Market Wrap 2025-11-19

- Sources indicate the Trump administration has been working discreetly with Russia to formulate a new strategy aimed at resolving the conflict in Ukraine; Politico reported that US officials are nearing the announcement of a significant new peace accord with Russia to bring an end to the Ukraine situation.

- The White House has verified that US President Trump is scheduled to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

- US Treasury Secretary Bessent mentioned, via Fox News, that US President Trump might reveal the next Fed Chair before Christmas.

- European stock exchanges are fluctuating around the unchanged level, while US equity futures are increasing ahead of NVIDIA's report.

- The USD is slightly stronger leading up to the release of the FOMC Minutes; USD/JPY is rising above 156.00 after Finance Minister Katayama stated that there were no specific FX discussions with BoJ Governor Ueda.

- Bonds initially saw buying interest due to a cautious risk environment, but are now showing a downward trend as sentiment improves; Gilts received a brief boost from CPI data, but subsequently experienced notable pressure.

- The price of crude oil is modestly decreasing as Zelensky’s delegation is in Turkey, and XAU is trading above USD 4100/oz.

- Upcoming events include US International Trade (Aug), FOMC Minutes, speeches from Fed officials Williams, Logan, Barkin, and Miran; BoE’s Dhingra, US supply data, and earnings from NVIDIA.

TRADE

- The White House announced that the US and Saudi Arabia have agreed to enhance collaboration on trade matters in the coming weeks, with an agreement in place for Saudi Arabia to purchase nearly 300 American tanks. President Trump has approved a substantial defense sale package, including future F-35 deliveries. Key Saudi-US achievements include a civil nuclear cooperation agreement, advancements in critical minerals cooperation, and a landmark AI memorandum of understanding (MOU).

- The White House confirmed that US President Trump is set to speak at the US-Saudi investment forum on Wednesday at 12:00 EST (17:00 GMT) in Washington.

- The Dutch government, according to Reuters citing sources, has stated that it has paused intervention at Nexperia as a gesture of goodwill. There is a positive view of the measures taken by China to ensure the supply of chips. Engagement in constructive talks with China will continue.

EUROPEAN TRADE

EQUITIES

- European stock exchanges (STOXX 600 +0.1%) are showing mixed performance and trading around the unchanged mark, as sentiment attempts to stabilize following recent losses. However, traders remain cautious ahead of the FOMC Minutes and NVIDIA earnings.

- European sectors are displaying mixed results. The top-performing sectors include Media (+1.5%), Energy (+1.0%), and Food and Beverage (+0.5%). The bottom-performing sectors include Utilities (-0.9%), Banks (-0.6%), and Insurance (-0.4%), with limited news flow to explain the downtick in those sectors.

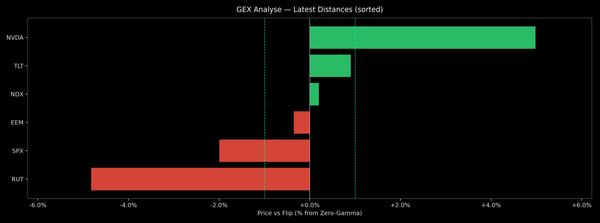

- US equity futures (ES +0.3% NQ +0.4% RTY +0.5%) are modestly higher across the board, attempting to recover some of the significant losses seen in the previous session.

- NVIDIA's earnings are scheduled for release after the market close, as investors become increasingly concerned about rising AI spending. Investors are seeking clarity on where billions allocated to AI are being directed, with analysts suggesting that the results could influence broader market sentiment. Analyst forecasts indicate Q3 earnings of USD 1.24 per share and revenue of USD 54.41bln, primarily from Data Centre operations. Orders for Blackwell and Rubin chips are expected to exceed USD 500bln, according to Susquehanna. Despite optimism, Michael Burry recently disclosed holding 1mln puts, while SoftBank (SFTBY) has exited its stake.

FX

- The DXY is slightly firmer and trading within a narrow range of 99.49 to 99.79. Sentiment remains cautious ahead of key risk events today (NVIDIA/FOMC Minutes) and into September’s NFP report on Thursday. G10 currencies are currently broadly flat/lower against the USD, with the Antipodeans showing clear underperformance. Regarding the Fed, US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas, via Fox News.

- The EUR is flat/mildly lower against the USD and trading within a narrow range of 1.1566 to 1.1597, just below the 1.1600 level. This low for the day marks a fresh WTD trough, but is towards the midpoint of last week’s confines. EZ HICP Final Metrics were left unrevised – no move on the report.

