Market Wrap 2025-11-20

- Sources indicate China is considering new property stimulus measures, potentially including mortgage subsidies.

- Equity futures in Europe and the US are generally higher, supported by positive NVIDIA results and CEO Huang's comments dismissing concerns about an "AI bubble."

- The DXY is firmer ahead of the September Non-Farm Payroll (NFP) report, while the JPY remains unresponsive to further verbal interventions.

- WTI and Brent crude oil prices are slightly higher, with some support following the Kremlin's statement that peace talks with the US are not currently taking place. XAU (gold) is experiencing a slight dip.

- Japanese Government Bonds (JGBs) are underperforming amid stimulus considerations, while US Treasuries (USTs) are bearish as data clarity remains limited.

- Upcoming events include: Eurozone Consumer Confidence Flash (November), US NFP (September), US Jobless Claims (week ending November 15), New Zealand Trade Balance (October), Australian Flash PMIs (November), Japanese Nationwide CPI (October), South African Reserve Bank (SARB) Policy Announcement, speeches from Fed officials Cook, Barr, Hammack, Paulson, Miran, and Goolsbee, and speeches from BoE officials Dhingra and Mann. Supply from the US and earnings reports from Gap and Walmart are also anticipated.

Newsquawk in 3 steps:

- Subscribe to the free premarket movers reports

- Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news

squawk box for 7 days

TRADE/TARIFFS

- US lawmakers are reportedly considering a new bill to codify China AI chip export restrictions. The White House has reportedly requested Congress to reject the bill limiting NVIDIA (NVDA) exports.

- The US Commerce Department reportedly plans to approve the export of 70,000 advanced AI chips to the UAE and Saudi Arabia. The export deal includes approval for NVIDIA's (NVDA) GB300 or equivalent chips.

- China's October exports of rare earth magnets to the US increased by 56.1% compared to September.

- The European Commission will reportedly present a list of sectors it wants to be exempt from US tariffs to US Commerce Secretary Lutnick and USTR Greer on Monday; sectors include medical devices, wines, spirits, beers, and pasta.

EUROPEAN TRADE

EQUITIES

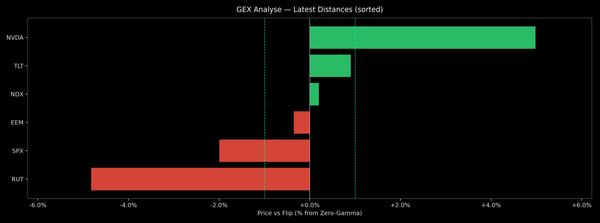

- European stock markets (STOXX 600 +0.7%) opened with gains across the board, driven by positive sentiment following strong earnings from NVIDIA. Price action has been relatively sideways at elevated levels as markets await the US NFP report.

- European sectors are showing a strong positive trend. The tech sector is leading gains, mirroring pre-market gains in NVIDIA (+5%). ASML (+1.4%) and Infineon (+1.5%) are also moving higher.

- US equity futures (ES +1.2% NQ +1.5% RTY +0.7%) are stronger across the board, with the tech-heavy NQ showing significant outperformance following NVIDIA's results. NVIDIA reported stronger-than-expected revenue and provided upbeat sales guidance, easing investor concerns about heavy AI spending. Data center sales rose 66%, driven by demand for Blackwell and GB300. The company noted that cloud GPUs are sold out, and there is strong growth in gaming, visualization, and robotics, although sales in China are limited.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

NVIDIA Commentary Highlights:

- CEO on AI bubble: CEO Huang stated that while there has been much discussion about an AI bubble, NVIDIA sees "something different."

- CFO on China: NVIDIA will continue to cooperate on China. Sizeable purchase orders for the H20 AI chip did not materialize in the quarter due to geopolitical issues and increased competition in China. Data center compute revenue from China is not expected in Q4.

- CEO Comments: NVIDIA has performed well in terms of planning and supply chains and will continue to do stock buybacks. The company is more successful this year compared to last year.

- CFO Comments: The company is still in the early stages and reiterates visibility into USD 500 billion in Blackwell and Rubin revenue. Cloud services are sold out, and demand continues to exceed expectations.

FX

- The DXY is slightly firmer, trading between 100.10 and 100.32. The index surpassed its 200-day moving average at 99.91 in the previous session and has continued to rise to multi-month highs, levels not seen since late May 2025. The upside was supported by hawkish FOMC minutes and the BLS announcement that the October and November NFP reports will be delayed until December 16th, leaving the Fed with only today's (September) NFP report. Money markets are currently pricing in a near-25% chance of a rate cut at the December meeting.

