Market Wrap 2025-12-18

Today's US Market Wrap — Key Points

- Stocks declined, led by tech sector weakness amid Oracle data center deal uncertainty.

- US Dollar, crude oil, and gold rose; Treasuries were flat.

- Focus shifts to US CPI, jobless claims, and central bank decisions.

- Trump's Venezuela blockade and potential Russia sanctions boosted energy prices.

- Fed Governor Waller sees potential for rate cuts, but no immediate need.

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

- Equities: Down

- Treasuries: Flat

- Crude Oil: Up

- US Dollar: Up

- Gold: Up

REAR VIEW

- Federal Reserve Governor Waller reiterated his stance for gradual interest rate reductions, citing the current employment situation.

- Former US President Trump designated Venezuela as a terrorist organization and mandated a complete blockade of sanctioned oil tankers entering and exiting Venezuela.

- The US is reportedly preparing energy sanctions against Russia if it rejects a proposed Ukraine peace agreement.

- UK CPI data was soft.

- Oracle's $10 billion data center funding discussions in Michigan have reportedly stalled.

- Chinese researchers have reportedly completed a functional EUV prototype.

- EIA data indicated a larger-than-expected decrease in crude oil inventories.

- Steel Dynamics (STLD) and Nucor (NUE) have lowered their EPS outlooks for the upcoming quarter.

COMING UP

- Data releases: US CPI (November), US Jobless Claims (week ending December 13), Philadelphia Fed Index (December), Japanese CPI (November), New Zealand Trade Balance (November).

- Events: ECB Announcement, BoE Announcement, Norges Bank Announcement, Riksbank Announcement, CNB Announcement, Banxico Announcement.

- Speakers: Former US President Trump; Norges Bank Governor Bache; Riksbank Governor Thedeen; ECB President Lagarde; BoE Governor Bailey.

- Supply: US.

- Earnings: Carnival, Nike, FedEx.

MARKET WRAP

Stocks experienced declines on Wednesday, with the Nasdaq showing the weakest performance due to tech sector selling. The tech sector was impacted by reports that Oracle's (ORCL) $190 billion Michigan data center deal is facing uncertainty after funding talks with Blue Owl (OWL) stalled. Despite Oracle's statement that the equity deal is still on track, ORCL shares fell by approximately 5%. Chip stocks also declined (NVDA -3.9%, AMD -5.3%) following reports that Chinese researchers have completed a working EUV prototype with plans for working chips by 2028, increasing competition in the tech sector and potentially reducing the demand for US-made chips in China. Google (GOOGL) is reportedly collaborating with Meta (META) to broaden software support for AI chips, aiming to make TPU compatible with PyTorch as an alternative to NVIDIA (NVDA). In FX markets, the US Dollar saw modest gains, while the Japanese Yen weakened, reversing some recent gains ahead of the Bank of Japan (BoJ) meeting on Friday. Gold and silver continued their upward trend, with silver reaching a new record high. T-notes remained flat, with commentary from Fed Governor Waller initially lifting prices before paring gains ahead of the 20-year bond auction, which ultimately aligned with recent averages. Energy prices increased due to worsening US-Venezuela relations and potential new energy sanctions on Russia. Looking ahead, the focus on Thursday is on CPI and Jobless Claims data, as well as the BoE and ECB rate decisions. The BoE is widely expected to cut rates by 25bps, while the ECB is expected to maintain current rates.

FED

WALLER

Governor Waller discussed a range of topics. Regarding monetary policy, he stated that the Fed funds rate is 50-100bps above neutral and that there is no immediate need to cut rates. He added that the Fed can continue to lower rates, but the extent of support for this within the Fed is unclear. He noted that the labor market is "very soft" and that current payroll figures are overstated by 50-60k, indicating near-zero growth. He also stated that the job market suggests the Fed should continue to cut rates, but he does not foresee a sharp decline in the job market. On inflation, Waller said that expectations are anchored and that while inflation is above target, it should decrease in the coming months. He anticipates 1.6% GDP growth this year, compared to the Fed's SEP median 2025 GDP growth forecast of 1.7%. He also reiterated that he does not expect significant increases in tariffs. Lastly, he stated that new Fed asset purchases are not stimulus and that reserves are "pretty" close to ample, adding that the balance sheet is at the desired level.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED HALF A TICK LOWER AT 112-16

T-notes settled with minimal change amid commentary from Fed Governor Waller and the 20-year bond auction.

