Market Wrap 2025-12-03

Today's US Market Wrap — Key Points

- Stocks up, led by Tech. AI developments, Fed Chair speculation drive market moves.

- Trump to name Fed Chair in 2026; Hassett's chances uncertain. Dollar fluctuates.

- Oil down amid US-Russia talks. Eurozone inflation mixed. Yen weakens.

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

- Equities: Up

- Treasuries: Up

- Crude: Down

- Dollar: Flat

- Gold: Down

REAR VIEW

- US President Trump plans to announce the next Federal Reserve Chair in early 2026, mentioning Hassett as a "potential" candidate.

- Russian President Putin expressed readiness against Europe.

- Transneft reported an indefinite suspension of loadings from CPC's second-point mooring.

- Eurozone inflation data was mixed.

- Amazon (AMZN) launched a new AI chip.

- OpenAI CEO declared a "code red."

COMING UP

- Data releases: Australian Real GDP (Q3), Chinese RatingDog Services/Composite PMI Final (Nov), Eurozone/UK/US Services/Composite PMI Final (Nov), Swiss CPI (Nov), US ISM Services PMI (Nov), ADP National Employment (Nov), Import Prices (Sep), Industrial Production (Sep).

- Events: NBP Policy Announcement.

- Speakers: ECB’s Lagarde, Lane; BoE's Mann.

- Supply: Australia, UK.

- Earnings: Salesforce, Snowflake, Dollar Tree, Macy's, Inditex.

MARKET WRAP

Stocks ended the day higher, with the Nasdaq showing strong performance. Industrials, Technology, and Communications sectors led the gains. Several AI-related developments occurred, including OpenAI declaring a "code red" to focus on improving ChatGPT amid competition. Amazon (AMZN) unveiled its new AI chip, viewed by some as rushed but by others as a challenge to NVIDIA (NVDA). The Amazon AI chip announcement initially caused a decline in US equities, which later reversed. Attention was also directed towards the potential next Fed Chair. President Trump stated he would announce Powell's successor in early 2026, briefly strengthening the Dollar and flattening the Treasury curve as market participants speculated about Hassett's chances. However, Trump later indicated he had narrowed his choice to one and referred to Hassett as a "potential" candidate, causing the Dollar to decline and the curve to steepen again. Oil prices decreased amid focus on the meeting between US Special Envoy Witkoff and Kushner with Russian President Putin, although no progress was reported. The US officials are scheduled to travel to Europe to meet with Ukrainian President Zelensky. In FX markets, the Yen relinquished some of its Monday gains and underperformed as equities rose, while the Australian Dollar outperformed, supported by risk sentiment and ANZ's revised forecast removing expectations for an RBA rate cut in the first half of 2026. Gold and silver prices moved in opposite directions, with Gold selling off around USD 4,200/oz and silver experiencing renewed buying interest.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 2 TICKS HIGHER AT 112-28+

Treasury notes saw a bull steepening in quiet trading, influenced by Trump's decision to delay the Fed Chair announcement to early 2026.

- 2-year: -2.9bps at 3.512%

- 3-year: -2.3bps at 3.530%

- 5-year: -1.6bps at 3.657%

- 7-year: -1.1bps at 3.853%

- 10-year: -1.0bps at 4.087%

- 20-year: -0.8bps at 4.703%

- 30-year: -0.4bps at 4.739%

INFLATION BREAKEVENS:

- 1-year BEI: -1.0bps at 2.737%

- 3-year BEI: -1.4bps at 2.409%

- 5-year BEI: -1.3bps at 2.227%

- 10-year BEI: -0.4bps at 2.222%

- 30-year BEI: -0.1bps at 2.208%

THE DAY:

Treasury notes experienced two-way trading on Tuesday, with downward pressure emerging during the US session. The weakness lacked clear macro drivers, but seven investment-grade issuers entered the market, and the move largely reversed thereafter. The 10-year yield briefly exceeded 4.10%, peaking at 4.116%. With the Federal Reserve in a blackout period, attention is focused on this week's data, including the September PCE report due on Friday. President Trump's announcement that he would name the new Fed Chair in early 2026 led to a slight flattening of the yield curve, as the delay suggested the possibility of another contender. However, he later reiterated that he had narrowed the choice to one member and referred to Hassett as a potential Fed Chair. Prediction markets indicated a decrease in the probability of Hassett becoming Fed Chair following Trump's initial comment, but the probability increased after his later remark. Treasury notes saw some upside following the Amazon (AMZN) AI chip announcement, which briefly triggered selling in US indices as AI stocks, including Amazon (AMZN), were affected. However, the move in equities moderated from its extremes.

SUPPLY:

Bills

- US sold 6-week bills at a high rate of 3.700%, B/C 3.15x

- US to sell USD 80bln 8-week bills (prev. 90bln) on December 4th

- US to sell USD 90bln 4-week bills (prev. 100bln) on December 4th

- US to sell USD 69bln 17-week bills (unch) on December 3rd; all to settle on December 9th

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: Dec 21.2bps (prev. 23bps), January 29.48bps (prev. 30bps), March 36.6bps (prev. 36bps).

- NY Fed RRP op demand at USD 5.62bln (prev. 3.24bln) across 11 counterparties (prev. 9)

- NY Fed Repo Op demand at USD (prev. 26bln) across two operations

- EFFR at 3.89% (prev. 3.89%), volumes at USD 85bln (prev. 90bln) on December 1st.

- SOFR at 4.12% (prev. 4.12%), volumes at USD 3.454tln (prev. 3.361tln) on December 1st.

