Market Wrap 2025-12-23

Today's US Market Wrap — Key Points

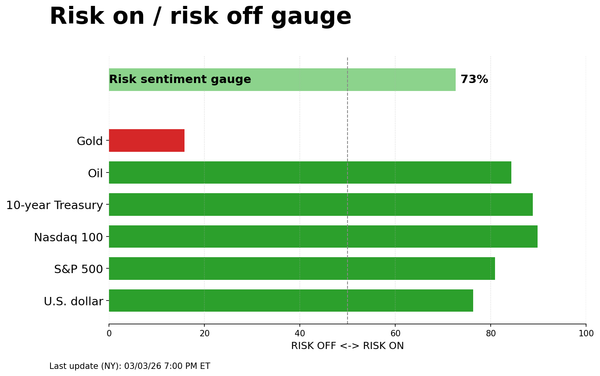

- Equities and crude oil rose; dollar declined; treasuries flattened.

- Strong GDP offset by weak consumer confidence and durable goods.

- Verbal intervention in Yen; Wegovy pill approved in US.

- Light economic calendar ahead of Christmas holiday.

Already a member? Sign in to unlock the full wrap

MARKET SNAPSHOT

- Equities are up.

- Treasuries are flattening.

- Crude oil is up.

- The Dollar is down.

- Gold is up.

RECENT EVENTS

- The US Q3 GDP was strong.

- Durable Goods orders disappointed, but this was driven by volatile aircraft orders.

- Consumer Confidence underwhelmed.

- Industrial Production impressed.

- There was further verbal intervention from the Japanese Finance Minister.

- Novo Nordisk’s Wegovy pill was approved in the US.

- The US 5yr auction was decent.

- The US 2yr FRN auction was solid.

- The Bank of Canada board stated that it is difficult to predict whether the next move will be a rate hike or a rate cut.

UPCOMING EVENTS

- Note: The desk will operate until 18:05GMT/13:05EST on Wednesday, December 24th. The desk will be closed between December 25th, 2025, and January 1st, 2026. A shortened service will cover the FOMC Minutes on December 30th, 2025, from 18:45GMT/13:45EST to 19:30GMT/14:30EST. Normal service will resume at 0700GMT/02:00EST on Friday, January 2nd, 2026, for the beginning of the European Session.

- Data: US Jobless Claims (week ending December 20th)

- Events: Christmas Eve

- Supply: US

MARKET WRAP

US indices (excluding the Russell 2000) closed in positive territory, reversing initial declines following the release of US data. Treasuries initially maintained and extended losses after the strong US Q3 GDP report but settled with a flattening yield curve as the long end pared earlier losses, while the short end remained sold off. Other US data included Durable Goods (October), which declined more than expected, largely due to a plunge in volatile aircraft orders. Consumer Confidence (December) notably underperformed, and Industrial Production (November) rose slightly more than forecast. As mentioned, the Treasury curve flattened, with little reaction observed after a solid 2yr FRN and 5yr auction. Sectors closed with an upward bias, with Communication Services and Technology outperforming, supported by gains in companies like NVIDIA (NVDA). Consumer Staples and Health were the laggards, with Eli Lilly (LLY) showing slight weakness as competitor Novo Nordisk (NOVOB DC) had its Wegovy pill approved in the US. Crude oil was choppy but settled with gains within a tight daily range, as focus remained on global geopolitical issues. More recently, the US Envoy to the UN stated that the US will impose and enforce sanctions to deprive Venezuela's Maduro of resources to fund Cartel de Los Soles, including oil profits. The Dollar was sold, benefiting G10 FX peers, while the Yen remained in focus due to continued verbal intervention from Finance Minister Katayama. Precious metals (XAU, XAG) gained, with spot silver soaring past USD 70/oz. Looking ahead, the calendar is light on Wednesday as traders prepare for the Christmas holidays.

