Market Wrap 2025-11-27

Today's US Market Wrap — Key Points

- Risk-on sentiment prevails; tech leads, comm services lags.

- Mixed US data: Jobless claims down, durable goods up, PMI weak.

- Dollar weakens; NZD & AUD outperform after central bank news.

- Oil rises amid Russia/Ukraine peace talk uncertainty.

- BoJ rate hike speculation boosts Yen, but risk appetite weighs.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

Wednesday saw a risk-on trading environment leading into the Thanksgiving holiday, with the Russell 2000 and Nasdaq showing strong performance alongside widespread gains. Technology stocks were notable outperformers, while Communication Services lagged, with AI-related stocks rising after recent declines, although Alphabet (GOOGL) partially reversed its recent gains, impacting the communications sector. Several macroeconomic events occurred on Wednesday. US data presented a mixed picture, with low initial jobless claims alleviating concerns about the labor market and durable goods orders exceeding expectations, but the Chicago PMI experienced a significant drop. The jobless claims and durable goods data put downward pressure on T-Notes, but this move was partially reversed by the settlement, possibly due to the weak Chicago PMI or profit-taking before Thanksgiving. In the UK, the budget caused volatile trading in UK assets, but ultimately the increased fiscal headroom eased concerns, leading to gains in Gilts and GBP. Oil prices rose, with attention remaining on Russia/Ukraine peace negotiations. Initial optimism arose from comments by Trump indicating progress and Ukrainian satisfaction, but this faded after Russian officials cautioned against premature conclusions and stated that Russia is not making concessions on key issues related to a settlement in Ukraine. In the FX market, the Dollar weakened in the risk-on environment, while the NZD outperformed after the RBNZ reduced rates by 25bps as anticipated but projected rates to remain unchanged throughout the following year, supporting the NZD. The AUD was also boosted by higher-than-expected Australian CPI, with the strong risk sentiment also contributing to its strength. GBP strengthened against the Dollar and Euro following the budget, while the Yen ultimately underperformed despite overnight strength following reports from sources. These reports indicated that the BoJ is preparing markets for a potential rate hike as early as December, with adjustments to its communication, although the decision to proceed in December or wait until January remains uncertain. US markets are closed on Thursday for Thanksgiving and will close early on Friday, with trading expected to be subdued.

US

JOBLESS CLAIMS: Initial Jobless Claims decreased in the week ending November 22nd, falling to 216k from 220k, despite expectations of an increase to 225k. This matched the lowest claims figure since the 215k recorded in the week of February 8th (equaling the 216k in the week of April 12th). The four-week average decreased to 223.75k from 224.75k. Continued claims, for the week ending November 15th, increased to 1.96 million from 1.953 million, indicating that individuals out of work are facing challenges in finding employment. The four-week average is at 1,956k, the highest since July 5th, 2025. Oxford Economics is closely monitoring the data for indications that recent layoffs are translating into substantial job losses, but notes that the evidence is not yet apparent. It also notes that "There are some signs of softening in various private sector metrics, but that's not the signal coming from the jobless claims data".

DURABLE GOODS: Durable Goods orders for September increased by 0.5%, a deceleration from the previous 2.9% increase but still above the 0.3% forecast. Excluding transportation, orders rose by 0.6%, exceeding the 0.2% forecast and accelerating from the previous 0.3%. Excluding defense, orders rose 0.1% vs. prior 1.9%. Nondefense capital goods orders excluding aircraft increased by 0.9%, up from the previous 0.4% and the 0.2% forecast. Pantheon Macroeconomics notes that the data is outdated due to the delayed release caused by the government shutdown, but suggests a slight improvement compared to the earlier trend. Following the data release, the Atlanta Fed GDPNow estimate for Q3 25 was lowered to 3.9% from 4.0%. The Q3 25 GDP data has been delayed until December 23rd.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED HALF A TICK LOWER AT 113-18+

T-Notes ultimately steepened after strong jobless claims and Durable Goods beat, while Chicago PMI misses. At settlement, 2-year +2.2bps at 3.481%, 3-year +2.0bps at 3.472%, 5-year +0.7bps at 3.572%, 7-year +0.1bps at 3.755%, 10-year -0.4bps at 3.998%, 20-year -1.1bps at 4.604%, 30-year -1.4bps at 4.644%.

INFLATION BREAKEVENS: 1-year BEI +9.1bps at 2.680%, 3-year BEI +2.4bps at 2.399%, 5-year BEI +1.5bps at 2.238%, 10-year BEI +0.6bps at 2.219%, 30-year BEI +0.6bps at 2.199%.

