Market Wrap 2025-12-28

Today's US Market Wrap — Key Points

- US stocks gained, led by tech, despite mixed economic data.

- Treasury yield curve flattened after strong GDP, weak confidence.

- Dollar weakened; Yen volatility persists amid intervention.

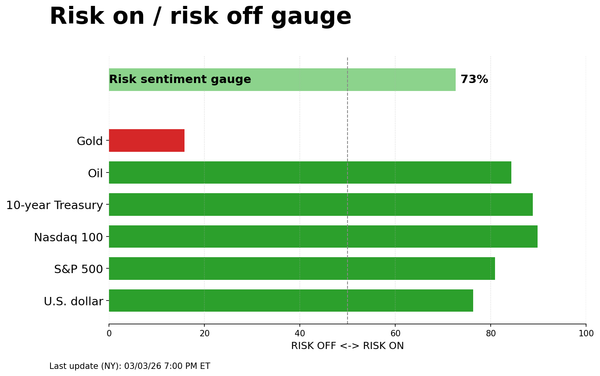

- Crude oil rose slightly; gold gained.

- Light economic calendar ahead of Christmas holiday.

Already a member? Sign in to unlock the full wrap

MARKET WRAP

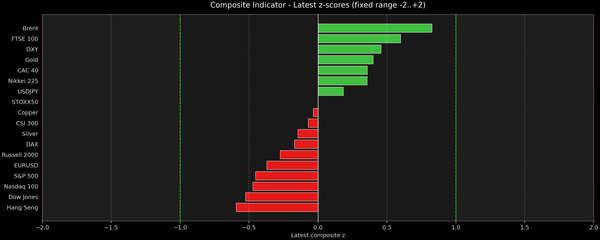

US stock indices, excluding the Russell 2000, ended the day with gains, reversing earlier declines that followed the release of a series of US economic data points. Treasury securities initially held onto and extended losses after a strong US Q3 GDP report, but ultimately the yield curve flattened as longer-dated maturities pared earlier losses, while shorter-dated maturities remained under selling pressure. Other US data releases included Durable Goods orders for October, which declined more than anticipated, largely due to a drop in volatile aircraft orders. Consumer Confidence for December was weaker than expected, while Industrial Production for November rose slightly more than forecast. The Treasury yield curve flattened, with little discernible reaction to solid auctions of 2-year Floating Rate Notes and 5-year notes. Sector performance was generally positive, with Communication Services and Technology leading the way, supported by gains in companies such as NVIDIA (NVDA). Consumer Staples and Health sectors lagged, with Eli Lilly (LLY) experiencing slight weakness after competitor Novo Nordisk (NOVOB DC) received US approval for its Wegovy pill. Crude oil prices experienced volatility but ultimately settled higher, albeit within a narrow daily range, as attention remained focused on global geopolitical issues. Recent reports indicated that the US Envoy to the UN stated that the US will impose and enforce sanctions to deprive Venezuela's Maduro of resources to fund Cartel de Los Soles, including oil profits. The US Dollar weakened against its G10 counterparts, with the Japanese Yen remaining in focus due to continued verbal intervention from Finance Minister Katayama. Precious metals, including gold (XAU) and silver (XAG), gained, with spot silver surpassing USD 70/oz. Looking ahead, the economic calendar is light on Wednesday as traders prepare for the Christmas holidays.

US

GDP: The advance Q3 GDP report showed strong growth, rising 4.3%, accelerating from the 3.8% increase in Q2. The increase in real GDP reflected increases in consumer spending, exports, and government spending, partially offset by a decrease in investment. Imports, which are subtracted in the calculation of GDP, decreased. Consumer Spending rose 3.5%, accelerating from 2.5% in Q2, while GDP Sales rose 4.6%, cooling from 7.5%, with the Deflator +3.7%, above the 2.7% expected and 2.1% prior. Regarding PCE, headline prices rose 2.8%, accelerating from 2.1%, but matching the 2.8% forecast, with Core PCE also matching forecasts at 2.9%, accelerating from the 2.6% prior. Exports rose 8.8%, and imports fell 4.7%, both contributing to the headline GDP figure. One analysis highlighted that net trade lifted GDP growth to its fastest rate since Q3 2023, noting that key drivers remain high-income consumers and tech capex, and that seems unlikely to change in 2026. Net trade contributed 1.6% of the 4.3% headline growth rate. Consumer spending was still strong at 3.5%. The report was described as a fantastic outcome, but Q4 GDP is likely to record considerably slower growth, due to the government shutdown. Net trade is also expected to contribute less than it did in Q3, and consumer spending is set to slow.