US

GDP: The Q3 advance GDP report was strong, rising 4.3% in Q3, accelerating from the 3.8% gains seen in Q2. The increase in real GDP reflected increases in consumer spending, exports, and government spending that were partly offset by a decrease in investment. Imports, which are a subtraction in the calculation of GDP, decreased. Consumer Spending rose 3.5%, accelerating from the 2.5% in Q2, while the GDP Sales rose 4.6%, cooling from the 7.5%, with the Deflator +3.7%, above the 2.7% expected and 2.1% prior. Regarding PCE, headline prices rose 2.8%, accelerating from 2.1%, but matching the 2.8% forecast, with Core PCE also matching forecasts at 2.9%, accelerating from the 2.6% prior. Looking into the breakdown, exports rose 8.8%, and imports fell 4.7% - both boosting the headline GDP. It was highlighted that net trade is what lifted GDP growth to its fastest rate since Q3 23. Key drivers remain high-income consumers and tech capex, and that seems unlikely to change in 2026. Net trade contributed 1.6% of the 4.3% headline growth rate. Nonetheless, consumer spending was still strong at 3.5%. The report was described as a fantastic outcome, but Q4 GDP is likely to record growth that is considerably slower, due to the government shutdown. It is also expected that net trade will contribute less than it did in Q3, while consumer spending is also set to slow.

DURABLE GOODS: Durable Goods for October tumbled 2.2% (previous 0.5%, expected -1.5%), largely due to the volatile aircraft orders component, which plummeted close to 30%, reflecting a weak month for Boeing. Excluding transportation, orders rose 0.2% (previous 0.6%, expected 0.3%), which is consistent with little change in real terms, while the 0.5% increase in orders of Nondefense capital ex-air (previous 0.9%, expected 0.4%) is consistent with a real-terms increase of around 0.3%. Core capital goods orders have picked up slightly in recent months following a long stagnation, but most survey measures of capex intentions remain very depressed, suggesting further strong gains are unlikely.

CONSUMER CONFIDENCE: Consumer Confidence in December declined to 89.1 from 92.9, which was revised notably higher from the initial 88.7, and beneath the expected 91.0. The Present situation index tumbled to 116.8 (previous 126.3), while the Expectations index remained relatively steady at 70.7. Within the report, consumers’ assessments of current business conditions turned mildly pessimistic, as 18.7% of consumers said conditions were “good” (previous 21.0% in Nov), while 19.1% said they were “bad” (previous 15.8%). Views of the labor market also weakened, as 26.7% of consumers said jobs were “plentiful” (previous 28.2%), and 20.8% (previous 20.1%) said they were “hard to get”. Looking forward, consumers were moderately less pessimistic about future business conditions, as 18.0 expected conditions to improve (previous 18.1%), although 21.8% (previous 25.8%) expected them to worsen. In general, consumers were a bit more concerned about the labor market outlook in December, and income prospects were slightly less positive.

INDUSTRIAL PRODUCTION: The October and November Industrial production reports were released, with November IP rising 0.2%, above the 0.1% forecast and October’s -0.1%. Manufacturing Output rose by 0.0% from October’s -0.4%, while capacity utilization rose to 76% from 75.9%. There were swings in both mining and utilities output over October and November, though, on net, both sectors posted gains. The details fell short of expectations, but the outlook is better for next year as trade uncertainty fades and the full benefits of Trump’s One Big Beautiful Bill Act kick in. Increases in manufacturing production are expected to broaden next year, and output of electrical equipment is expected to register stronger advances on the back of AI-related investment. The drag from motor vehicle production should also subside.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 1+ TICK LOWER AT 112-09+

The Treasury curve flattened after strong GDP data. At settlement, 2-year +1.29bps at 3.528%, 3-year +2.24bps at 3.581%, 5-year +1.94bps at 3.736%, 7-year +1.05bps at 3.939%, 10-year +0.20bps at 4.169%, 20-year -0.50bps at 4.788%, and 30-year -0.71bps at 4.831%.

INFLATION BREAKEVENS: 5-year TIPS +1.4bps at 1.464%, 10-year TIPS -0.1bps at 1.912%, 30-year TIPS -1.7bps at 2.624%.

THE DAY: T-Notes traded in a narrow range overnight before the Q3 GDP report. The data revealed much higher than expected growth, rising 4.3%, well above the 3.3% forecast and accelerating from the prior 3.8%. This immediately pressured the Treasury complex with the front-end leading the moves lower as stronger growth prospects - coupled with in-line inflation data - reduced the need for more Fed action, albeit money markets still price in two more rate cuts this year (now pricing 53bps of easing vs 58bps pre-data). T-Notes had pared off lows across the curve after the US Consumer Confidence data disappointed. Meanwhile, following the strong GDP growth, NEC Director Hassett (front-runner for Fed Chair) and US President Trump reiterated calls for lower rates while simultaneously cheering the GDP growth. Meanwhile, the 5-year auction was decent but saw no reaction, and the 2-year FRN was solid too.

