Market Wrap 2025-11-12

- The US House of Representatives is scheduled to vote on a bill aimed at averting a shutdown and ensuring government funding through January 2026.

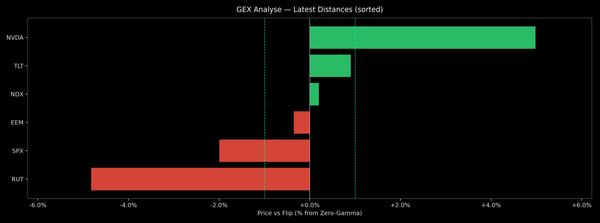

- European stock exchanges are generally showing gains and reaching new highs, while US equity futures are also increasing, with the RTY showing the strongest performance at +1%.

- The USD is strengthening ahead of numerous speeches by Federal Reserve officials, while the GBP is under pressure due to political uncertainty, and the JPY is lagging.

- Global bonds are weakening due to the risk-on sentiment, with Gilts particularly lagging as PM Starmer faces pressure during PMQs.

- Crude oil benchmarks are declining after gains on Tuesday, while XAU remains within a limited range.

- Upcoming events include the release of BoC Minutes (Oct), EIA STEO, OPEC MOMR, and speeches from ECB’s de Guindos, Fed’s Paulson, Bostic, Williams, Waller, Miran, Collins, and US Treasury Secretary Bessent. Supply data from the US is also expected.

Newsquawk in 3 steps:

- Subscribe to the free premarket movers reports

- Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news

squawk box for 7 days

TARIFFS/TRADE

- US President Trump mentioned in a Fox News interview that some tariffs on coffee will be reduced.

- Dutch Economy Minister Karremans stated that discussions with EU Trade Commissioner Sefcovic regarding Nexperia took place, with both parties committed to restoring supply chains quickly and securing the semiconductor supply, working closely with European and International partners.

- US and Saudi officials have reportedly been engaged in intense negotiations to finalize several agreements, including a defense pact, before Saudi Crown Prince MBS meets with US President Trump next week in the US, according to Axios sources.

EUROPEAN TRADE

EQUITIES

- European stock markets (STOXX 600 +0.6%) opened mostly higher, continuing the positive trend from the previous two days. The FTSE 100 is underperforming due to concerns about PM Starmer's leadership being "vulnerable."

- Most European sectors are also showing gains. The top-performing sectors are Utilities (+1.1%), Banks (+1.1%), and Automobiles & Parts (+1.3%). The latter was boosted by a broker upgrade for Ferrari (+2%). In the Tech sector, Infineon (+6.6%) is surging after reporting strong Q3 results and providing positive commentary related to AI.

- US equity futures (ES +0.3%, NQ +0.6%, RTY +0.1%) are trading higher. The NQ is stronger as Tech stocks regain ground, supported by results from Infineon and Foxconn, with the latter expressing "very optimistic" views on AI-driven demand.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The DXY is relatively flat/slightly firmer, trading between 99.44 and 99.61, with limited news flow. The previous session's focus was on the weak ADP prelim estimate, which put some pressure on the USD. Today's calendar is light on data, but numerous Fed speakers are scheduled, including Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent. Markets are still focused on developments regarding a potential government shutdown. To recap, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. The bill is expected to pass (though dissent is possible), which would fund the US government until at least January 30th.

- The EUR is essentially unchanged against the USD. It failed to break above 1.16, peaking at 1.1588 before falling back towards session lows of 1.1571. The EUR is slightly stronger against the weaker GBP (which is facing political pressure). European news flow has been limited, featuring an unrevised German inflation report, while Italian Industrial Output exceeded analyst expectations. The schedule includes ECB speakers later in the day, with Schnabel (Hawk) and de Guindos (Dove), but no text release is expected from either.

- The JPY is the weakest-performing G10 currency, given the positive risk environment, with other safe-haven assets generally being sold (except for gold). ING suggests that one factor keeping USD/JPY higher is Japan's agreement to invest directly in the US. This JPY weakness has led to continued verbal intervention from Japanese officials. Overnight, Finance Minister Katayama stated that she has seen “one-sided and sharp foreign exchange moves” recently, adding that it is being watched with a “high sense of urgency”. While similar comments have previously strengthened the JPY, they have not boosted the currency today.

- The GBP is under pressure against the USD, with regional political uncertainty weighing on traders' minds. The Guardian reported that Downing Street feared some of the PM’s closest viewed PM Starmer as “vulnerable ” to leadership change in the wake of the Budget. More recently, Wes Streeting has clarified his support for Starmer, stating that he has not had talks with anyone regarding attempts to oust his leader.

- Antipodean currencies are mixed, with the Aussie near the top of the G10 and the Kiwi essentially flat. There is no specific driver for the Aussie's outperformance, but there are significant option expiries in the Aussie: 0.6495-0.6505 (2.4bln), 0.6525-30 (1.2bln), 0.6550-60 (906mln).

- The PBoC set the USD/CNY mid-point at 7.0833 vs exp. 7.1141 (Prev. 7.0866).

