Market Wrap 2025-10-22

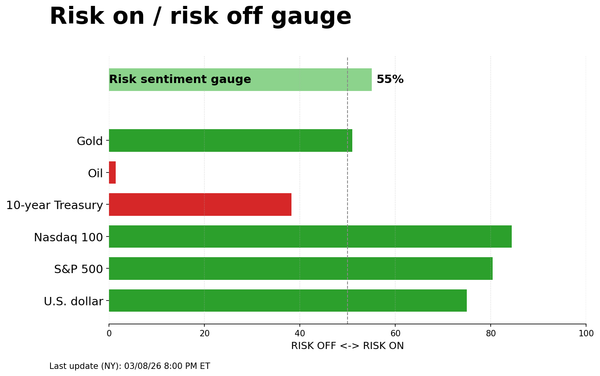

- European stock markets are generally trading lower, although the FTSE 100 is outperforming following the release of UK inflation data; US equity futures are showing slight weakness.

- The USD is holding steady, while the GBP experienced a decline after the UK's inflation report came in softer than anticipated, increasing expectations for an interest rate cut in December.

- US Treasury securities are stable to slightly higher ahead of new supply, UK Gilts rose following the CPI data, and German Bunds are facing marginal pressure after another weak auction.

- An initial recovery in gold prices has diminished, with XAU now trading lower for the session; the crude oil complex is showing strength.

- Upcoming events include the CCP 4th Plenum (October 20-23), speeches from ECB officials de Guindos and Lagarde, as well as Fed's Barr, US supply, and earnings reports from SAP, Tesla, IBM, Kinder Morgan, Alcoa, Lam Research, GE Vernova, Hilton, AT&T, and Thermo Fisher.

Newsquawk in 3 steps:

- Subscribe to the free premarket movers reports

- Listen to this report in the market open podcast (available on Apple and Spotify)

- Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump reiterated that tariffs on China scheduled for November 1st will be approximately 155% and that China cannot sustain higher tariffs, also mentioning a trade discussion with India's PM Modi on Tuesday.

- A South Korean chief presidential policy aide stated that South Korea and the US have differing views on some aspects of tariff negotiations.

- South Korea's Minister for Trade Yeo expressed concerns to China's Li Chenggang regarding China's shipbuilding restrictions, requesting a swift removal of sanctions on South Korean shipbuilder Hanwha Ocean and discussing China’s rare earths export restrictions.

- India and the US are nearing a long-awaited trade agreement that could reduce tariffs on Indian exports from 50% to between 15-16%, according to Mint, citing sources.

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.2%) are mostly in negative territory, with the FTSE 100 (+0.4%) showing relative strength after the UK inflation report increased expectations of a December rate cut.

- Most European sectors are showing a negative trend. Energy and Utilities are leading, with the former benefiting from higher oil prices. Consumer Products is under pressure due to post-earnings losses in L'Oreal (-6.2%), Hermes (-4.4%), and Adidas (-2%). L'Oreal is down after a quarterly sales miss, Hermes disappointed investors despite being roughly in line with expectations, and Adidas is seemingly affected by sectoral losses, despite reporting better-than-expected headline figures and raising guidance.

- US equity futures are slightly lower, continuing the price action from the previous session. Key pre-market movers include Netflix (-7.1%, Q3 profit miss due to a Brazilian tax dispute, but sales were in line) and Texas Instruments (-8%, issuing a weak forecast for the next quarter).

- Apple (AAPL) is reportedly significantly reducing iPhone Air production orders while increasing orders for other 17 models, according to Nikkei, reflecting weak demand for the Air outside of China and strong demand for the 17 and 17 Pro models.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The USD is slightly firmer/flat. There are no clear drivers at the moment, but traders are monitoring trade and shutdown developments, and some are positioning ahead of Friday’s inflation report. Recent dollar strength has been attributed to a reversal of debasement trades, a sharp correction in gold prices, and easing credit concerns. The DXY is currently trading near the upper end of its 98.84-99.05 range.

- The EUR is essentially flat, trading in a narrow 1.1590-1.1615 range, with a slightly downward bias. Price action is subdued amid a lack of significant news. There is some focus on reports that several EU leaders have called for a review, reduction, and restraint of legislation to ease the burden on business, according to Reuters.

- The JPY is essentially flat/mildly lower against the USD, trading in a 151.48-151.95 range, just below the 152.00 level. Reuters reported that PM Takaichi will tell US President Trump that Japan will buy US soybeans, pickups, and LNG, but may not commit to a new defense spending target. The POTUS is scheduled to visit Japan from October 27-29. Takaichi is reportedly preparing an economic stimulus package expected to exceed JPY 13.9 trillion, with measures to counter inflation, invest in growth industries, and enhance national security. Finance Minister Katayama echoed her PM’s recent remarks, pushing back on government involvement with the BoJ, stating that monetary policy specifics are up to the BoJ, but they should work together for effective economic policies.

