Market Wrap 2025-12-04

Today's US Market Wrap — Key Points

- Equities mixed; Russell 2000 up, Nasdaq down. Treasury yields fell amid BoJ speculation.

- US jobless claims beat forecasts, fueling Dollar gains. Oil up on Ukraine tensions.

- BoJ rate hike bets strengthen Yen. China intervenes to curb Yuan gains.

- Upcoming data: EZ GDP, Canadian jobs, US PCE. Focus on labor market & central banks.

Already a member? Sign in to unlock the full wrap

MARKET CONDITIONS

- SNAPSHOT: Equities showed mixed performance, Treasury yields declined, Crude oil prices increased, the Dollar strengthened, and Gold prices remained relatively stable.

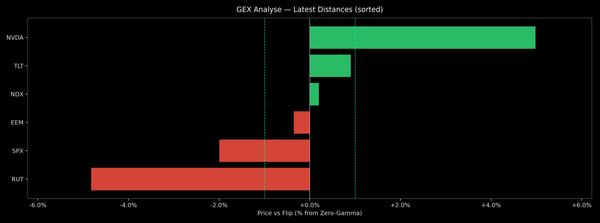

- REAR VIEW: US initial and continuing unemployment claims decreased more than anticipated; US Factory Orders fell short of expectations; Sources within the Bank of Japan (BoJ) suggest a potential interest rate increase in December, with reports indicating the government will likely refrain from intervention; The US issued a travel advisory for Venezuela; The CEO of Meta (META) is expected to significantly reduce resources allocated to the metaverse; The Trump administration is reportedly considering whether to grant NVIDIA (NVDA) a license to export its H200 chip to China.

- COMING UP: Economic data releases include: German Industrial Orders (October), French Trade Balance (October), Italian Retail Sales (October), Eurozone (EZ) Final Employment figures (Q3), Revised EZ GDP (Q3), Canadian Jobs Report (November), US PCE (September), and the US University of Michigan Preliminary report (December). Events scheduled: Reserve Bank of India (RBI) Announcement. Speakers: ECB's Lane. Supply: Australia.

MARKET WRAP

Thursday's trading session concluded with a mixed performance in equities. The Russell 2000 showed significant gains, while the Nasdaq Composite underperformed, closing in negative territory. The S&P 500 remained nearly unchanged. Futures experienced a brief boost in pre-market trading following reports that Meta (META) would reduce its metaverse spending by 30%, which initially supported Meta's stock price and US indices as the company shifted its focus towards AI. However, this positive impact was short-lived for the broader indices, although Meta shares still closed with gains of approximately 3.5%. Treasury notes experienced declines across the yield curve, with pressure during the Asian and European sessions mirroring the downward movement of Japanese Government Bonds (JGBs) amid speculation of a December rate hike by the BoJ. Attention then shifted to US economic data, which indicated a slowdown in both challenger layoffs and the total non-farm payroll losses reported by RevelioLabs on a month-over-month basis. There was also a slight month-over-month improvement in the Chicago Fed's unemployment rate estimate for November. Furthermore, both initial and continuing jobless claims were lower than all analyst forecasts, alleviating some recent concerns about the labor market. The generally positive labor market data weighed on Treasury notes across the curve. Treasury notes reached their lows following the release of the initial jobless claims data but quickly recovered amid questions about its accuracy due to the Thanksgiving holiday the previous week. Nevertheless, Treasury notes gradually sold off, eventually settling around the earlier lows. Oil prices closed higher, with limited progress reported in US-Russia discussions regarding Ukraine. Oil prices continued to recover from the peace optimism observed on Tuesday. In the foreign exchange market, the Dollar experienced modest gains in response to the higher yield environment following the US labor market data, but these gains were limited by Yen strength following reports of a potential BoJ rate hike. Gold prices remained stable, hovering around USD 4,200 per ounce, while silver prices declined. Additionally, reports indicated that Senators are seeking to prevent the Trump administration from easing regulations that restrict Beijing's access to AI chips for 2.5 years. This includes sales of NVIDIA's (NVDA) H200 and Blackwell chips.

US DATA

JOBLESS CLAIMS:

The latest weekly initial jobless claims showed a significant decrease to 191,000 from the previous week's 218,000, marking the lowest level since September 2022. The data was below the forecast of 220,000 and the lowest estimate of 205,000. The substantial divergence from expectations may be attributed to reporting issues during the Thanksgiving week; however, a review of the 2024 Thanksgiving week did not reveal significant divergence in weekly claims. Pantheon Macroeconomics suggests that the low claims number is primarily due to a flawed seasonal adjustment. The non-seasonally adjusted data decreased by 49,000 to 197,000, while seasonal factors anticipated a 21,000 decrease. Given the weekly release of the data, a single print should not be interpreted as a definitive signal, but if claims continue to print lower than recent averages in the coming week, it would suggest that the labor market is not as weak as feared. Meanwhile, continuing claims for the preceding week decreased to 1.939 million from 1.943 million, despite expectations for an increase to 1.961 million.

