Market Wrap 2025-12-17

Today's US Market Wrap — Key Points

- Equities fell after mixed US data: jobs up, unemployment rises, retail sales mixed, PMIs weak.

- Treasuries saw volatile trading, ultimately settling higher. Crude oil declined on Ukraine/Russia news.

- Dollar slightly lower; Pound outperformed on wage data. Focus shifts to upcoming data and Fed speakers.

- Key events ahead: UK inflation, German Ifo, Eurozone CPI, Fed speakers, Micron earnings.

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

- Equities decreased, Treasuries increased, Crude decreased, Dollar was flat, Gold was flat.

REAR VIEW

- US November Non-Farm Payrolls exceeded expectations, while the Unemployment rate increased past the Federal Reserve's year-end forecast. US October headline Non-Farm Payrolls declined. US Retail Sales missed expectations on the headline figure, but the Control figure exceeded expectations. US Flash S&P Global PMIs decreased more than anticipated. Fed's Bostic stated the jobs report does not significantly alter the outlook. UK Composite PMI exceeded expectations, but Wage growth remained persistent. European PMIs were mixed.

COMING UP

- Data: UK Inflation (November), German Ifo Survey (December), Eurozone CPI Final (November), New Zealand GDP (Q3). Speakers: Fed’s Waller, Williams, Bostic. Supply: Australia, US. Earnings: Micron.

MARKET WRAP

US indices concluded the trading day with losses, following a volatile session that began in futures trading during the US morning after the release of delayed US data. The US November payrolls report indicated a higher-than-expected headline figure, with the unemployment rate rising to 4.6% from 4.4%. This increase was partially attributed to a rise in the participation rate, but the household survey is subject to a larger standard error than usual, which may persist for several months. The October headline figure decreased by 105,000 (expected -25,000). Retail sales were weaker than expected, primarily due to a decline in auto sales, while S&P Global Flash PMIs were disappointing. Similar to US indices, Treasuries experienced two-way price action, initially rising due to the increase in the November unemployment rate, but this movement quickly subsided as the data was mixed overall. Despite T-Notes reaching new lows, they gradually increased throughout the US afternoon, ultimately settling with gains of approximately 3-5 basis points across the curve. The crude oil complex was supported by positive updates regarding Ukraine/Russia, while some traders also pointed to a surge in China's oil purchases from Venezuela in anticipation of sanctions. In FX markets, the Dollar experienced slight losses, although it remained above earlier lows, as the Pound outperformed due to stronger-than-expected UK wage data ahead of the Bank of England meeting on Thursday. Most sectors experienced losses, although mega-cap stocks dominated. Technology, Consumer Discretionary, and Communication Services were the only sectors to gain, while Energy and Health lagged. The decline in Energy was likely due to the aforementioned weakness in oil prices, while Healthcare was affected by Pfizer's reduced guidance. Looking ahead, Williams and Waller are scheduled to speak on Wednesday, with Micron earnings released after-hours. CPI data will be released on Thursday, along with Nike earnings.

US

NFP:

Both the October and November jobs reports were released following the government shutdown, although the October report did not include the unemployment rate due to data collection issues from the household survey during the shutdown. The November headline NFP showed 64,000 jobs added, exceeding the forecast of 50,000. The unemployment rate increased to 4.6% from 4.4% in September, or 4.56% when rounded to two decimal places, 12bps higher than the 4.44% in September, but still above the Fed's median year-end projection of 4.5%. The BLS announced that the November household survey has a slightly larger standard error, which may persist for a few months. The participation rate increased to 62.5% from 62.4%, and the U6 underemployment rate rose to 8.7% from 8.0%. Wage growth was weaker than expected, rising 0.1% month-over-month in November, below the 0.3% forecast, and 3.5% year-over-year, below the 3.6% forecast. The October NFP showed a loss of 105,000 jobs, primarily due to a 162,000 decrease in federal government employment amid the government shutdown. Private payrolls increased by 69,000 in November, adding to the 52,000 increase in October. Fed Chair Powell has suggested that the overall NFP is being overstated by 60,000 per month before accounting for annual revisions, implying real job growth of approximately 4,000 in November. Overall, the data had little impact on Fed market pricing, with 6 basis points of easing still priced in for January, implying a 24% probability of another 25 basis point rate cut. ING wrote that "Job creation continues to slow and unemployment is on the rise, which will mean the doves at the Federal Reserve will continue to make the case for further interest rate cuts". It added that the risk of outright job losses is growing, and with mid-term elections less than a year away, the political pressure on the Fed to do more will intensify."