- The GBP is underperforming against the USD following the UK's soft inflation report. Headline Y/Y inflation was unchanged at 3.8% (expected 4%), with the Services component also weaker than expected. GBP/USD fell from 1.3384 to 1.3343, then to a low of 1.3314. Further downside levels include the October 15th low and last week's low at 1.3248. Market pricing has shifted dovishly, with markets now assigning a 74% chance of a rate cut by year-end, compared to 44% before the release; the first full 25bps cut is priced in by Feb 2026.

- Antipodean currencies are the marginal G10 outperformers, benefiting from a recent rebound in metals prices as spot gold and base metals recover from the pressure seen in the previous session.

- The PBoC set the USD/CNY mid-point at 7.0954 vs expected 7.1225 (previous 7.0930).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- US Treasury securities are flat, trading in a narrow 113-21 to 113-25 range. Focus has been on mixed trade rhetoric from the US, with Trump previewing a potential meeting with China’s Xi, saying he expects good negotiations, but adding that the meeting may not occur. The US docket is limited due to the shutdown and Fed blackout; Barr is scheduled to speak. Trump poured cold water on the shutdown situation by saying he won’t meet with Democratic leaders until the government reopens.

- German Bunds are contained but experienced a choppy morning, rising to a 130.38 peak on the UK inflation report before paring gains and falling back to a 130.16 low. ECB’s de Guindos and Lagarde are due to speak, but recent comments from officials have not changed the narrative into the end-October meeting. A weak German auction (bid-to-cover ratio of 1.2x) sparked some marginal pressure in Bunds.

- OATs are trading broadly in line with EGB peers in a 123.19 to 123.44 band, while the OAT-Bund 10yr yield spread remains steady around 80bps. Amova’s Williams told Bloomberg that they added to their overweight position on French debt in September and believes OATs are still at attractive levels despite recent sovereign downgrades. He believes a move above 100bps would cause the ECB to intervene.

- UK Gilts are outperforming following the UK's inflation report. CPI for September remained at 3.8% Y/Y, cooler than the market and BoE forecast of 4.0%; September represented the peak in the BoE’s inflation forecast horizon. Accompanying measures were also cooler than expected, and while there were some mixed internals and unusual moves in some subset components, the overall narrative is dovish. Gilts gapped higher by 54 ticks to 93.45 and then extended further to a 93.78 peak, notching a contract high. The UK 2yr yield fell to 3.77%, below the 3.80% level, and the 10yr moderated to 4.4%, convincingly taking out 4.45%.

- Germany sold EUR 2.284 billion of 2.50% 2032 Bunds vs an expected EUR 3.0 billion: bid-to-cover ratio of 1.2x (previous 1.5x), average yield of 2.33% (previous 2.52%), retention of 23.87% (previous 23.88%).

- Click for a detailed summary

COMMODITIES

- Crude benchmarks extended on Tuesday’s high during the APAC session as Mint citing sources reported that a US-India trade deal is near, that could see India cut Russian oil imports for a lower export tariff to 15-16% from 50%. WTI and Brent peaked at USD 58.50/bbl and USD 62.62/bbl respectively following the trade news but are currently trading slightly off best levels at USD 58.20/bbl and USD 62.30/bbl.

- Spot XAU began the European morning firmer, bouncing back from Tuesday’s 5% selloff, which was its biggest selloff since November 2020. However, XAU was then pressured once again to currently trade around USD 4,065/oz - trough for today's session was made overnight at USD 4,005.98/oz.

- Base metals have rebounded from Tuesday’s selloff following a trade deal near its completion between India and the US. 3M LME Copper dipped to a low of USD 10.54k/t before reversing a trending back through Tuesday’s range and is currently trading near session highs at USD 10.66k/t.

- US Private Inventory Data (bbls): Crude -3.0 million (expected +1.2 million), Distillate -1.0 million (expected -1.9 million), Gasoline -0.2 million (expected -0.8 million).

- A Russian overnight attack on Ukraine's Poltava region damaged oil and gas industry facilities.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Sep) 3.8% vs. Exp. 4.0% (Prev. 3.8%); MM (Sep) 0.0% vs. Exp. 0.2% (Prev. 0.3%)

- UK Core CPI YY (Sep) 3.5% vs. Exp. 3.7% (Prev. 3.6%); MM (Sep) 0.0% vs. Exp. 0.2% (Prev. 0.3%)

- UK CPI Services YY (Sep) 4.7% vs. Exp. 4.90% (Prev. 4.70%); MM (Sep) -0.3% (Prev. 0.20%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is targeting tax partnerships in a crackdown on the UK’s wealthy, preparing a crackdown on lawyers, accountants, doctors, and other professionals who use tax partnerships, according to the FT.

- Politico reports that a decision on whether to postpone the French Social Affairs Committee's examination of the Social Security Budget will be taken this morning, in the context of a "rectifying letter" regarding pensions likely being adopted on Thursday.