DURABLE GOODS: Durable Goods orders for October fell 2.2% (previous 0.5%, expected -1.5%), largely due to the volatile aircraft orders component, which plummeted close to 30%, reflecting a weak month for Boeing. Excluding transportation, orders rose 0.2% (previous 0.6%, expected 0.3%), which one analysis noted is consistent with little change in real terms, while the 0.5% increase in orders of Nondefense capital ex-air (previous 0.9%, expected 0.4%) is consistent with a real-terms increase of around 0.3%. Core capital goods orders have picked up slightly in recent months following a long stagnation, but most survey measures of capex intentions remain very depressed, suggesting further strong gains are unlikely.

CONSUMER CONFIDENCE: Consumer Confidence in December declined to 89.1 from 92.9, which was revised notably higher from the initial 88.7, and beneath the expected 91.0. The Present situation index tumbled to 116.8 (previous 126.3), while the Expectations index remained relatively steady at 70.7. Consumers’ assessments of current business conditions turned mildly pessimistic, as 18.7% of consumers said conditions were “good” (previous 21.0% in November), while 19.1% said they were “bad” (previous 15.8%). Views of the labor market also weakened, as 26.7% of consumers said jobs were “plentiful” (previous 28.2%), and 20.8% (previous 20.1%) said they were “hard to get”. Consumers were moderately less pessimistic about future business conditions, as 18.0% expected conditions to improve (previous 18.1%), although 21.8% (previous 25.8%) expected them to worsen. In general, consumers were a bit more concerned about the labor market outlook in December, and income prospects were slightly less positive.

INDUSTRIAL PRODUCTION: Industrial production for November rose 0.2%, above the 0.1% forecast and October’s -0.1%. Manufacturing Output rose by 0.0% from October’s -0.4%, while capacity utilization rose to 76% from 75.9%. There were swings in both mining and utilities output over October and November, though, on net, both sectors posted gains. One analysis highlighted that the details fell short of expectations, but suggests the outlook is better for next year as trade uncertainty fades and the full benefits of a particular bill kick in. Increases in manufacturing production are expected to broaden next year, and output of electrical equipment is expected to register stronger advances on the back of AI-related investment. The drag from motor vehicle production should also subside.

FIXED INCOME

T-NOTE FUTURES (H6) SETTLED 1+ TICK LOWER AT 112-09+

Treasury curve flattens after strong GDP data. At settlement, 2-year +1.29bps at 3.528%, 3-year +2.24bps at 3.581%, 5-year +1.94bps at 3.736%, 7-year +1.05bps at 3.939%, 10-year +0.20bps at 4.169%, 20-year -0.50bps at 4.788%, and 30-year -0.71bps at 4.831%.

INFLATION BREAKEVENS: 5-year TIPS +1.4bps at 1.464%, 10-year TIPS -0.1bps at 1.912%, 30-year TIPS -1.7bps at 2.624%.

THE DAY: T-Notes traded in a narrow range overnight before the Q3 GDP report. The data revealed much higher than expected growth, rising 4.3%, well above the 3.3% forecast and accelerating from the prior 3.8%. This immediately pressured the Treasury complex with the front-end leading the moves lower as stronger growth prospects - coupled with in-line inflation data - reduced the need for more Fed action, albeit money markets still price in two more rate cuts this year (now pricing 53bps of easing vs 58bps pre-data). T-Notes had pared off lows across the curve after the US Consumer Confidence data disappointed. Meanwhile, following the strong GDP growth, a particular director and the US President reiterated calls for lower rates while simultaneously cheering the GDP growth. The 5-year auction was decent but saw no reaction, and the 2-year FRN was solid too.