SUPPLY:

Notes:

- The US Treasury sold USD 70bln of 5-year notes at a high yield of 3.747%, a higher yield than the prior 3.562% but in line with recent averages. The auction still tailed, albeit by 0.1bps - an improvement on the prior 0.5bps and six-auction average of 0.4bps. The bid-to-cover of 2.35x, however, was lower than the prior 2.41x, but more in line with the 2.36x average. The breakdown of demand was solid with a rise in direct demand to 31.7% from 27.6% (average 27.5%), more than offsetting the drop in indirect demand to 59.5% from 61.4%, leaving dealers with 8.8% of the auction - an improvement from the prior 11% and average 10.7%.

- The 2-year FRN auction (USD 28bln) was solid. The high discount margin fell from the prior to 0.14% from 0.17%, beneath the 0.18% average. The bid-to-cover of 3.75x was notable above the prior and averages, with dealer demand dropping thanks to an increase in indirect demand.

- The US will sell USD 44bln 7-year notes on December 24th.

Bills:

- The US sold 6-week bills at a high rate of 3.580%, B/C 2.87x.

- The US sold 1-year bills at a high rate of 3.380%, B/C 3.74x.

- The US will sell USD 80bln in 8-week bills, USD 80bln in 4-week bills and USD 69bln in 17-week bills on December 24th; to settle Dec 30th.

STIRS/OPERATIONS:

- Market Implied Fed Rate Cut Pricing: January 3bps (previous 5bps), March 11.7bps (previous 15bps), April 18.3bps (previous 22bps), December 53.7bps (previous 55.7bps).

- NY Fed RRP Op demand at USD 5.893bln (previous 1.523bln) across 14 counterparties (previous 7).

- EFFR at 3.64% (previous 3.64%), volumes at USD 87bln (previous 93bln) on December 22nd.

- SOFR at 3.68% (previous 3.66%), volumes at USD 3.253bln (previous 3.238tln) on December 22nd.

- Treasury Buyback (10- to 30-year TIPS, max USD 500mln): Accepts USD 108mln of USD 1.19bln offers, accepts 4 out of 15 eligible issues; Offer to cover 11.02x

CRUDE

WTI (G6) SETTLED USD 0.37 HIGHER AT 58.38/BBL; BRENT (G6) SETTLED USD 0.31 HIGHER AT 62.38/BBL

The crude complex was choppy, but in a very contained range, amid light energy-specific newsflow on Tuesday. Focus continues to surround global geopolitical concerns, but WTI traded between USD 57.74-58.41/bbl and Brent USD 61.72-62.43/bbl, highlighting the thin session. Regarding Ukraine/Russia, President Trump overnight said that Ukrainian talks are going along, and are going ‘okay’. As we edge towards the Christmas break, geopolitical headlines will remain a key focus in the short-term that could keep supporting crude benchmarks. In the weekly Baker Hughes Rig Count, which was brought forward due to the truncated week, oil rigs rose 3 to 409, Nat Gas was unchanged at 127, leaving the total up 3 at 545. After-hours, we get the weekly private inventory metrics, whereby current expectations are (bbls): Crude -2.4mln, Distillate +0.4mln, Gasoline +1.1mln.

EQUITIES

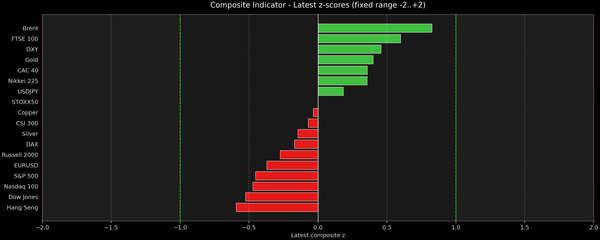

CLOSES: SPX +0.46% at 6,910, NDX +0.50% at 25,588, DJI +0.16% at 48, 442, RUT -0.69% at 2,541.