- Overnight, USD/JPY traded choppily within a tight range, with the yen showing modest strength as risk sentiment in Japan and South Korea deteriorated. Into the morning, the JPY scaled back that strength to trade modestly lower vs the USD, ahead of a meeting between BoJ Governor Ueda and Japanese Finance Minister Katayama. To put this meeting in some context, Japan’s bond yields hit multiyear highs overnight on fears a roughly JPY 17tln stimulus package under PM Takaichi will strain already weak public finances. She provided some post-meeting remarks, where she highlighted that the meeting focused on maintaining a close BoJ-Government coordination, with the largest bout of pressure for the JPY seen following remarks that there was “no specific discussion on FX”. This broke the Yen out of its overnight range to make a fresh session high above the 156.00 mark - a changing target right now, but high for today 156.29 at time of writing.

- The GBP is lower today following the UK inflation report. Headline CPI Y/Y and M/M printed in-line with expectations, and cooled a touch from the prior whilst Services was cooler-than-expected. Governor Bailey, who cast the tie-breaking vote last time around, made clear in the statement & press conference that, in terms of the next cut, the BoE generally but Bailey in particular, is highly inflation contingent. As such, the as-expected moderation will push Bailey towards a December cut; however, it is too soon to say for sure, given the uptick in food inflation and the stickiness of various components. Additionally, we await next week's budget and then the November inflation print just before the December announcement for further insight.

- Antipodeans trade lower overnight amidst the subdued risk tone – price action which has continued to play out into the European session. The Kiwi sits at the foot of the G10 pile, closely joined by the Aussie; NZD/USD is currently at the bottom end of a 0.5622 to 0.5661 range.

- PBoC set USD/CNY mid-point at 7.0872 vs exp. 7.1121 (Prev. 7.0856)

FIXED INCOME

- Gilts opened firmer by a handful of ticks before lifting to a 92.46 peak with gains of 13 at most. Upside spurred given the modest bullish bias in peers early doors and, more pertinently, after the morning's CPI release confirmed that UK inflation peaked across the late Summer. A release that factors in favour of the dovish contingent of the BoE.

- However, the stickiness of several components and uncertainty into the Budget and November inflation report mean that a definitive call for a December cut cannot be made just yet. Explaining the minimal magnitude of the Gilt move, its subsequent paring and why market pricing didn't deviate significantly/lastingly from a c. 80% chance of a cut. Downside was exacerbated after supply , where another sub-3x b/c spurred modest pressure to losses of c. 15 ticks, before slipping further to within reach of 50 of downside ticks at most. Supply aside, no clear fresh driver behind the move , aside from the uptick in the general risk tone (European equities moving a little higher).

- Bunds began on the front foot, and got to gains of eight ticks at most at a 128.79 peak. Thereafter, the complex saw a modest pullback and fell into the red with downside of just over five ticks at most. Specifics for the space light thus far and the docket ahead is devoid of Tier 1 events. As such, we look to US drivers for direction.

- USTs were contained ahead of several key US events, but slipped to troughs alongside a pickup in sentiment and underperformance in Gilts; supply, minutes, speakers and potentially most pertinently NVIDIA earnings all due. For the minutes, we look for insight into how the FOMC aligns itself to the hawkish tone taken by Powell in the press conference; ahead of that, markets ascribe a c. 40% chance of a December cut. Into this, USTs hover around the unchanged mark in a narrow 112-23 to 112-27+ band.

- UK sells GBP 4.5bln 4.75% 2035 Gilt: b/c 2.84x (prev. 2.78x), average yield 4.608% (prev. 4.769%), tail 0.6bps (prev. 0.6bps).

- Bond dealers have pushed back against Fed officials urging them to use the Standing Repo Facility, Bloomberg reports citing sources; citing stigma over borrowing from the Fed directly, operational and balance sheet concerns as factors.

COMMODITIES

- Crude benchmarks have begun to pull back slightly and retrace the gains made in Tuesday’s session after consolidating in a tight band throughout the APAC session. WTI and Brent oscillated in narrow USD 60.32-60.70/bbl and USD 64.51-64.78/bbl ranges during APAC trade before falling to a trough of USD 60.00/bbl and USD 64.19/bbl as the European session got underway. Thus far, benchmarks have bounced off session lows as risk tone begins to pick up across global markets. In geopols, Axios reported that the Trump administration has been secretly working in consultation with Russia to draft a new plan to end the war in Ukraine. More recently, Brent Jan'26 took a leg lower to fresh troughs on Politico reports that US officials are reportedly nearing a deal to unveiling a major new peace agreement ; last at USD 64.15/bbl.