SUPPLY:

Notes:

- The US Treasury sold USD 70bln of 5-year notes at a high yield of 3.747%, a higher yield than the prior 3.562% but in line with recent averages. The auction still tailed, albeit by 0.1bps - an improvement on the prior 0.5bps and six-auction average of 0.4bps. The bid-to-cover of 2.35x, however, was lower than the prior 2.41x, but more in line with the 2.36x average. The breakdown of demand was solid with a rise in direct demand to 31.7% from 27.6% (average 27.5%), more than offsetting the drop in indirect demand to 59.5% from 61.4%, leaving dealers with 8.8% of the auction - an improvement from the prior 11% and average 10.7%.

- The 2-year FRN auction (USD 28bln) was solid. The high discount margin fell from the prior to 0.14% from 0.17%, beneath the 0.18% average. The bid-to-cover of 3.75x was notable above the prior and averages, with dealer demand dropping thanks to an increase in indirect demand.

- US to sell USD 44bln 7-year notes on December 24th.

Bills

- US sold 6-week bills at a high rate of 3.580%, B/C 2.87x.

- US sold 1-year bills at a high rate of 3.380%, B/C 3.74x.

- US to sell USD 80bln in 8-week bills, USD 80bln in 4-week bills and USD 69bln in 17-week bills on December 24th; to settle Dec 30th.

STIRS/OPERATIONS

- Market Implied Fed Rate Cut Pricing: January 3bps (previous 5bps), March 11.7bps (previous 15bps), April 18.3bps (previous 22bps), December 53.7bps (previous 55.7bps).

- NY Fed RRP Op demand at USD 5.893bln (previous 1.523bln) across 14 counterparties (previous 7).

- EFFR at 3.64% (previous 3.64%), volumes at USD 87bln (previous 93bln) on December 22nd.

- SOFR at 3.68% (previous 3.66%), volumes at USD 3.253bln (previous 3.238tln) on December 22nd.

- Treasury Buyback (10- to 30-year TIPS, max USD 500mln): Accepts USD 108mln of USD 1.19bln offers, accepts 4 out of 15 eligible issues; Offer to cover 11.02x

CRUDE

WTI (G6) SETTLED USD 0.37 HIGHER AT 58.38/BBL; BRENT (G6) SETTLED USD 0.31 HIGHER AT 62.38/BBL

The crude oil complex experienced volatility, but within a contained range, amid light energy-specific newsflow on Tuesday. Attention continues to surround global geopolitical concerns, but WTI traded between USD 57.74-58.41/bbl and Brent USD 61.72-62.43/bbl, highlighting the thin session. Regarding Ukraine/Russia, the US President said that Ukrainian talks are going along, and are going ‘okay’. As the Christmas break approaches, geopolitical headlines will remain a key focus in the short-term that could keep supporting crude benchmarks. In the weekly Baker Hughes Rig Count, which was brought forward due to the truncated week, oil rigs rose 3 to 409, Nat Gas was unchanged at 127, leaving the total up 3 at 545. After-hours, the weekly private inventory metrics will be released, whereby current expectations are (bbls): Crude -2.4mln, Distillate +0.4mln, Gasoline +1.1mln.

EQUITIES

CLOSES: SPX +0.46% at 6,910, NDX +0.50% at 25,588, DJI +0.16% at 48, 442, RUT -0.69% at 2,541.

SECTORS: Communication Services +0.99%, Technology +0.95%, Energy +0.64%, Utilities +0.29%, Materials +0.23%, Consumer Discretionary +0.18%, Financials +0.17%, Real Estate -0.01%, Industrials -0.05%, Health -0.19%, Consumer Staples -0.41%.

EUROPEAN CLOSES: Euro Stoxx 50 +0.14% at 5,752, Dax 40 +0.22% at 24,337, FTSE 100 +0.24% at 9,889, CAC 40 -0.21% at 8,104, FTSE MIB +0.03% at 44,607, IBEX 35 +0.14% at 17,183, PSI -0.27% at 8,169, SMI +0.68% at 13,254, AEX -0.05% at 942.

STOCK SPECIFICS:

- Johnson & Johnson (JNJ) was ordered to pay over USD 1.5bln in a lawsuit that alleged the company's talc-based personal products gave a Maryland woman cancer; JNJ said it will appeal.

- Kroger (KR) board approves additional USD 2bln share repurchase authorization.