- The EUR is slightly weaker against the Dollar, with a lack of European-specific data to guide the currency. Price action has been largely influenced by the Dollar side of the pair and will depend on the NFP report. German Producer Prices data printed roughly in line with expectations and had limited impact on the pair.

- USD/JPY has continued its ascent beyond 157.00, reaching a session high of 157.77. The pair has experienced moves in both directions, with the USD gaining amid hawkish repricing into the December meeting and the JPY digesting domestic factors. Overnight, Katayama reiterated verbal intervention attempts, but without effect. The pair has cooled from its best levels to trade at 157.20 but remains at the upper end of Wednesday's range.

- The GBP is experiencing a quiet session, with little fresh news flow from a Budget perspective. Cable is currently trading between 1.3039 and 1.3076. The GBP has faced selling pressure over the past month, with losses totaling roughly 3%, amid Budget-related concerns and political uncertainty within the Labour party. Scheduled speakers today include Dhingra and Mann.

- Antipodean currencies are trading mixed, with the NZD benefiting from the risk tone while the AUD is flat, conforming to the subdued risk tone in China. China is affected by its position in the AI race post-NVIDIA, and base metals are generally softer. No major move was seen on reports that China is considering new property stimulus. AUD/USD trades between 0.6472 and 0.6491, while NZD/USD trades between 0.5596 and 0.5614.

- The PBoC set the USD/CNY mid-point at 7.0905 vs. the expected 7.1201 (previous 7.0872).

- Click for JPY Analysis

- Click for a detailed summary

FIXED INCOME

- JGBs are under pressure as Japanese yields continue to climb, reaching a contract low of 134.56. The 10-year yield has risen to a peak of 1.85%, returning to levels from early 2008. This is driven by ongoing speculation and reporting about the upcoming stimulus, which is expected to be around JPY 17 trillion, exceeding the JPY 13.9 trillion figure from the last package. This has pressured JGBs due to expectations of greater issuance than the JPY 6.7 trillion outlined previously.

- USTs are under pressure, but modestly. Downside comes given the upbeat risk tone after NVIDIA numbers (see Equities). Additionally, the latest FOMC minutes showed a somewhat divided board but the undertones were hawkish. Potentially more pertinently, the BLS has confirmed the October payrolls release will not print in full (no unemployment rate) while the November series has been delayed until after the December meeting. Factors that are both hawkish/bearish. As the lack of data visibility gives the Fed theoretical scope to wait-and-see how the economy is faring before easing further; reminder, in October, Powell remarked, “when there is fog, you could slow down”. Given all this, USTs are in the red and down to a 112-18 base. Support comes into play at 112-17 from Tuesday before Monday’s 112-15+ WTD low.

- Bunds are softer, following the risk tone lower and posting downside of just under 20 ticks at most. Holding around a 128.48 low, if the move continues, we look to 128.25 from early October before the figure and then touted support at 127.88. Specifics for the bloc are somewhat light thus far. No move to ECB’s Makhlouf this morning, remarks that chimed with the market view that the ECB is at a terminal. Interestingly, Makhlouf said he does not think the new projections are likely to change; a remark in reference to the December forecast round which will include the first look at 2028, a period in focus and of particular note for those looking for further ECB easing. Supply from Spain passed without incident, whilst France was a little more mixed. Overall though, no move seen and OATs trade in-line with Bunds as we approach the tail-end of the week where attention returns back to French budget deliberations.

- Gilts are marginally outperforming after the underperformance on Wednesday. Underperformance that was seemingly due to concerns around the stability of Labour leadership amid mounting challenges to PM Starmer in the background. A challenge that would be a knock to the relatively, market-favourable pairing of Starmer and Reeves. This morning, Gilts are holding in the green by a handful of ticks. Initially opened lower acknowledging the bearish bias seen in peers but then swiftly pared to post gains of 15 ticks at best. Overall though, the benchmark has settled just above the unchanged mark in a 91.51-85 band. Scheduled speakers today include Dhingra and Mann.

- Spain sold EUR 4.921 billion of 3.00% 2033, 3.20% 2035, and 4.00% 2054 Bono, against an expected EUR 4.5-5.5 billion.

