Market Wrap 2025-12-01

Today's US Market Wrap — Key Points

- Stocks decline amid weak data; Treasury yields rise on corporate supply.

- ISM Manufacturing PMI unexpectedly falls, signaling economic concerns.

- Crude oil rises on supply concerns; Dollar flat, Yen gains on rate hike hints.

- Focus shifts to upcoming data, central bank events, and earnings reports.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

Here's a recap of the day's market activity:

- SNAPSHOT: Equities declined, Treasuries fell, Crude oil increased, the Dollar was unchanged, and Gold rose.

- REAR VIEW: The US ISM Manufacturing PMI unexpectedly decreased; Bank of Japan Governor Ueda suggested a potential December rate hike; the UK and US agreed to a zero-tariff pharmaceutical agreement; Chinese Final PMIs were disappointing; European PMIs were mixed; Vanke reportedly requested a 12-month extension to pay its bonds; BP announced the Olympic Pipeline has returned to full service.

- COMING UP:

- Data: Eurozone Flash CPI (November), Unemployment Rate, US RCM/TIPP Economic Optimism.

- Events: Bank of England Financial Stability Report (FSR).

- Speakers: Federal Reserve Chair Powell, Federal Reserve's Bowman (on Blackout).

- Supply: Japan, UK, Germany.

- Earnings: Marvell, CrowdStrike.

- WEEK AHEAD: Key events include a potential Federal Reserve Chair selection, US ISM PMIs, US PCE, Eurozone CPI, Canada Jobs data, and Swiss CPI.

- CENTRAL BANK WEEKLY: A preview of a potential Federal Reserve Chair selection and the Reserve Bank of India (RBI); a review of the Reserve Bank of New Zealand (RBNZ), European Central Bank (ECB) Minutes, and Bank of Korea (BoK).

- WEEKLY US EARNINGS ESTIMATES: Notable earnings include CRWD, MRVL, SNOW, DLTR, and DG.

Stocks closed lower after a volatile session. Equity futures were sold off overnight, and Asian-Pacific markets showed caution due to weak Chinese PMIs. The downward pressure continued into the European session, with the DAX underperforming due to a downward revision of the German manufacturing PMI. However, the risk tone in equities improved around the opening bell before fading near the close.

Treasuries were sold across the curve, steepening the yield curve. This followed overnight weakness in Japanese Government Bonds (JGBs) after hawkish comments from Bank of Japan (BoJ) Governor Ueda, as well as rising energy prices. The selling intensified during US trading hours amid corporate supply, particularly Merck's (MRK) USD 8 billion offering, which triggered rate lock selling.

The US ISM Manufacturing PMI unexpectedly fell, along with a drop in New Orders. Prices Paid accelerated, and employment decreased. Over the weekend, US President Trump stated that he has decided on his nominee to succeed Fed Chair Powell, and Hassett indicated his willingness to accept the position if offered.

Energy prices increased following continued Ukrainian attacks on Russian oil facilities and rising tensions between the US and Venezuela. OPEC+ maintained its output policy over the weekend, as expected.

In FX markets, the Dollar was flat, while the Canadian Dollar (CAD) underperformed due to weak energy prices, and the Yen (JPY) outperformed following Ueda's comments suggesting a potential December rate hike from the BoJ.

US

ISM:

The US ISM Manufacturing PMI decreased to 48.2 from 48.7, falling short of the expected increase to 49.0. This marks the ninth consecutive month in contractionary territory. However, the overall economy continued to expand for the 67th month (a Manufacturing PMI of 42.3 or above generally indicates expansion in the overall economy). New Orders declined to 47.4 from 49.4, indicating the third consecutive month of contraction. The Production index returned to expansion, rising to 51.4. Supplier deliveries indicated faster delivery performance, falling to 49.3 from 54.2. Inventories rose to 48.9 from October's 45.8. The Prices Paid component increased to 58.5 from 58.0, exceeding expectations for a decrease to 57.0, indicating a slight acceleration in price increases in November compared to October. The report noted that the Prices Index continues to be driven by increases in steel and aluminum prices, impacting the entire value chain, as well as tariffs on many imported goods. The employment index fell to 44 from 46, marking its tenth consecutive month of contraction. The report noted that for every comment on hiring, there were 3.4 on reducing headcounts, equaling the ratio in October. Companies continued to focus on accelerating staff reductions due to uncertain near- to mid-term demand, primarily through layoffs and not filling open positions.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 16+ TICKS LOWER AT 112-26+

Treasuries sold off due to a wave of corporate issuances.

