Market Wrap 2025-10-22

Stocks Decline Amid US Consideration of Export Controls on China

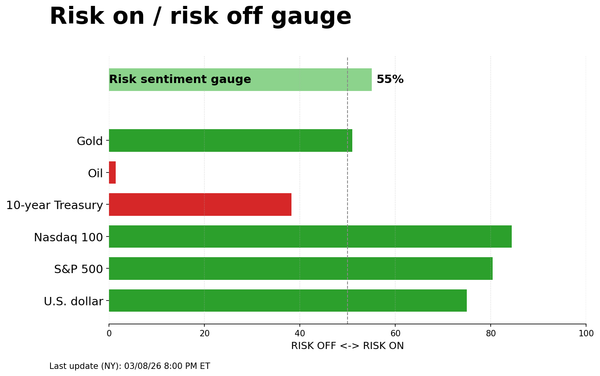

- OVERVIEW: Stock values decreased, Treasury values remained stable, Crude oil prices increased, the Dollar's value held steady, and Gold prices declined.

- BACKGROUND: The US is considering export restrictions on goods sent to China that are made using US software. The US is expected to announce significant new sanctions against Russia either today or tomorrow. The US has eased a key restriction on Ukraine's use of Western long-range missiles. A meeting between Trump and Xi is still planned, and Greer and Bessent will meet with Chinese officials in Malaysia. Netflix (NFLX) and Texas Instruments (TXN) reported weak earnings. UK CPI was lower than expected.

- UPCOMING: Data releases include the US National Activity Index for September, Existing Home Sales for September, the Eurozone Consumer Confidence Flash for October, Canadian Retail Sales for August, and Australian Flash PMIs for October. Suspended Releases: US Weekly Claims. Events include the CBRT Policy Announcement, the CCP 4th Plenum (October 20-23), and the European Council (October 23-24). Speakers include the ECB’s Lane, and the Fed's Bowman and Barr (Fed on Blackout). Supply releases are expected from the UK and US. Earnings reports are anticipated from Intel, American Airlines, Freeport McMoRan, Honeywell, Dow, Southwest Airlines, T-Mobile US, Blackstone, and PG&E.

MARKET WRAP

US stock indices closed in negative territory on Wednesday, experiencing downward pressure in the afternoon due to reports that the Trump administration is considering export controls on goods made with or containing US software destined for China. Some losses were partially recovered as details of the potential controls appeared less severe. However, a risk-off sentiment returned near the close. Sector performance was mixed, with Industrials and Consumer Discretionary sectors underperforming, while Energy outperformed, supported by gains in crude oil prices. Before the settlement, benchmarks had already received boosts from positive factors, but these gains were extended following two reports: 1) the Trump administration lifted a key restriction on Ukraine's use of Western long-range missiles, and 2) Bessent indicated that substantial new sanctions against Russia are expected to be announced soon. Regarding individual stocks, there were numerous earnings reports, with those from TXN and NFLX being particularly disappointing. The Dollar experienced volatility but remained relatively unchanged overall. The Canadian dollar (CAD) was supported by rising oil prices, while the British Pound (GBP) declined following a lower-than-expected inflation report, which prompted a dovish shift in Bank of England (BoE) rate expectations. Spot gold briefly tested USD 4,000/oz before rebounding, although it remained lower for the session. Areas of the market that have seen significant gains (gold, nuclear power stocks, rare earths) have faced notable pressure this week. T-Notes settled flat amid choppy trading, with focus on US/China relations. A solid 20-year auction had little impact.

FIXED INCOME

T-NOTE FUTURES (Z5) SETTLED UP 1+ TICK AT 113-25+

T-Notes settled flat in choppy trade with focus on US/China relations. At settlement, the 2-year yield decreased by 1.3bps to 3.442%, the 3-year yield decreased by 1.2bps to 3.443%, the 5-year yield decreased by 0.8bps to 3.552%, the 7-year yield decreased by 0.9bps to 3.730%, the 10-year yield decreased by 1.2bps to 3.951%, the 20-year yield decreased by 1.2bps to 4.508%, and the 30-year yield decreased by 1.1bps to 4.537%.

INFLATION BREAKEVENS: The 1-year breakeven inflation rate increased by 1.7bps to 3.179%, the 3-year breakeven inflation rate increased by 0.6bps to 2.604%, the 5-year breakeven inflation rate increased by 1.7bps to 2.346%, the 10-year breakeven inflation rate increased by 1.1bps to 2.268%, and the 30-year breakeven inflation rate increased by 0.9bps to 2.211%.