- France sold EUR 12 billion of 2.40% 2028, 2.70% 2031, 1.50% 2031, and 3.50% 2033 OAT, against an expected EUR 10-12 billion.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks have traded subdued to start the European session despite the positive risk tone following NVIDIA earnings and further reporting about the proposed 28-point plan to end the war in Ukraine. After grinding higher throughout Wednesday's US session, WTI and Brent pulled back to a trough of USD 59.27/bbl and USD 63.52/bbl respectively before extending to session highs of USD 59.80/bbl and USD 64.08/bbl as European traders stepped into the market. Despite the muted trade, benchmarks currently remain near session highs as the European session continues. Some further upside seen following comments via Russia's Kremlin which said that consultations with the US on peace are not taking place, but contacts are.

- Spot XAU sold off at the start of the APAC session and has continued to drift lower following the hawkish FOMC minutes and the bid seen across global equities as NVIDIA posted positive earnings. After a slight bid to a peak of USD 4110/oz at the start of APAC trade, XAU sold off to a trough of USD 4042/oz before consolidating in a USD 4042-4085/oz band. As the European session got underway, the yellow metal briefly extended to a new session low of USD 4039/oz before bouncing back into the earlier band.

- Base metals have traded rangebound to start the European session despite the positive global risk tone, outside of China, following NVIDIA earnings. 3M LME Copper started positive and bid higher to a peak of USD 10.83k/t at the start of APAC trade. However, the red metal fell lower and as the European session got underway, copper extended losses to a trough of USD 10.72k/t. Thus far, 3M LME Copper has managed to bounce off worst levels and is currently trading at USD 10.80k/t.

- The Offshore Alliance Union has applied to the Australian tribunal for permission to strike at Woodside’s (WDS AT) Pluto 2 LNG project.

- BP (BP/ LN) shut the Olympic Pipeline system after a leak in Washington.

- According to Bloomberg, "As the busy period for Chinese manufacturing draws to a close, copper consumption has largely disappointed, with run rates at fabricators plumbing multiyear lows for the season."

- Click for a detailed summary

NOTABLE DATA RECAP

- Swiss Trade (October): 4319.0M CHF (previous 4073.0M CHF, revised 3990M CHF); Gold exports 128.2/T, -11%; Watch exports: CHF 2.2 billion, -4.4% Y/Y.

- German Producer Prices (October): Month-over-month 0.1% (expected 0.0%, previous -0.1%); Year-over-year -1.8% (expected -1.9%, previous -1.7%).

- Norway's preliminary oil production (October): 1.82 million BPD (previous 1.82 million BPD M/M); gas production 10.4 billion cubic meters (previous 8.5 billion cubic meters M/M).

NOTABLE EUROPEAN HEADLINES

- ECB's Makhlouf stated that he is comfortable with the current policy stance and requires further evidence to change his view. He believes outcomes are in line with projections, and new projections are unlikely to change. He also stated that the risks around the inflation outlook are balanced and that he is "completely relaxed" about undershooting next year, as inflation will return.

NOTABLE US HEADLINES

- US President Trump is reportedly considering an executive order to pre-empt state AI laws.

- US President Trump is considering signing an executive order as soon as Friday.

- US President Trump posted that he signed the bill approving the release of the Epstein files.

- US President Trump is set to meet New York City Mayor Mamdani on Friday at the Oval Office.

- BoC Deputy Governor Vincent stated that Canada’s weak productivity problem has become more urgent and is a systemic issue requiring a coordinated, economy-wide approach. He added that the country is stuck in a vicious cycle where weak productivity makes it harder to meet challenges, shocks to the economy have become more frequent, and Canada is too vulnerable to their impacts. He also noted that when assessing inflation, the Bank places particular importance on the relationship between rising labor costs and productivity.

- A UBS (UBSG SW) executive stated that US inflation is quite sticky and that the upcoming quarters are likely to be challenging from a macro standpoint.

- BofA Total Card Spending (week ending November 15th): +1.5% (previous +4.2%, October average +2.4%); notes that "as we approach the holiday seasons, spending per household on holiday items is tracking significantly ahead of 2023 and 2024 levels".

DELAYED DATA UPDATE

- The US November jobs report has been rescheduled for December 16th at 08:30 EST/13:30 GMT, with the October NFP to be released alongside November but without an unemployment rate. The BLS said the October 2025 Employment Situation Report has been cancelled, noting the Establishment Survey (NFP) data will be published with November’s release on December 16th, while Household Survey data (unemployment rate) could not be collected.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia stated that it is ready for dialogue with the United States on nuclear arms reduction.

- US President Trump reportedly quietly approved a peace plan between Russia and Ukraine earlier this week.