LABOUR MARKET PROXIES:

Thursday also saw the release of several other labor market metrics from the Chicago Fed and other private releases. The Chicago Fed Unemployment rate estimate for November was unchanged from the mid-month read of 4.44%, and is down slightly from October's 4.46%. Meanwhile, the November RevelioLabs total non-farm payrolls estimate saw a decline of 9k in November, with the prior revised to -15.5k from -9.1k. Challenger Layoffs saw the pace of job cuts slow in November to 71k from 153k. “Layoff plans fell last month, certainly a positive sign. That said, job cuts in November have risen above 70,000 only twice since 2008: in 2022 and in 2008,” said Andy Challenger, workplace expert and chief revenue officer for Challenger, Gray & Christmas.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 12+ TICKS LOWER AT 112-23

Treasury notes sold off on US labor market data and hawkish BoJ reports ahead of supply next week. At settlement, 2-year yields increased by 4.5 basis points to 3.531%, 3-year yields increased by 5.0 basis points to 3.552%, 5-year yields increased by 5.7 basis points to 3.682%, 7-year yields increased by 5.6 basis points to 3.877%, 10-year yields increased by 5.0 basis points to 4.108%, 20-year yields increased by 4.3 basis points to 4.725%, and 30-year yields increased by 4.1 basis points to 4.766%.

INFLATION BREAKEVENS: 1-year BEI +0.9bps at 2.735%, 3-year BEI +2.6bps at 2.445%, 5-year BEI +2.4bps at 2.260%, 10-year BEI +2.1bps at 2.252%, 30-year BEI +1.1bps at 2.228%.

THE DAY: Treasury notes experienced declines across the curve on Thursday, with pressure observed overnight and during the European morning, mirroring the downward movement of Japanese Government Bonds (JGBs) amid further reports suggesting a potential Bank of Japan (BoJ) rate hike in December. However, Treasury notes extended their losses following the release of US labor market data. The downside was further exacerbated after challenger layoffs showed a slowdown in the pace of layoffs to 71,000 in November from 153,000 in October, with Treasury notes gradually moving lower after the release. Treasury notes hit session lows in wake of the jobless claims data, which saw initial claims print the lowest number since September 2022 at 191k, down from the prior 218k and well below the 220k forecast. It was also below the lowest forecast of 205k. However, it is likely largely related to seasonal effects from Thanksgiving last week, which saw the move swiftly pare. However, if claims remain around this level in the weeks ahead, it would likely help offset recent labour market fears. Elsewhere, the Revelio NFP report saw job losses of 9k in November vs the revised -15.5k in October, while the Chicago Fed unemployment rate was maintained from the mid-month read of 4.44%, a slight improvement from the 4.46% in October. Attention turns to JOLTS on Tuesday for another look into the labour market ahead of the Dec 10th FOMC. PCE on Friday will also be gauged. T-notes gradually sold off throughout the session to test the post IJC lows, which ultimately found support at 112-22, and settled just above the session low.

SUPPLY:

Notes

US Treasury to sell:

- USD 58 billion of 3-year notes on December 8th.

- USD 39 billion in 10-year notes on December 9th.

- USD 22 billion of 30-year bonds on December 11th.

Bills

- The US sold USD 80 billion of 8-week bills at a high rate of 3.620%, with a bid-to-cover ratio of 2.98x.

- The US sold USD 90 billion of 4-week bills at a high rate of 3.680%, with a bid-to-cover ratio of 2.69x.

- The US will sell USD 75 billion of 6-week bills on December 9th.

- The US will sell USD 86 billion of 13-week bills on December 8th.

- The US will sell USD 77 billion of 26-week bills on December 8th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: December 21.3bps (previous 21.6bps), January 29.6bps (previous 30.0bps), March 36.7bps (previous 38.3bps).

- NY Fed RRP operation demand at USD 2.2 billion (previous 2.5 billion) across 39 counterparties (previous 40).

- NY Fed Repo Operation demand at USD 0.002 billion (previous 0.001 billion) across two operations.

- EFFR at 3.89% (previous 3.89%), volumes at USD 85 billion (previous 91 billion) on December 3rd.

- SOFR at 3.95% (previous 4.01%), volumes at USD 3.360 trillion (previous 3.407 trillion) on December 3rd.

