Market Wrap 2025-10-30

- President Trump characterized his meeting with President Xi as "amazing," noting numerous decisions were reached and assigning it a rating of 12/10; the US and China have reportedly agreed to a one-year trade truce.

- European stock exchanges are generally experiencing declines, while US equity futures are showing mixed performance; Meta shares are down 8.8%, Microsoft is down 2.3%, and Google is up 6.9% following their respective earnings releases.

- The Japanese Yen is weakening after the Bank of Japan (BoJ) maintained its current interest rates and refrained from making any explicitly hawkish statements; Governor Ueda stated there is no predetermined plan regarding the timing of the next rate increase. The US Dollar is managing to maintain its gains from the post-Federal Open Market Committee (FOMC) environment.

- Global benchmark fixed income, excluding Japanese Government Bonds (JGBs), remains soft following the FOMC meeting; European Government Bonds (EGBs) are facing pressure leading up to the European Central Bank (ECB) meeting.

- Gold (XAU) has returned above USD 4,000 per ounce following a hawkish signal from the Federal Reserve regarding interest rate cuts, while crude oil prices remain within a defined range.

- Upcoming key events include Japanese Tokyo CPI (October) and Unemployment Rate (September) data releases, (Suspended Releases: US GDP & PCE (Q3), Weekly Claims), the ECB policy announcement, and comments from ECB President Lagarde, as well as Federal Reserve officials Logan and Bowman.

- Earnings reports are expected from Amazon, Apple, Coinbase, Reddit, MicroStrategy, Cloudflare, Riot Platforms, Eli Lilly, Comcast, Roblox, and Mastercard.

TARIFFS/TRADE

OVERNIGHT

- President Trump stated that his meeting with President Xi was exceptional and resulted in numerous decisions, with conclusions on significant matters forthcoming. He added that President Xi will dedicate efforts to curbing fentanyl production. Trump confirmed that China will immediately resume soybean purchases and that both parties agreed to reduce Chinese fentanyl tariffs to 10%. Discussions also included chips, with plans to engage with NVIDIA and other companies regarding chip acquisition, excluding Blackwell chips. Trump indicated that the rare earth issue has been resolved, eliminating any remaining obstacles, and that the one-year agreement is extendable, reducing tariffs on China from 57% to 47%. He also mentioned plans to visit China in April, with President Xi visiting the US afterward, and rated the meeting a 12 out of 10.

- President Xi told President Trump at the beginning of their meeting that he was pleased to meet him and acknowledged that disagreements are normal and that economic frictions are typical. He added that China's development aligns with the vision of making America great again. President Xi also stated that China and the US should be partners and friends, noting that trade teams have reached a basic consensus and are prepared to continue building a solid foundation for bilateral relations.

- US Treasury Secretary Bessent stated that the announcement following the Trump-Xi meeting would be a significant victory for US farmers. According to Chinese state media, President Xi described China's economy as an ocean, emphasizing that conversation is preferable to confrontation in trade matters. Regarding the Trump meeting, both sides see promising prospects for AI, and the US and China should aim to narrow down the list of problems and expand cooperation. The Chinese Commerce Ministry confirmed the agreement to extend certain tariff exemption measures, with China set to adjust some countermeasures. The US is extending the suspension of 24% reciprocal tariffs for one year and pausing countermeasures related to the 301 investigation for a year. President Trump posted that he had a truly great meeting with President Xi and that they agreed to begin purchasing American energy, with a potentially large transaction involving Alaska.

EUROPEAN TRADE

EQUITIES

- European stock markets (STOXX 600 -0.3%) opened with mixed performance but have trended downward throughout the morning. Traders are processing a hawkish statement from Fed Chair Powell and the outcome of the Trump-Xi meeting. Trump expressed optimism following the meeting, while the Chinese Commerce Ministry confirmed the extension of certain tariff exemption measures.

- European sectors are predominantly negative, with Tech and Healthcare showing relative strength, while Media is lagging. Key movers include Shell (-0.4%, mixed results and a USD 3.5 billion buyback announcement), TotalEnergies (+2.7%, in-line metrics), and Stellantis (-5%, a 13% year-over-year increase in shipments but a warning of a one-time hit).