RETAIL SALES:

Retail sales for October were 0.0% month-over-month, below the expected 0.1% and the revised lower 0.1%. The weak headline figure was primarily due to a decrease in vehicle sales following the expiration of the EV tax credit, which offset the strong ex-autos reading. Oxford Economics noted that this leaves real consumption on track for growth of close to 2% annualized in Q4. Ex-autos month-over-month rose 0.4% (expected 0.3%, previous 0.1%), and ex-gas/autos rose 0.5% (previous 0.0%). Retail control jumped 0.8% (expected 0.4%, previous -0.1%). Oxford Economics noted that due to the Government shutdown, they are missing other data that would feed into its tracking estimate of real consumption, but the details they have point to a decent gain in October. The consultancy adds that, with private sector job gains holding up and a strong stock market still driving spending by older, wealthier households, they expect a robust holiday shopping season and an acceleration in spending over 2026 as well.

FLASH PMI:

The S&P Global's Flash PMI showed slower business growth in December as prices spiked higher. Manufacturing fell to 51.8 from 52.2 (expected 52), and Services dropped more than expected to 52.9 from 54.1 (expected 54), also beneath the lowest forecast of 53.0. This left the Composite lower at 53.0 from 54.2. Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, writes that “the flash PMI data for December suggest that the recent economic growth spurt is losing momentum. Although the survey data point to an annualized GDP expansion of ~2.5% over Q4, growth has now slowed for two months. He adds that a key concern is rising costs, with inflation jumping sharply to its highest since November 2022, which fed through to one of the steepest increases in selling charges for the past three years.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 7+ TICKS HIGHER AT 112-16+

T-notes experienced choppy trading due to the US data releases. At settlement, the 2-year note was down 2.9 basis points at 3.479%, the 3-year note was down 4.2 basis points at 3.519%, the 5-year note was down 4.4 basis points at 3.689%, the 7-year note was down 4.0 basis points at 3.900%, the 10-year note was down 3.7 basis points at 4.145%, the 20-year note was down 3.7 basis points at 4.773%, and the 30-year note was down 3.3 basis points at 4.819%.

INFLATION BREAKEVENS: 1-year BEI -16.5bps at 2.416%, 3-year BEI -5.5bps at 2.301%, 5-year BEI -3.5bps at 2.169%, 10-year BEI -2.3bps at 2.212%, 30-year BEI -1.0bps at 2.221%.

THE DAY: T-notes experienced choppy trading but ultimately settled with gains. Treasury futures saw gradual gains before paring ahead of the US data, which ultimately was a mixed bag. T-notes surged higher on the release amid a jump in the November unemployment rate and a 105k NFP decline in the October report. However, the spike higher quickly faded - perhaps as the October losses were primarily due to federal government layoffs amid the shutdown (162k federal workers' jobs were lost in October). Meanwhile, the rise in the unemployment rate could be explained by a higher standard error, the BLS warned us about yesterday. Alongside the NFP reports, the Retail Sales report was mixed, with the headline printing softer than expected, ex-autos beating, while the control saw a notable beat. The initial spike higher had completely pared, but after disappointing flash PMI data, the upside resumed before meandering into settlement. Attention turns to the 20-year bond supply on Wednesday, ahead of CPI on Thursday.

SUPPLY:

Notes

- US Treasury to sell USD 13 billion of 20-year bonds on December 17th and USD 24 billion of 5-year TIPS on December 18th; to settle on December 31st.

Bills

- US sold 6-week bills at a high rate of 3.625%, with a bid-to-cover ratio of 2.73x.

- US Treasury to sell USD 69 billion (previous 69 billion) of 17-week bills on December 17th, to sell USD 80 billion (previous 80 billion) of 8-week bills and USD 80 billion (previous 85 billion) of 4-week bills on December 18th; all to settle December 23rd.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 6bps (previous 5.5bps), March 14.4bps (previous 13bps), April 21.6bps (previous 20.5bps), December 59.8bps (previous 57bps).

- NY Fed RRP Op demand at USD 1.55 billion (previous 2.6 billion) across 2 counterparties (previous 6).

- NY Fed Repo Op demand at USD 4 billion (previous 16.801 billion) across two operations.

- EFFR at 3.64% (previous 3.64%), volumes at USD 97 billion (previous 102 billion) on December 15th.

- SOFR at 3.75% (previous 3.67%), volumes at USD 3.270 trillion (previous 3.261 trillion) on December 15th.

CRUDE

WTI (F6) SETTLED USD 1.55 LOWER AT 55.27/BBL; BRENT (G6) SETTLED USD 1.64 LOWER AT 58.92/BBL

Oil prices decreased, seemingly pressured by more promising developments regarding a potential peace deal between Ukraine and Russia. Russia's Ryabkov stated their readiness to overcome disagreements related to the Ukraine crisis, but noted they are unwilling to make concessions regarding Crimea, Donbas, and Novorossiya. From the Ukrainian side, Zelensky said the US will discuss security guarantees, a 20-point plan, and a reconstruction plan for Ukraine with Russia. Elsewhere, crude-specific news flow was light despite a deluge of delayed US data, including October and November US payrolls reports, and US retail sales. WTI and Brent reached highs of USD 56.70/bbl and 60.40, respectively, at the start of the European session and then edged lower through the duration of the US day to hit troughs of USD 54.98/bbl and 58.72, albeit settling just off these levels. After-hours attention turns to private inventory metrics whereby current expectations are (bbls): Crude -1.1mln, Distillate +1.2mln, Gasoline +2.1mln.