- Treasury Buyback (10-20 year, max USD 2 billion): Accepts USD 2 billion of 28.4 billion offers; Accepts 2 eligible issues out of 34 offered

CRUDE

WTI (F6) SETTLED USD 0.72 HIGHER AT USD 59.67/BBL; BRENT (G6) SETTLED USD 0.59 HIGHER AT USD 63.26/BBL

Crude oil prices were firmer on Thursday, continuing to pare the optimistic-induced downside seen on Tuesday when US officials met with Russian President Putin. Geopolitical updates continued to suggest progress is at a halt. Putin viewed the meeting as necessary but said it was "too early to say" and claimed Russia would take control of Donbas and Novorossiya by military means or otherwise. In the US morning, a bout of pressure was seen in the complex, seemingly weighed from the Saudi Arabia OSP premium to Asia against the Oman/Dubai average coming in on the low end of analysts' expectations (act. +USD 0.60/bbl, exp. 0.60-0.70/bbl, prev. 1.00/bbl). Crude prices briefly moved into the red before hitting new highs shortly after, despite quiet newsflow. Tensions between Venezuela and the US remain elevated amid the US issuing a travel alert to Venezuela, and as such is likely to bolster the risk premium in the space. Rystad Energy’s Jorge Leon says the rising tensions are likely to push oil prices higher, especially as China and India rely heavily on Venezuelan crude. Leon expects continued volatility, with geopolitical risks firmly embedded in the market.

EQUITIES

CLOSES : SPX +0.11% at 6,857, NDX -0.10% at 25,582, DJI -0.07% at 47,851, RUT +0.76% at 2,531

SECTORS: Health -0.73%, Consumer Staples -0.73%, Consumer Discretionary -0.48%, Materials -0.48%, Utilities -0.21%, Real Estate -0.12%, Financials +0.24%, Energy +0.38%, Communication Services +0.42%, Technology +0.43%, Industrials +0.51%.

EUROPEAN CLOSES : Euro Stoxx 50 +0.41% at 5,718, Dax 40 +0.85% at 23,894, FTSE 100 +0.19% at 9,711, CAC 40 +0.43% at 8,122, FTSE MIB +0.32% at 43,519, IBEX 35 +0.97% at 16,747, PSI +0.23% at 8,239, SMI +0.41% at 12,910, AEX -0.20% at 948

STOCK SPECIFICS

- Salesforce (CRM): Reported earnings and revenue guidance that exceeded expectations.

- Snowflake (SNOW): Reported a weak operating margin outlook.

- Dollar General (DG): Reported earnings that exceeded expectations, with a full-year EPS outlook above expectations.

- Hormel Foods (HRL): Reported a profit beat.

- Five Below (FIVE): Q3 metrics surpassed forecasts

- Guidewire Software (GWRE): Reported earnings that exceeded expectations and raised its full-year guidance.

- UiPath (PATH): Q3 metrics & guidance beat

- HealthEquity (HQY): EPS & revenue topped.

- PVH (PVH): Issued downbeat forecasts

- Toast (TOST): Upgraded at JPM to 'Overweight' from 'Neutral'.

- PayPal (PYPL): Downgraded at JPM to 'Neutral' from 'Overweight'.

- US senators seek to block NVIDIA (NVDA) sales of advanced chips to China for 30 months and would target NVDA's H200 and Blackwell chips, via FT.

- Imax (IMAX) guided initial FY26 adj. EBITDA margin at or above 45%, via investor slides.

- US reportedly plans more stakes in mineral companies, according to a Trump official cited by Bloomberg.

- Pepsi (PEP) reportedly close to an agreement with activist investor Elliott, via WSJ

FX

The Dollar Index was slightly firmer on Thursday as EUR & CHF selling more than offset the gains in JPY. The bigger-than-expected drop in the weekly claims report offered a nice touch for the Fed on the labour side of the dual mandate, given the recent ADP figure solidified labour market concerns as the driving force behind policy decisions. Both initial and continued claims dropped beneath the analyst's lowest forecast range, with initial back to Sept 2022 levels while continued remains elevated. That said, the drop has the potential to be a one-off, with some desks citing a poor seasonal adjustment over the Thanksgiving period. DXY was little phased by the data failing to track the move in US yields higher throughout the session; DXY hovers around 99.00.

JPY was firmer as both Reuters and Bloomberg reports pointed towards an increasing chance of a BoJ hike in December. Reuters sources noted that the BoJ is likely to hike rates in December, with both news outlets' sources noting that the government wouldn't try to circumvent such a decision. JPY strength tracked the move higher in JGB yields, which saw the 20-year yield move to its highest level since mid-1999 and the 30-year to a record high. Now, a 66% chance of a December hike is priced in. USD/JPY hit lows of 154.52 before rebounding to ~155.00.

CHF and Scandi FX were the worst G10 performers, with softer-than-expected inflation reports this week weighing on CHF and SEK. In Sweden, CPI Flash Y/Y (Nov) printed 2.3% (exp. 2.5%), resulting in marginal SEK pressure at the time, which increased over the day. EUR/SEK rose to ~10.97 from earlier 10.9345 lows while USD/CHF trades around 0.8034 highs from the 0.7995 trough.

CNY: The Chinese Yuan faced pressure from the PBoC's softer-than-expected reference rate setting following the CNY rising to a 14-month high. After, Reuters reported that Chinese State-owned banks reportedly bought USD on the onshore spot market this week in a bid to rein in CNY strength, to which, Bloomberg reported similarly that China gave its most forceful signal since 2022 to slow Yuan gains.