- US equity futures are mixed (ES -0.2%, NQ -0.2%, RTY +0.1%), with the RTY showing slight outperformance as it attempts to recover from previous underperformance. Key pre-market movers include Meta (-7.8%, mixed results with focus on AI costs), Microsoft (-3%, strong results potentially overshadowed by Q2 revenue guidance), and Google (+7.9%, beating forecasts).

- Novo Nordisk (NOVOB DC) is reportedly preparing an increased bid for Metsera (MTSR), according to Bloomberg, which is seen as a challenge to Pfizer (PFE).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The US Dollar Index (DXY) is flat, pausing after gains in the previous session following hawkish comments from Fed Chair Powell. The Fed cut rates by 25 basis points as expected, with dissent regarding a 50 basis point cut and unchanged policy; it also announced the end of balance sheet drawdown. However, Powell's press conference struck a hawkish tone, raising doubts about a December rate cut and stating that a rate reduction is "far from assured." Aside from the Fed, focus has been on the Trump-Xi meeting. The US President appeared positive about the outcome, announcing that China had agreed to soybean purchases and alluding to an "American Energy" agreement, with details pending. The Chinese Commerce Ministry confirmed the agreement to extend certain tariff exemption measures, adding that the US is extending the suspension of 24% reciprocal tariffs for one year. The DXY is currently trading in a range of 98.91 to 99.21.

- The Euro (EUR) is slightly firmer today. Several key data points are keeping traders busy, including French GDP (beating expectations), Spanish inflation (slightly hotter than expected), German GDP (no growth quarter-over-quarter, but beating expectations year-over-year), and State CPIs (pointing to a cooler than expected year-over-year print for the nationwide figure, but perhaps to a lesser magnitude than expected). Overall, there has been little movement in the single currency, which currently trades at the upper end of a 1.1598-1.1637 range. The ECB policy announcement will follow the mainland German inflation figure at 13:00 GMT. The ECB is expected to maintain the Deposit Rate at 2.0%, with less than 1 basis point worth of easing currently implied.

- The Japanese Yen (JPY) is the clear G10 underperformer today, following the BoJ decision. As expected, the Bank kept rates steady at 0.50%, a decision that was subject to dissent by Takata and Tamura. Accompanying commentary also lacked surprises and any hawkish hints for the next meeting, which may be driving the pressure on the JPY today. Furthermore, additional pressure on the Yen was observed during Governor Ueda's press conference, in which he stated that there is no pre-set idea about the timing of the next rate hike. USD/JPY has been gradually edging higher throughout the morning and trades at the upper end of a 152.17-153.88 range.

- The British Pound (GBP) is essentially flat against the US Dollar today. It briefly reclaimed the 1.32 mark overnight but has since been pressured below that level, trading within a 1.3182-1.3218 range. Focus is on the UK's Budget at the end of next month; reports suggest that UK Chancellor Reeves is considering an early scrapping of the windfall tax on the UK oil and gas sector, according to the Financial Times. Elsewhere, the Chancellor is said to be considering a 2 pence rise in income tax, according to The Telegraph.

- Antipodean currencies are marginally flat or slightly firmer against the Dollar today. Ultimately, traders are digesting the Trump-Xi outcome and the pressure seen across the metals space this morning.

- The People's Bank of China (PBoC) set the USD/CNY mid-point at 7.0864 versus an expected 7.1056 (previous 7.0843).

- Click for a detailed summary

FIXED INCOME

- A softer start to Thursday for US Treasuries (USTs). The benchmark is holding around the post-Powell lows but briefly dropped to a 112-22+ base, taking out the 112-24 trough from Wednesday. In brief, the Fed cut rates by 25 basis points, a decision subject to 50 basis point and unchanged policy dissent. They also announced a decision to exit balance sheet reduction, as part of which the Mortgage-Backed Securities (MBA) unwind will continue but will be offset by T-Bill purchases as and when necessary. The bulk of the action came from Powell, who was hawkish regarding the near-term path of policy, outlining that there is a growing feeling that they should perhaps wait a cycle in terms of continuing to ease. Ahead, Federal Reserve officials Bowman (voter) and Logan (2026) are scheduled to speak, though Bowman is pre-recorded and Logan is on bank research; remarks should not cover current policy as the Fed is technically still in the blackout period until the end of Thursday. Friday’s docket has Logan, Bostic (2027), and Hammack (2026). Additionally, the dissent letters from Miran (voter) and Schmid (2025), who preferred 50 basis points and unchanged policy respectively, will be awaited. Since then, news flow has focused on tariffs. The mentioned 112-22+ base this morning came alongside a readout from China’s Commerce Ministry on the Trump-Xi meeting, which President Trump described as a 12/10. The readout from China confirmed that the US is extending the suspension of 24% reciprocal tariffs for one year.