THE DAY: T-Notes settled with a flattening of the curve following US data and the UK budget. In the morning, T-Notes followed Gilts higher after an early leak regarding the UK budget, which indicated fiscal headroom of GBP 22 billion, higher than the GBP 9.9 billion in March, supporting UK assets. However, Gilts and US Treasuries partially reversed this move before the actual budget announcement. Nevertheless, the Chancellor eased concerns, and Gilts moved higher again, pulling USTs with them to match the post-leak highs of 113-19+ in the 10-year T-Note futures (Mar 2026). This peak occurred just before the US data, which helped alleviate some labor market concerns after Jobless Claims fell more than expected, while growth prospects were supported by Retail Sales exceeding expectations. T-Notes continued to decline thereafter, bottoming out at 113-08+. Following the Chicago PMI, T-Notes began to gradually reverse the move after the Chicago PMI fell to 36.3 from 44.3. Subsequently, much of the downside was reversed, with T-Notes settling with little change ahead of Thanksgiving in quiet trading, but the curve remained flatter.

SUPPLY:

Notes

- The US Treasury sold USD 44 billion of 7-year notes at a high yield of 3.781%, slightly above the prior 3.79%. This tailed the when-issued by 6bps, not as large as the prior 0.8bps tail, but not as strong as the six-auction average regarding a stop-through of 0.6bps. The bid-to-cover ratio was unchanged from October at 2.46x, below the 2.56x average. Direct demand rose to 30.3% from 27.8%, above the 23.5% average, while indirect demand slipped to 56.7% from 59%, below the 67.2% average. This left dealers with 13.1% of the auction, unchanged from the prior but worse than the average. Overall, a soft auction, but an improvement from October's offering.

Bills

- US sold USD 100 billion of 4-week bills at a high rate of 3.905%, B/C 2.77x

- US sold USD 85 billion of 8-week bills at a high rate of 3.840%, B/C 2.87x.

- US sold USD 69 billion of 17-wk bills at a high rate of 3.740%, B/C 2.84x

- US to sell USD 86 billion of 13-week bills (prev. 86bln) and USD 77 billion of 26-week bills (prev. 77bln) on December 1st; to sell USD 75 billion of 6-week bills on December 2nd (prev. 85bln); all to settle on December 4th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: Dec 19bps (prev. 19bps), January 27bps (prev. 28bps), March 35bps (prev. 36bps).

- NY Fed RRP op demand at USD 2.2 billion (prev. 2.3bln) across 6 counterparties (prev. 8)

- NY Fed Repo Op demand at USD 14 billion across two operations today (prev. 10.6bln).

- EFFR at 3.88% (prev. 3.88%), volumes at USD 78 billion (prev. 73bln) on November 25th

- SOFR at 4.01% (prev. 3.96%), volumes at USD 3.317 trillion (prev. 3.232 trillion) on November 25th.

CRUDE

WTI (F6) SETTLED USD 0.70 HIGHER AT 58.65/BBL; BRENT (F6) SETTLED USD 0.65 HIGHER AT 63.13/BBL

The crude complex was firmer as attention continues to centre around Russia/Ukraine peace talk negotiations. While updates were on the lighter side today, fleeting upside in benchmarks was seen after Russia's Deputy Foreign Minister Ryabkov stated there are no concessions from Russia on key issues on Ukraine settlement. In the weekly EIA data, albeit garnering little reaction, crude saw a larger-than-expected build, contradicting the surprise draw in the private metrics on Tuesday night. Gasoline and Distillates both built more than St. consensus, with overall crude production falling 20k W/W to 13.814mln. On account of the upcoming Thanksgiving holiday and US market closures, the Baker Hughes Rig Count was also released today: Oil rigs tumbled by 12 to 407, nat gas rigs rose 3 to 130, leaving the total down 10 at 544. WTI traded between USD 57.66-58.67/bbl and Brent USD 61.53-62.53/bbl, and as oil “rallied” into settlement, albeit on no headline driver, benchmarks settled at peaks.

EQUITIES

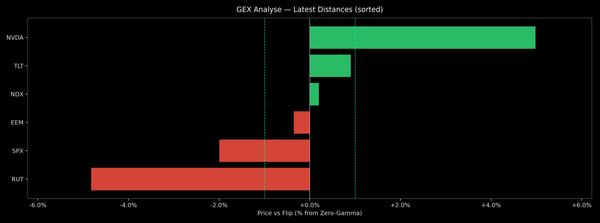

CLOSES: SPX +0.65% at 6,810, NDX +0.87% at 25,237, DJI +0.67% at 47,427, RUT +0.91% at 2,489.

SECTORS: Utilities +1.32%, Technology +1.27%, Materials +1.21%, Consumer Staples +0.97%, Financials +0.79%, Energy +0.68%, Industrials +0.58%, Consumer Discretionary +0.54%, Real Estate +0.52%, Health -0.25%, Communication Services -0.49%.