- Spot XAU has seen modest gains to start the European session as markets await for FOMC minutes and NVIDIA earnings after the closing bell. XAU dipped to a low of USD 4056/oz in the early hours of the APAC session before reversing higher and peaking at USD 4099/oz. The yellow metal pulled back slightly to a low of USD 4078/oz before extending above USD 4100/oz. Currently, XAU is trading at session highs at USD 4113/oz.

- Base metals have traded subdued at the start of the European session amid a lack of catalysts. 3M LME Copper oscillated in a tight USD 10.7k-10.77k/t band before extending to a peak of USD 10.78k/t in line with the global risk tone. Broadly speaking the complex, as is the case for markets elsewhere, are waiting for AI behemoth NVIDIA to report Q3 earnings after the closing bell (see board for primer).

- US Private inventory data (bbls) : Crude +4.4mln (exp. -0.6mln), Distillate +0.6mln (exp. -1.2mln), Gasoline +1.5mln (exp. -0.2mln), Cushing -0.8mln

- EU plans to create a central body to co-ordinate the purchasing and stockpiling of critical minerals , according to the FT.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK CPI YY (Oct) 3.6% vs. Exp. 3.6% (Prev. 3.8%); MM (Oct) 0.4% vs. Exp. 0.4% (prev. 0.00%)

- UK Core CPI YY (Oct) 3.4% vs. Exp. 3.4% (Prev. 3.5%); CPI MM (Oct) 0.3% vs. Exp. 0.4% (prev. 0.00%)

- UK CPI Services YY (Oct) 4.50% vs. Exp. 4.60% (Prev. 4.70%); MM (Oct) 0.2% vs. Exp. 0.40% (Prev. -0.30%)

- UK ONS House Price Index: +2.6% in the 12-months to September

- EU Current Account SA, EUR (Sep) 23.1B (Prev. 11.9B)

- EU HICP Final YY (Oct) 2.1% vs. Exp. 2.1% (Prev. 2.1%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is reportedly considering shielding small businesses from tax rises , according to The Times.

- UK Chancellor Reeves is reportedly looking at ways to cut household energy bills, via Politico citing sources; targeting a cut of GBP 150-170/yr on annual household energy bulls. Cut to VAT on energy bills is also being considered.

NOTABLE US HEADLINES

- US Treasury Secretary Bessent said US President Trump may announce the next Fed Chair before Christmas , via Fox News.

- US President Trump posted "Investment in AI is helping to make the U.S. Economy the “HOTTEST” in the World — But overregulation by the States is threatening to undermine this Growth Engine...We MUST have one Federal Standard instead", via Truth Social.

- Tesla (TSLA) CEO Musk and NVIDIA (NVDA) CEO Huang are set to participate in a panel at the US-Saudi investment forum on November 19th , according to Reuters.

- Elon Musk's xAI is said to be in advanced talks to raise USD 15bln in new equity at a USD 230bln valuation , according to WSJ sources.

- JPMorgan's 2026 outlook note sees Fed rate cuts supporting global equities and credit , with long-term Treasury yields likely to remain range-bound and multi-asset portfolios set for another year of solid returns.

GEOPOLITICS

MIDDLE EAST

- Saudi Crown Prince Mohammed bin Salman said Saudi Arabia wants to be part of the Abraham Accords while ensuring a path to a two-state solution, and added that the kingdom will raise its investment in the US to USD 1tln , according to Reuters.

- US President Trump reiterated that Iran would like to make a deal with the US .

- US President Trump said Saudi Arabia has been designated as a major non-NATO ally to the US , according to Reuters.

RUSSIA-UKRAINE

- Polish Foreign Minister Sikorski says they will respond to the railway sabotage, not just diplomatically.

- The Trump administration has been secretly working in consultation with Russia to draft a new plan to end the war in Ukraine, according to Axios sources. The plan’s 28 points fall into four general categories: peace in Ukraine, security guarantees, security in Europe, and future US relations with Russia and Ukraine. The basic idea was to take the principles that Trump and Russian President Vladimir Putin agreed to in Alaska in August and produce a proposal to address the Ukraine conflict, restore US-Russia ties, and address Russia’s security concerns, according to Axios.

- US officials are reportedly near to unveiling a major new peace agreement with Russia to end the Ukraine conflict, via Politico; expected to be agreed by all parties by end-November, possibly as soon as this week .

- US President Trump dispatched a high-level Pentagon delegation to Kyiv for talks on Wednesday, in the administration’s latest attempt to revive negotiations on halting Ukraine’s war with Russia , according to WSJ.

- Russia's Defence Ministry said Ukraine attempted to strike targets deep inside Russian territory with ATACMS missiles (long-range, guided missiles) on Tuesday, with Voronezh as the target; Russian media reported that all of the ATACMS were shot down .