THE DAY: T-Notes ultimately settled flat in choppy trade. T-Notes reached a high of 113-29 in the US morning before declining, with no specific news driving price action at that time. However, later in the day, risk-off trading caused T-Notes to rise again following reports that the US is considering export controls on US software (ranging from laptops to jet engines) in response to China's rare-earth restrictions. The report also noted that narrower options are under consideration, and this option may not be implemented. The broader upside was also likely supported by significant gains in crude oil, while gold prices added to the prior day's losses. Areas of the market that have seen significant gains (gold, nuclear power stocks, rare earths) have come under pressure this week. In the UK, Gilts were supported after cooler-than-expected CPI data increased expectations of BoE rate cuts. Meanwhile, Bunds experienced choppy trading with some pressure following another soft auction. Back in the US, the 20-year bond auction was strong. Attention remains focused on the US CPI data on Friday ahead of the FOMC meeting next week.

SUPPLY

Notes

- The US Treasury sold USD 13 billion of 20-year bonds at a high yield of 4.506%, stopping through the when issued by 1.2bps. The bid-to-cover ratio was little changed from the September offering at 2.73x, but remained above the six auction average of 2.64x. Direct demand eased slightly to 26.3% from 27.9%, but remained above the 20.4% average. Indirect demand also slipped slightly, to 63.6% from 64.6%, below the 66.5% average. Dealers were left with 10% of the offering, above the 7.6% prior but below the 13.1% average.

- The US Treasury will sell USD 26 billion of 5-year TIPS on October 23rd, settling on October 31st.

Bills

- The US sold 17-week bills at a high rate of 3.735%, with a bid-to-cover ratio of 3.27x.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: October 25bps, December 48bps, January 64bps.

- NY Fed RRP operation demand was at USD 4 billion across 8 counterparties.

- NY Fed Repo operation demand was at USD 0 billion.

- The EFFR was at 4.11%, with volumes at USD 85 billion on October 21st.

- The SOFR was at 4.23%, with volumes at USD 2.957 trillion on October 21st.

- Treasury Buyback (2-3yr, liquidity support, max USD 4 billion): Accepted USD 1.9 billion of 8.6 billion offered, accepting 7 eligible issues out of 34. Offer to cover 4.53x.

CRUDE

WTI (Z5) SETTLED USD 1.26 HIGHER AT 58.50/BBL; BRENT (Z5) SETTLED USD 1.27 HIGHER AT 62.59/BBL

The crude oil complex was firmer and continued its upward trend throughout the day. Energy prices were already rising at the start of the session, continuing gains from Tuesday on reports that the US is replenishing its Strategic Petroleum Reserve (SPR). Reports from Mint, indicating that India and the US are nearing a long-pending trade agreement that could reduce tariffs on Indian exports from 50% to 15-16%, provided further upward momentum in the European morning. Later, the energy sector received an additional boost when US Energy Secretary Wright stated that the SPR will be gradually filled, oil prices are 'low,' and it is a good time to buy. The weekly EIA data showed a surprise draw in crude oil inventories, aligning with private metrics, while gasoline saw a larger-than-anticipated draw, and distillates saw a smaller-than-forecasted draw. Overall, crude oil production fell by 7,000 barrels per day to 13.629 million barrels per day. WTI traded between USD 57.34-58.92/bbl, and Brent traded between USD 61.38-62.96/bbl.

EQUITIES

- CLOSES: SPX -0.53% AT 6,699, NDX -0.99% AT 24,879, DJI -0.71% AT 46,591, RUT -1.45% AT 2,452.

- SECTORS: Energy +1.29%, Health +0.59%, Consumer Staples +0.58%, Real Estate +0.40%, Utilities -0.27%, Materials -0.35%, Financials -0.65%, Technology -0.83%, Communication Services -0.90%, Consumer Discretionary -1.04%, Industrials -1.34%.

- EUROPEAN CLOSES: Euro Stoxx 50 -0.80% at 5,642, Dax 40 -0.71% at 24,158, FTSE 100 +0.93% at 9,515, CAC 40 -0.63% at 8,207, FTSE MIB -1.03% at 42,210, IBEX 35 +0.09% at 15,782, PSI +0.40% at 8,305, SMI -0.10% at 12,610, AEX -0.06% at 966.