At settlement:

- 2-year: +0.6bps at 3.485%

- 3-year: +0.8bps at 3.529%

- 5-year: +0.3bps at 3.697%

- 7-year: +0.6bps at 3.908%

- 10-year: +0.4bps at 4.153%

- 20-year: +0.8bps at 4.785%

- 30-year: +0.7bps at 4.830%

INFLATION BREAKEVENS:

- 1-year BEI: +6.0bps at 2.456%

- 3-year BEI: +1.0bps at 2.315%

- 5-year BEI: +0.8bps at 2.178%

- 10-year BEI: +0.5bps at 2.216%

- 30-year BEI: -0.4bps at 2.218%

THE DAY:

T-notes settled flat on Wednesday, with attention shifting to the US CPI data on Thursday. T-notes experienced two-way trading, with pressure observed overnight and in the morning before partially recovering during US trading hours. The upside coincided with commentary from Fed Governor Waller, who suggested that rates are currently 50-100bps above neutral, indicating the potential need for at least two more rate cuts. However, he emphasized that there is no rush to lower rates again, advocating for a moderate pace of easing. T-notes then sold off ahead of the 20-year bond auction, which ultimately aligned with recent averages but was better than the previous auction. Following the auction, T-notes gradually increased to settle with minimal change, with yields across the curve firmer by no more than 1bps at settlement. Other developments included a report suggesting that Trump officials have privately expressed doubts about Hassett becoming the next Fed Chair. Focus on Thursday is on the CPI and Jobless Claims data, while next week's 2-, 5-, and 7-year note announcements are scheduled, expected at USD 69, 70, and 44 billion, respectively. The 2-year FRN is expected at USD 28 billion. Elsewhere, the BoE and ECB rate decisions are due, with the BoE widely expected to cut rates by 25bps and the ECB widely expected to maintain current rates.

SUPPLY:

Notes

- The US Treasury sold USD 13 billion of 20-year bonds at a high yield of 4.798%, stopping through the when-issued by 0.1bps. The bid-to-cover ratio increased to 2.67x from 2.41x, slightly above the six-auction average of 2.65x. Direct demand decreased to 22.2% from 29.1%, below the average of 25.3%, while indirect demand increased to 65.2% from 59.5%, above the average of 63.7%. Dealers were left with 12.6% of the auction, above the previous 11.4% and the average of 11.0%.

- The US Treasury will sell USD 24 billion of 5-year TIPS on December 18th, settling on December 31st.

Bills

- The US sold 17-week bills at a high rate of 3.540%, with a bid-to-cover ratio of 3.27x.

- The US Treasury will sell USD 80 billion (previously 80 billion) of 8-week bills and USD 80 billion (previously 85 billion) of 4-week bills on December 18th, all settling on December 23rd.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 6bps, March 14.4bps, April 21.8bps, December 59.8bps.

- NY Fed RRP Op demand at USD 10.4 billion across 17 counterparties.

- NY Fed Repo Op demand at USD 0.001 billion across two operations.

- EFFR at 3.64%, volumes at USD 95 billion on December 16th.

- SOFR at 3.69%, volumes at USD 3.319 trillion on December 16th.

- Treasury Buyback (3- to 5-year, Liquidity Support; Max purchase amount USD 4 billion): Buys 3.7 billion of 11.94 billion offered, accepts 16 of 48 eligible issues. Offer to cover: 3.23x

- NY Fed Reserve Management Bill Purchases: Buys USD 8.17 billion of the USD 58.21 billion submitted. Offer to cover: 7.12x

CRUDE

WTI (F6) SETTLED USD 0.67 HIGHER AT 55.94/BBL; BRENT (G6) SETTLED USD 0.76 HIGHER AT 59.68/BBL

WTI and Brent crude prices increased on Wednesday, driven by worsening US-Venezuela relations and potential new energy sanctions on Russia.

Former US President Trump initiated the upside with a post, designating Venezuela as a terrorist organization and ordering a complete blockade of all sanctioned oil tankers entering and leaving Venezuela. Venezuela rejected Trump's "grotesque threat". Subsequently, a report indicated that the US is preparing new Russian energy sanctions if Russia rejects a Ukraine peace deal, potentially targeting vessels in Russia's "shadow fleet" of tankers used to transport Moscow's oil. However, the White House stated that Trump has not made any decisions on the matter. Existing gains were maintained despite the WH pushback, with prices trading sideways into settlement after the EIA weekly inventory data. Crude stocks showed a larger-than-expected draw of -1.724 million barrels (expected -1.066 million barrels), with production falling by 10,000 barrels. WTI and Brent reached their highs in the EU morning at USD 56.74/bbl and 60.40/bbl, respectively.