EUROPEAN CLOSES: Euro Stoxx 50 +1.48% at 5,656, Dax 40 +0.98% at 23,695, FTSE 100 +0.85% at 9,692, CAC 40 +0.88% at 8,096, FTSE MIB +1.01% at 43,130, IBEX 35 +1.36% at 16,361, PSI +0.95% at 8,126, SMI +0.48% at 12,834, AEX +1.17% at 944.

STOCK SPECIFICS:

- Chinese regulators blocked ByteDance from using NVIDIA (NVDA) chips in new data centres, with a move part of Beijing’s strategy to force adoption of domestic chips.

- Deutsche Bank believes the recent pullback in Oracle (ORCL) shares brings an attractive entry point and reiterates its 'Buy' with a USD 375 PT.

- Amazon (AMZN) faces FAA probe after an MK30 drone downed an internet cable in Waco, Texas.

- Apple (AAPL) challenges India's antitrust penalty law, according to Reuters citing a court filing; AAPL could face up to USD 38bln in potential penalties in antitrust case under new law.

- Pentagon reportedly says Alibaba (BABA) should be on list for China military ties, via Bloomberg; adds that Baidu (BIDU) and BYD should be added to the list.

EARNINGS:

- Autodesk (ADSK): EPS & revenue beat with strong guidance.

- Deere & Co (DE): Guides initial FY net income view notably below expected.

- Dell (DELL): Upbeat earnings & guidance coupled with accelerating AI-server demand outweighed slightly softer sales.

- HP (HPQ): Issued weak guidance, reflecting added costs from US trade-related regulations despite announcing large layoffs; note, EPS, revenue topped & lifted the quarterly dividend.

- NetApp (NTAP): Top & bottom-line surpassed expectations.

- Nutanix (NTNX): Quarterly revenue and guidance disappointed investors.

- Urban Outfitters (URBN): Profit & revenue impressed.

FX

The Dollar was weaker ahead of the US Thanksgiving holiday on Thursday, when news flow and volatility are expected to be lower, which is also expected on Friday. Wednesday's headline drivers out of the US were data-driven. Initial jobless claims fell to 216k from 220k, below the expected 225k, causing the DXY to rise to initial intra-day highs. Durable goods also exceeded expectations, although the Chicago PMI later disappointed. The Beige Book indicated that economic activity was little changed since the previous report, according to most of the twelve Federal Reserve Districts, though two Districts noted a modest decline and one reported modest growth. Employment declined slightly over the current period, with around half of the Districts noting weaker labor demand, while prices rose moderately during the reporting period.

G10 FX, excluding JPY, was exclusively firmer against the Greenback, with NZD the clear outperformer, buoyed by the RBNZ decision overnight. The central bank cut rates by 25bps to 2.25%, as expected, but kept its options open on future policy, although its projections suggested a pause in rates throughout 2026. NZD/USD reached a peak of 0.5697, just short of the 0.5700 level. AUD was the next best performer, aided by Kiwi tailwinds and higher-than-expected Australian CPI. AUD/USD topped out at 0.621, with risk sentiment also strong on Wednesday.

GBP was in focus, with Cable ultimately slightly firmer in a 1.3125-3241 range, following an unprecedented UK Budget in which the OBR front-ran the Chancellor. Investors are taking comfort in the higher headroom (GBP 21.7 billion in 2029-30 vs GBP 9.9 billion in March), although UK journalists also suggest skepticism over the credibility of Chancellor Reeves' package. Overall, the OBR forecasts do not alter the narrative that the BoE is likely to cut in December; if anything, the growth downgrades and tax rises favor a cut. The initial response saw UK assets bid, before selling off, and then recovering throughout the budget presentation from Reeves, with GBP/USD heading into APAC trade at highs and EUR/GBP at lows.

JPY lagged amid the broader risk appetite, despite the hawkish leaning BoJ sources overnight, which initially boosted the Yen. Source reports noted that BoJ messaging is said to be preparing markets for a possible interest rate hike as soon as December, with a tweak to communication, although the decision on whether to hike in December or hold off until January remains a close call.

Scandis were both firmer, although the NOK saw modest downside following Q3 Norwegian GDP Growth, which disappointed at 0.1% (exp. 0.2%, prev. 0.6%).

In EMFX, ZAR weakened after US President Trump posted on Truth that the US will stop all payments and subsidies to South Africa. This follows Trump's statement that the US did not attend G20 in South Africa because the government refuses to acknowledge or address human rights abuses endured by Afrikaners, and other descendants of Dutch, French and German settlers. Lastly, in the latest Banxico QIR, it lowered near-term headline inflation forecasts and near-term growth forecasts, but 2026 forecasts were maintained.