STOCK SPECIFICS:

- Texas Instruments (TXN): Provided weak guidance for the next quarter.

- Netflix (NFLX): Reported light profits, impacted by a Brazilian tax dispute, but sales were in line, and the company had its best-ever ad sales quarter.

- Intuitive Surgical (ISRG): Released a strong report and raised its full-year procedure growth outlook and profit margin view.

- Thermo Fisher (TMO) beat on EPS and revenue and raised guidance.

- Capital One Financial (COF): Beat on EPS and revenue.

- Hilton Worldwide (HLT): Beat top and bottom line expectations with a strong outlook for the next quarter and full year.

- Western Alliance (WAL): Profit, revenue, and net interest income (NII) topped expectations with better-than-expected full-year 2025 NII guidance. The company also stated that the disputed loans are a one-off problem.

- GE Vernova (GEV): EPS and revenue surpassed Wall Street consensus estimates.

- Mattel (MAT): Q3 metrics disappointed.

- Beyond Meat (BYND): Rally continues due to meme stock hype/short squeeze.

STOCK SPECIFICS:

- Apple (AAPL): Reportedly drastically cutting iPhone Air production orders but boosting orders for other 17 models.

- DraftKings (DKNG): Acquiring predictions platform Railbird to prepare for the launch of its new mobile platform, DraftKings Predictions.

- Avadel Pharmaceuticals (AVDL): To be acquired by ALKS for up to $20 per share in cash; AVDL closed Tuesday at $17.87 per share. Google (GOOGL) unveils quantum computing breakthrough with willow chip; achieved demonstration of verifiable quantum advantage. General Motors (GM) reportedly intends to bring eyes-off driving to market in 2028, debuting on the Cadillac Escalade IQ Electric SUV. Jim Chanos says he is still short Carvana (CVNA).

US FX WRAP

The Dollar was weaker on Wednesday, although trading was choppy, as market participants largely await the US CPI data on Friday ahead of the FOMC meeting next Wednesday, where a 25bps rate cut is widely expected. Regarding the potential government shutdown, Bloomberg reported that the House Ways and Means Committee Chair Smith remarked that lawmakers are considering a stopgap bill through December 2026. In terms of broader sentiment, ING notes that a further USD rally from here will be harder to justify unless markets find reasons to price out one of the three Fed cuts expected by March, with the most realistic driver of such hawkish repricing this week being a hot CPI figure on Friday, which ING do not anticipate. Regarding US/China relations, USTR’s Greer said the location for the meeting between Trump and Xi is on schedule, with Bessent and Greer meeting Chinese officials in Malaysia to see if there is room to move forward.

G10 FX performance was mixed, as the CAD outperformed due to surging energy prices, with USD/CAD hitting a low of 1.3977. Antipodean currencies, pressured by risk sentiment, and the Pound were the G10 laggards, with the latter experiencing pressure after cooler-than-expected UK CPI data. Money market pricing moved markedly dovish following the release, with a 76% chance of a rate cut by year-end priced in, compared to 44% before the release; the first full 25bps cut is priced in by February 2026. Regarding the data release, ING notes that the main dovish surprise came from food prices, which is a significant concern for the BoE, which actually fell on the month and are now 0.5 percentage points below the BoE's August forecasts. Cable traded between 1.3306-87.

EUR, JPY, and CHF all saw slight gains and traded within narrow ranges, with Yen watchers awaiting Japanese CPI data on Friday. For the Swiss Franc, little movement was observed, but SNB's Schlegel said inflation is expected to rise slightly in the coming quarters, while ECB's Kazaks said it may well be the case that the next rate move could as easily be a hike as a cut. EUR/USD traded between 1.1578-1622 ahead of Lane's speech on Thursday.

EMFX performance was mixed. HUF, ARS, CLP, and INR gained, while COP, MXN, BRL, and ZAR weakened, with TRY and Yuan remaining flat. Regarding the Rupee, Mint reported overnight that India and the US are nearing a long-pending trade deal that could reduce current tariffs on Indian exports from 50% to between 15-16%. The ZAR was impacted by the further decline in gold prices, although the precious metal recovered significantly from its trough, where it tested USD 4,000/oz. In addition, there was mixed South African inflation data - CPI M/M was in line, Y/Y was cooler-than-expected, with core Y/Y in line, and M/M surpassing expectations. Lastly, Mexican IGAE economic activity for August was better than anticipated, with M/M rising above consensus and Y/Y not falling as much as feared.