- Click for NY OpEx Details

- Click for a detailed summary

FIXED INCOME

- USTs are under pressure, in line with global bonds, as US paper retraces some of the ADP-related gains from the previous session and risk sentiment improves (equity futures are firmer across the board). USTs are currently trading at the lower end of a 112-27 to 113-00+ range, with relatively muted price action. The data calendar is light, but numerous Fed speakers are scheduled, including Fed’s Paulson, Bostic, Williams, Barr, Waller, Miran, Collins and Treasury Secretary Bessent. Markets are still focused on developments regarding a potential government shutdown. To recap, the US passed a funding bill to end the longest-ever shutdown in the prior day – this was then voted 8-4 by the House Rules Committee to advance it to the House Floor for consideration. The bill is expected to pass (though dissent is possible), which would fund the US government until at least January 30th.

- Bunds are lower at the start of the European day, opening at 129.19 with losses of a handful of ticks, briefly rebounding to a 129.24 peak with gains of a tick before getting dragged lower as the European risk tone continues to improve. Currently holding just off a 129.02 trough with downside of 21 ticks at most, if the move continues and the figure is breached then yesterday's 128.97 base comes into view. Bunds are also potentially lower in sympathy with Gilts (see below) given the speculation around UK PM Starmer and associated price action as we get ever closer to the November Budget. For Germany, no move to Final CPI, which was unrevised , as expected. More recently, remarks from ECB's Kocher of note, as he said it would not be too surprising if the ECB holds rates steady in 2026, especially if inflation and growth projections play out as expected. A mixed Bund auction (2046 strong, but 2056 line garnered a 1.3x b/c), had little impact German paper at the time.

- This afternoon, the French National Assembly is to hold the first reading on the Social Security articles , with reference to the suspension of pension reform, set to occur around 14:00GMT. Politico writes that the articles should be adopted. Into this, OATS trade better than peers with the mood-music relatively constructive for PM Lecornu at this particular stage. Narrowing the OAT-Bund 10yr yield spread down to 74bps, the lowest since August.

- Gilts are underperforming compared to peers, reversing some of the jobs-related gains from the previous session, which increased the odds of a December BoE rate cut. Political uncertainty in the region has also resurfaced following a report in The Guardian. On that, in the prior session, The Guardian reported that Downing Street were fearing that some of the PM’s closest viewed PM Starmer as “vulnerable” to leadership change in the wake of the Budget. More recently, Wes Streeting has clarified his support for Starmer, stating that he has not had talks with anyone regarding attempts to oust his leader. Today's PMQs from around 12:00GMT onward will draw significant attention, and both GBP and Gilt trades will watch for any signs of a drop in support for Starmer as we count down to the Budget ; equally, a particularly strong performance could offset some of the pressure seen in Gilts this morning.

- Germany sells EUR 0.898bln vs exp. EUR 1.0bln 2.50% 2046 and EUR 1.14bln vs. exp. 1.5bln 2.90% 2056 Bund.

- Click for a detailed summary

COMMODITIES

- Crude oil benchmarks declined throughout the APAC session and have continued to move lower as the European session gets underway, despite the IEA releasing a report indicative of oil demand growth. After closing +1.6% in Tuesday’s session, WTI and Brent initially c. USD 0.50/bbl to a trough of USD 60.54/bbl and 64.71/bbl, respectively, as the market awaits reports from the EIA and OPEC. Most recently, Tass reported that Russia is prepared to continue talks with Ukraine in Istanbul. While there was no significant price action at the time, the complex has continued lower to USD 60.41/bbl and USD 64.30/bbl, respectively. Later today, the EIA and OPEC are expected to release their monthly oil reports. In its prior report, EIA raised its 2025 demand forecast and its view on global oil production, while OPEC maintained its 2025 and 2026 oil demand forecasts.

- Spot XAU continues to fluctuate within Tuesday’s USD 4097-4149/oz range as the market awaits a flurry of Fed speakers that could hint of the direction of travel for rates. After peaking at USD 4145/oz, XAU fell lower as it was weighed on by a stronger dollar and the generally constructive risk tone. The yellow metal troughed just shy of Tuesday’s low before rebounding back higher and currently trading at USD 4125/oz.

- Base metals remain rangebound as the market waits for a fresh specific catalyst and having struggled to make any headway overnight amid an indecisive APAC session. Currently, 3M LME Copper is oscillating in a tight USD 10.79k-10.86k/t band despite the positive risk tone across Europe and stateside.

- ANZ projects gold prices peaking around USD 4,800/oz by mid-2026.

- The IEA's World Energy Outlook report stated that LNG supplies are to grow 50% or by 300bln cubic meters by 2030, while IEA sees no demand peak for oil before 2050 under the current policies scenario.