- SNB's Schlegel says inflation is expected to rise slightly in the coming quarters. Planned US tariffs on some pharma products could increase downside risk for the economy. Uncertainty in the economy remains high. Will continue to observe the situation and adjust monetary policy where necessary.

NOTABLE US HEADLINES

- US President Trump said he won't meet with Democratic leaders unless the government is reopened.

- US President Trump's administration plans to release over USD 3 billion in aid to US farmers previously frozen due to the government shutdown, according to the WSJ.

- The US has offered energy companies access to nuclear waste that they can convert into fuel for advanced reactors in an attempt to break Russia’s stranglehold over uranium supply chains, according to the FT.

- China's Trade Remedy and Investigation Bureau published questionnaires to gather intelligence for an anti-dumping investigation on some US-made analog IC chips, via Bloomberg.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia obtained security guarantees from Ukraine to restore power to the Zaporizhia nuclear power plant, according to RIA.

- US President Trump said he has not made a determination yet regarding a meeting with Russian President Putin and doesn't want to have a wasted meeting, while he still sees a chance for a Russia-Ukraine ceasefire.

- Russia's Special Economic Envoy said 'preparations continue' for a Trump-Putin meeting.

- Russia's Deputy Foreign Minister Ryabkov says preparations for a Russia-US summit are ongoing and there has been no agreement on a Lavrov-Rubio meeting; sees no major obstacles for a Trump-Putin meeting via RIA.

- Russia's Kremlin says their position is well known with nothing else to add in regard to reports of a non-paper passed to USA on Ukraine. Preparation is necessary for Putin-Trump summit.

- Ukraine's President Zelensky calls US President Trumps' idea a good compromise in regards to the concept of stopping at the current lines.

OTHER NEWS

- North Korea fired a missile, which the South Korean military said was a ballistic missile, while Japanese PM Takaichi later confirmed there was no damage to Japan's exclusive economic zone and waters from the North Korean missile.

- The US is reportedly trying to drive a wedge between Argentina and China with the Trump administration pushing officials in Argentina to limit China’s influence over the distressed South American nation, according to the WSJ.

- China's Defence Ministry said it is strongly dissatisfied with Australia's statement about military aircraft around the Paracel Islands, while it added that organised troops are to resolutely block and drive away Australian military aircraft that 'invaded' China's airspace.

- "Israel's Channel 12: The security establishment warns that accelerating the implementation of the Trump plan may harm Israel's security interests", via Sky News Arabia

CRYPTO

- Bitcoin is a touch firmer today and trades just shy of the USD 108k mark.

APAC TRADE

- APAC stocks were mostly subdued following the mixed handover from the US, where participants digested a mixed bag of earnings releases, and precious metals slumped, with a historic drop seen in gold following the recent record-setting rally.

- The ASX 200 retreated with heavy losses in the mining sector after gold prices fell by the most since 2013 and which was its largest one-day dollar value drop on record.

- The Nikkei 225 briefly dipped beneath the 49,000 level with early pressure seen following mixed trade data, although the index gradually pared its early losses as participants also reflected on the new Takaichi-led government, with the PM instructing the cabinet to compile a package of steps to cushion the blow from the rising cost of living.

- The Hang Seng and Shanghai Comp were subdued following a slew of recent trade-related rhetoric, including from US President Trump, who reiterated 155% tariffs on China from November 1st and that he will meet with Chinese President Xi in two weeks, but then also commented that maybe that meeting won't happen.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi is preparing economic stimulus expected to exceed last year's JPY 13.9 trillion, with the package to be built around three main pillars which are measures to counter inflation, investment in growth industries, and national security, according to sources cited by Reuters.

- Japanese PM Takaichi is to meet with US President Trump on October 28th and will discuss national defence. It was later reported that Japanese Chief Cabinet Secretary Kihara said US President Trump is to visit Japan from October 27th to 29th and is to meet Japan’s Emperor and PM Takaichi during the visit.

- Japanese Minister for Economic Security Kiuchi says it is important that the government and the BoJ continue to cooperate and carry out responsible macroeconomic policies, while he hopes the BoJ will closely coordinate with the government to achieve the 2% inflation target, and stated that the economy needs to be supported until strong real wage growth is achieved.

- Japan's Finance Minister Katayama announces that Prime Minister Takaichi will proceed with fiscal reform both in terms of spending and revenue. Says weak JPY boosts food costs, so there needs to be a quick measurement to cushion impact. "Takaichi Trade" has somewhat calmed down.

DATA RECAP

- Japanese Trade Balance Total Yen (Sep) -234.6B vs. Exp. 22.2B (Prev. -242.8B)

- Japanese Exports YY (Sep) 4.2% vs. Exp. 4.6% (Prev. -0.1%)

- Japanese Imports YY (Sep) 3.3% vs. Exp. 0.6% (Prev. -5.2%)