EQUITIES

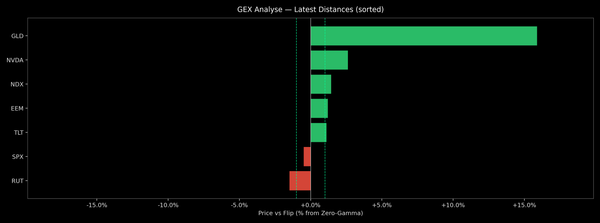

CLOSES : SPX -0.24% at 6,800, NDX +0.26% at 25,133, DJI -0.62% at 48,114, RUT -0.45% at 2,519

SECTORS: Energy -2.98%, Health -1.28%, Real Estate -0.95%, Financials -0.67%, Industrials -0.58%, Consumer Staples -0.44%, Utilities -0.36%, Materials -0.22%, Communication Services +0.19%, Consumer Discretionary +0.31%, Technology +0.32%.

EUROPEAN CLOSES : Euro Stoxx 50 -0.58% at 5,719, Dax 40 -0.59% at 24,087, FTSE 100 -0.68% at 9,685, CAC 40 -0.23% at 8,106, FTSE MIB -0.29% at 43,990, IBEX 35 -0.70% at 16,922, PSI -0.16% at 8,062, SMI +0.10% at 13,050, AEX -1.12% at 935

STOCK SPECIFICS:

- Accenture (ACN) was upgraded at Morgan Stanley to 'Overweight' from 'Equal Weight'.

- ADP (ADP) was downgraded at Jefferies to 'Underperform' from 'Hold'.

- Apple (AAPL) reportedly plans to expand its iPhone lineup to seven models by fall 2027 from five, according to The Information.

- Ford (F) is to see a USD 19.5 billion charge to write down EV investments; news seen as net positive as managements aggressive actions to move away from the dwindling EV market & boost other areas.

- PayPal (PYPL) submits applications to establish an industrial bank to expand financial services access for US small businesses.

- Pfizer (PFE) cuts FY25 revenue midpoint guide and initial FY26 revenue view underwhelms.

- Roku (ROKU) double Upgraded at Morgan Stanley to 'Overweight' from 'Underweight'.

- Waste Management (WM) hiked dividend by 14.5% with a USD 3 billion repurchase authorisation.

- Zscaler (ZS) upgraded at Mizuho to 'Outperform' from 'Neutral'.

FX

The Dollar was modestly lower, able to recover some to the weakness induced by slowing job growth. The choppy trade that followed was likely participants digesting the different signals sent from the combined NFP report and Retail Sales. On the one hand, October jobs fell 105k, notably beneath the expected -25k, though the drop is seemingly driven by a decline in the Federal government due to the government shutdown, -162k. November showed a modest rebound of the headline +64k (exp. 50k). Additionally, the Unemployment Rate moved higher to 4.6% from 4.4%, but again, participants may interpret the reading as less informative given the BLS issued a notice beforehand that it would contain a larger standard error. Hawkish takeaways from the data were core spending gauge in the Retail Sales report, whereby Retail Control rose 0.8% (exp. 0.3%) with federal employment job losses slowing to 6k in November. DXY hit lows of 97.868 post data before recovering to ~98.16.

Sterling outperformed against USD as October wages proved hawkish. Avg Wk Earnings 3M Y/Y printed 4.7% (exp. 4.4%) with the prior 4.8% reading revised up to 4.9%. Meanwhile, on the jobs front, the releases highlighted continued pressure in the labour market, with the unemployment rate ticking up, and HMRC payrolls falling once again. December Flash PMIs were also positive, 52.1 (exp. 51.6, prev. 51.2), giving GBP another boost. Cable now trades around 1.3420 from earlier 1.3356 lows.

European PMIs were mixed. Manufacturing unexpectedly expanded in France, but contracted at a faster pace in Germany and the EZ. While Services expanded at a lesser rate in all three regions, printing beneath expectations. EUR/USD was met with small upticks following the France Mfg beat, before later reversing the upside on the German Mfg miss. EUR/USD now resides at 1.1750.

AUD/USD was unchanged as the poor overnight sentiment in Asia likely hindered the Aussie's ability to keep up with peer strength against USD. While money markets have assigned a 74% chance of unchanged rates at the RBA February meeting, although NAB sees them hiking by 25bps, and a further 25bps in the May meeting.