- The Fed weighed on JGBs on Wednesday, reaching a low of 135.78 into the close. Thereafter, JGBs picked up slightly following the BoJ decision, which was unchanged as expected, subject to two hawkish dissenters. However, modest upside was seen in JGBs after the statement as it did not contain any overtly hawkish signals. Specifically, this lifted JGBs above the 136.00 mark after the Tokyo lunch break, a move that continued thereafter to a 136.26 peak just before Ueda began speaking. The main market-moving update was Ueda outlining that there is no pre-set idea about the timing of the next hike, a move that spurred some JPY pressure at the time but did not have much impact on JGBs.

- Bunds were impacted by the Fed alongside USTs, as outlined above. Early on, the benchmark held near yesterday’s 129.21 base and then dipped a tick further to the current 129.20 low, a low print that occurred alongside the discussed commentary from China’s Commerce Ministry. Thereafter, Bunds lifted in line with the likes of XAU as the risk tone dipped slightly, evidenced by European and US equity futures moving into the red versus the slightly firmer performance seen before the European cash equity open. At most, Bunds reached a 129.38 peak but are still lower by 19 ticks. There was no move this morning to a much stronger than expected French GDP figure for Q3, while hotter-than-expected Spanish CPI weighed slightly, but EGBs remained well within earlier ranges. Eurozone GDP came in above expectations, printing at 0.2% quarter-over-quarter (expected 0.1%) and 1.3% year-over-year (expected 1.2%) following the much better than expected French figure and Germany remaining at 0.0% (assuaging some concern around a negative figure). The ECB policy announcement will follow the mainland German inflation figure at 13:00 GMT. The ECB is expected to maintain the Deposit Rate at 2.0%, with less than 1 basis point worth of easing currently implied.

- Gilts opened lower by 23 ticks, as the benchmark had yet to react to the Powell-pressure seen in peers. A move that extended by another 20 ticks to a 93.35 low shortly after the resumption of trade. Since then, Gilts have found a base just below the 93.55 opening mark, posting losses of approximately 30 ticks on the session. News flow for the UK remains focused on the November Budget, amid reports that Reeves is looking at the early scrapping of oil/gas windfall taxes and a potential 2 pence increase to income tax; the latter would be a manifesto breach. Note that attention on Reeves herself has intensified owing to her admitting she breached housing rules regarding her family home; Prime Minister Starmer has since dismissed calls for an investigation.

- Italy is selling EUR versus an expected EUR 6.5-7.5 billion of 2.85% 2031, 3.45% 2036, and EUR versus an expected EUR 1.5-2 billion of 1.645% 2031, 1.594% 2032 CCTeu.

- Click for a detailed summary

COMMODITIES

- Price action in crude benchmarks has been choppy throughout the APAC session and into the European trading day amid light crude-specific news flow. WTI and Brent are currently trading around USD 60.20/bbl and USD 64.00/bbl as the market awaits a new catalyst.

- Spot gold (XAU) has stabilized above Wednesday’s trough of USD 3,915 per ounce after falling back below USD 4,000 per ounce following the hawkish cut by the FOMC. Gold fell just shy of Wednesday’s low to USD 3,916 per ounce during the APAC session before slowly reversing the losses seen during the FOMC meeting. The yellow metal has returned back above USD 4,000 per ton as the European session continues, with gold currently trading at USD 4,004 per ounce.

- Base metals have fallen from Wednesday’s record highs as the meeting between President Trump and President Xi ended with a lack of statements from both sides, indicating a possibility that the talks did not go as well as expected. However, recent comments from both sides indicated that the talks did go well, with the US cutting the fentanyl tariff to 10% and suspending the 24% reciprocal tariff for another year, while the Chinese will halt rare earth export curbs and resume US soybean purchases.