- Russia and the US have reportedly discussed the possibility of conducting another prisoner exchange , via Axios’ Ravid citing comments from a Russian special envoy.

- Poland scrambled aircraft to secure its airspace following Russian strikes on Ukraine, according to the Polish armed forces .

- Explosions reported in Lviv in Western Ukraine, following Ukrainian military warning of high threat of Russian missile and drone attacks. Note, Lviv is approximately 70km (43 miles) from the Polish border.

CHINA-JAPAN

- The Chinese government issued a renewed ban on Japanese seafood imports , according to Kyodo.

- China told Japan that the suspended seafood imports are amid monitoring of treated water release from the Fukushima nuclear plant , according to Kyodo.

- China's Foreign Ministry says Japan's PM Takaichi's "erroneous remarks" about Taiwan has fundamentally damaged the political foundation of Sino-Japanese relations. Suspending talks on resuming imports of Japanese beef.

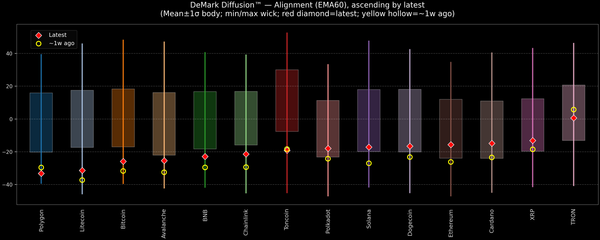

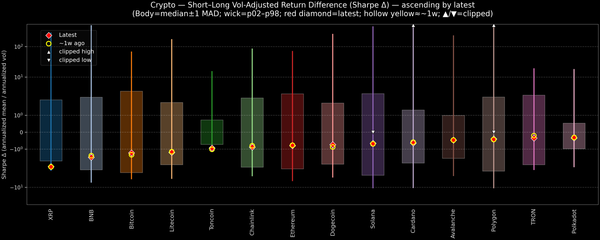

CRYPTO

- Bitcoin is a little lower and trades around USD 91k whilst Ethereum sits above USD 3.1k.

APAC TRADE

- APAC stocks were choppy, cautious, and eventually traded subdued, as the region held a tentative stance ahead of the FOMC minutes and NVIDIA earnings.

- ASX 200 printed on either side of the unchanged mark with limited news flow in the region. Wage Price Index data came in as expected, producing little market reaction. The index found support from gains in gold miners after the metal bounced from support around USD 4,000/oz.

- Nikkei 225 experienced choppy trade, swinging between gains and losses. Following modest opening gains, the index quickly turned negative within the first 30 minutes as JGB yields continued to rise, while Japan navigated ongoing tensions with China and PM Takaichi's fiscal package. Nikkei thereafter moved to session highs above 49,000 before trimming those gains once again.

- KOSPI saw a sharp acceleration in losses shortly after the open (-2.2% at one point), driven by declines in its heavily-exposed tech sector, with Samsung Electronics falling some 3% at one point. KOSPI thereafter trimmed a bulk of its losses but remained negative.

- Hang Seng and Shanghai Comp opened with modest, cautious gains, in contrast to the more negative tone in Japan and South Korea, although the former later conformed to the global tech losses, whilst the latter gave up initial modest gains.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama says she held meeting from perspective of maintaining close government and BoJ coordination; reconfirmed technical tweak to BoJ-Government joint statement, and no change to substance . No specific discussion on FX.

- China's Foreign Ministry says Japan's PM Takaichi's "erroneous remarks" about Taiwan has fundamentally damaged the political foundation of Sino-Japanese relations

- Japan's government plans to spend over JPY 20tln in an economic package , according to Kyodo News.

- Japanese PM Takaichi's advisory panel member Kataoka said the BoJ is not likely to raise rates before March and estimated that a budget of JPY 20tln is needed for this fiscal year , via Bloomberg.

- Former TSMC (2330 TT) Senior VP Dr. Wei-Jen Lo is rumoured to have obtained the latest data on TSMC’s 2nm advanced chip manufacturing processes before joining Intel (INTC) , according to MoneyUDN.

DATA RECAP

- Australian Wage Price Index YY (Q3) 3.4% vs. Exp. 3.4% (Prev. 3.4%)

- Australian Wage Price Index QQ (Q3) 0.8% vs. Exp. 0.8% (Prev. 0.8%)

- Japanese Machinery Orders YY (Sep) 11.6% vs. Exp. 5.4% (Prev. 1.6%)

- Japanese Machinery Orders MM (Sep) 4.2% vs. Exp. 2.5% (Prev. -0.9%)