At settlement:

- 2-year: +4.8bps at 3.539%

- 3-year: +6.3bps at 3.553%

- 5-year: +7.5bps at 3.673%

- 7-year: +7.6bps at 3.864%

- 10-year: +7.7bps at 4.096%

- 20-year: +7.9bps at 4.711%

- 30-year: +7.4bps at 4.745%

INFLATION BREAKEVENS:

- 1-year BEI: +1.2bps at 2.721%

- 3-year BEI: +2.4bps at 2.427%

- 5-year BEI: +0.8bps at 2.241%

- 10-year BEI: +1.3bps at 2.229%

- 30-year BEI: +1.8bps at 2.209%

THE DAY:

Treasuries were lower across the curve. Global fixed income was weighed down overnight after Bank of Japan Governor Ueda hinted at a December rate hike, while rising crude prices bolstered inflation expectations. The downside in T-notes accelerated once US trade was underway, seemingly led by rate lock selling in response to corporate supply, with approximately eight investment-grade deals announced. The Merck (MRK) deal, seeking to sell USD 8 billion in an 8-part offering, was a highlight. The curve bear steepened, with long-end yields rising the most in response to the corporate issuance, and potentially due to rising term premium. US President Trump told reporters that he knows who he is going to pick for the next Fed Chair, while NEC Director Hassett said he would be happy to take the job from Chair Powell. Kalshi prediction markets have Hassett as the clear favorite, rising to 79% today from just above the 50% probability seen on Friday. The rise in term premium is in response to a potentially less independent Federal Reserve if Hassett takes the helm, given his close proximity to US President Trump. Meanwhile, oil prices saw notable upside as Ukraine struck two Russian tankers in the Black Sea as well as more Russian oil refineries, reducing the chances of a ceasefire and further impacting supply. The higher oil prices weighed on Bunds on fears of higher energy costs in Europe, which also pressured USTs. There is no Fed speak due to the blackout period ahead of next week's rate decision and projections, but Chair Powell is scheduled to speak overnight, albeit it will not be about current monetary policy or the economic outlook. The data highlight was the ISM Manufacturing PMI, which surprisingly declined while Prices Paid accelerated and employment slowed. The data briefly stopped the decline in T-notes, but it was short-lived, and T-notes sold off gradually into settlement.

SUPPLY:

- Bills

- US sold USD 79 billion of 6-month bills at a high rate of 3.635%, B/C 3.02x

- US sold USD 88 billion of 3-month bills at a high rate of 3.725%, B/C 2.82x

- US to sell USD 75 billion of 6-week bills on December 2nd (previous 85 billion)

- STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: December 23bps (previous 19bps), January 30bps (previous 27bps), March 36bps (previous 35bps).

- NY Fed RRP op demand at USD 3.24 billion (previous 7.56 billion) across 9 counterparties (previous 8)

- NY Fed Repo Op demand at USD 26 billion (previous 24.4 billion) across two operations

- EFFR at 3.89% (previous 3.88%), volumes at USD 90 billion (previous 89 billion) on November 28th

- SOFR at 4.12% (previous 4.05%), volumes at USD 3.361 trillion (previous 3.297 trillion) on November 28th.

CRUDE

WTI (F6) SETTLED 0.77 HIGHER AT 59.32/BBL; BRENT (G6) SETTLED USD 0.79 HIGHER AT USD 63.17/BBL

Crude oil prices increased due to continued Ukrainian attacks on Russian oil refineries, the OPEC+ decision to pause output through Q1’26, and diminishing US-Venezuela relations.

The Ukrainian attacks resulted in the Caspian Pipeline Consortium suspending loadings at its terminals. The operator said mooring 2 was significantly damaged by unmanned boats and cannot continue operating, disrupting shipments of most of Kazakhstan’s crude exports routed through Russia. Meanwhile, OPEC+ kept oil output unchanged for Q1 2026, as widely expected, maintaining ~3.24 million bpd of output cuts, after releasing 2.9 million bpd since April 2025. Members also approved a mechanism to assess maximum production capacity between January and September 2026 for setting 2027 baselines. WTI and Brent peaked in overnight trade at USD 59.97/bbl and USD 63.35/bbl, respectively, before paring around half of the gains afterwards. Another subject that poses a risk to oil supply is US President Trump's souring relations with Venezuela, with the latest escalation coming from Trump, who is considering closing the airspace over Venezuela. Separately, BP's Olympic Pipeline (325k bpd) returned to full service.