- Russia's Kremlin stated that consultations or negotiations with the US on peace in Ukraine are not taking place but contacts are, and added that there is nothing to say on if President Putin has been briefed on the peace plan.

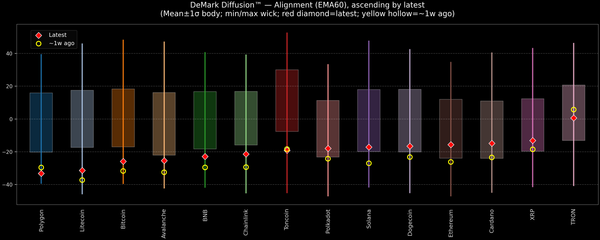

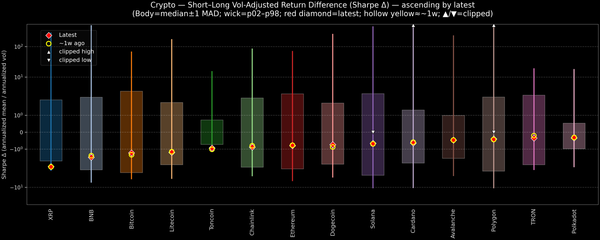

CRYPTO

- Bitcoin is slightly firmer and trades around USD 92k, while Ethereum dips and holds around USD 3k.

- BlackRock (BLK) is preparing to file for an "iShares Staked Ethereum Trust ETF".

APAC TRADE

- APAC stocks surged across the board, buoyed by a strong performance in the tech sector following NVIDIA’s solid earnings and guidance, while CEO Huang dismissed concerns of an AI bubble, stating, “We see something different.”

- The ASX 200 held near highs, supported by strength in the tech and gold sectors.

- The Nikkei 225 surged at the open and reclaimed 50,000+ levels as NVIDIA boosted tech stocks, though it pulled back from highs amid ongoing US-China tensions and fiscal concerns and as JGB yields continued climbing.

- The Hang Seng and Shanghai Comp both opened firmer but lagged peers, with China struggling to capitalize on NVIDIA’s performance amid the US/China AI race. Some modest upside was seen on reports that China is reportedly mulling new property stimulus with mortgage subsidies. Meanwhile, the PBoC held LPRs steady as expected.

NOTABLE ASIA-PAC HEADLINES

- Sources indicate China is considering new property stimulus measures, potentially including mortgage subsidies.

- Japan's economic stimulus package is expected to be around JPY 21.3 trillion. The Japanese government is in the final stages of compiling its economic stimulus package worth JPY 21.3 trillion, according to a draft seen by Reuters; the package will total JPY 42.8 trillion, including private-sector investments.

- BoJ Board Member Koeda stated that the BoJ is ready to step into the market via an increase in bond buying and emergency market operations when long-term yields make rapid moves. She wants to closely watch how FX volatility could affect prices and made no comment on a specific long-term rate level, adding that it should be set by markets reflecting fundamentals.

- BoJ Board Member Koeda stated that the bank must normalize interest rates to avoid causing distortion in the future, adding that she believes underlying inflation is about 2%. She reinforced a data-dependent approach.

- Japanese Chief Cabinet Secretary Kihara stated that the government is watching market moves, including the bond market, closely and expressed concern about recent sharp, one-sided FX moves. He emphasized that the FX market needs to move stably, reflecting fundamentals, and that the government is watching FX with a high sense of urgency.

- Japanese Finance Minister Katayama stated that she won’t comment directly on JGB yield levels, which are determined by various factors, and reaffirmed with BoJ Governor Ueda that authorities will watch market moves with a strong sense of urgency.

- RBA's Hunter stated that monthly inflation data can be volatile and that the bank will not react to just one month of data. He also noted that the response in the housing market to rate cuts has been a little stronger than expected.

- Chinese Loan Prime Rate (November): 1-Year 3.00% (expected 3.00%, previous 3.00%); 5-Year 3.50% (expected 3.50%, previous 3.50%).

- BoJ Governor Ueda is set to attend a lower house Finance Committee on Friday, November 21st.

- The Chinese Commerce Ministry stated that if Japan insists on going down the wrong path, then China will take the necessary measures. It also stated that Japan's PM Takaichi's remarks have a great impact on bilateral trade cooperation and that Tokyo should create a favorable environment for economic trade cooperation.

- BoJ Ueda is to appear at a Financial Times event on December 9th.

More

markets stories on ZeroHedge