- Novo Nordisk’s (NVO) Wegovy pill was approved in the US as the first oral GLP-1 treatment, and said it plans to launch the drug in the US in January 2026.

- PHMSA approves Sable Offshore’s (SOC) Las Flores Pipeline restart plan.

- One analysis notes renewed speculation around US approval of GPU sales to China has highlighted potential upside for NVIDIA (NVDA) and AMD (AMD). Estimates AMD could add USD 500–800mln in revenue, or USD 0.10–0.20 in non-GAAP EPS; NVDA’s opportunity is larger, with USD 7–12.5bln in potential revenue and USD 0.15–0.30 in 2026 EPS upside.

- ServiceNow (NOW) is to acquire Armis for USD 7.75bln in cash.

- US President Trump plans to meet with several defense industry executives next week to urge them to spend more on weapons and R&D. Of note for Huntington Ingalls Industries (HII), which saw gains.

- ZIM Integrated Shipping Services (ZIM) provided an investor update on its strategic review process, and the board is evaluating strategic proposals.

FX

The Dollar was weaker on Tuesday ahead of the upcoming Christmas break, as a data deluge took the headlines. Q3 GDP was very strong, which weighed on T-Notes and global fixed income. Durable Goods (Oct) declined more than expected, but largely due to a plunge in the volatile aircraft orders. Consumer Confidence (Dec) notably underwhelmed, while IP (Nov) rose slightly greater than forecasted. Elsewhere, newsflow was spare, and no Fed speak was on the docket, although particular comments from a podcast did the rounds, who thinks November CPI is a pretty accurate number. DXY traded between 97.85-98.237 ahead of a very quiet Christmas Eve, whereby there is little scheduled on the calendar. The Dollar Index was lower for most of the session following strength in other currencies, but it pared off its worst levels after the strong GDP, but gains were capped after the weak consumer confidence.

G10 FX saw gains against the Dollar, with Antipodeans outperforming and buoyed by ongoing strength in metals prices. Overnight, the Aussie was unreactive to the latest RBA Minutes, whereby the Board discussed whether a rate increase might be needed at some point in 2026, and holding the cash rate steady for some time could be sufficient to keep the economy in balance. NZD/USD and AUD/USD chopped between 0.5792-5843 and 0.6655-6700, respectively.

The Yen was once again much the talk of the town amid further verbal intervention from Finance Minister Katayama overnight. She declined to comment on FX levels or interest rates and said Japan will take appropriate action, and reiterated that they have a “free hand” to respond to excessive moves in the JPY. As such, USD/JPY fell to lows of 155.66 from earlier highs of 157.07.

For the Loonie watchers, Canadian October GDP and BoC Minutes were the only things of note. The data declined 0.3%, more than the expected -0.2%, albeit little reaction was seen, and the latest BoC Minutes noted the GC agreed to remain cautious in interpreting data given recent volatility, and felt it was hard to predict whether the next move would be a hike or a cut.

Lastly, the Yuan saw slight gains, while on the trade footing, US tariffs on Chinese semiconductors will be at 0% until June 2027, and will then increase with the rate to be announced not fewer than 30 days before June 23rd, 2027.

SNAPSHOT

- Equities up

- Treasuries flatten

- Crude up

- Dollar down

- Gold up

REAR VIEW

- Strong US Q3 GDP

- Durable Goods disappoints, but driven by volatile aircraft orders

- Consumer Confidence underwhelms

- IP impresses

- Further jawboning from Japanese FinMin

- Novo Nordisk’s Wegovy pill approved in the US

- Decent US 5yr auction

- Solid US 2yr FRN auction

- BoC board says it is hard to predict whether next move is a hike or cut

COMING UP

Note: The desk will run until 18:05GMT/13:05EST on Wednesday, 24th December. The desk will be closed for business between 25th December 2025 and 1st January 2026. However, a shortened service will cover the FOMC Minutes on 30th December 2025 - where the desk will open from 18:45GMT/13:45EST - 19:30GMT/14:30EST. Normal service will resume at 0700GMT/02:00EST on Friday, 2nd of January 2026 for the beginning of the European Session.

Data: US Jobless Claims (w/e 20 Dec)

Events: Christmas Eve

Supply: US