SECTORS: Communication Services +0.99%, Technology +0.95%, Energy +0.64%, Utilities +0.29%, Materials +0.23%, Consumer Discretionary +0.18%, Financials +0.17%, Real Estate -0.01%, Industrials -0.05%, Health -0.19%, Consumer Staples -0.41%.

EUROPEAN CLOSES: Euro Stoxx 50 +0.14% at 5,752, Dax 40 +0.22% at 24,337, FTSE 100 +0.24% at 9,889, CAC 40 -0.21% at 8,104, FTSE MIB +0.03% at 44,607, IBEX 35 +0.14% at 17,183, PSI -0.27% at 8,169, SMI +0.68% at 13,254, AEX -0.05% at 942.

STOCK SPECIFICS:

- Johnson & Johnson (JNJ) was ordered to pay over USD 1.5bln in a lawsuit that alleged the company's talc-based personal products gave a Maryland woman cancer; JNJ said it will appeal.

- Kroger (KR) board approves additional USD 2bln share repurchase authorization.

- Novo Nordisk’s (NVO) Wegovy pill was approved in the US as the first oral GLP-1 treatment, and said it plans to launch the drug in the US in January 2026.

- PHMSA approves Sable Offshore’s (SOC) Las Flores Pipeline restart plan.

- Raymond James notes renewed speculation around US approval of GPU sales to China has highlighted potential upside for NVIDIA (NVDA) and AMD (AMD). Estimates AMD could add USD 500–800mln in revenue, or USD 0.10–0.20 in non-GAAP EPS; NVDA’s opportunity is larger, with USD 7–12.5bln in potential revenue and USD 0.15–0.30 in 2026 EPS upside.

- ServiceNow (NOW) is to acquire Armis for USD 7.75bln in cash.

- US President Trump plans to meet with several defense industry execs next week to urge them to spend more on weapons and R&D. Of note for Huntington Ingalls Industries (HII), which saw gains.

- ZIM Integrated Shipping Services (ZIM) provided an investor update on its strategic review process, and the board is evaluating strategic proposals.

FX

The Dollar was weaker on Tuesday ahead of the upcoming Christmas break, as a data deluge took the headlines. Q3 GDP was very strong, which weighed on T-Notes and global fixed income. Durable Goods (Oct) declined more than expected, but largely due to a plunge in the volatile aircraft orders. Consumer Confidence (Dec) notably underwhelmed, while IP (Nov) rose slightly greater than forecasted. Elsewhere, newsflow was spare, and no Fed speak was on the docket, although Bessent’s comments from a podcast “All-In” did the rounds, who thinks November CPI is a pretty accurate number. DXY traded between 97.85-98.237 ahead of a very quiet Christmas Eve, whereby there is little scheduled on the calendar. The Dollar Index was lower for most of the session following strength in other currencies, but it pared off its worst levels after the strong GDP, but gains were capped after the weak consumer confidence.

G10 FX saw gains against the Dollar, with Antipodeans outperforming and buoyed by ongoing strength in metals prices. Overnight, the Aussie was unreactive to the latest RBA Minutes, whereby the Board discussed whether a rate increase might be needed at some point in 2026, and holding the cash rate steady for some time could be sufficient to keep the economy in balance. NZD/USD and AUD/USD chopped between 0.5792-5843 and 0.6655-6700, respectively.

The Yen was once again much the talk of the town amid further jawboning from Finance Minister Katayama overnight. She declined to comment on FX levels or interest rates and said Japan will take appropriate action, and reiterated that they have a “free hand” to respond to excessive moves in the JPY. As such, USD/JPY fell to lows of 155.66 from earlier highs of 157.07.

For the Loonie watchers, Canadian October GDP and BoC Minutes were the only things of note. The data declined 0.3%, more than the expected -0.2%, albeit little reaction was seen, and the latest BoC Minutes noted the GC agreed to remain cautious in interpreting data given recent volatility, and felt it was hard to predict whether the next move would be a hike or a cut.

Lastly, the Yuan saw slight gains, while on the trade footing, US tariffs on Chinese semiconductors will be at 0% until June 2027, and will then increase with the rate to be announced not fewer than 30 days before June 23rd, 2027.