- Click for a detailed summary

NOTABLE DATA RECAP

- German HICP Final YY (Oct) 2.3% vs. Exp. 2.3% (Prev. 2.3%); MM (Oct) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- Italian Industrial Output YY WDA (Sep) 1.5% vs. Exp. -0.5% (Prev. -2.7%, Rev. -3.0%); MM SA (Sep) 2.8% vs. Exp. 1.5% (Prev. -2.4%, Rev. -2.7%)

NOTABLE EUROPEAN HEADLINES

- UK Health Secretary Wes Streeting announces his support for UK PM Starmer Any talk of a challenge against PM Starmer is self-defeating and not true. Have not had talks with anyone about getting rid of Starmer. Adds that the PM is not fighting for his job.

- UK Chancellor Reeves is reportedly considering an increase in taxes on alcohol in line with elevated inflation, via CityAM citing sources.

- ECB's Kocher says that given recent data, a somewhat stronger growth outlook is not impossible. Would not be too surprising if ECB hold rates steady in 2026. If inflation and growth projections play out, rates may not change for a long time.

NOTABLE US HEADLINES

- US Supreme Court extended the pause on a judge's order that required the Trump administration to fully fund food aid for 42mln Americans this month amid the federal government shutdown.

- White House is exploring rules that would upend shareholder voting with the Trump admin examining new measures to curb the influence of proxy advisers and index-fund managers, according to WSJ.

GEOPOLITICS

RUSSIA-UKRAINE

- Russian defence units destroyed a Ukrainian drone heading towards Moscow.

- Russia is reportedly ready to resume talks with Ukraine in Istanbul , via Tass.

- Russia's Kremlin says the reports of contact with London was true, adds that dialogue with the UK not continued as the UK showed no desire to listen to Russia's position.

OTHER

- Australian PM Albanese said Indonesia and Australia have concluded negotiations on a new bilateral treaty on common security, and if either or both countries’ security is threatened, the treaty commits them to consult and consider what measures may be taken, individually or jointly, to deal with those threats. Furthermore, the treaty commits Australia and Indonesia to consult at a leader and ministerial level on a regular basis on matters of security, while it represents a major extension of existing security and defence cooperation.

- US President Trump has sent a letter to the State of Israel President Herzog requesting that Israel PM Netanyau is pardoned, describing the trial as "unjustified", via Jerusalem Post.

CRYPTO

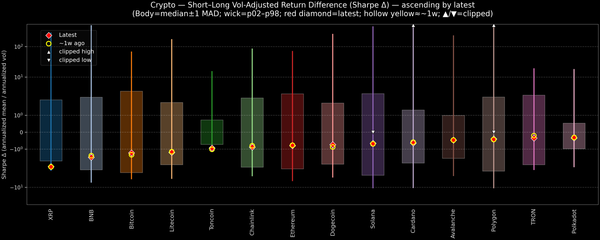

- Bitcoin is a little lower and slips below USD 105k whilst Ethereum underperforms and heads back below USD 3.5k.

APAC TRADE

- APAC stocks traded mixed with the region indecisive amid light fresh catalysts and as participants digested earnings.

- ASX 200 was rangebound with upside limited as strength in the commodity-related sectors was offset by weakness in tech, telecoms, consumer discretionary and financials, while the latest Home Loans data from Australia firmly topped estimates.

- Nikkei 225 swung between gains and losses and traded on both sides of the 51,000 level in the absence of any key data and following a slew of earnings, including from SoftBank, which is pressured despite reporting a 191% rise in 6-month net, as it also announced a 4-for-1 stock split and that it offloaded its entire stake in NVIDIA.

- Hang Seng and Shanghai Comp were mixed despite the PBoC's Q3 monetary policy implementation report, in which it reiterated to implement an appropriately loose monetary policy and strengthen the transmission of policy, while an NDRC official recently noted private investment has slowed down this year, and there are challenges in private investment but also flagged a plan to support private investment to flow to high-value service sectors.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said in a meeting with Spain's King that China is willing to work with Spain to build a comprehensive strategic partnership that is steadier, while he added that a relationship of trust has been forged between China and Spain.

- RBA Deputy Governor Hauser said their best guess is that monetary policy is still restrictive, and the committee is debating this, while he added that if it turns out they are no longer mildly restrictive, that has important implications for future policy. Hauser also stated that there are some ups and downs in consumption readings, with the central case being for a gradual, modest recovery and noted there are no levels of unemployment that will make the central bank happy.

- Japanese PM Takaichi says appropriate monetary policy is very important and they will be coordinating closely with the BoJ to attain economic growth.

- Two new members of Japan's top government economic panel are calling for larger economic stimulus Y/Y.

DATA RECAP

- Australian Home Loans QQ (Q2) 9.6% vs Exp. 2.6% (Prev. 2.0%)

- Australian Owner-Occupied Loan Value QQ (Q2) 4.7% vs Exp. 2.5% (Prev. 2.4%)

- Australian Investor Housing Finance QQ (Q2) 17.6% vs Exp. 4.0% (Prev. 1.4%)

- South Korean Unemployment Rate (Oct) 2.6% (Prev. 2.5%)

More

markets stories on ZeroHedge