CRUDE

WTI (F6) SETTLED USD 0.68 LOWER AT 58.64/BBL; BRENT (G6) SETTLED USD 0.72 LOWER AT USD 62.45/BBL

Crude oil prices declined as market participants awaited updates from the US-Russia meeting in Moscow. The complex experienced downward pressure throughout the session, despite a lack of significant market-moving news. Prior to the meeting, Russian President Putin criticized Europe, deeming EU demands unacceptable and stating that Russia is ready for war if Europe desires it. WTI and Brent reached lows of 58.28/bbl and 61.81/bbl, respectively, before rebounding sharply around the US cash open, then approaching lows again into settlement. Energy-related news included Transneft's report of an indefinite halt in loadings from CPC's second-point mooring following recent attacks in Ukraine. After the close, private inventory data is expected, with current expectations (in barrels) of: Crude -0.8 million, Distillate +0.7 million, Gasoline +1.5 million.

EQUITIES

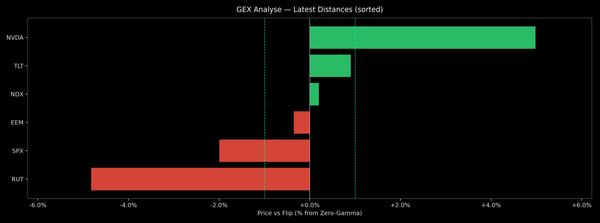

CLOSES: SPX +0.25% at 6,829, NDX +0.84% at 25,556, DJI +0.39% at 47,474, RUT -0.17% at 2,465

SECTORS: Energy -1.28%, Materials -0.83%, Utilities -0.72%, Health -0.58%, Consumer Staples -0.40%, Real Estate -0.20%, Financials -0.05%, Consumer Discretionary -0.01%, Communication Services +0.37%, Technology +0.84%, Industrials +0.87%.

EUROPEAN CLOSES: Euro Stoxx 50 +1.17% at 5,793, Dax 40 +1.22% at 24,381, FTSE 100 +0.12% at 9,911, CAC 40 +1.04% at 8,241, FTSE MIB +0.80% at 44,793, IBEX 35 +1.39% at 16,616, PSI +1.21% at 8,294, SMI +0.80% at 12,803, AEX -0.21% at 969

STOCK SPECIFICS

- Marvell Tech (MRVL): In advanced discussions to acquire Celestial AI for over USD 5 billion.

- MongoDB (MDB): Reported better-than-expected profit and revenue with strong guidance.

- Credo Technology (CRDO): Exceeded expectations for profit, revenue, and guidance.

- Signet Jewelers (SIG): Issued a disappointing outlook.

- Iren (IREN): Plans to offer USD 2 billion of convertible senior notes.

- XPO (XPO): Preliminary November LTL metrics indicated a year-over-year decrease of 5.4% in tonnage per day.

- Janux Therapeutics (JANX): Recent clinical data fell short of investors' expectations.

- Teradyne (TER): Upgraded to 'Buy' from 'Hold' at Stifel.

- Solventum (SOLV): Upgraded to 'Buy' from 'Neutral' at BITG.

- OpenAI is reportedly developing an LLM named "Garlic" to compete with Google's (GOOGL) Gemini.

- Amazon (AMZN) announced updates to its AI models, stating that its new chips are more cost-effective than NVIDIA's (NVDA). AWS launched its in-house-built Trainium3 AI chip, which delivers over four times the computing performance of its predecessor while using 40% less energy. The company also announced the development of Trainium4, expected to deliver at least three times the performance of Trainium3 for standard AI workloads.

- President Trump will hold a White House meeting with auto executives on Wednesday to announce the rollback of vehicle fuel standards. Ford (F), General Motors (GM), and Stellantis (STLA) will be present at the event.

FX

The Dollar Index showed little change as the currency struggled to maintain a consistent direction. With no data releases or Federal Reserve commentary scheduled, news flow was generally limited, but remarks from the US President were closely watched. Despite Trump's announcement over the weekend that he had chosen the next Fed Chair, he now says he will announce it in early 2026 (previously expected by year's end). This announcement briefly strengthened the Dollar, possibly due to speculation that the extended timeline might indicate that the widely held view of NEC Director Hassett (who is considered dovish) as the next Fed Chair is not as certain as markets initially believed. However, Trump later reiterated that he had narrowed it down to one candidate and even referred to Hassett as a "potential Fed Chair," which caused the Dollar to decline. Nevertheless, the consensus remains that there is a third consecutive 25bps Fed rate cut in December, but only a ~20% chance of another in January.

AUD

The Australian Dollar strengthened on Tuesday after ANZ removed its forecast for an RBA rate cut in the first half of 2026, expecting the central bank to maintain an "extended pause" through 2026. This move aligns with a growing number of firms that view the RBA's policy cycle as being on hold. However, Westpac continues to anticipate two rate cuts in 2026 (May and August). AUD/USD reached highs of 0.6570, with AUD/NZD modestly firmer at around 1.1440 at the time of writing.

In Europe, Eurozone inflation data for November was mixed, having little impact on ECB rate expectations. Core inflation was slightly lower than expected, while headline inflation was slightly higher. Meanwhile, US officials met with Russian President Putin to seek an end to the war. While the readouts from both sides are still pending, Putin spoke firmly on Europe, stating that "if Europe wants to fight a war, we are ready now." EUR/USD experienced choppy trading and is currently flat at approximately 1.1620.

JPY

The Japanese Yen gave up some of the gains it made on Monday in response to what were perceived as hawkish remarks from Bank of Japan Governor Ueda. The reversal lacked fresh drivers, as continued analysis of Ueda's remarks has left the JPY outlook more uncertain than the price action implied on Monday. USD/JPY is trading around the middle of its 155.44-156.17 intraday range.