- Russia's Lukoil says it has received an offer to acquire foreign assets from Gunvor.

- Click for a detailed summary

NOTABLE DATA RECAP

- French GDP Preliminary QQ (Q3): 0.5% vs. Expected 0.2% (Previous 0.3%)

- Spanish CPI YY Flash NSA (October): 3.1% vs. Expected 2.90% (Previous 3.00%); Core 2.5% (previous 2.4%)

- German Unemployment Change SA (October): -1.0k vs. Expected 8.0k (Previous 14.0k); Unemployment Total SA (October): 2.973M (Previous 2.976M); Unemployment Total NSA (October): 2.91M (Previous 2.955M); Unemployment Rate SA (October): 6.3% vs. Expected 6.3% (Previous 6.3%)

- German GDP Flash YY NSA (Q3): 0.3% vs. Expected 0.2% (Previous -0.2%); QQ SA (Q3): 0.0% vs. Expected 0.0% (Previous -0.3%)

- Italian GDP Preliminary QQ (Q3): 0.0% vs. Expected 0.1% (Previous -0.1%); GDP Preliminary YY (Q3): 0.4% vs. Expected 0.6% (Previous 0.4%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is considering an early scrapping of the windfall tax on the UK oil and gas sector, according to the Financial Times. Elsewhere, the Chancellor is said to be considering a 2 pence rise in income tax, according to The Telegraph.

- UK Chancellor Reeves has admitted she breached housing rules when renting out her family home, according to the BBC; Prime Minister Starmer has dismissed calls for an investigation into the incident.

NOTABLE US HEADLINES

- President Trump's administration is tapping three different funds to pay US troops this Friday, according to Axios.

- Alphabet Inc (GOOGL) Q3 2025 (USD): EPS 2.87 (expected 2.30), Revenue 102.3 billion (expected 99.73 billion); shares rose 7% after-market.

- Microsoft Corp (MSFT) Q1 2026 (USD): Adjusted EPS 4.13 (expected 3.67), Revenue 77.7 billion (expected 75.40 billion); shares fell 3% after-market.

- Meta Platforms Inc (META) Q3 (USD): EPS 1.05 (expected 6.76), Revenue 51.2 billion (expected 49.35 billion), includes a one-time non-cash income tax charge of USD 15.93 billion; shares fell 6% after-market.

GEOPOLITICS

- President Trump posted that the US has more nuclear weapons than any other country, which was accomplished during his first term in office. He stated that because of other countries' testing programs, he has instructed the Department of War to start testing US nuclear weapons on an equal basis, and that process will begin immediately. President Trump said he was unable to talk with North Korean leader Kim because he was so busy but would come back to talk with Kim. US Defense Secretary Hegseth said they carried out a lethal kinetic strike earlier today on another narco-trafficking vessel operated by a designated terrorist organization in the Eastern Pacific. Russian and Chinese officials discussed potential war settlement issues, via Tass.

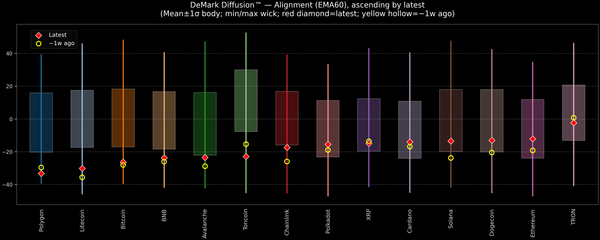

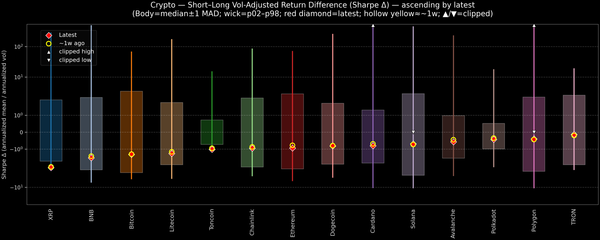

CRYPTO

- Bitcoin is on a weaker footing, with pressure also seen in Ethereum; BTC is currently hovering around USD 110,000.