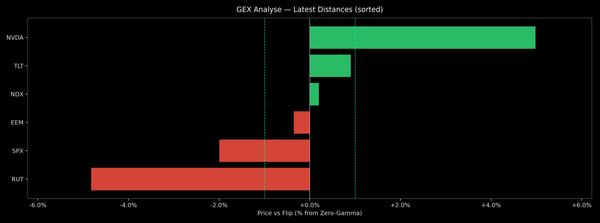

EQUITIES

CLOSES:

- SPX: -0.53% at 6,813

- NDX: -0.36% at 25,343

- DJI: -0.89% at 47,289

- RUT: -1.25% at 2,469

SECTORS:

Utilities -2.35%, Health -1.49%, Industrials -1.49%, Real Estate -1.39%, Communication Services -1.01%, Financials -0.86%, Materials -0.34%, Consumer Staples -0.19%, Consumer Discretionary +0.02%, Technology +0.07%, Energy +0.91%.

EUROPEAN CLOSES:

Euro Stoxx 50 +0.01% at 5,669, Dax 40 -1.00% at 23,597, FTSE 100 -0.18% at 9,703, CAC 40 -0.32% at 8,097, FTSE MIB -0.22% at 43,259, IBEX 35 +0.11% at 16,389, PSI -0.04% at 8,107, SMI +0.01% at 12,835, AEX +0.45% at 948.

STOCK SPECIFICS

- Synopsys (SNPS): NVIDIA (NVDA) invested USD 2 billion in SNPS stock at USD 414.79/share.

- Leggett & Platt (LEG): Somnigroup (SGI) proposes to buy LEG in an all-stock deal.

- Tesla (TSLA): Tesla's November registrations in France, Denmark, and Sweden halved from a year earlier.

- PTC Therapeutics (PTCT): Downgraded at RBC Capital to 'Sector Perform' from 'Outperform'.

- American Tower (AMT): Downgraded at Barclays to 'Equal Weight' from 'Overweight'.

- Zscaler (ZS): Downgraded at Bernstein to 'Market Perform' from 'Outperform'.

- Chime Financial (CHYM): Upgraded at Goldman Sachs to 'Buy' from 'Neutral'.

- Google (GOOGL) is bringing Gemini3 to AI mode in Google search in nearly 120 countries and territories in English.

- NVIDIA (NVDA) released a new open-source software aimed at speeding up the development of self-driving cars using new "reasoning" techniques in AI.

- Interactive Brokers Group (IBKR) November Daily Average Revenue Trades (DARTs): 4.27 million, -4% M/M.

- Bidders for Warner Bros Discovery (WBD) say they've been given every indication from the WBD board that either a winner or a new round of bids will be announced this week after second-round bids are delivered today, Fox reports.

- Microsoft (MSFT) CEO said his company is increasingly looking to Europe as a key region for its AI strategy, according to Politico.

FX

The Dollar Index was flat to start the week as JPY outperformance was offset by weakness in GBP, CHF, and CAD.

Through the European morning, the USD was sold broadly, with JPY strength behind the bulk of the move, thanks to hawkish BoJ Ueda remarks. Also weighing is the strengthening call across Wall St. that the Fed will be cutting by 25bps at the December meeting. Now, money markets assign ~92% chance of a cut, after being ~70% before Thanksgiving Day. The ISM Manufacturing PMI report showed a surprise decline in the headline, indicating a worsening outlook for the sector as declines in New Orders and Employment weighed. DXY hit lows of 99.01 in the US morning before paring losses into the evening.

JPY gathered all the focus to start the week following overnight comments from BoJ Governor Ueda. Overall, the remarks were seen as hawkish, with Morgan Stanley highlighting the unusual move from the Governor to refer to a specific meeting in such a speech (‘make decisions as appropriate’), and as such, believe the likelihood of a December rate hike has further increased. Citi also pointed out that such phrasing is similar to that of Deputy Governor Himino before the hike in January this year: “The board will discuss whether to raise the policy rate or not”. As it stands, a 33% chance of a 25bps hike is priced in, with USD/JPY now hovering at ~ 155.50, but off 154.67 lows.

European Manufacturing PMIs were mixed for November. Germany and EZ missed, France was in line, and Italy and Spain topped expectations. The releases had little bearing on EUR/USD, with focus on US data this week (ADP, Challenger, PCE), as well as US Envoy Wiktoff's visit to Russia this week. The latter comes after a stall in a possible Ukraine/Russia ceasefire, as Russia rejected Ukraine's shortened version of Trump's peace plan.

Antipodes were modestly firmer but with strength capped by a disappointing Chinese PMI report, with Manufacturing once again deteriorating while services surprised with a contraction. G10 currencies at pixel time that are weaker vs USD include CAD, GBP, and CHF. Sterling failed to hold onto earlier strength, which was somewhat supported by the UK and US agreeing to a zero-tariff pharma deal, but calls for the UK NHS to increase the net price it pays for new medicines by 25%; Cable now sits lower at 1.3210 from earlier 1.3275 highs.