EQUITIES

CLOSES

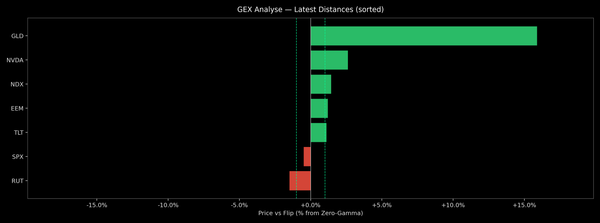

- S&P 500 (SPX): -1.16% at 6,721

- Nasdaq 100 (NDX): -1.93% at 24,648

- Dow Jones Industrial Average (DJI): -0.47% at 47,886

- Russell 2000 (RUT): -1.07% at 2,492

SECTORS:

- Technology: -2.19%

- Communication Services: -1.90%

- Industrials: -1.64%

- Consumer Discretionary: -1.22%

- Utilities: -0.79%

- Health: -0.22%

- Financials: -0.03%

- Real Estate: +0.28%

- Materials: +0.43%

- Consumer Staples: +0.45%

- Energy: +2.21%

EUROPEAN CLOSES

- Euro Stoxx 50: -0.58% at 5,685

- DAX 40: -0.50% at 23,956

- FTSE 100: +0.92% at 9,774

- CAC 40: -0.25% at 8,086

- FTSE MIB: +0.25% at 44,099

- IBEX 35: +0.10% at 16,938

- PSI: +0.10% at 8,070

- SMI: -0.25% at 13,024

- AEX: -0.59% at 930

STOCK SPECIFICS:

- Oracle (ORCL): Blue Owl Capital will reportedly not proceed with backing a planned USD 10 billion, 1-GW Oracle data center in Michigan. Oracle responded that the equity deal on the Michigan data center is still on schedule, adding Related Digital chose 'the best equity partner' on the deal.

- Google (GOOGL): To collaborate with Meta (META) to expand software support for AI chips; the project aims to make TPU run well on PyTorch as an alternative to NVIDIA (NVDA).

- Nucor (NUE): Q4 EPS guidance missed expectations.

- Steel Dynamics (STLD): Q4 EPS view disappointed.

- General Mills (GIS): Profit & revenue beat expectations.

- Lennar (LEN): EPS fell short of expectations.

- Warner Bros Discovery (WBD): Unanimously recommended to stockholders to reject Paramount Skydance (PSKY); Paramount later affirmed its commitment to a USD 30/shr offer for Warner Bros.

- Jabil (JBL): EPS & revenue beat expectations with strong guidance.

- Hut 8 (HUT): Announced an AI infrastructure partnership with Anthropic & Fluidstack.

- Gap (GAP): Upgraded at Baird to 'Outperform' from 'Neutral'.

- Fortinet (FTNT): Downgraded at JPMorgan to 'Underweight' from 'Neutral'.

FX

The US Dollar index (DXY) is trading higher than it was before the October/November jobs reports, likely supported by small increases in US yields. The usual significance of the releases was likely dampened by several factors, including the US government shutdown, a higher BLS standard of error, and delayed resignations arising from layoffs earlier in the year. As such, the path of the dollar is likely to remain more uncertain than usual, with upcoming unemployment rates likely to be somewhat distorted. Key updates included those on the Fed, with reporting suggesting that Trump officials have privately raised doubts over Hassett being the next Fed Chair. Meanwhile, Fed Governor Waller continued to call for cuts as the job market says so, arguing rates are 50-100bps over neutral, meaning Waller's neutral rate view is more or less around the Fed median view of 3.0%. DXY hit highs of 98.641 before retracing to ~98.38.

GBP

The British Pound (GBP) was weighed down by soft CPI data. Headline Y/Y inflation eased more than anticipated to 3.2% (expected 3.5%, previous 3.6%), mainly driven by a drop in food prices. Core CPI M/M was -0.2% (expected 0.1%, previous 0.3%). The report solidified bets for a 25bps BoE rate cut, with markets now assigning ~99.7% chance of an outcome from the 91% seen before the release.

JPY

The Japanese Yen (JPY) was the worst G10 performer against the US Dollar, paring its week-to-date strength. Events throughout the day did little to change the dynamics in Japan. Imports fell short of expectations in November, while Exports and Machinery Orders beat expectations. Japanese Government member Nagahama said the BoJ's monetary policy appears to be heavily influenced by FX moves. "If the BoJ were to raise rates this week, it might be to combat the weak Yen that reduces the positive effect of government measures to cushion the blow from the rising cost of living." USD/JPY hit highs of 155.70 from earlier 154.52 lows.

EUR

The Euro (EUR) finished the day unchanged versus the US Dollar, unreactive to data points in the morning, which did little to change the expected unchanged outcome from the ECB meeting on Thursday. Nonetheless, the German Ifo hit its lowest level since May, weighed by deteriorations in current conditions and expectations.

MORE

- "It's Unbelievable": Taxpayers' Money Still Flowing To Indicted Fraud Suspect: Minnesota Lawmaker

- China's 'Manhattan Project' Builds Secret EUV Chip Machine Long Blocked By The West

- Activist Investor Elliott Builds Billion Dollar Stake In Lululemon