and sharp weakness. The overall risk environment was choppy, as was price action in oil. Oil prices sold off aggressively after Trump told Middle Eastern countries, including Israel, "not yet" regarding re-entering Gaza to "straighten out" Hamas. The downside in oil appeared to support upside in Treasury notes, with lower oil prices helping ease inflationary pressures. Treasury notes also moved off peaks when oil prices rebounded, following reports that work has stopped on planning a Trump/Putin meeting, while the U.S. is also set to buy 1 million barrels of oil for the SPR. There is significant focus on U.S. CPI data due Friday amid the government shutdown ahead of the Federal Reserve rate decision next week.

SUPPLY

Notes:

- The U.S. Treasury will sell USD 13 billion of 20-year bonds on October 22nd and USD 26 billion of 5-year Treasury Inflation-Protected Securities (TIPS) on October 23rd; all to settle October 31st.

Bills:

- The U.S. Treasury sold 6-week bills at a high rate of 3.940%, covered 2.93x.

- The U.S. will sell USD 110 billion in 4-week bills and USD 95 billion of 8-week bills on October 23rd, and USD 69 billion of 17-week bills on October 22nd; to settle October 28th.

STIRS/OPERATIONS:

- Market Implied Fed Rate Cut Pricing: October 24bps (previous 25bps), December 49bps (previous 51bps), January 64bps (previous 64bps).

- NY Fed Reverse Repurchase (RRP) operation demand at USD 4.7 billion (previous 5.9 billion) across 10 counterparties (previous 9).

- NY Fed Repo operation demand at USD 0 billion (previous 2 billion).

- Effective Federal Funds Rate (EFFR) at 4.11% (previous 4.11%), volumes at USD 82 billion (previous 79 billion) on October 20th.

- Secured Overnight Financing Rate (SOFR) at 4.16% (previous 4.18%), volumes at USD 2.945 trillion (previous 3.022 trillion) on October 20th.

CRUDE

WTI (Z5) SETTLED USD 0.22 HIGHER AT 57.24/BBL; BRENT (Z5) SETTLED USD 0.31 HIGHER AT 61.32/BBL

The crude oil complex ended the day firmer after a volatile trading session influenced by various headlines. In the European morning, benchmark prices rose to initial intra-day highs after Russia's Foreign Minister Lavrov stated that Russia's position had not changed since Anchorage, and a halt at the current frontline meant forgetting the causes of the war. Subsequently, WTI and Brent began to decline, a move that was further accelerated after Trump posted on Truth, stating that he told Middle Eastern countries, including Israel, “NOT YET!”, regarding going into Gaza to "straighten out" Hamas. However, he added, "There is still hope that Hamas will do what is right. If they do not, an end to Hamas will be FAST, FURIOUS, & BRUTAL!" This caused WTI and Brent to fall to session troughs of USD 56.35/bbl and 60.35, respectively. These moves then reversed, with benchmarks coming off lows following reports from NBC citing a White House official stating that planning for a Trump/Putin summit in Budapest is "on hold" at the moment - this was later confirmed by the White House. Finally, WTI and Brent spiked to session highs of USD 58.08/bbl and 62.10 after Bloomberg reported that the U.S. is to buy 1 million barrels for the SPR, with oil for delivery in December 2025 and January 2026. Nonetheless, benchmarks came off peaks to settle with gains and well within the day's range.

EQUITIES

CLOSES: SPX -0.01% at 6,735, NDX -0.06% at 25,127, DJI +0.47% at 46,925, RUT -0.52% at 2,487.

SECTORS: Consumer Discretionary +1.32%, Industrials +0.88%, Health +0.21%, Financials -0.13%, Technology -0.15%, Energy -0.20%, Consumer Staples -0.34%, Real Estate -0.35%, Materials -0.70%, Communication Services -0.85%, Utilities -0.99%.

EUROPEAN CLOSES: Euro Stoxx 50 +0.11% at 5,687, Dax 40 +0.37% at 24,349, FTSE 100 +0.25% at 9,427, CAC 40 +0.64% at 8,259, FTSE MIB +0.60% at 42,648, IBEX 35 -0.39% at 15,767, PSI -0.64% at 8,272, SMI -0.04% at 12,630, AEX +0.02% at 967.

EARNINGS:

- Coca-Cola (KO): EPS and revenue beat expectations.

- Philip Morris (PM): Reversed earlier pre-market strength after top and bottom-line topped expectations, as the CEO stated that the smoke-free portfolio is "outgrowing the industry by a clear margin.”

- Crown Holdings (CCK): Reported strong earnings with stellar guidance.

- 3M (MMM): Profit and revenue topped expectations and lifted the full-year outlook.