BOJ

DECISION

- The Bank of Japan (BoJ) maintained its short-term interest rate target at 0.5%, as expected, with board members Takata and Tamura dissenting and proposing raising short-term rates by 25 basis points. The BoJ said real interest rates are at significantly low levels and it will continue to raise the policy rate if the economy and prices move in line with its forecast, in accordance with improvements in the economy and prices. It will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target and noted that it is important to scrutinize without any pre-set idea whether the BoJ’s projection will be met, given high uncertainty on trade policy and its impact on the economy. Furthermore, the BoJ stated that underlying consumer inflation is likely to stagnate on slowing growth but increase gradually thereafter and is likely to be at a level generally consistent with the 2% target in the second half of the projection period from fiscal 2025 through 2027, while board members' median projections for Real GDP and Core CPI were mostly kept unchanged from the previous aside from the slight upgrade to FY2025 Real GDP to 0.7% from 0.6%.

UEDA

- There is no pre-set idea about the timing of the next rate hike. A remark that lifted USD/JPY.

- More data is needed before deciding to adjust the degree of monetary easing.

- It is possible to change policy even in the middle of the budget being compiled and will adjust the rate irrespective of the political situation.

- The reason for holding off on rate hikes is due to overall economies and trade policy uncertainties still being high.

- Expect next wage hikes to be roughly in line with this year's and want to carefully watch wage negotiations, especially in the autos sector, given the tariff impact.

- Click here for more details.

APAC TRADE

- APAC stocks were mixed after the Fed rate cut and Powell's hawkish press conference, while participants also digested the BoJ decision and the Trump-Xi meeting.

- The ASX 200 lacked demand in the absence of tier-1 data and as markets reflected on the recent deluge of risk events.

- The Nikkei 225 swung between gains and losses, with price action indecisive amid the BoJ policy decision in which the central bank maintained rates, as widely expected, and refrained from any major clues for when it will resume its rate normalization.

- The Hang Seng and Shanghai Comp were indecisive as attention was on the Trump-Xi meeting, where the leaders exchanged pleasantries at the start but were then quiet, with no statements provided upon the conclusion of the meeting. However, Trump later commented that the meeting was amazing and confirmed a reduction in fentanyl-related tariffs, while he also said the rare earths issue was resolved and rated the meeting a 12 out of 10.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said it is necessary to implement requirements of high-quality development in all fields and aspects of economic and social development, while he added it is necessary to promote high-quality development as the theme, reform and innovation as the fundamental driving force, and meet the people's growing needs for a better life. Furthermore, he stated it is necessary to focus more on strengthening the domestic cycle, coordinate the implementation of the strategy of expanding domestic demand, and deepen supply-side structural reforms.

- The HKMA cut its base rate by 25 basis points to 4.25%, as expected.

- China is to announce a new financing tool to drive over CNY 6 trillion in investments, via Bloomberg citing Xinhua.

- Agricultural Bank of China (1288 HK / 601288 CH) 9-month (CNY): Net Income 222.3 billion, Net Fee Income 69.8 billion, NII 427 billion, NIM 1.3%. Q3 (CNY): net 81.4 billion, +3.7% Y/Y; Operating Revenue 181 billion, +4.3% Y/Y.

- ICBC (1398 HK) Q3 (CNY): Net 101.8 billion, +3.3% Y/Y. 9-month: NIM 1.28%, Net Income 271.8 billion, NII 610.9 billion.

- CNOOC (0883 HK) Q3 (CNY): Revenue 104.9 billion (expected 97.6 billion), net 32.4 billion (previous 36.9 billion).

- Bank of Communications (3328 HK) 9-month (CNY): Net income 29.994 billion, +0.15% Y/Y; NII 128.65 billion, +1.46% Y/Y.

- China Construction Bank (0939 HK) Q3 net profit 95.3 billion, +4.2% Y/Y.

EUROPEAN MORNING

President Trump posted that "South Korea has agreed to pay the USA 350 Billion Dollars for a lowering of the Tariffs charged against them by the United States. Additionally, they have agreed to buy our Oil and Gas in vast quantities, and investments into our Country by wealthy South Korean Companies and Businessmen will exceed 600 Billion Dollars. Our Military Alliance is stronger than ever before and, based on that, I have given them approval to build a Nuclear Powered Submarine, rather than the old fashioned, and far less nimble, diesel powered Submarines that they have now. A great trip, with a great Prime Minister!"