- General Electric (GE): Q3 metrics surpassed expectations and raised the full-year view.

- Northrup Grumman (NOC): Top line was light and lowered full-year revenue guidance.

- RTX (RTX): EPS and revenue beat expectations alongside raising the full-year outlook.

- Haliburton (HAL): Q3 metrics impressed.

- Elevance Health (ELV): EPS and revenue beat expectations.

- General Motors (GM): EPS, revenue, and vehicle sales topped expectations; raised the full-year view.

- PulteGroup (PHM): Net new orders fell 6% while home sale gross margin weakened year-over-year.

- Lockheed Martin (LMT): Reported solid earnings and guidance.

- Zions (ZION): Indicated that a large quarterly loss stemmed from a few faulty loans rather than broad credit stress.

STOCK SPECIFICS:

- Starboard Value has acquired nearly a 5% stake in Fluor (FLR) and plans to advocate for measures to boost its share price.

- Epam Systems (EPAM) announced a new USD 1 billion stock buyback program.

- Institutional Shareholder Services (ISS) recommends that investors reject CoreWeave’s (CRWV) USD 9 billion all-stock acquisition of Core Scientific (CORZ), citing the latter’s strong standalone performance.

- CNBC's Faber reported that Warner Bros. Discovery (WBD) is putting itself up for sale and multiple parties are interested, including Comcast (CMCSA) and Netflix (NFLX). Reuters sources indicated that the WBD board rejected a PSKY offer of between USD 23-24 per share. Earlier in October, it was reported that the WBD CEO wanted PSKY to offer possibly upwards of USD 30 per share to close a deal.

- OpenAI confirmed that it is launching ChatGPT Atlas, an AI-powered web browser built around ChatGPT. Alphabet (GOOGL) shares were impacted by the news.

- Ananym has built a stake in Baker Hughes (BKR) and is pushing for a breakup, according to Bloomberg.

- Activist investor Engaged has built a stake in Cognex (CGNX) and stated that the stock could double in two years with cost cuts.

FX

The U.S. Dollar strengthened on Tuesday amid a busy news cycle. The Dollar was seemingly supported by the easing of credit market concerns, reinforced by Zion Bancorp's earnings report, which attributed a large quarterly loss to a few faulty loans rather than broad credit stress. There were no tier 1 data releases due to the ongoing government shutdown, with attention focused on U.S. CPI data on Friday ahead of the Federal Reserve meeting next week, where a 25bps rate cut is widely anticipated, along with a likely announcement of an end to its balance sheet runoff. Elsewhere, the Putin/Trump meeting is on hold, while Trump stated that he will discuss many things with Chinese President Xi in two weeks, and reiterated that they are going to do well in that negotiation.

G10 FX was largely lower against the Greenback, but CAD was the sole gainer and profited from firmer than expected Canadian CPI, which saw USD/CAD fall to lows of 1.4004, and money market pricing moving hawkish over the shorter time frame. However, while the stronger-than-expected CPI inflation print raises the odds that the BoC will pause next week, Oxford Economics notes underlying inflation remains contained, and with the economy struggling to grow and slack in the labour market, the consultancy expects another 25bps rate cut.

JPY was the clear laggard, with USD/JPY topping out at 152.17 after the Japanese election, whereby Takaichi was confirmed as the new Japanese PM. Although the Yen did see some strength as the new PM said she does not see the need to review the BoJ-Government accord now, and the method of implementing monetary policy lies with the BoJ. As such, attention turns to the BoJ next week, 30th October, where money markets currently price a c. 20% chance of a 25bps hike.

GBP, EUR, AUD, and CHF all saw losses to similar degrees, with not much currency-specific newsflow, and more a function of wider trade. Cable traded between 1.3362-3416 ahead of inflation metrics on Wednesday, while the ECB added little new. EU Trade Commissioner Sefcovic said he held a video call with his Chinese counterpart this morning, and invited Chinese authorities to Brussels in the coming days, and they accepted. On the single currency, ING quips that EUR/USD remains almost entirely driven by US credit/equity sentiment, and further stabilisation could take EUR/USD to 1.160, with levels below that harder to justify unless the US CPI on Friday comes in hotter than expected.

EMFX broadly saw weakness, with HUF largely unmoved after the NBH held rates steady, as expected. In LatAm FX, Brazil Finance Minister Haddad said the interest rate is too restrictive, inflation is already approaching the upper band in the target, and Brazil's real interest rate is over 10%.

Spot gold tumbled in the largest move on record (on absolute change), albeit after testing another ATH early this morning as it continued its initial march higher. Some had cited easing credit concerns and Trump taking a more friendly tone to China. However, given the magnitude of the move, large profit-taking was likely driving price action following its recent rally.